View on market

The Federal Reserve is likely on track for a September interest rate cut, as suggested by the minutes from the July meeting. Meanwhile, U.S. Bitcoin ETFs have seen increased inflows, and the key $61,800 supply zone may soon be breached after multiple tests.

Bull Call Spread

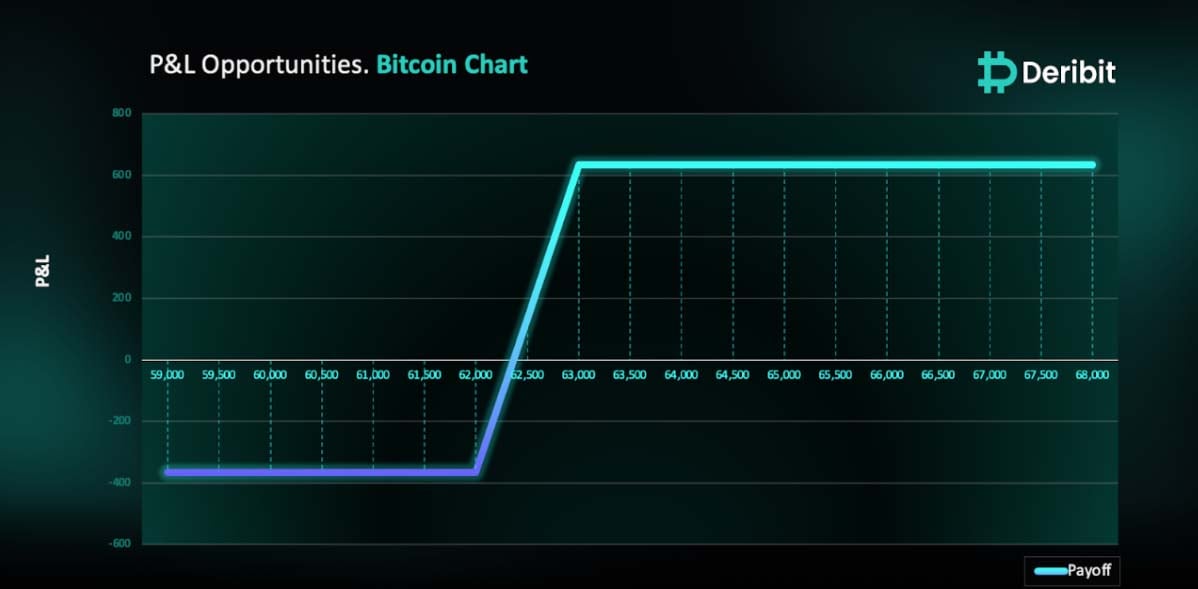

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying price rises.

You may consider taking this trade if you expect the BTC price to rise as the technical setup is bullish and FOMC Minutes gives a clue for rate cuts in the coming month.

Trade Structure

(OTM Call) Buy 1x BTC-30AUG24-$62,000-C @ $1,435

(OTM Call) Sell 1x BTC-30AUG24-$63,000-C @ $1,070

Target: Spot level > $63,000

Payouts

Maximum Profit: $635/BTC

Debit of Strategy: $365/BTC

Why are we taking this trade?

The Federal Reserve seems to be heading towards a likely interest rate cut in September, as indicated by the minutes from the July 30-31 meeting. The minutes reveal that a “vast majority” of officials support this action, with some policymakers even expressing a willingness to reduce borrowing costs during last month’s meeting.

While the Federal Open Market Committee (FOMC) kept its benchmark interest rate steady at 5.25%-5.50% on July 31, the minutes suggest that a rate cut could be on the horizon at the upcoming September 17-18 meeting. (Source: Reuters).

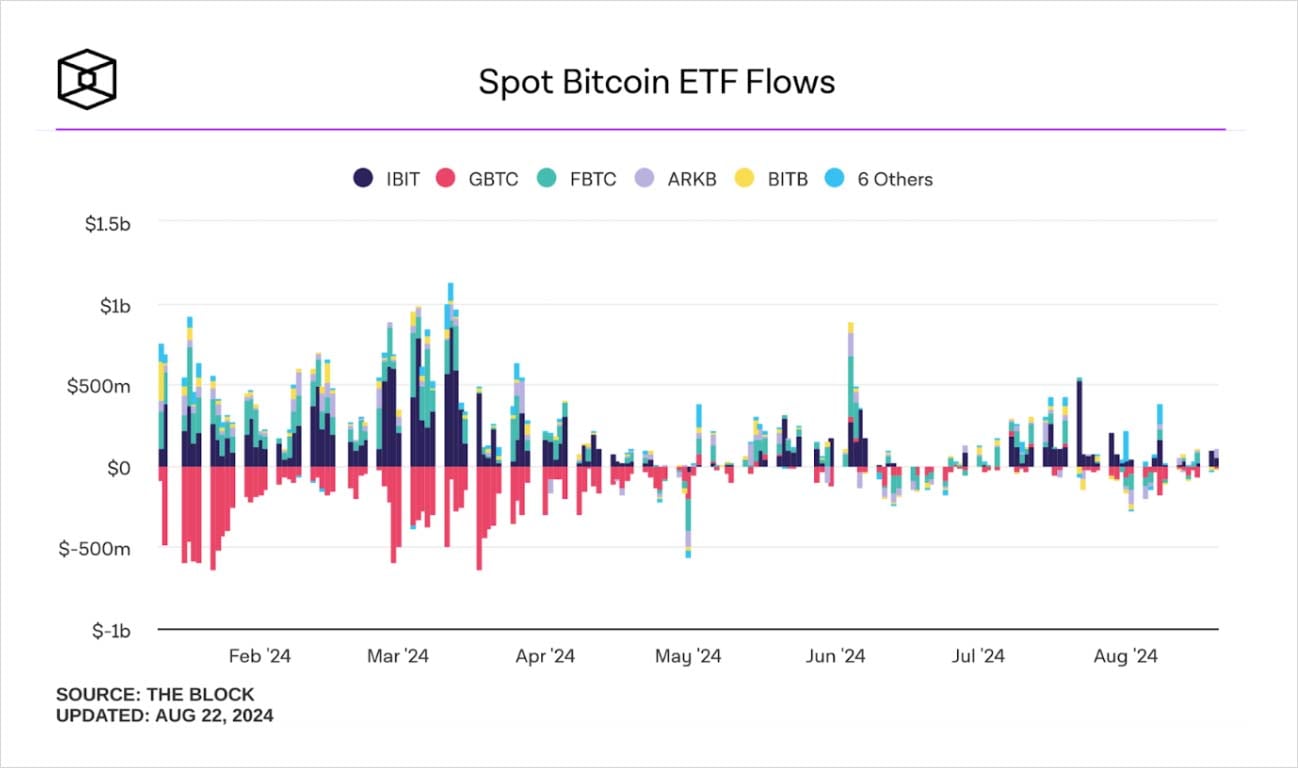

On another note, there has been inflows into the U.S. Bitcoin ETFs over the past week, which is indicating a sign of bullishness among investors. (Source: Farside).

From a technical perspective, the key supply zone at $61,800 has been tested multiple times, with no significant retracement or pullback observed following these tests. With this level repeatedly challenged, the price may soon attempt to break through it.

We can therefore expect the price to continue trading higher with the increased institutional flows, reinstating a bullish market environment.

Hence, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $62,000) and simultaneously sell a Call option at a higher strike price (e.g., $63,000).

If the price of BTC is at or above $63,000, when the options expire on August 30th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $365.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)