Technicals Turn Bearish Near Term

BTC and ETH prices dropped significantly last week, breaking crucial levels. BTC’s fall below $60k is particularly worrying, as this level had held for over four months. The anticipated ETH ETF launch hasn’t prevented ETH’s decline either, as BTC dragged the whole market down.

The current crypto market lacks strong narratives and faces selling pressure from Mt Gox creditors and the German Government. The price drop occurred during the low-liquidity 4th of July holiday, and the subsequent bounce was driven by oversold conditions and fresh BTC ETF inflows.

Despite high equity markets, many potential crypto buyers have already invested earlier this year. Although the year’s performance is still positive, a strong recovery is expected once the supply overhang clears. For now, stay cautious and consider hedging.

Realized Vol Spike

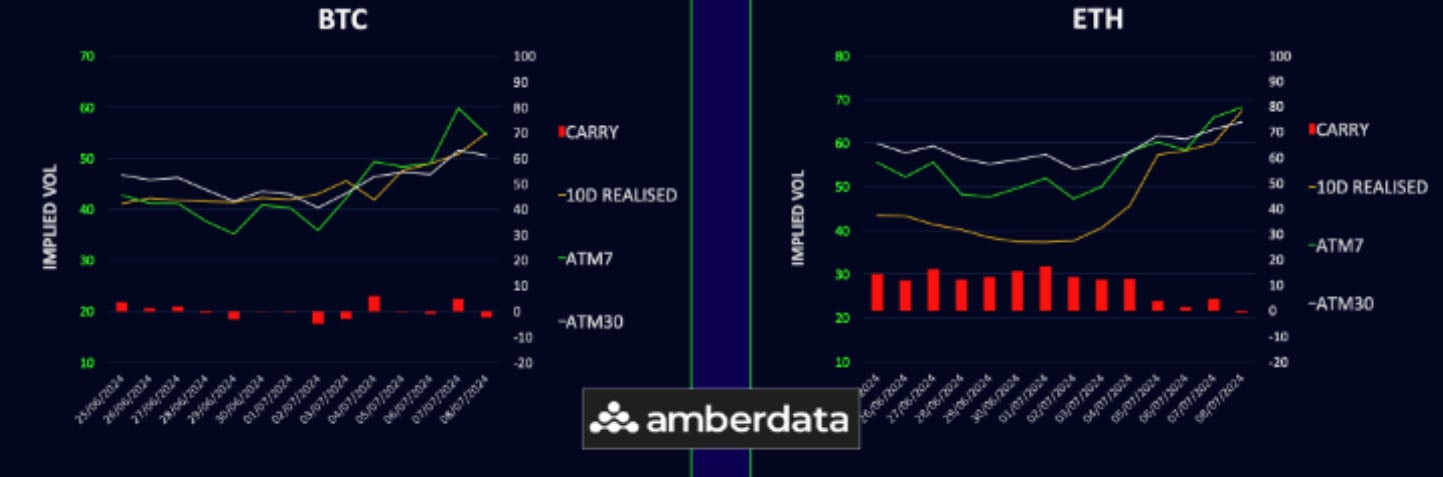

Crypto volatility surged, with BTC and ETH seeing realized vol spikes of 15 and 30 points, respectively. Implied volatility also increased significantly, reflecting market nervousness. This week’s inflation data could impact rates markets and crypto. The ETF launch has been delayed but is expected soon.

Inverted Term Structures

BTC’s term structure inverted as spot prices fell. Short-dated vol rose by 15 points, while back-end vols increased by only 2 points, a typical reaction to sudden volatility spikes. ETH’s term structure mirrored BTC’s, with short-term vol up 20 points and long-term vol up 2-3 points. The delayed ETF launch would kick the “event” bucket into next week, but front-end GAMMA is in demand, so we see no kink in the curve.

ETH/BTC Vol Spread Holds Big Premium

The ETH/BTC vol spread maintains a 15 vol premium in 1-month expiry due to ETH’s volatile downside moves. Despite a sharp drop in the ETH/BTC spot spread to key support levels, it appears to have stablised. The delayed ETF launch keeps the vol spread high, making ETH resilient in recent days. Post-launch, expect a vol reset to sub-10 vols, though how much spot will move remains highly uncertain.

Put Skew Goes Bid Short Term

Weekly put skew increased as traders, including myself, sought short-term protection. BTC’s put skew is higher due to upcoming supply, while ETH may find support if inflows materialize next week. Long-term call premiums persist, reflecting a bullish outlook despite market drops. This steep skew term structure is becoming typical in such market conditions as only front end put really catch a bid.

Option Flows

Trading volumes rose 16% to $9.5Bn, with protection buying in the $58k to $52k range for BTC. Long-dated premiums shifted, with OTM Dec and Mar25 calls moving from $90-100k to $62-75k. ETH volumes hit $2.7Bn as the ETF launch was delayed another week. Call flows shifted from July to Sep and Dec strikes around $3000/4000, with 26Jul being popular for downside hedges below $3000.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)