BTC Takes Out $100k

Bitcoin makes another all-time high, as FED chairman Powell endorses it, by calling it a “competitor with Gold” and triggering the much-anticipated break above 100k. Microsoft shareholders will vote on December 10 on a proposal to add Bitcoin to the company’s balance sheet – a move that could propel prices even more. November saw record inflows into U.S. spot Bitcoin ETFs, significantly impacting demand and supply dynamics. The crypto market has added above $1.3 trillion in capitalization since the November 4 election, reflecting optimism for industry-friendly policies ahead. Ongoing discussions about past regulatory challenges are sparking interest in the market’s untapped potential.

Gamma Sellers Are Still Waiting For The New Range?

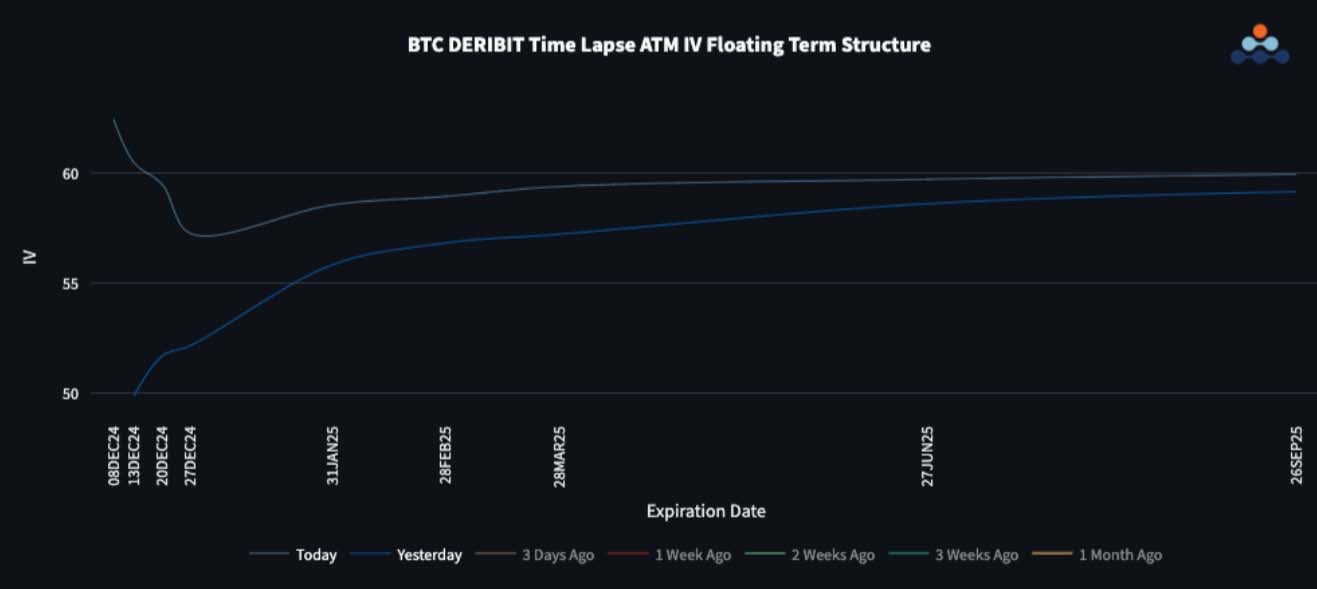

Realized volatility was decreasing in both Bitcoin and Ethereum, but Ethereum maintained a higher level. Implied volatility also dropped, especially in the front expiry, taking BTC into a steep contango before we broke higher. Positive carry remains in both assets but the break above 100k has triggered a strong bounce in implied vol and has inverted the curve once again. ETH moves remain larger on average still.

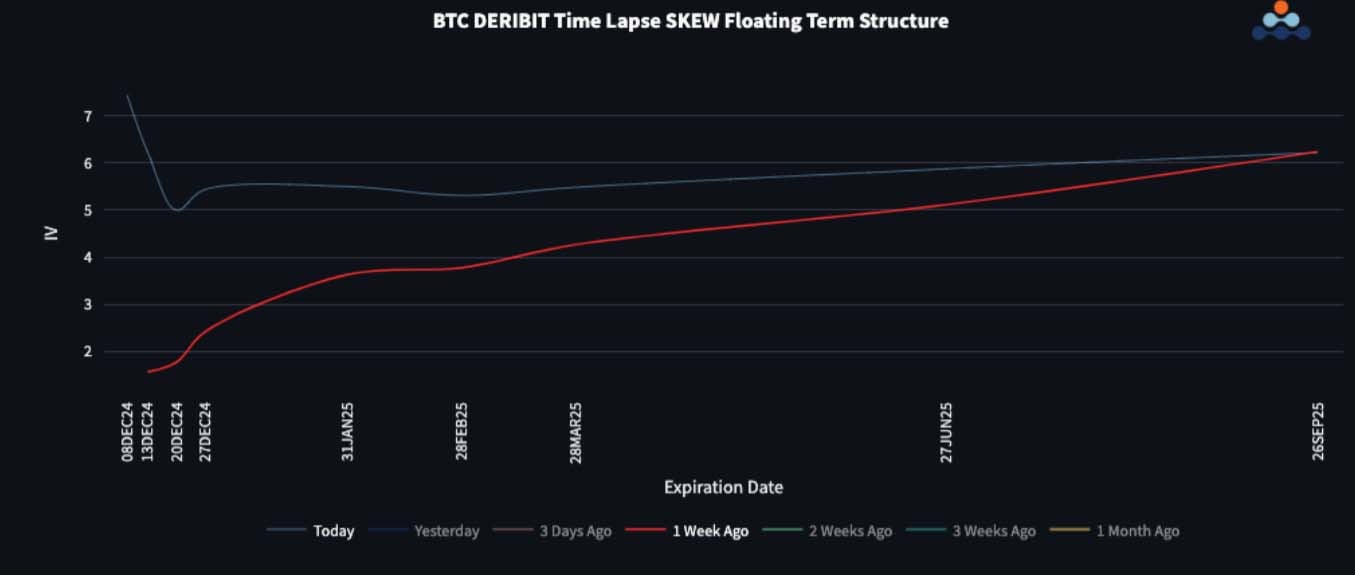

BTC Call Skew Bid Again

Skew term structures caught a strong bid for calls once again, led by the front end as BTC broke to new highs. ETH had been better bid for calls as it was showing more strength but the break above 100k has brought some life back to BTC upside.

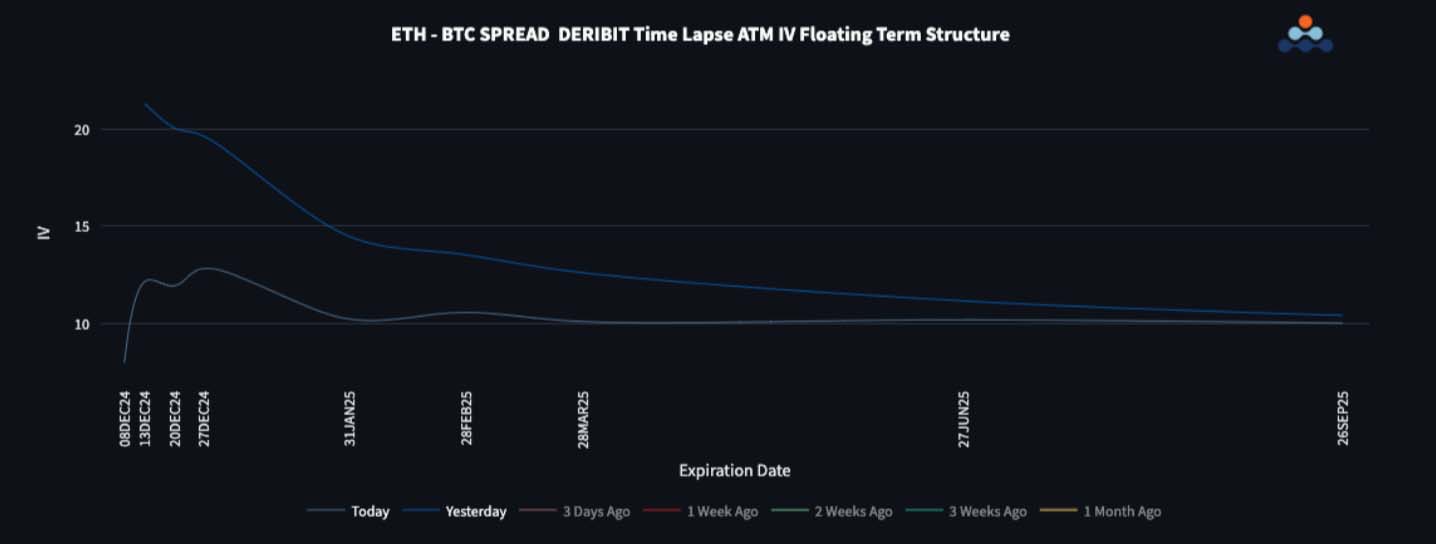

ETH/BTC Tests 0.04

The ETH/BTC pair rallied about 15% and tested 0.04, which is starting to look like a trend reversal, and could unlock significant upside for Ethereum. The jury is still out as the BTC pop overnight has dragged us back to 0.038. Ethereum’s volatility has held up better than Bitcoin’s across the curve, the spread touched 20 vols in the front end but has since reverted as BTC broker higher. The relative skew term structure is trading quite flat after the recent BTC rally, but had been in favour of ETH calls for a while. Looks like BTC isn’t ready to hand over the reins just yet!

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)