In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

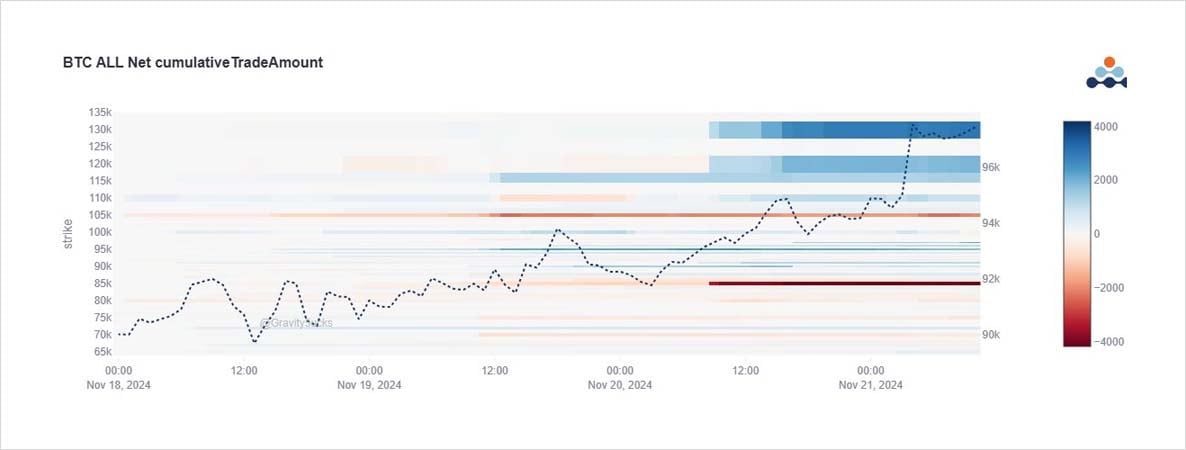

A robust opening day for IBIT options, volumes weighted heavily to Calls, +Saylor continued top-blasting potentially triggered huge roll-ups of strategic mid-term Calls and $10’s of millions of premium. Dec+Mar 80-90k Calls rolled-up to Dec 97k, Jan+Mar110-130s, Jun130k Calls.

2) Chart shows:

Dec90k Calls rolled up to 97k Calls cost neutral.

Dec 100k up-and-out to Jan 110k.

Mar80+85k to Mar 110+120+130ks.

Dec 85k Calls up-and-out to Jun 130ks

Additional Jan 110k+Jun 130k Calls bought.

Some hedging/basis via Nov 97-100k Collar.

Funds.

Fast-money 2way.

3) Now we’re starting to see these large vega upside buyers (note not as much gamma due to slow grind up movement), BTC curve IVs reacting upwards too.

With ETH not showing the same exuberance, BTC-ETH Dvol spread has tightened from 10% (still ETH over) to 2%.

View Twitter thread.

AUTHOR(S)