BTC Tries To Break Higher As Uptober Unfolds

Bitcoin is back in action, pushing toward breaking its $63,000 resistance. A successful breakout could reignite momentum toward the $67,000 high. With strong support at $60,000 and October historically being a positive month for Bitcoin, the stage is set for potential gains. Added boosts come from strong U.S. job numbers, crypto-focused media coverage, and global economic support. This week’s U.S. inflation report could further influence market direction.

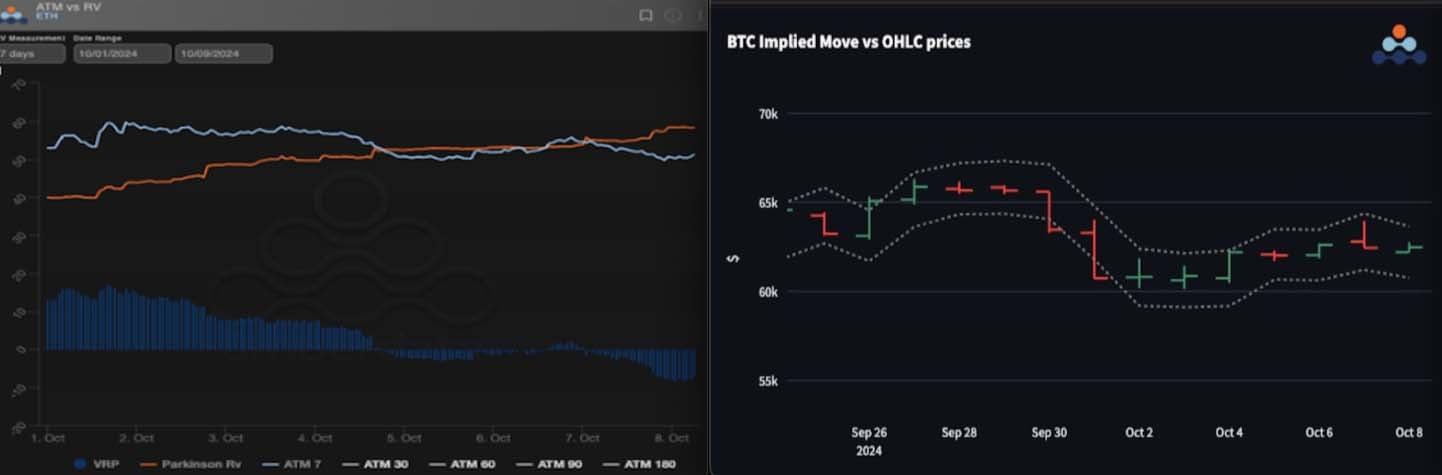

Realized Vol Steadily Higher

Crypto volatility surged as Bitcoin dipped to $60K before bouncing back. Despite this, implied vol remains under pressure. Carry flipped into negative for both assets with ETH getting as far as -8 vols. This makes owning vol more attractive than we’ve seen in weeks. Short gamma players were able to stay in positions with intraday swings mostly contained within implied ranges. Middle Eastern headlines and upcoming U.S. CPI data will likely drive further volatility.

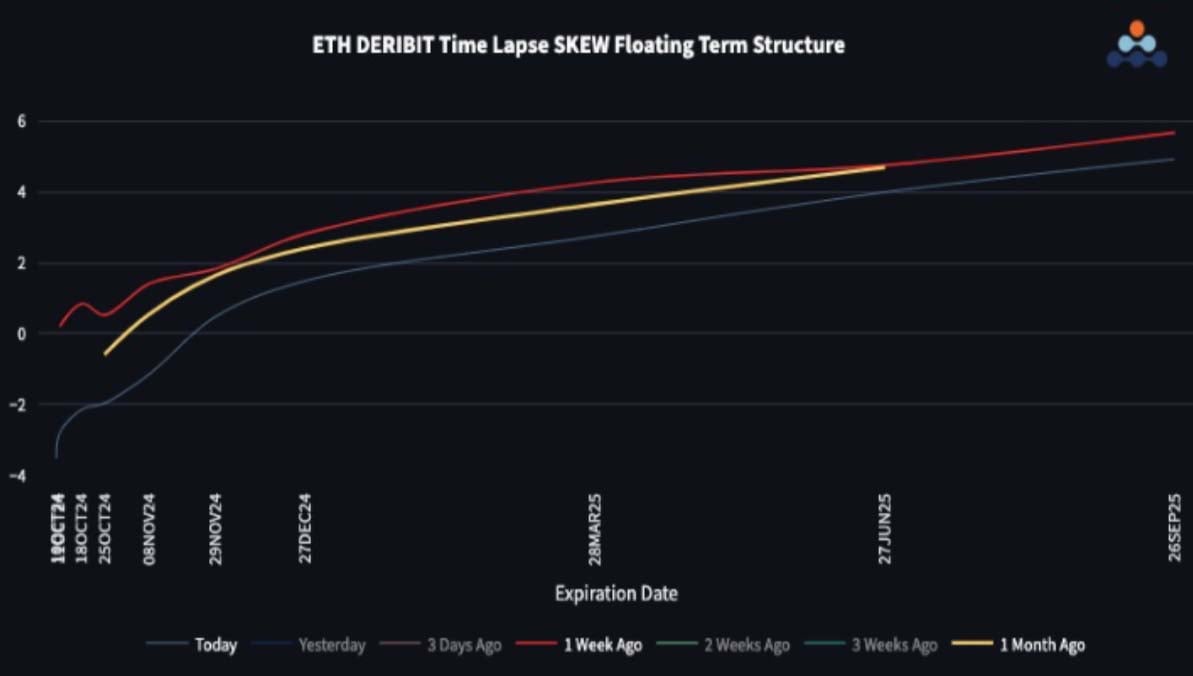

Skew Deeper Into Contango

Skew is deepening into contango as puts gain traction, particularly in ETH, which did not hold its support. Meanwhile, call skews are narrowing. When it comes to BTC, Downside vol below $60K strikes presents an attractive hedge against market weakness, especially in November and December, when election risk looms.

ETH/BTC Back To The Lows

ETC/BTC looks bearish with no major support in sight. ETH volatility lags behind BTC despite higher realized gains, and puts are better bid as ETH/BTC faces downside risks. With election odds favoring Trump, BTC may outperform.

Option Flows

Bitcoin volumes increased by 5%, with 73% favoring calls, driven by hedging and bullish bets on higher prices. December and March expiries saw significant activity. ETH volumes also rose, with a strong preference for short-dated calls, particularly October contracts, while put interest remained low.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)