BTC Hits Escape Velocity

Trump’s election has sparked massive excitement in the crypto space, pushing BTC to a new all-time high of $90k.

His presidency signals a potential shift towards pro-crypto policies, likely easing regulatory pressures like those from “Operation Chokepoint 2.0,” and possibly introducing a crypto-friendly SEC head. There’s even talk of a “Bitcoin Strategic Reserve.”

This supportive environment is attracting institutional investment, with major inflows into BTC and ETH, while giants like BlackRock and Visa make strides into crypto.

Trump’s economic policies could further boost liquidity, some of which may fuel crypto investments. While his term begins in January 2025, the market is already pricing in these anticipated changes.

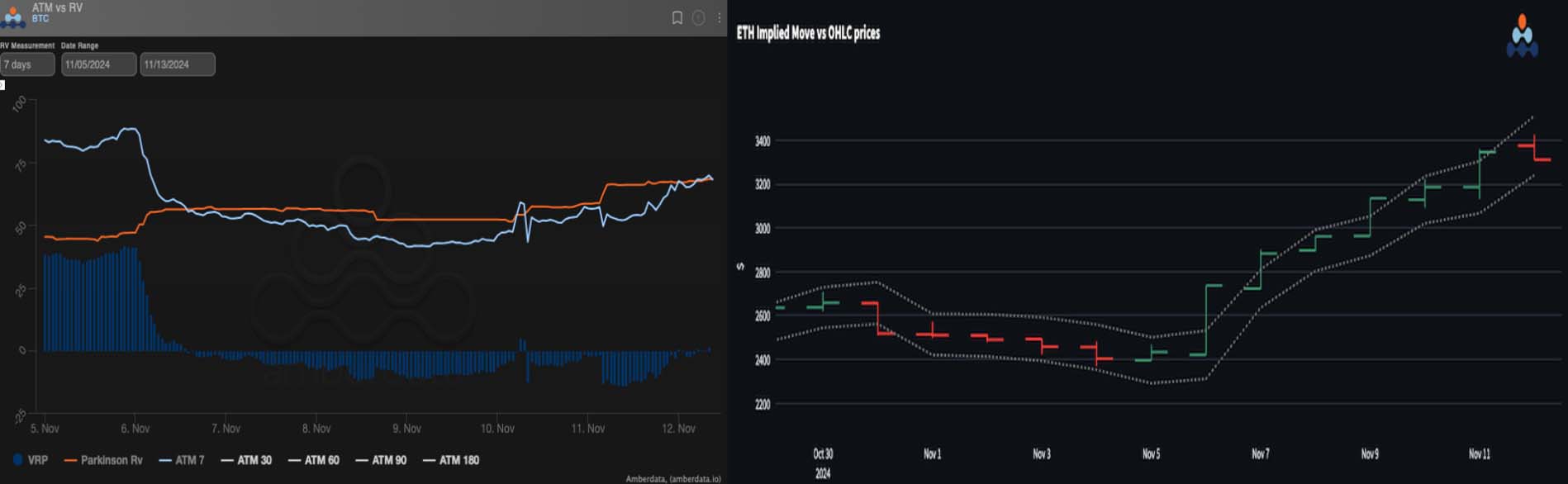

Vol Higher In The Front End

Crypto realized volatility has surged by 20-25 points since the election, with BTC’s climb above $80k over the weekend pushing front-end volatility and inverting curves. ETH has frequently broken its implied range, adding challenges for short gamma traders. As BTC explores unchartered highs, volatility is expected to stay elevated, while ETH outperforms BTC in realized volatility by nearly 20 points, re-establishing its position as the higher-beta asset.

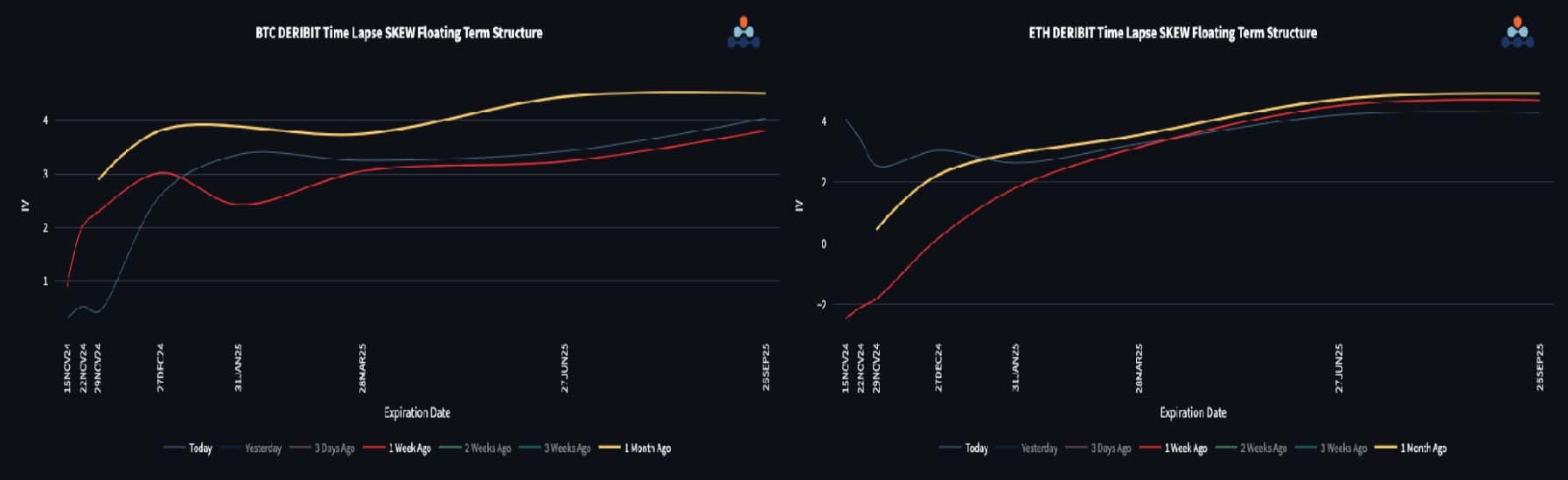

Skew Term Structures Diverging

Skew term structures have diverged this week. BTC’s skew curve remains steep as short-dated call skews quickly normalized after reaching $90k. ETH’s call skew holds strong in the near term, as markets anticipate further gains, with ETH still far from its all-time highs.

Change In Mindset For ETH Upside

ETC/BTC initially surged 20%, but has since lost half of its gains as BTC rallied on discussions of a “Bitcoin Strategic Reserve.” ETH volatility has strengthened, with a 15-point spread at the front end, stabilizing at around 10 points further down the curve. A shift in ETH’s skew structure now signals short-term bullishness, pulling forward what was previously a medium-term outlook.

BTC & ETH Option Flows

BTC trading volumes have jumped 60% to $20.5 billion, with a 70/30 split favouring calls over puts. Some profit-taking on near-dated calls followed the post-election rally near $76k, while hedges for Mar25 bear risk reversals are active. The recent move above $80k has spurred further upside rolling from Nov to Dec, though call skew remains moderate. Meanwhile, ETH volumes surged 200% to $4.8 billion with a 78/22 call split, driven largely by on-screen trades. After the initial rally, a massive 48k clip of Mar25 2800/3800 call spreads suggests significant interest in an ETH rally.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)