Cash and Carry Trade

The proposed strategy is a cash and carry trade. A cash and carry trade is achieved by simultaneously buying the underlying (BTC) and selling a BTC future at a premium. This trade requires the trader to start from a stablecoin position, and will end with them having more of that stablecoin.

Trade structure

Buy 1x BTC @ $57,270

Sell 1x BTC-25OCT24-@ $57,825

The future should be trading above spot at the time of trade.

Payouts

Target Profit: $555/BTC (Premium in BTC Futures)

Reasons for taking this trade?

We are executing this trade to capture the price difference between the spot price and the futures price of Bitcoin, a strategy known as basis trading. By buying the underlying asset (BTC) and simultaneously shorting Bitcoin futures that are trading at a premium, we eliminate exposure to price fluctuations in the underlying asset. The goal is for the difference between the spot and futures prices to decrease or reach zero.

The advantage of this strategy lies in the certainty provided by the futures contract’s expiration date. Futures are settled based on the index price, which is an average of several of the largest spot markets. The futures settle on a 30 minute TWAP of the index leading into expiry. As the expiration date approaches, the premium tends to shrink to zero. In cash and carry trading, traders will seek to open positions when the futures contract has a significant premium, allowing them to capture this premium without exposure to the underlying asset’s price movements.

Regardless of how Bitcoin’s price moves over time, the trader will secure a profit equal to the premium difference without taking directional risks. This makes it a low-risk trade, as the short futures position hedges the long position in the underlying asset.

The trade is closed when the premium on the futures contract reaches zero, which is most likely at expiry. If the premium decreases to zero before expiry, the trader can take advantage of the opportunity to close the position early. Additionally, if the premium turns negative—where the futures price falls below the spot price—there’s an opportunity for traders to capture extra profits by closing the position at that point.

If a trader decides to close the position before expiration, they must buy the underlying futures and simultaneously sell the BTC (underlying asset) back into USDC.

Alternatively, the trader can opt to roll the position by closing the current future position by buying it and simultaneously selling another BTC futures (sized based on the amount of BTC originally purchased), without needing to repurchase the underlying asset.

To execute this trade, traders can buy BTC (underlying asset) while simultaneously selling a BTC Future at a premium, like BTC-25OCT24.

When the BTC future prices are equal to spot/underlying prices, traders will achieve maximum profit from this strategy. Traders can expect an effective annualized return of around 7.5% in the current market.

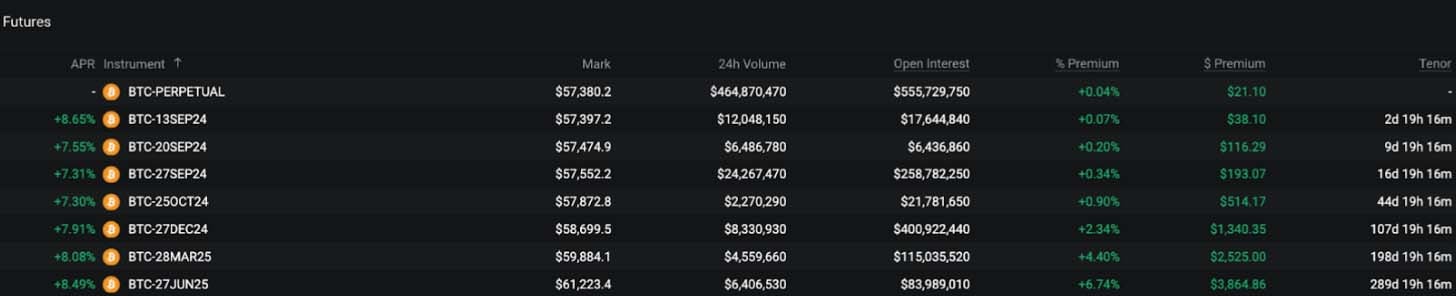

Traders can also refer to the Futures Metrics page to check the current premium and what rate that annualises to for each available expiry.

Additionally, can also refer to videos on cash and carry trades on Deribit’s Youtube Channel under the Cash and Carry playlists.

Source: Deribit Futures Metrics

How to take this trade on Deribit?

Step 1: Go to the “Spot” menu at the top of the page.

Step 2: Click on BTC/USDC, and enter the details for the desired quantity, and click on “Buy BTC”.

Step 3: Go to the “Metrics Futures” page, which can be found in the top menu by clicking the 9 dots besides the Deribit name and symbol.

Step 4: Select currency “BTC” and then select “BTC-25OCT24”.

Step 5: Enter your order details and quantity(should be sized according to the amount of BTC purchased in Step 2), and click on “Sell”.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of the analyst. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

Deribit or any of its connected persons including its directors or associates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained, views and opinions expressed in this publication.The Research Analyst/s engaged in preparation of this document does not have any financial interests in the subject contract/s mentioned in this document, and does not own any of these contract mentioned in the document, and does not have any other material conflict of interest at the time of publication of the research document.

AUTHOR(S)