Seasonality Gets Ugly In Sept

Bitcoin dropped 8.6% in August, struggling to recover above $65k after a significant ‘BOJ crash’ caused over $1 billion in liquidations. Ethereum saw an even steeper decline of 22.2%, primarily due to selling pressure from Jump Trading.

Historically, September tends to be a tough month for Bitcoin, often ending in the red.

On Tradfi, the attention has suddenly shifted to Nvidia after the US Justice Department subpoenaed the company over antitrust concerns. This has led to a major spike in the VIX and a sell-off of over 10% in the stock, dragging the Nasdaq more than 3% lower. BTC has also been negatively affected.

In terms of upcoming economic data releases like the Unemployment Claims and Non-Farm Payroll (NFP) are scheduled, even if their impact on crypto markets may be minimal.

Besides, as the U.S. election approaches, the outcome between Harris and Trump is likely to heavily influence crypto movements. A Trump win might boost crypto prices, while a Harris victory could have the opposite effect.

Realized Vol Increases

Crypto realized volatility surged last week, with Bitcoin’s realized volatility climbing to 53.5 and Ethereum’s to 71. Although front-end implied volatility spiked briefly, it ended the week only slightly higher. Carry remains negative, capturing last week’s significant moves. The November U.S. election continues to suggest a 10-15% swing, while the upcoming debate are maintaining a mild bid on short-term options term structure.

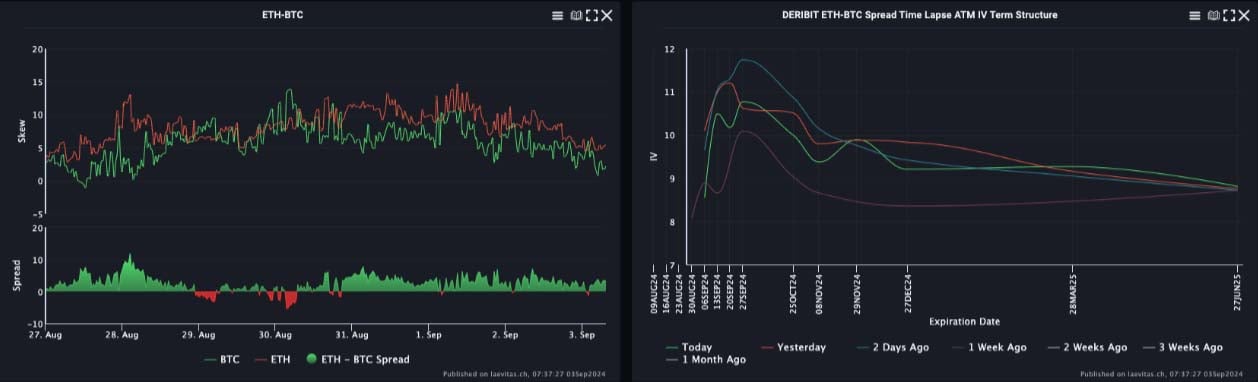

ETH/BTC Vol Spread Shifts Higher

ETC/BTC is holding near its recent lows around 0.04. The ETH/BTC volatility spread has widened, especially in the front end, with ETH leading. Current spreads are about 11-12 upfront, tapering to 9 in the back. Skew movements show stabilization in long-end call skews after recent pressure, while front-end skews have narrowed from a recent peak, with ETH maintaining a slight put premium over BTC.

Option Flows

Bitcoin trading volumes are steady at around $8 billion, with a focus on calls. Longer-term call positions have been unwound for December and March 2025 expiries, with new activity in September call spreads. Short-term put protection remains in demand as prices falter. Ethereum volumes have increased slightly to $2.4 billion, evenly split between calls and puts. September put protection is being actively adjusted as the market remains under pressure, with significant sales of December/March 2025 diagonal call calendars.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)