Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The derivatives market has recently behaved in contrast to what we observed post-election. BTC spot price has repeatedly broken all-time highs, now reaching $107K, but its short dated implied volatility has been trending lower, decreasing sharply after the rally in line with drifting realized volatility. Skew initially indicated increased interest in OTM puts as volatility was falling, but it has since returned to positive territory, with OTM calls now trading at a volatility premium again. The period of strong inversions coinciding with spot rallies appears to have come to an end, as traders have not yet reopened overly leveraged positions during drastic spot price moves. Sentiment has slowed, with futures implied yields being the only signal that continues to ramp up for short tenors.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – BTC’s yield term structure is showing rising levels for short tenors opposed to ETH’s, each curve reflecting current spot activity.

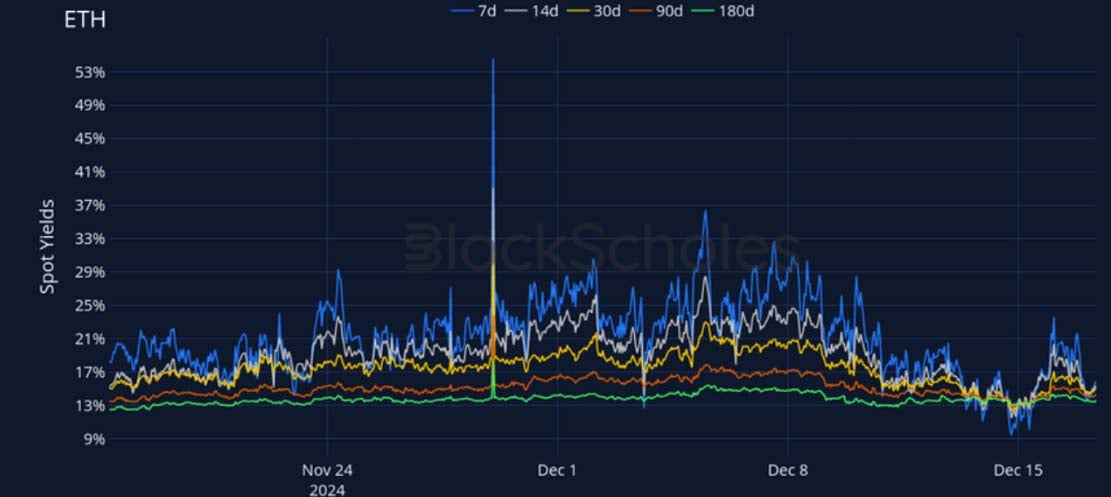

ETH ANNUALISED YIELDS – ETH’s yield curve is flat and has recently showed subdued movements across tenors compared to the past month.

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC’s perpetual funding rates traded positively during the rally on Monday morning, but rates has since returned to neutral.

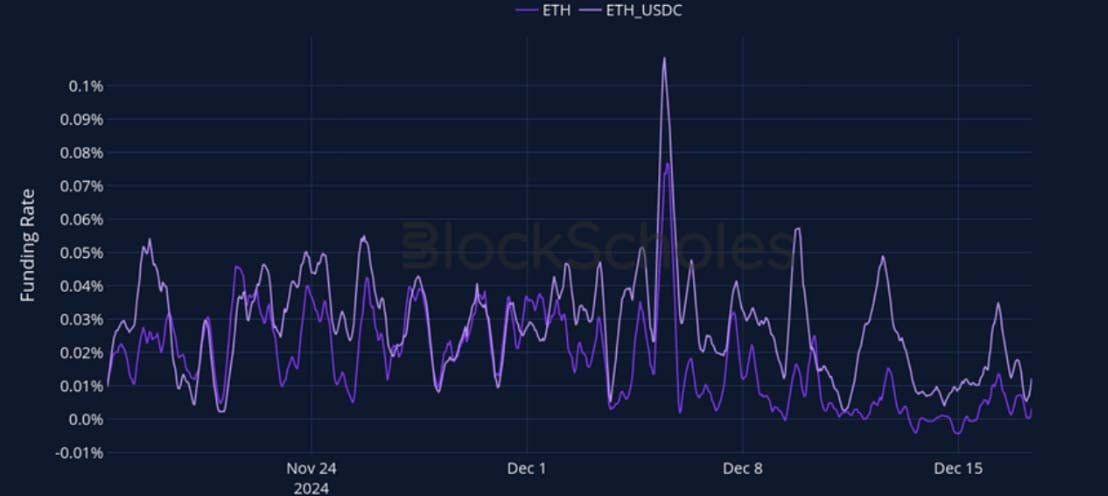

ETH FUNDING RATE – ETH’s funding rate remains neutral, without showing heightened activity.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – The term structure of implied volatility has steepened after the rally that brought BTC to a new ATH.

BTC 25-Delta Risk Reversal – Skew levels have been on a decline across tenors, with short-tenors dipping negative briefly after the rally.

ETH Options

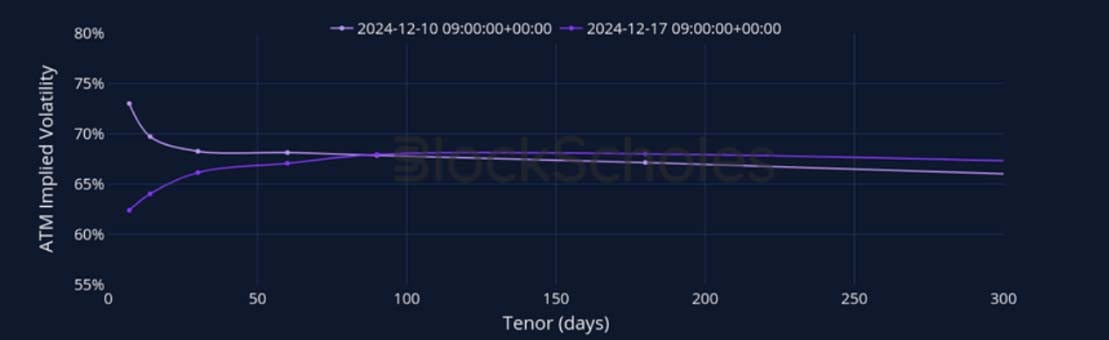

ETH SVI ATM IMPLIED VOLATILITY – ETH’s implied volatility term structure has steepened, mirroring BTC’s movements.

ETH 25-Delta Risk Reversal – Short-tenor smiles have lost much of their bullish skew, with short tenors assigning a volatility premium to OTM puts.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

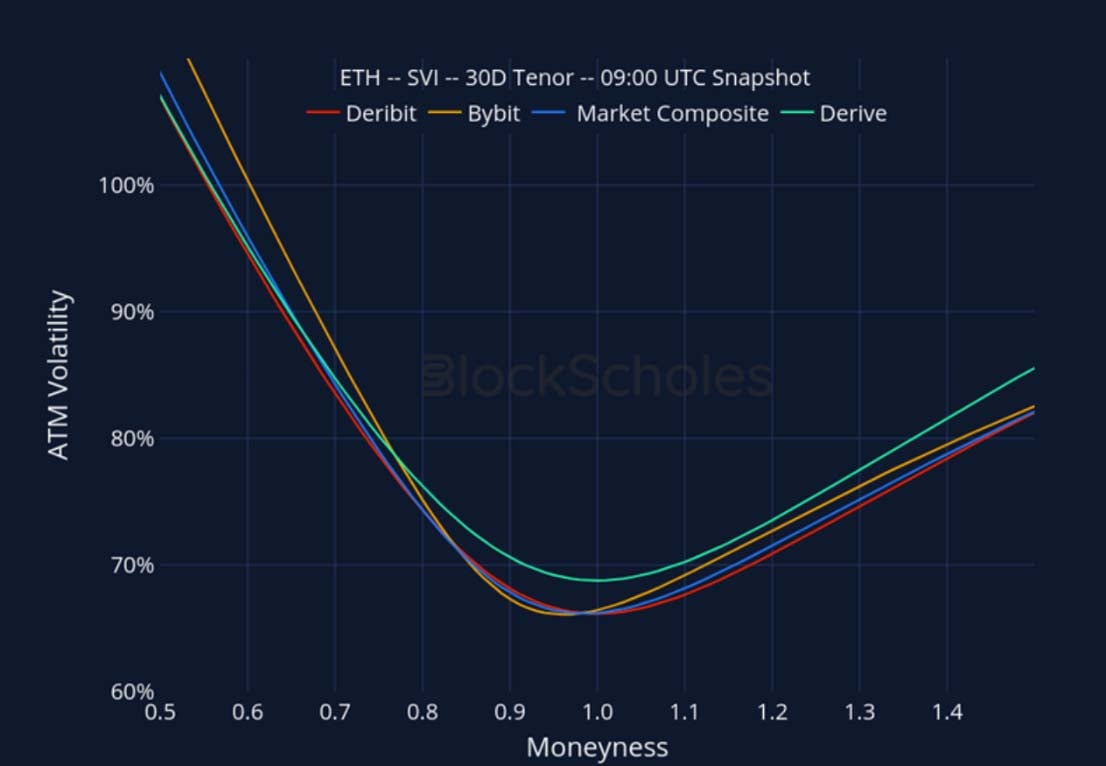

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

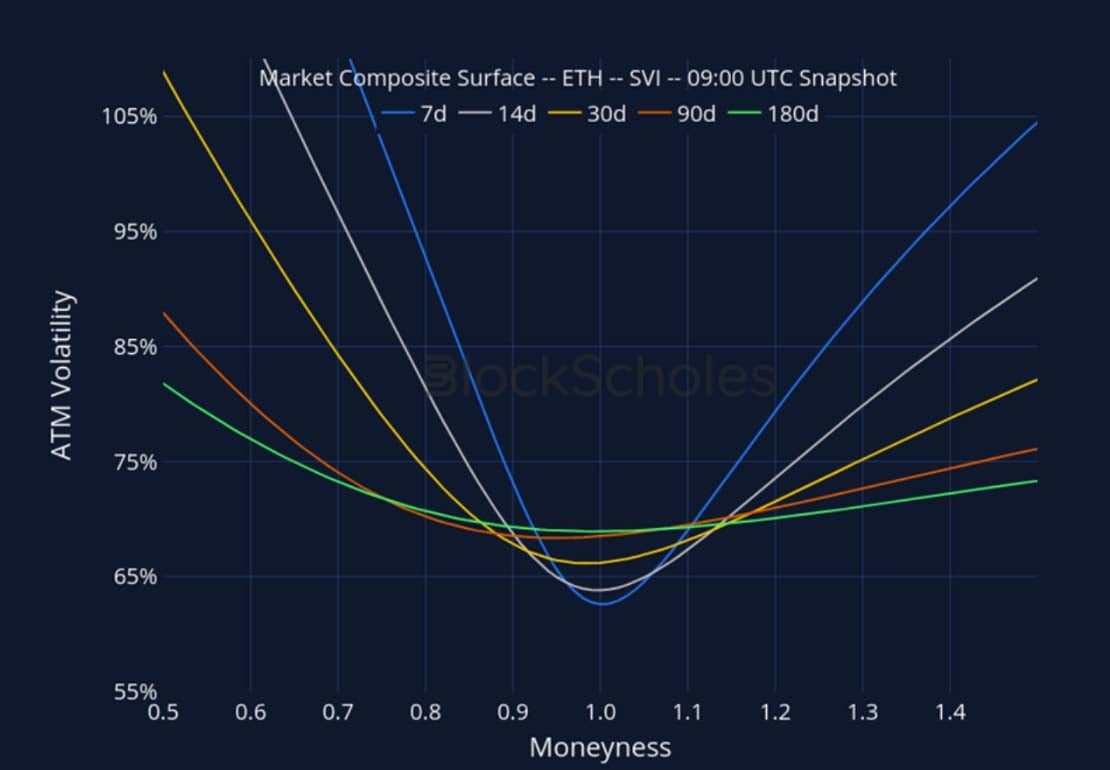

Market Composite Volatility Surface

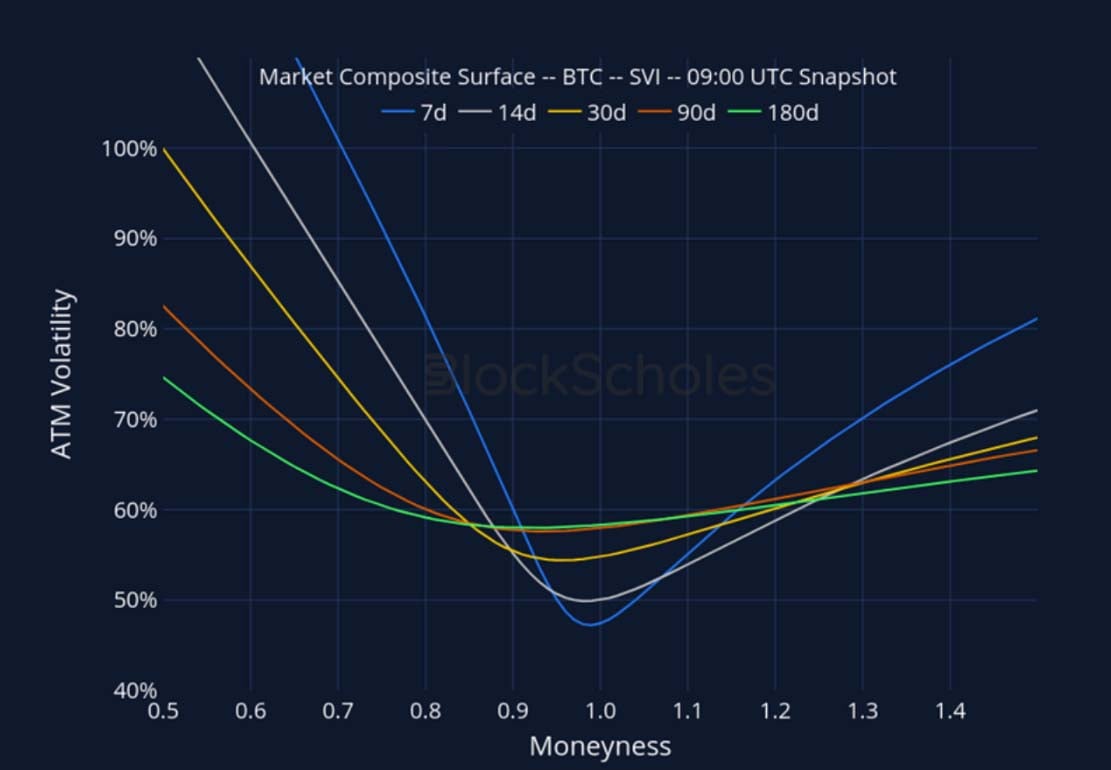

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

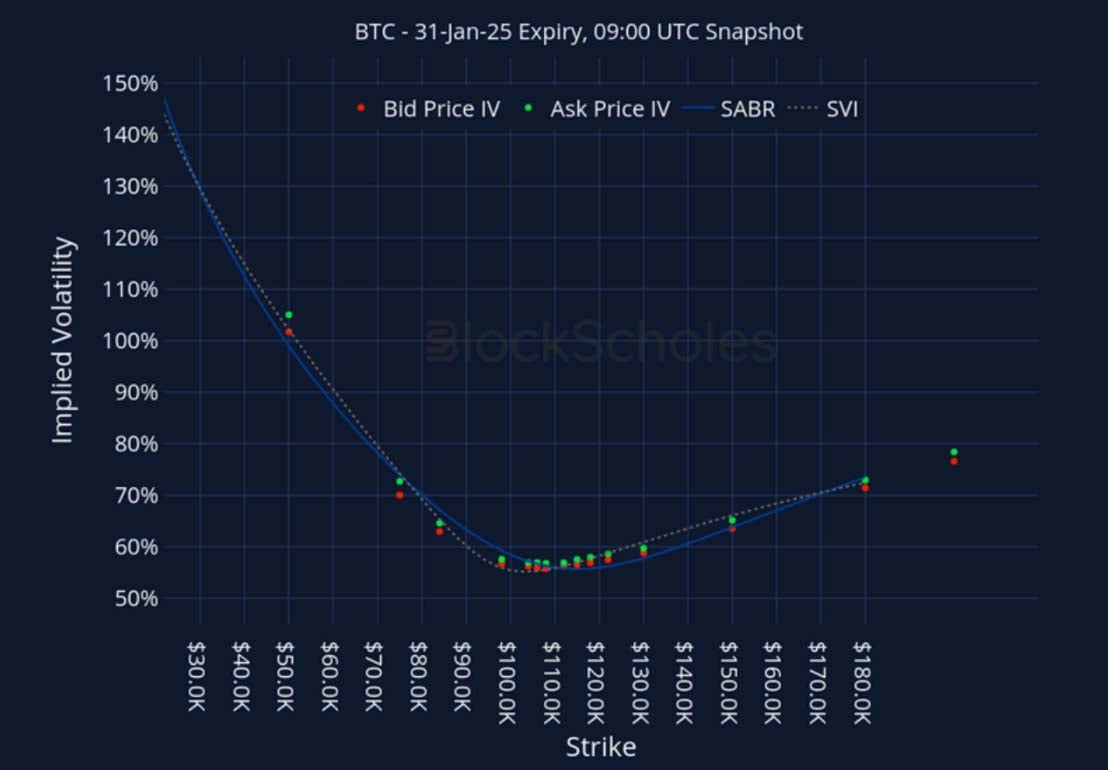

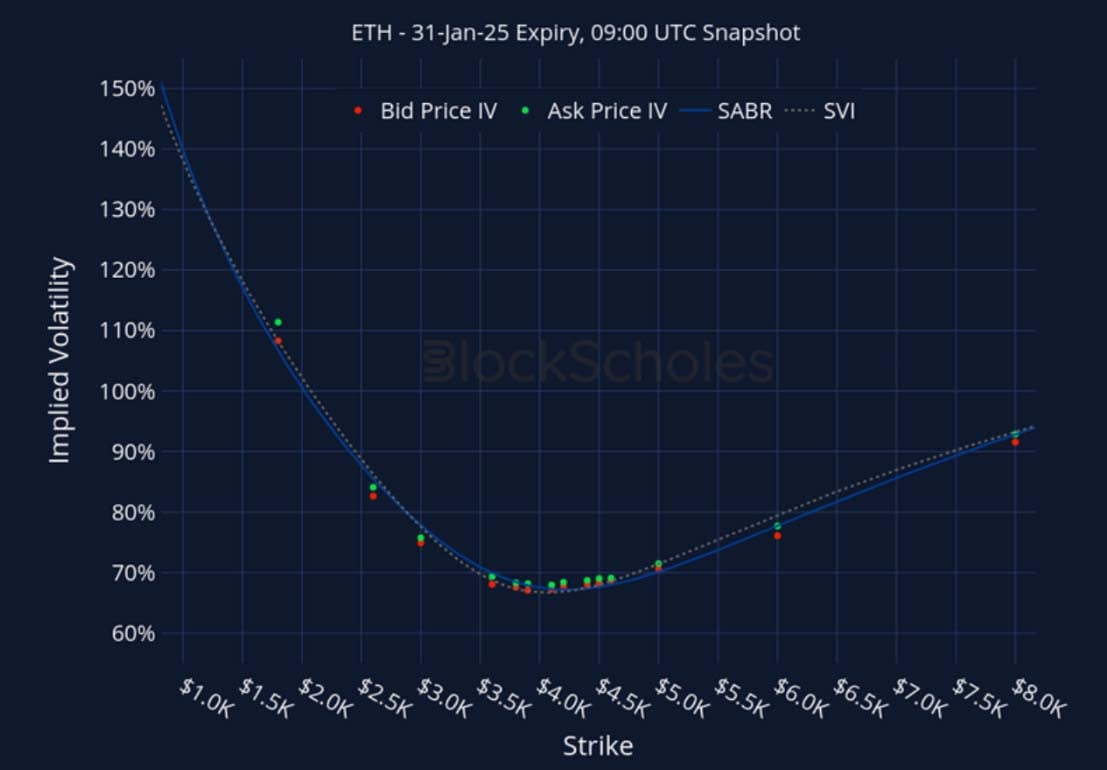

Listed Expiry Volatility Smiles

BTC 31-JAN EXPIRY – 9:00 UTC Snapshot.

ETH 31-JAN EXPIRY – 9:00 UTC Snapshot.

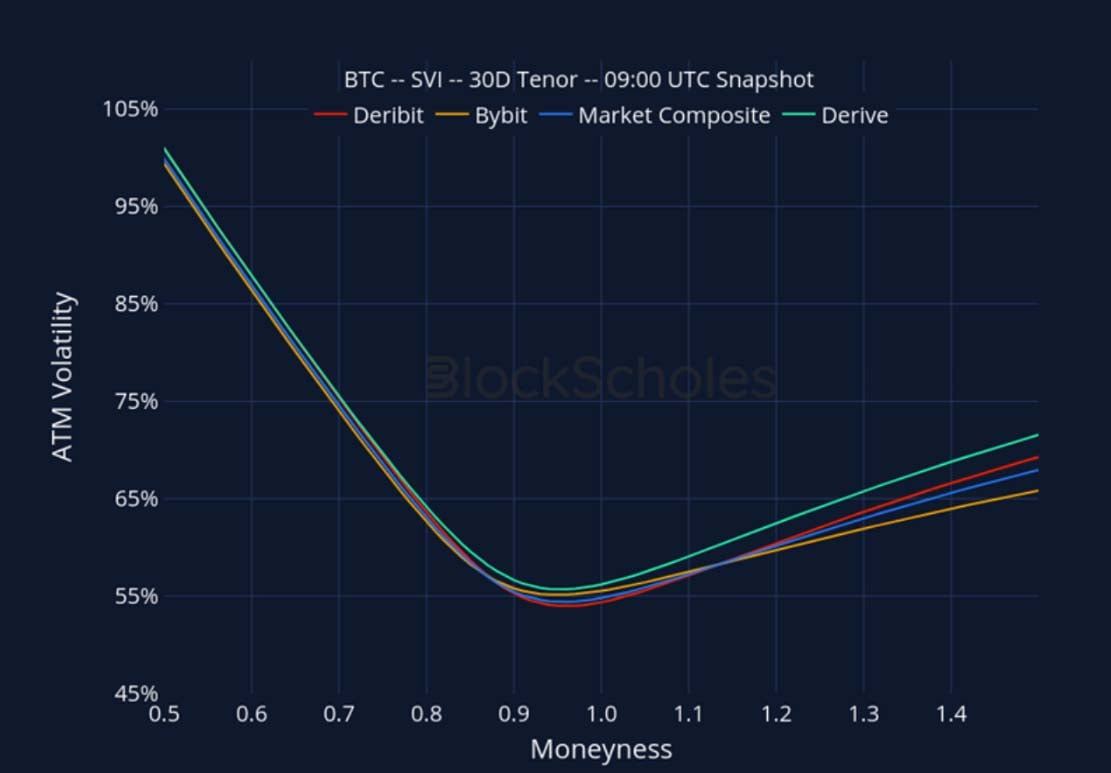

Cross-Exchange Volatility Smiles

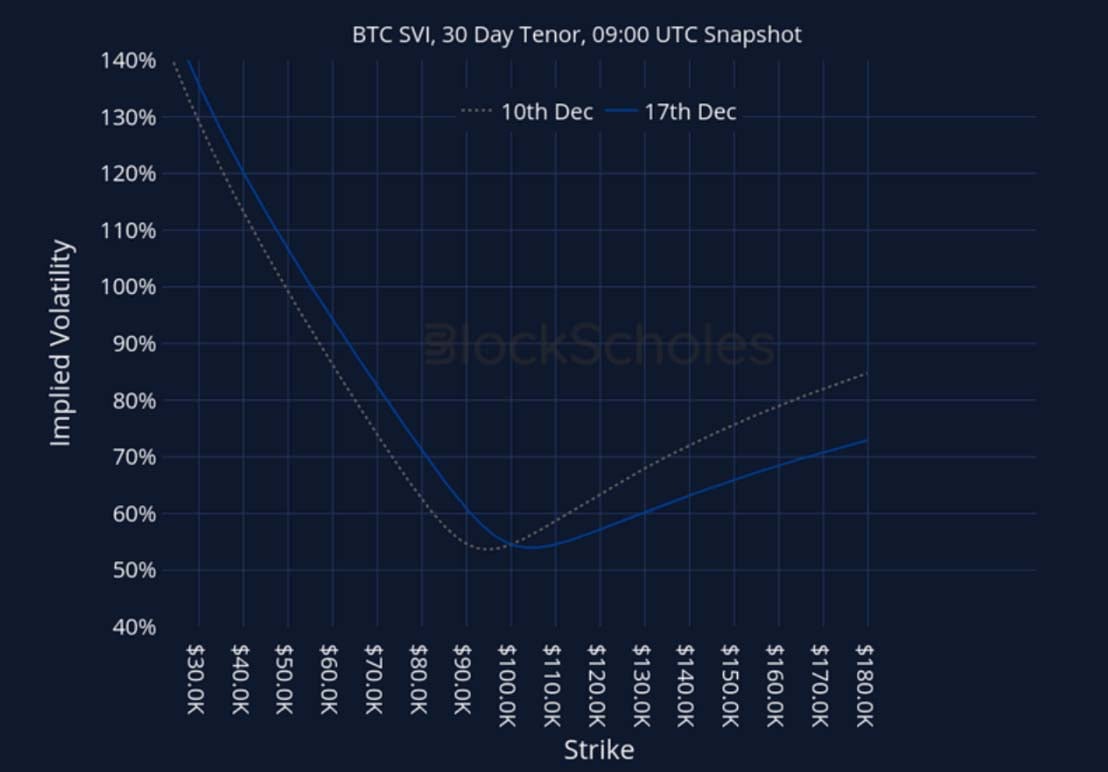

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

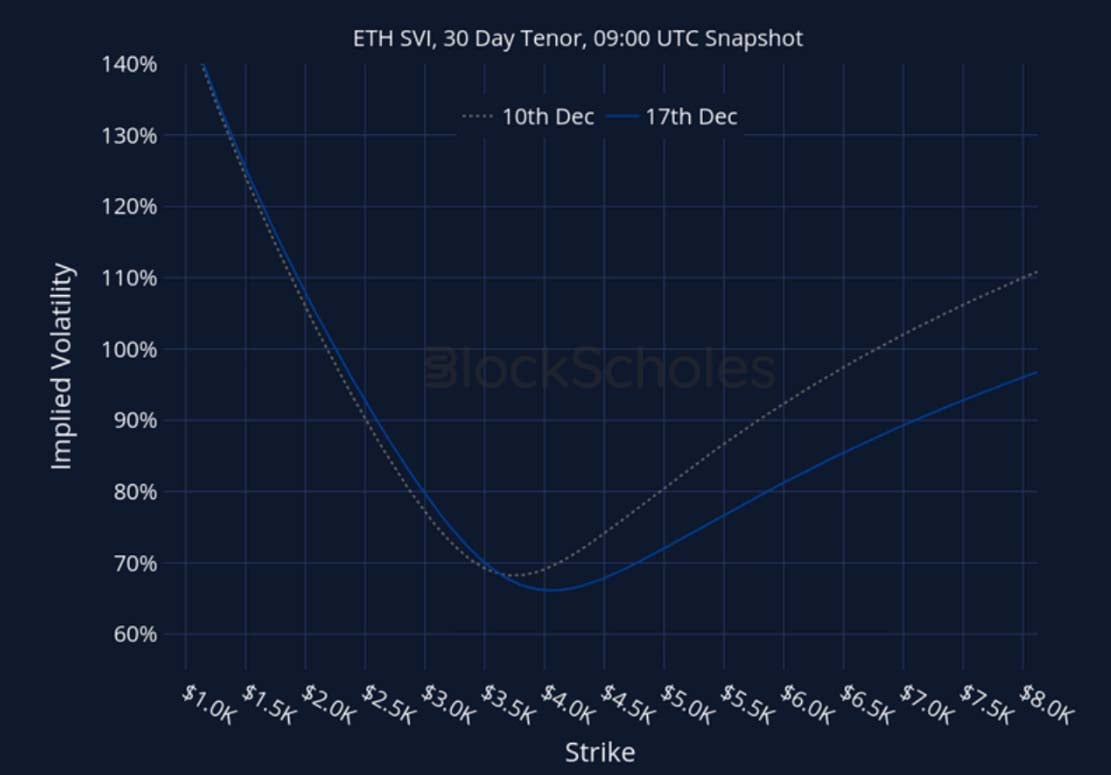

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)