View on market

The SEC has preliminarily approved three asset managers, including BlackRock and VanEck, to launch ether ETFs next Tuesday, marking another milestone for cryptocurrency mainstream adoption. Ether’s price rose on this news, technical analysis supports a bullish outlook.

Bull Call Spread

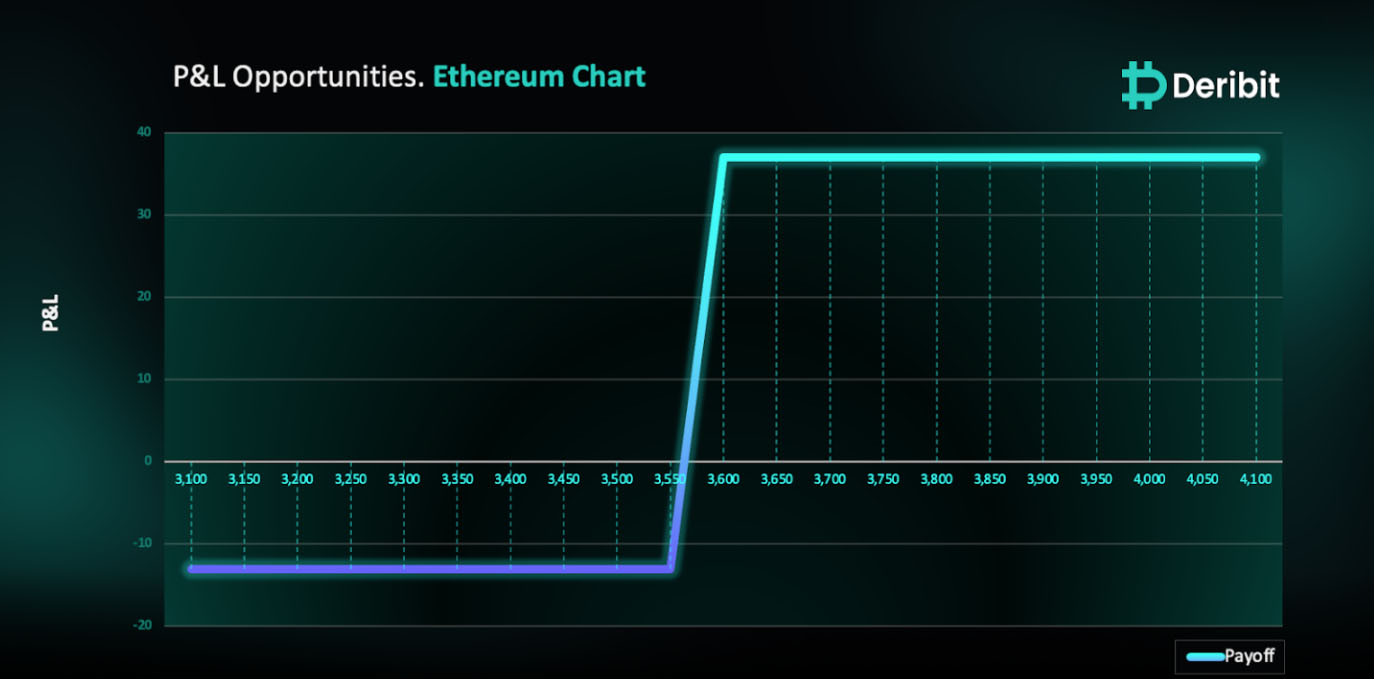

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying price rises.

You may consider taking this trade if you expect ETH price to rise as the technical setup has turned bullish.

Trade Structure

(OTM Call) Buy 1x ETH-19JUL24-$3,550-C @ $41

(OTM Call) Sell 1x ETH-19JUL24-$3,600-C @ $28

Target: Spot level > $3,600

Payouts

Maximum Profit: $37/ETH

Debit of Strategy: $13/ETH

Why are we taking this trade?

The U.S. Securities and Exchange Commission (SEC) has given preliminary approval to at least three of the eight asset managers planning to launch exchange-traded funds (ETFs) tied to the spot price of ether, set to begin trading next Tuesday. Following the introduction of nine U.S. spot bitcoin ETFs in January, these new ether ETFs would represent another significant milestone in the cryptocurrency industry’s efforts to mainstream digital assets. Ether is the second-largest cryptocurrency globally, following bitcoin.

Among the asset managers likely to receive the SEC’s green light next Monday afternoon, July 22, are BlackRock, VanEck, and Franklin Templeton, with trading expected to commence the following day. SEC Chair Gary Gensler mentioned last month that the Grayscale ruling had influenced his perspective on approving ether products, noting the similar underlying market conditions. The SEC had no further comments on the recently submitted S-1 forms, and the final versions are due by Wednesday.

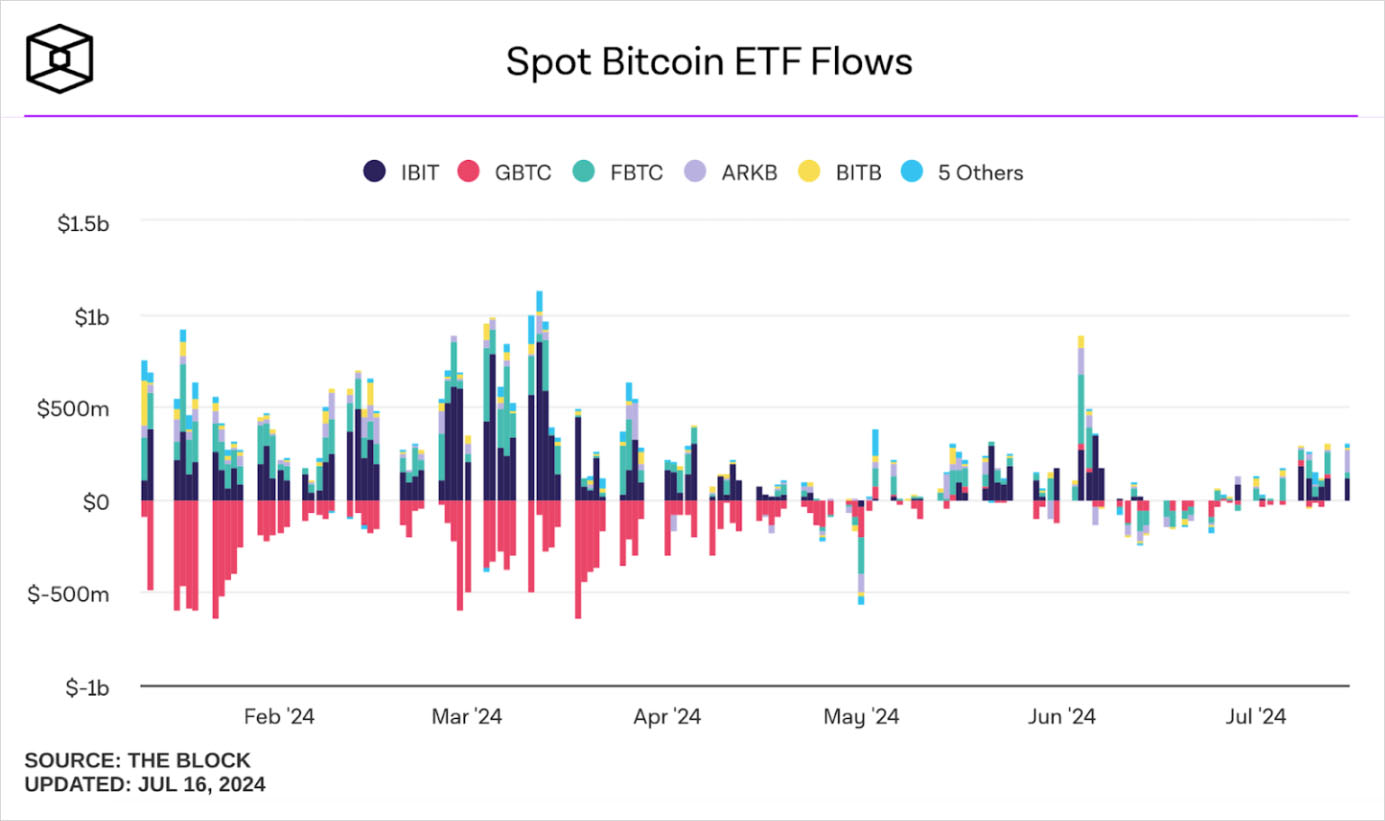

Ether outperformed bitcoin on Monday due to the news of potential ETF trading approval. U.S. spot bitcoin ETFs saw $422.5 million in net inflows yesterday, the largest since early June. Meanwhile, Grayscale’s converted GBTC fund recorded zero flows, and no funds reported net outflows on Tuesday (Source: Farside Investors).

From a technical analysis perspective, the attached 4Hr Ethereum price chart shows a rally-base-rally structure formed during Tuesday’s trading session. With slight retracements to the base of the demand zone, the price managed to rise, this behavior instills confidence, suggesting that the price could continue to rise with the imminent ETF approval and increased institutional flows, reinstating a bullish market environment.

Therefore, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $3,550) and simultaneously sell a Call option at a higher strike price (e.g., $3,600).

If the price of ETH is at or above $3,600, when the options expire on July 19th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $13.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)