In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

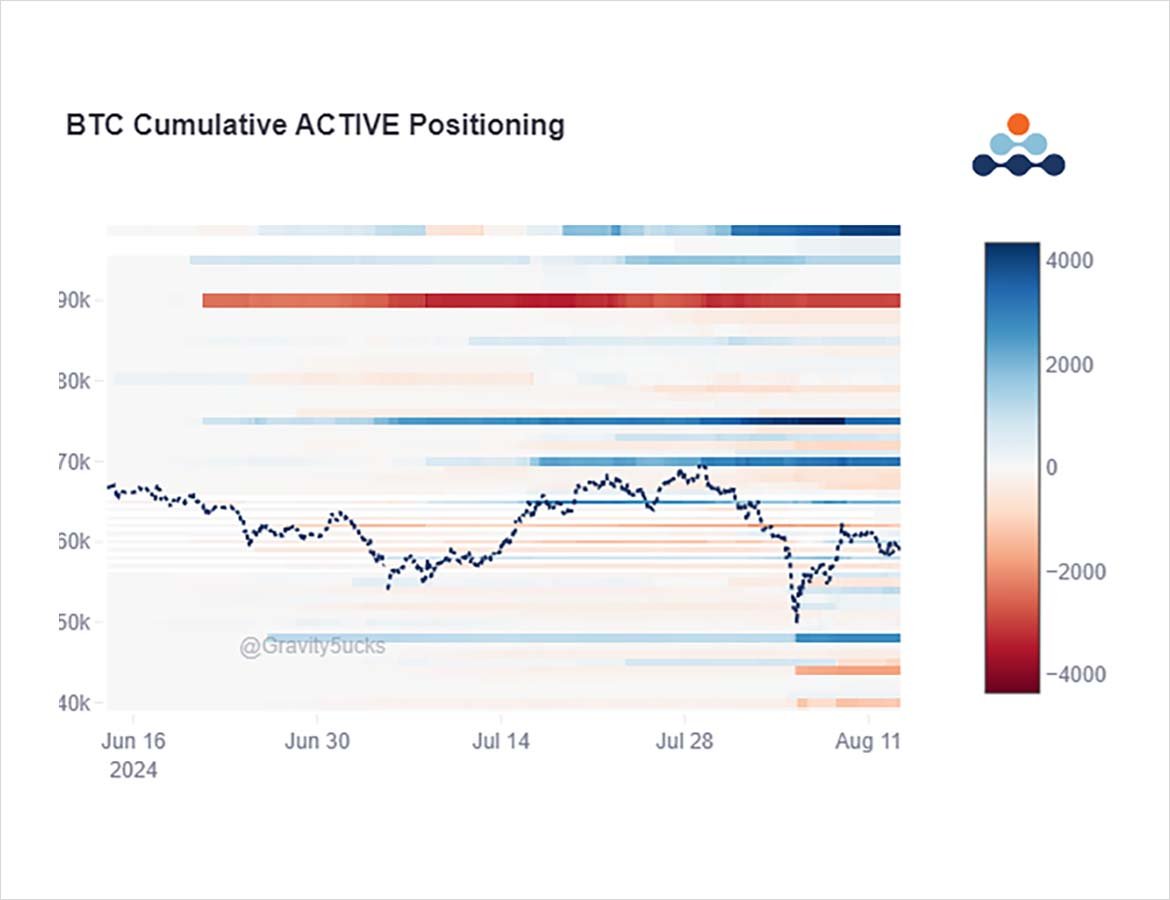

A tumultuous week, where we observed successful fast money hedge/bear plays accumulating 54-58k Puts TPing on the break, and Funds allocating further exposure to Oct-Mar 60-65k Calls on the bounce.

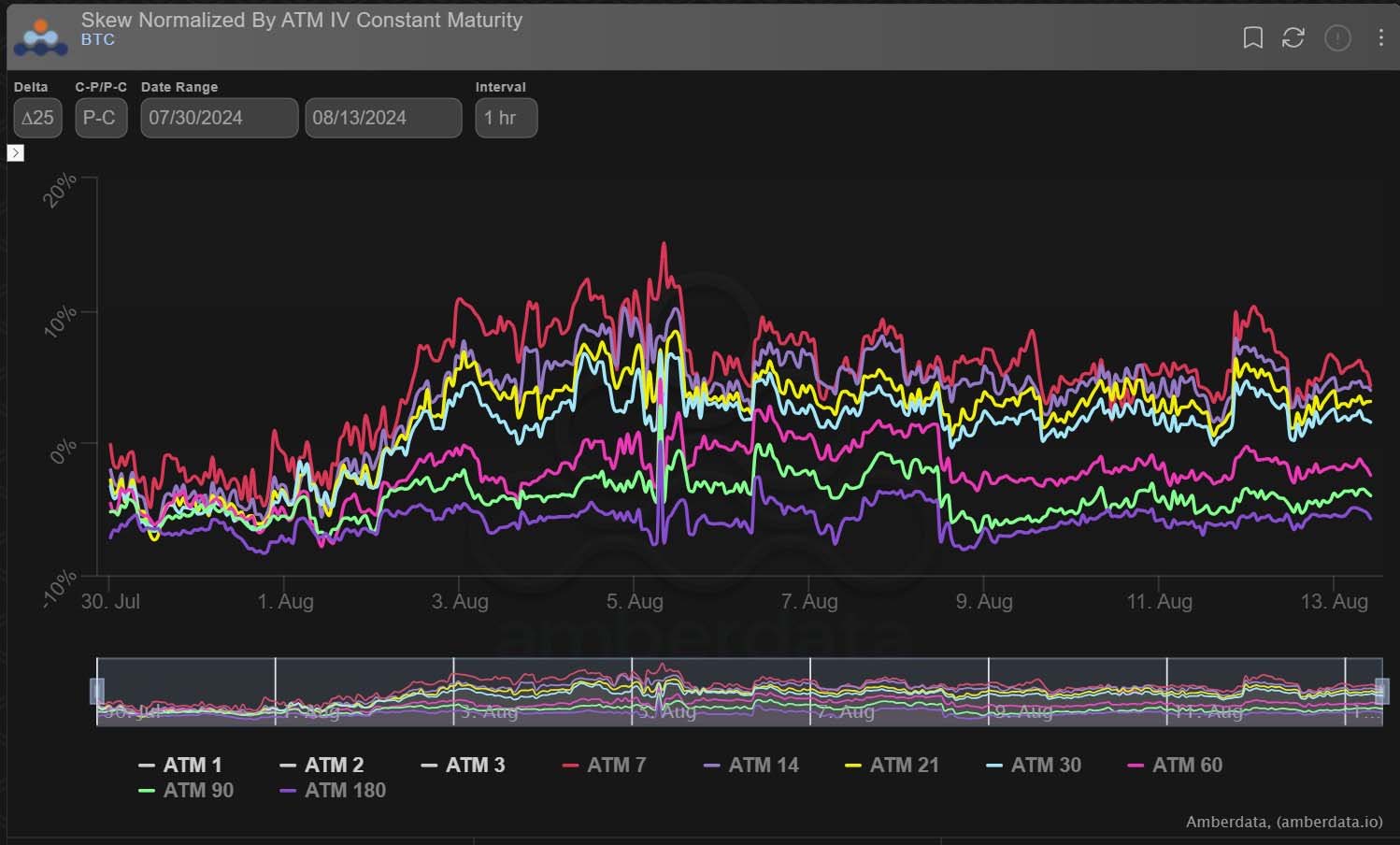

Short-term Put Skew cautious, but long-term Call bulls intact.

Awaiting PPI+CPI.

2) While near-term Vols+Skew have retraced, longer-term Calls+spreads were not restructured, and more was added.

Interestingly confidence to buy upside, funded by selling <45k Puts was evident in Dec.

But short-term positioning still remains cautious, with protection at 48-50k.

3) This can be seen via Skew dynamics, with short-term Put Skew elevated >5-10% over 25delta Calls, whereas longer-term (green+purple lines at the lower levels) Calls trade at a premium to Puts.

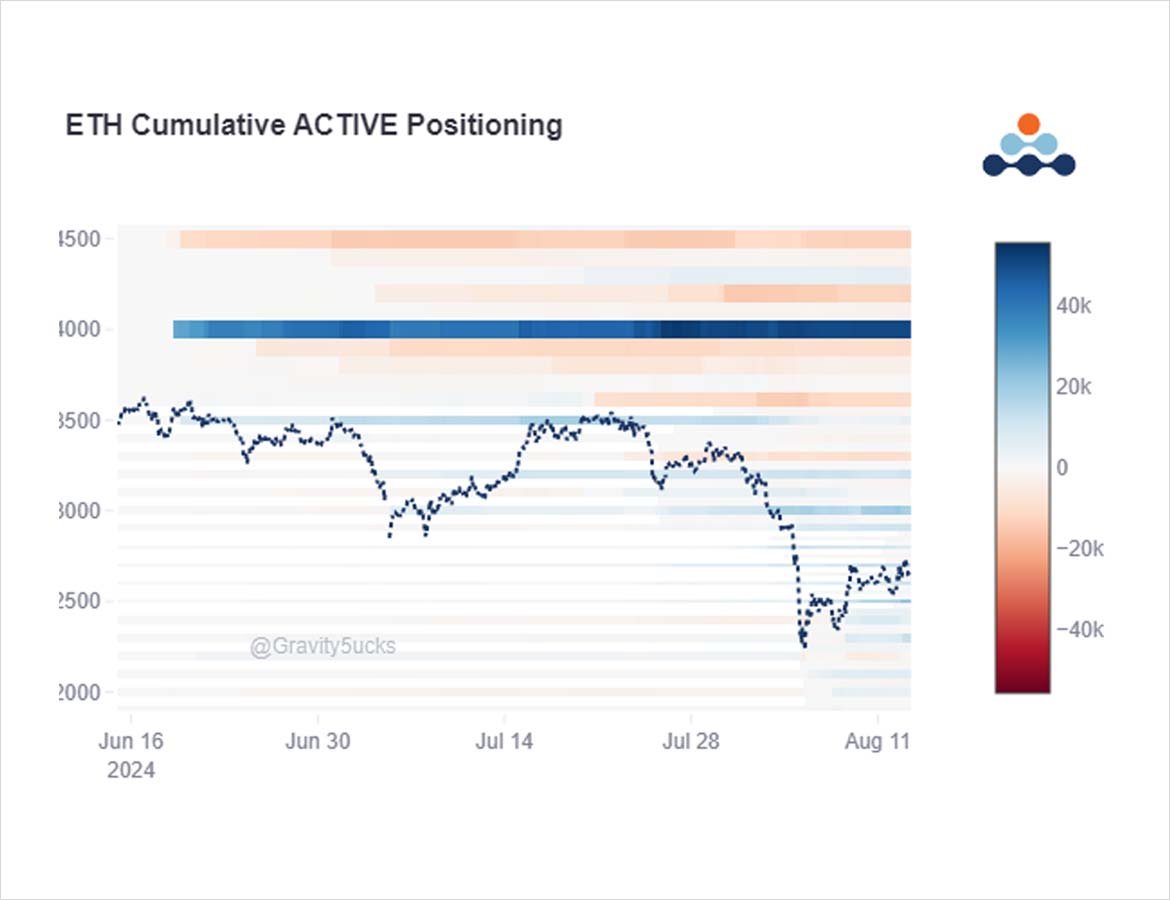

4) ETH finally saw strong volumes, but not all that the market wanted – heavy protection added around 2-2.3k Strikes, but later 2.3-2.7k Calls added.

Both ofc have a positive impact on IVs, raising the ETH-BTC Dvol spread >15%.

Pre-ETH-ETF optimistic Sep 4k Calls look desolate.

5) The last FOMC meeting + JPow AMA was insufficient to override NFP just days later which concerned the market over a potential recession.

Today we have PPI, and tomorrow CPI, which will give additional info to global markets and a possible crypto knock-on impact.

BTC Dvol 57%.

View Twitter thread.

AUTHOR(S)