In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

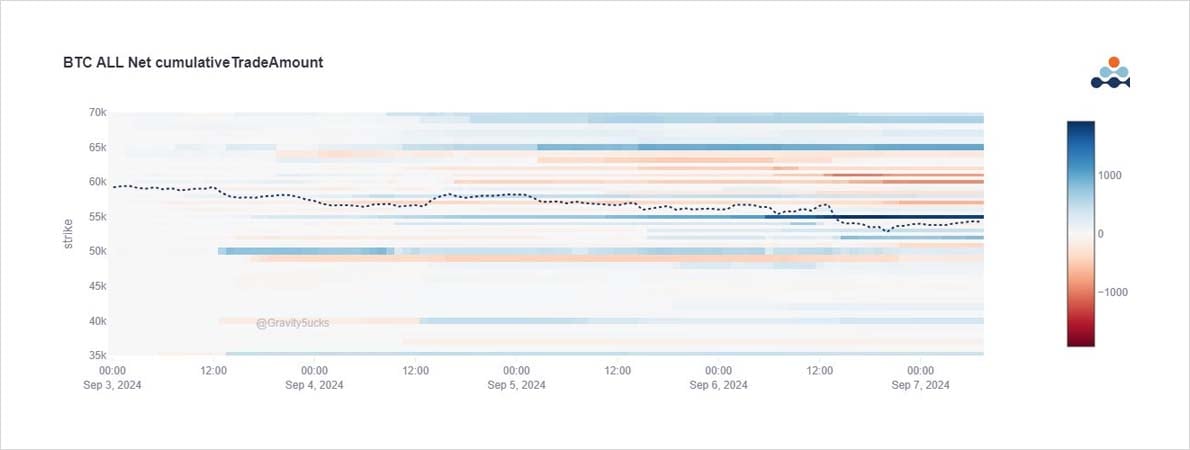

Exhibited last report Fast money getting ahead of this move lower in Spot, buying near-dated Puts.

NFP disappointed – risk off.

BTC and ETH plunged.

Fast money continued to add, some TP+roll down.

Funds back from summer bizarrely muted catching up and/or forced to risk-manage.

2) NFP failed to reassure markets.

Fast money continued to add to Puts buying 1week 49-53k Puts when BTC <55k.

Funds have been absent on downside protection but a well-timed buyer of Sep 55-48k Put spreads, in-and-out Sep 13 54k Puts, and risk-managed 52k Put purchase surfaced.

3) Still, the Fund size OTC trades are all <500lots (not Size) and some were large MM, not even large end-users, which begs the question what/how are the large Funds managing their risk in this cascade?

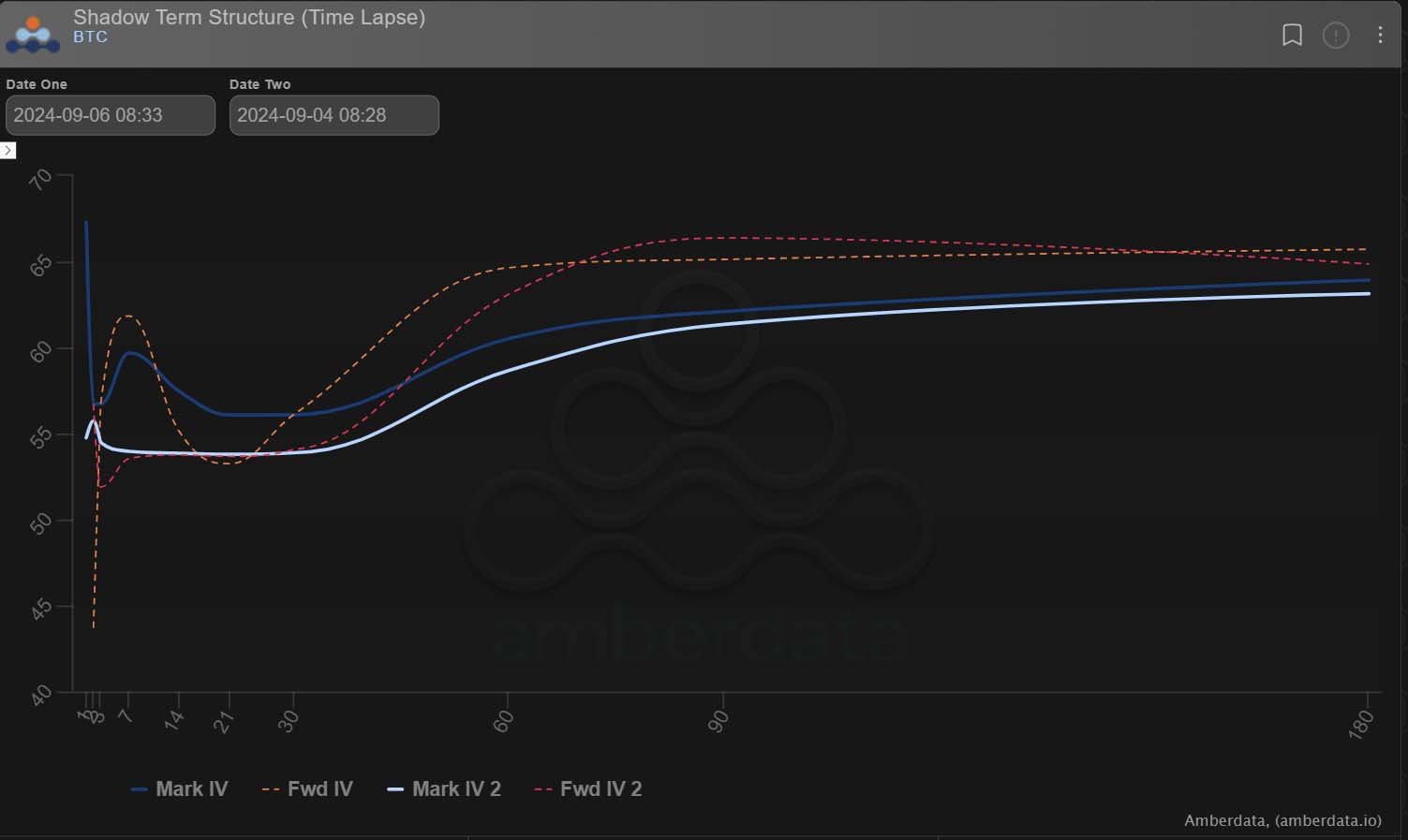

IVs are still reasonable and the curve is quite flat: opportunities missed?

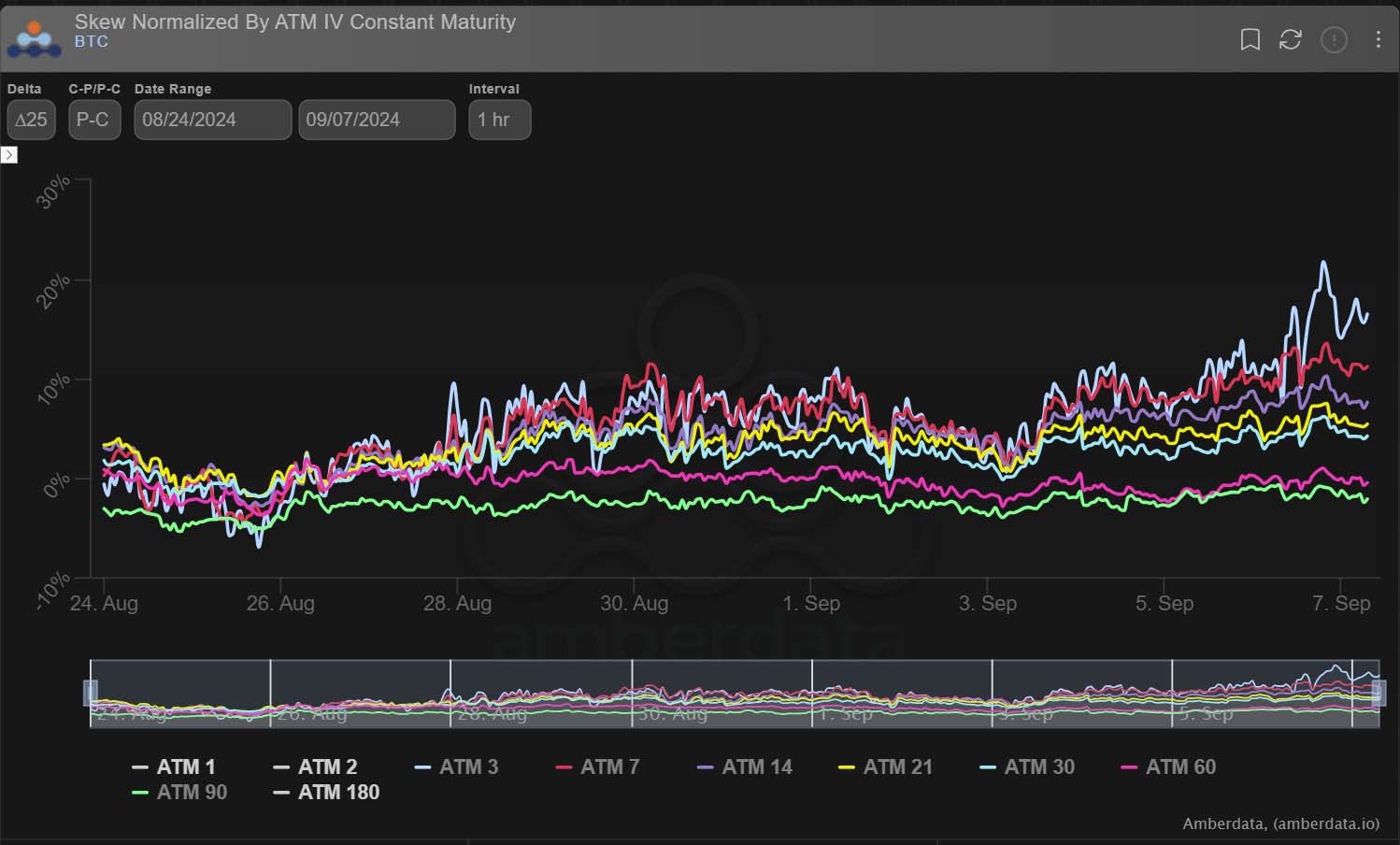

4) Not surprisingly near-dated Put Skew has continued to firm, and so some 1month+ Put buying was observed taking advantage of flatter mid-term Skew.

Some Fast-money TPd Sep 50-54k Puts near the lows and some rolled down their Puts to 48-49k Strikes increasing <1month Skew more.

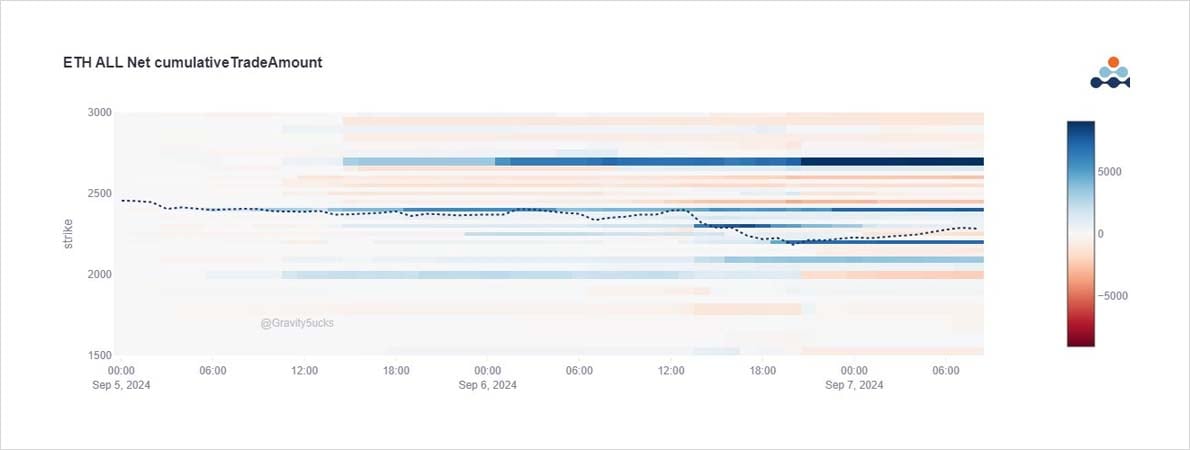

5) Interestingly on ETH, which despite underlying shocks has also been absent of proportionally-sized Option flows, the move <2.3k triggered some action (again by Fast money) TPing on 2.2-2.3k Puts and a rare sighting of $2m premium spent on near-dated 2.2-2.7k Calls.

Alts ‘firm’.

6) Despite CT bears calling for 1.5k ETH there’s been little evidence on the Option flows to support this.

Whereas there has been BTC evidence of 40-50k tests via Option flows.

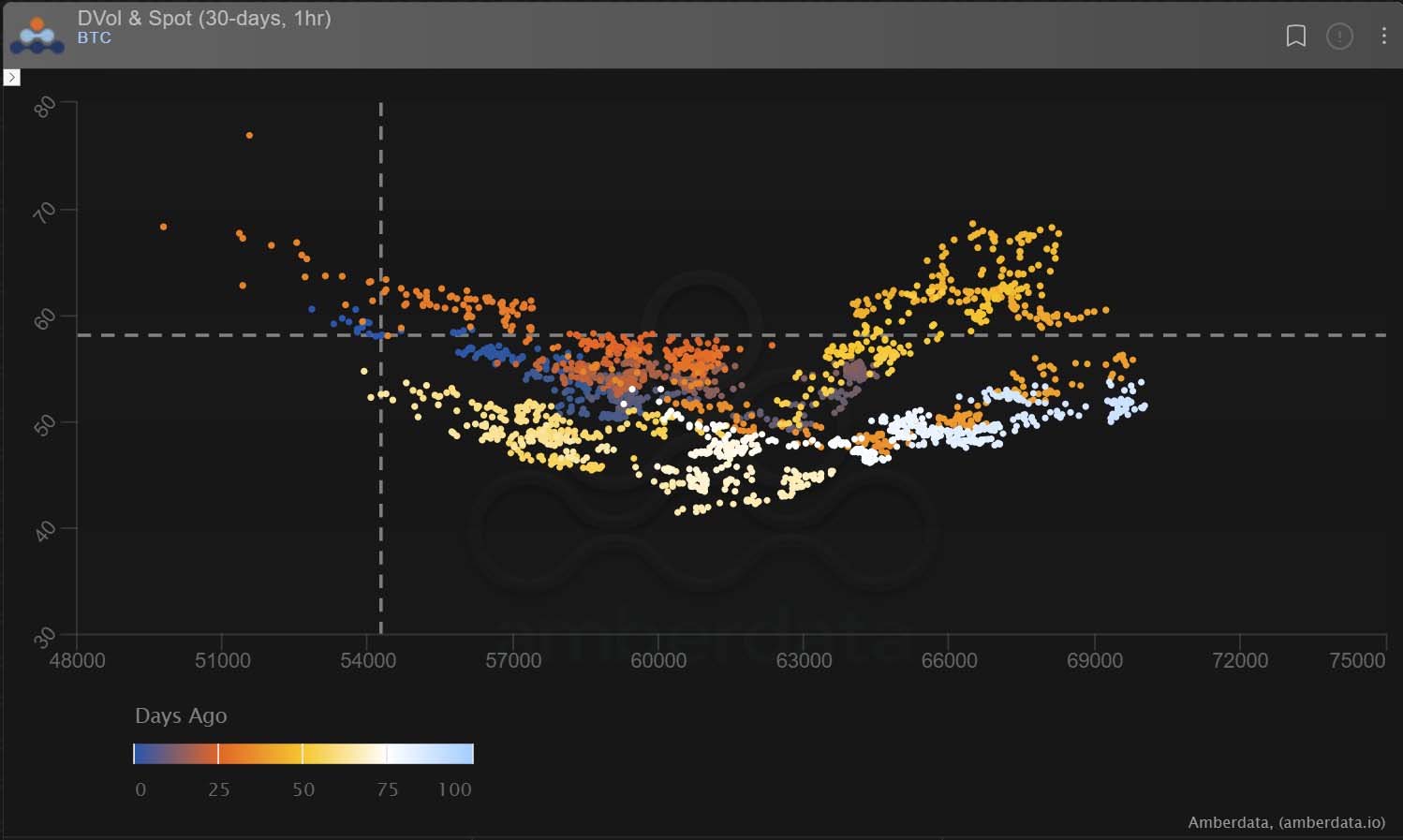

Spot-vol correlation held for a while, but then as is the case at extremes, was tested.

Still orderly.

View Twitter thread.

AUTHOR(S)