In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

The anticipated MtGox distribution plus realized German BTC sales plunged BTC to 54k (ETH sympathetically to 2825).

But near the lows, an additional $7m premium was added to a restructure of Dec+Mar upside Calls.

With a double low solidified, BTC ETF inflows have added ~$500m.

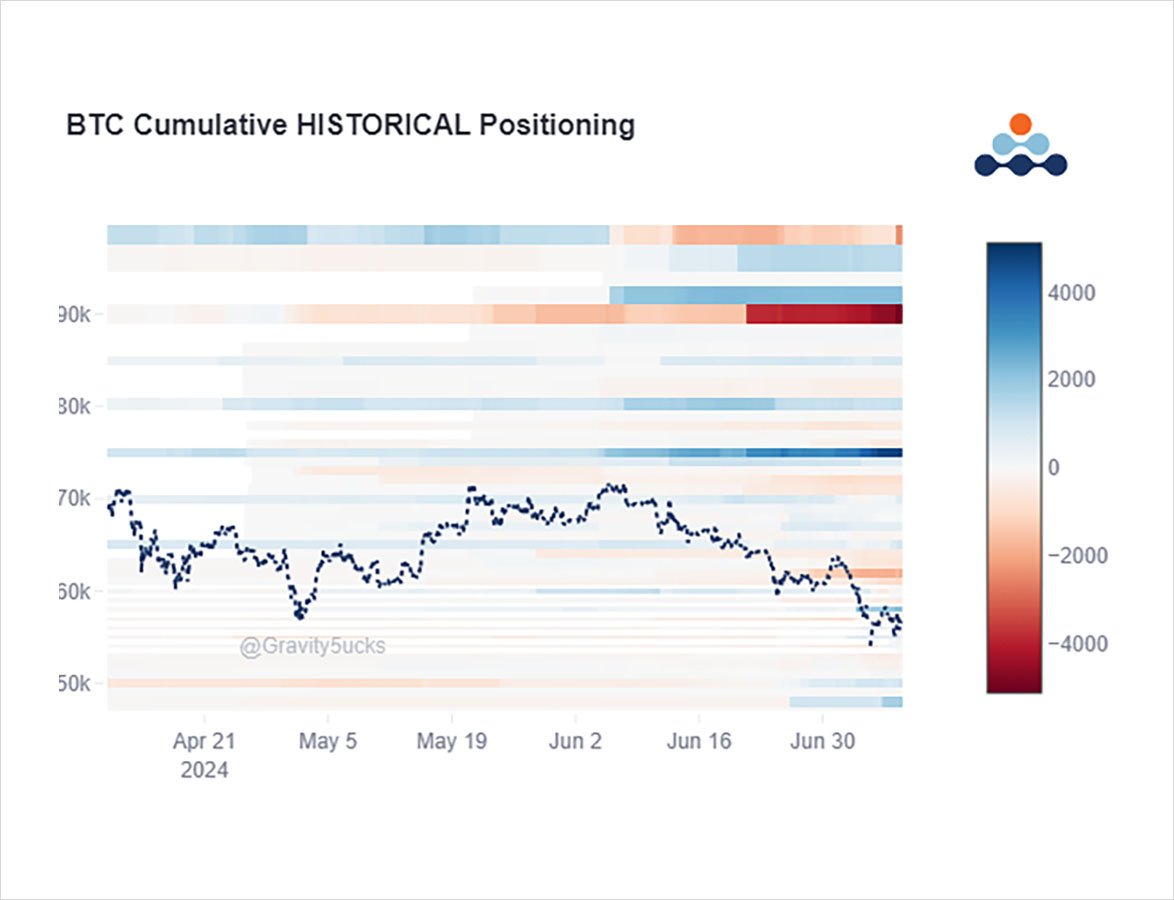

2) A large restructuring of long held aspirational Dec+Mar 90k+ Calls to 62-70k Strikes with an added $7m premium injected and +ve bullish Delta started the week off strongly from Spot lows.

The mkt absorbed poorly executed German BTC sales on a double bottom; ETF inflow assist.

3) Many of the Option hedges placed last week remain in place with added July ~50k Strike Puts as the German govt appeared to ramp up execution, but some July12 Puts were TPd.

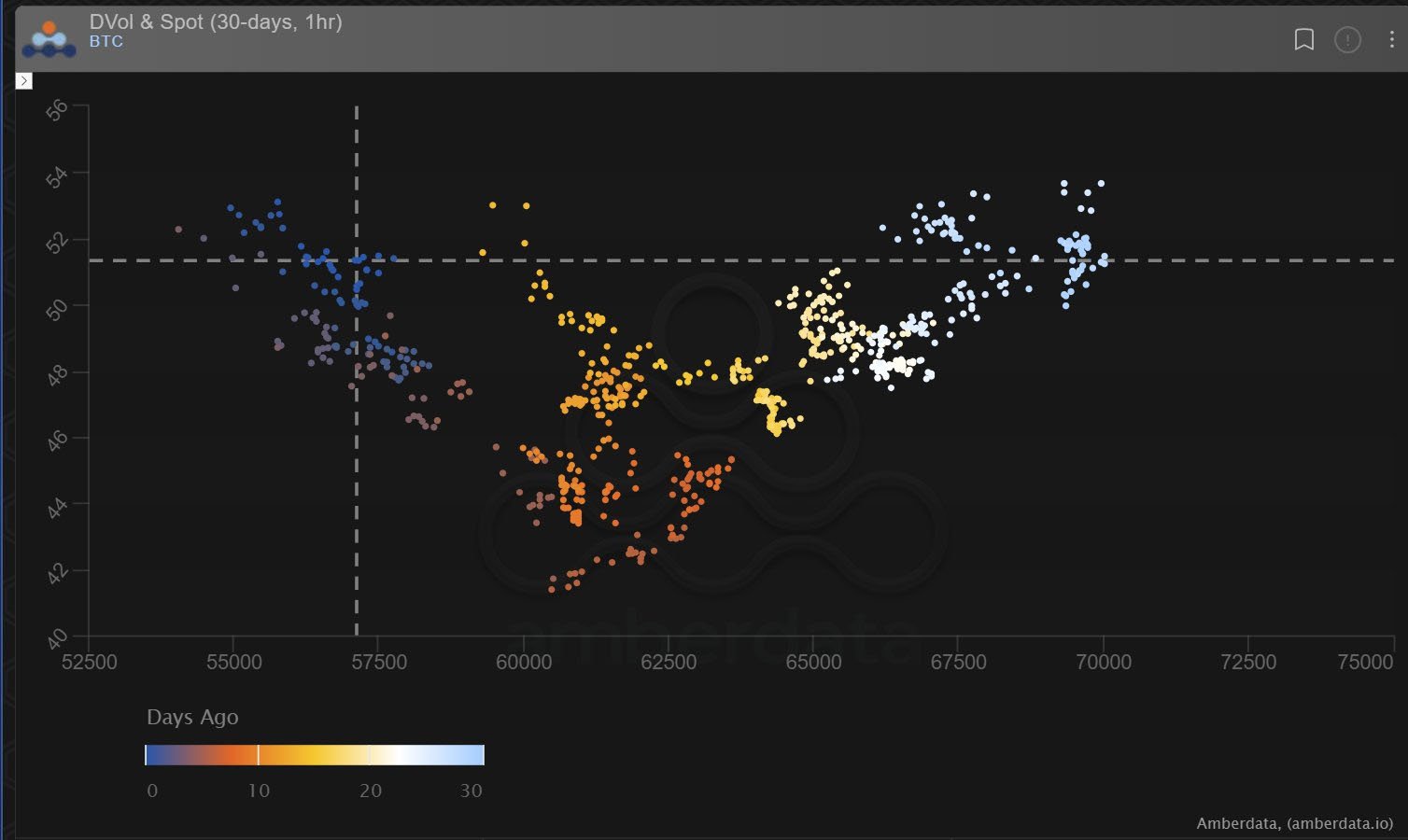

Gamma+Dvol have found strength divorcing the Spot-Vol marriage correlation, as RV+uncertainty engage.

4) Quite surprisingly, with ETH ETF imminent, ETH remains in the background with little fresh Option flow exposure.

Yet large volatility ETH moves abound – in sympathy with BTC moves [Ofc MtGox+German Govt are not selling ETH].

ETH Dvol holds a healthy 15% Vol premium over BTC.

View Twitter thread.

AUTHOR(S)