January 22, 2025 – Dubai, UAE – Deribit, the world’s premier digital assets derivatives exchange, today announced its full-year operational results and exchange statistics for 2024. The company achieved record growth for the 2024 year, including a YoY increase of 99% in options notional trading volume and a 95% YoY growth in company volumes.

As the largest crypto derivatives exchange in the world, Deribit’s leading position in the crypto options trading market was further demonstrated by continued growth across all products and assets in 2024. The rise in total Deribit volume included an 810% increase in spot trading as the (free) product with the greatest YoY growth. The most popular asset traded was options, with USD 743 billion in total volume. Average 24-hour volume also increased across assets, with a 24-hour rolling volume high of USD 14.8 billion on 12 November 2024.

Deribit CEO Luuk Strijers said, “Deribit saw an increase in activity throughout the year, particularly in Q4 as institutional investors demonstrated heightened optimism around the US presidential election, as well as the $100k Bitcoin bull run that followed. The rise in total platform volume and across our offered products indicates that Deribit continues to be the go-to derivatives exchange, particularly as more professional traders enter the space.”

Additional financial highlights for the year

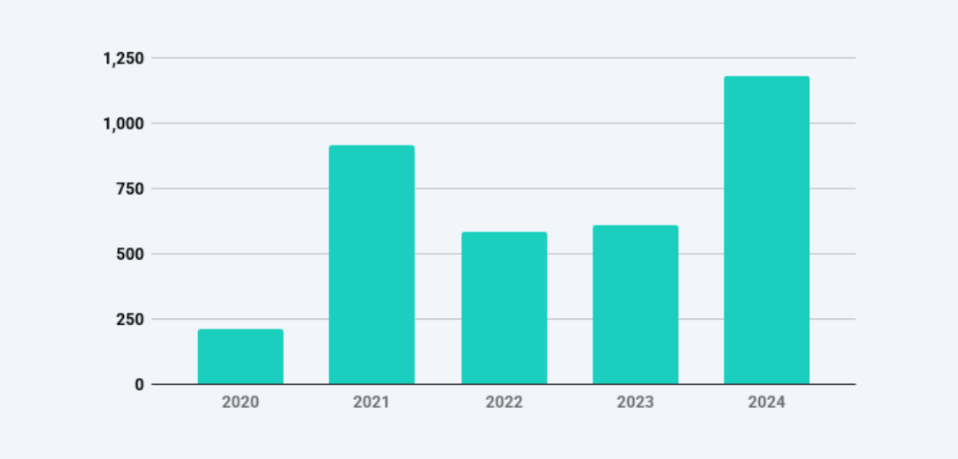

Total Annual Volume (USD Billion)

• 95% YoY growth in total Deribit volumes from USD 608 billion in 2023 to USD 1.185 trillion in 2024.

• Highest volume year, surpassing the previous 2021 yearly all-time high.

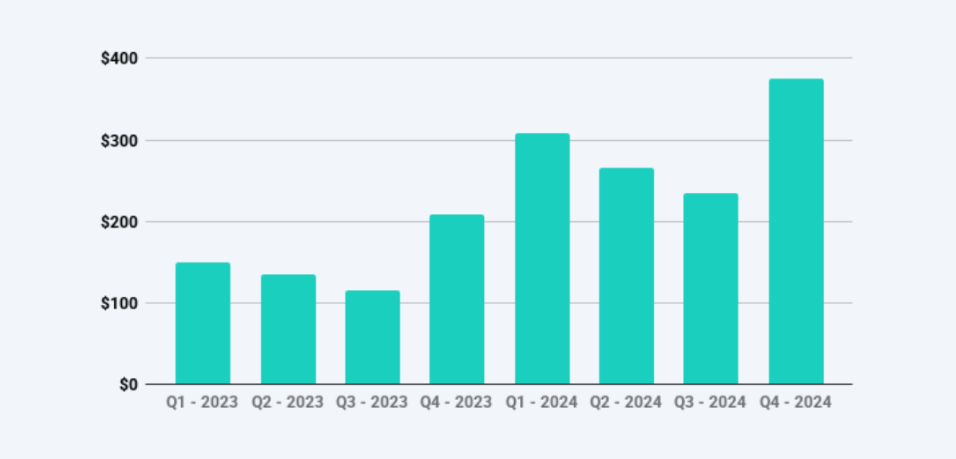

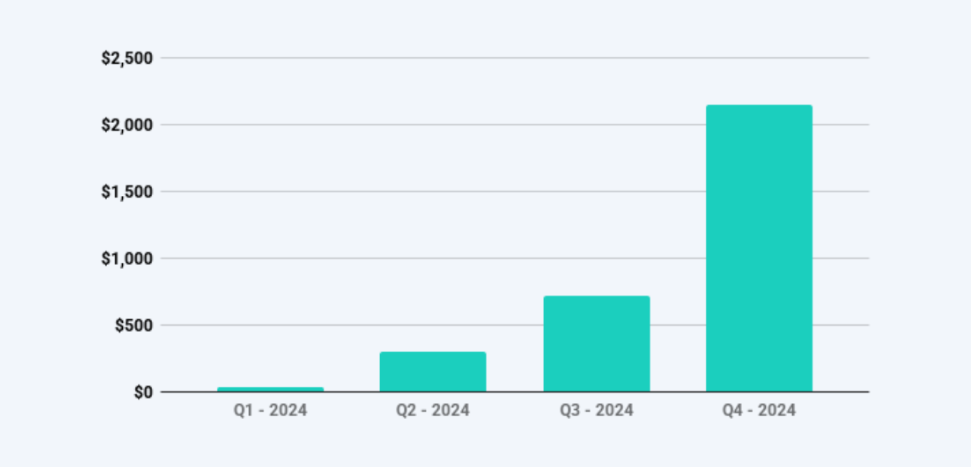

Total Platform Quarterly Volume (USD Billion)

• Q4 was the highest volume quarter ever, surpassing Q1 2024 by 22%.

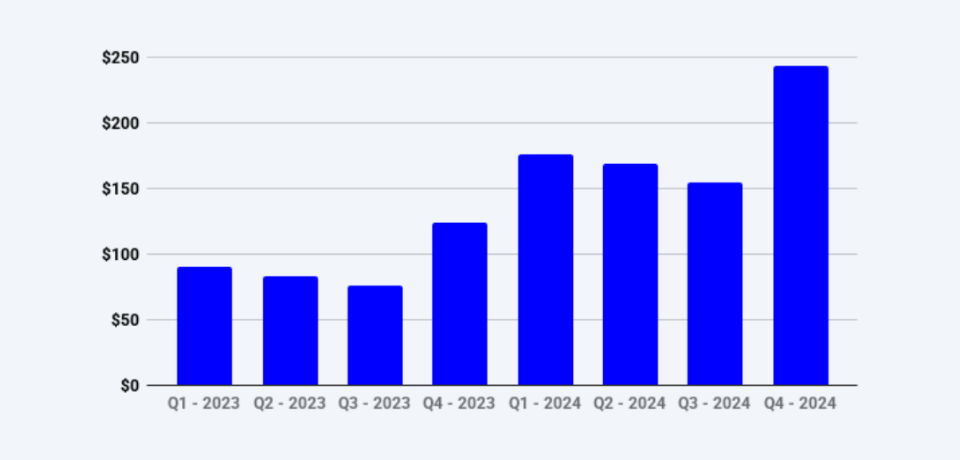

Quarterly Volume – Options (USD Billion)

• Total options notional trading volume grew 99% YoY to USD 743 billion in 2024.

• Q4 was the best quarter in 2024 with a total options notional volume of USD 243 billion.

Quarterly Volume – Perpetuals & Dated Futures (USD Billion)

• Perpetuals and futures volumes grew 86% YoY.

• Linear USDC perpetuals realised a 172% YoY growth with USD 14.5 billion traded in 2024.

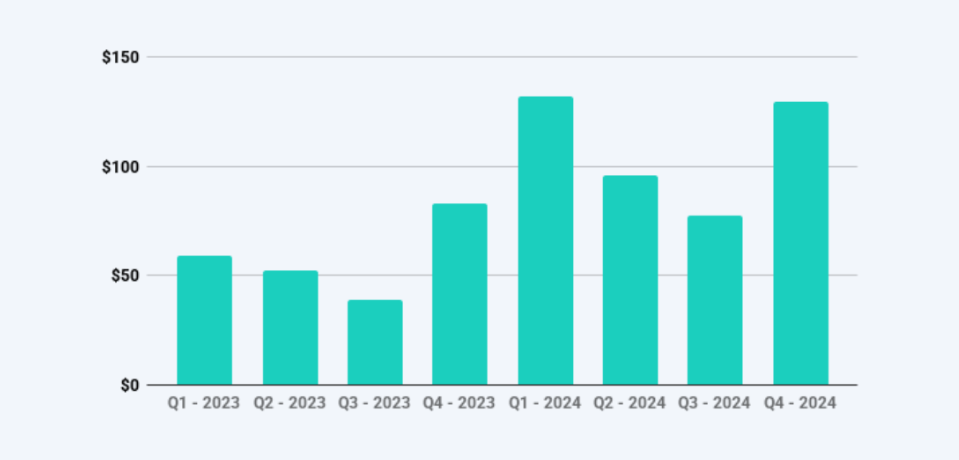

Quarterly Volume – Spot (USD Billion)

• In 2024, Deribit saw rapid growth peaking in Q4.

• Total 2024 spot turnover was USD 7.6 billion compared to USD 837 million in 2023; the year free spot trading was launched.

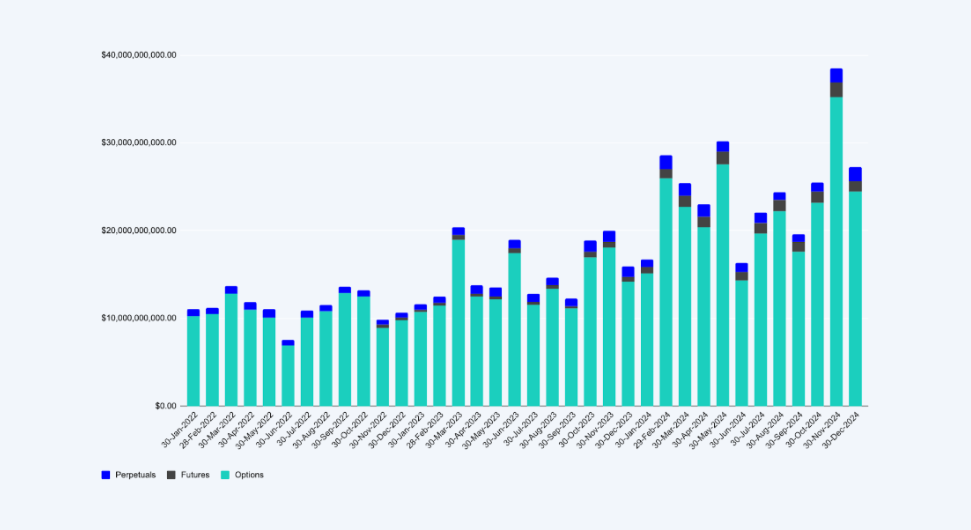

Month End Platform Open Interest (USD Billion)

• Platform open interest hit an all-time high of over USD 48 billion on 28 November 2024.

• The majority of notional open interest is held in BTC options.

Operational Update & Product Announcements

Hybrid Custody Model

Launched a hybrid custody model with Fidelity, Zodia, and Copper to enable more efficient onboarding of third-party custodians and brokerage partners.

Off Exchange Custody

First exchange to fully integrate Off Exchange Custody with Fireblocks.

Hardware Migration

Executed a successful hardware migration and expansion of space in Equinix LD4.

Position Builder

Revamped the Position Builder tool with powerful new features.

Cross Collateral

Introduced cross collateral, an innovative and much-demanded addition allowing traders to use multiple currencies as margin for open positions or orders in Deribit’s full derivatives range. This enhances capital efficiency and flexibility.

Travel Rule

Implemented the Travel Rule operational requirements for all client deposits and withdrawals to enhance compliance and bolster security.

New Licenses

Began discussions with regulators in France and Brazil with the goal of acquiring derivatives licenses.

Deribit’s dedication to maintaining security and regulatory compliance is reflected by its decision to migrate all institutional investor activity to its Dubai-based entity, Deribit FZE, which is now licensed by the Virtual Assets Regulatory Authority (VARA). Deribit was the first derivatives exchange to receive VARA approval in April and the company spent the remainder of 2024 preparing for the transition. Effective January 1, 2025, the migration to Dubai’s advanced regulatory framework is the next step in enhancing Deribit’s institutional offerings and providing superior customer service.

Deribit disclosed that Dennis Dijkstra, former CEO of Flow Traders, and industry veteran Willem Meijer, now serve as Non-Executive Directors (NEDs) for Deribit. As NEDs, Dijkstra and Meijer assist in advising on the long-term growth strategy of the company and ensuring that Deribit continues to position itself as a successful and profitable market leader.

“We are always evaluating how Deribit can introduce high-quality products that until now were absent in the crypto ecosystem,” said Strijers. “The introduction of new offerings—from yield-bearing collateral to gold and linear altcoin options—reflects our commitment to proactively respond to customer needs and offer robust products with deep liquidity. We will always adapt the Deribit platform and services based on interests expressed by our users, while simultaneously providing cutting-edge trading solutions that put security and transparency first.”

Expanded Market Offerings

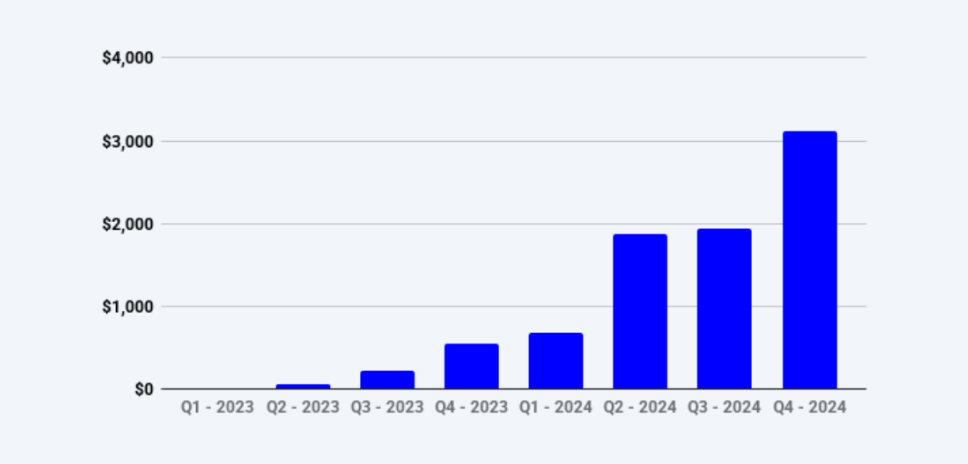

Linear USDC Options Volume (USD Billion)

• Linear options for altcoins Solana, XRP, and BNB.

• First platform to accept Hashnote’s USYC as a new yield-bearing cross-margin collateral.

• Inclusion of stETH in the cross-collateral pool.

• Gold futures and options trading with Paxos’ issued token (PAXG) backed by physical gold for additional risk management instruments.

• Total traded value of USD 3.2 billion in 2024 in the new linear options range.

Awards and Certifications

Forbes #5 World’s Best Crypto Exchanges May 2024

Deribit is ranked fifth on the Forbes list of the World’s Best Crypto Exchanges and Marketplaces. Deribit’s ranking was especially high in the Regulation and Transparency categories.

CER.live AAA Rating June 2024

Deribit was awarded a AAA rating by CER.live, placing it among the top-ranked crypto exchanges for security. Deribit is proud to be recognized as the #2 exchange out of more than 200 evaluated.

Hedgeweek Exchange of the Year – Derivatives June 2024

Deribit won the Hedgeweek Global Digital Assets Award for Exchange of the Year – Derivatives in 2024. The awards recognize fund performance and service provider excellence in digital assets.

SOC 2 – Compliance, Type 1 in February 2024 and Type 2 in October 2024

Deribit attained SOC 2 Type 2 certification—another significant milestone underscoring its dedication to the highest standards of data security and confidentiality.

CCSS Custody & Exchange Services Certificate December 2024

Deribit obtained a CCSS V8.1 Level III Full System certificate from the CryptoCurrency Security Standard (CCSS). The CCSS is a vital framework designed to safeguard cryptocurrency systems, particularly in the area of private key management.

About Deribit

Deribit is a centralized, institutional-grade crypto derivatives exchange for options and futures trading based in Dubai, United Arab Emirates. Deribit’s state-of-the-art infrastructure offers instantaneous price discovery, low latency trading, advanced risk mitigation services, and deep liquidity via its network of top-tier market makers. Led by a team with decades of experience in options trading across all markets, Deribit facilitates a significant majority of all crypto options trading and has robust proof of assets and liabilities procedures to ensure the exchange is held to the highest of standards. Deribit has been consistently acknowledged as a leader in space as one of few exchanges to secure the ISO 27001 certificate and was named Best Exchange for Innovation by Hedgeweek.

Media Contact

M Group Strategic Communications (on behalf of Deribit) [email protected].

AUTHOR(S)