Weekly recap of the crypto derivatives markets by BlockScholes.

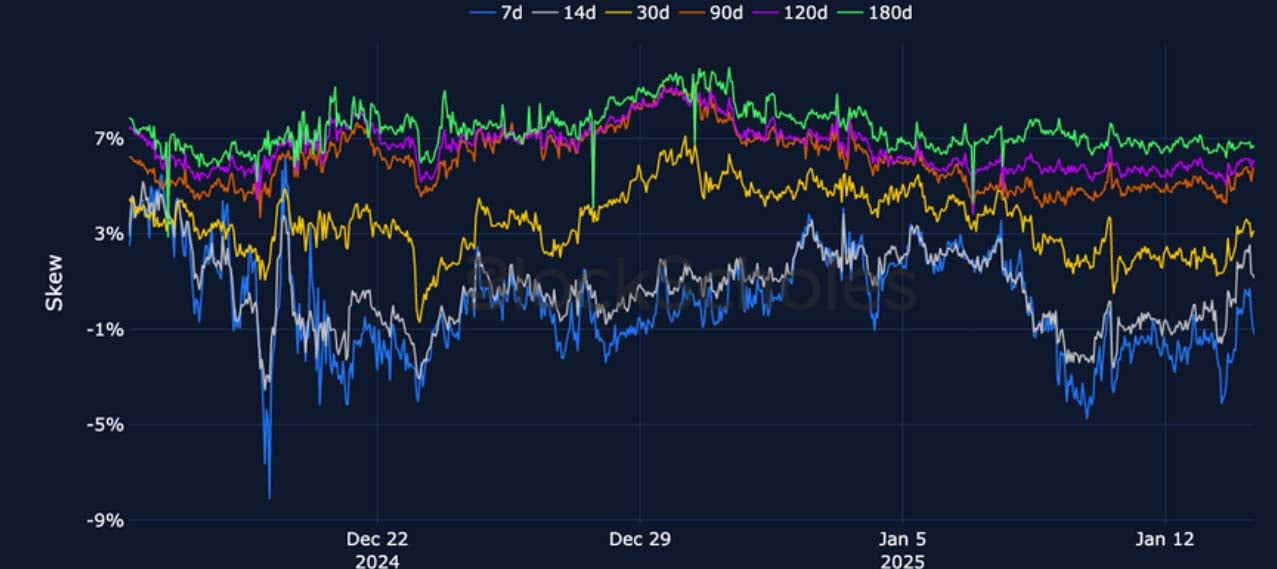

Key Insights:

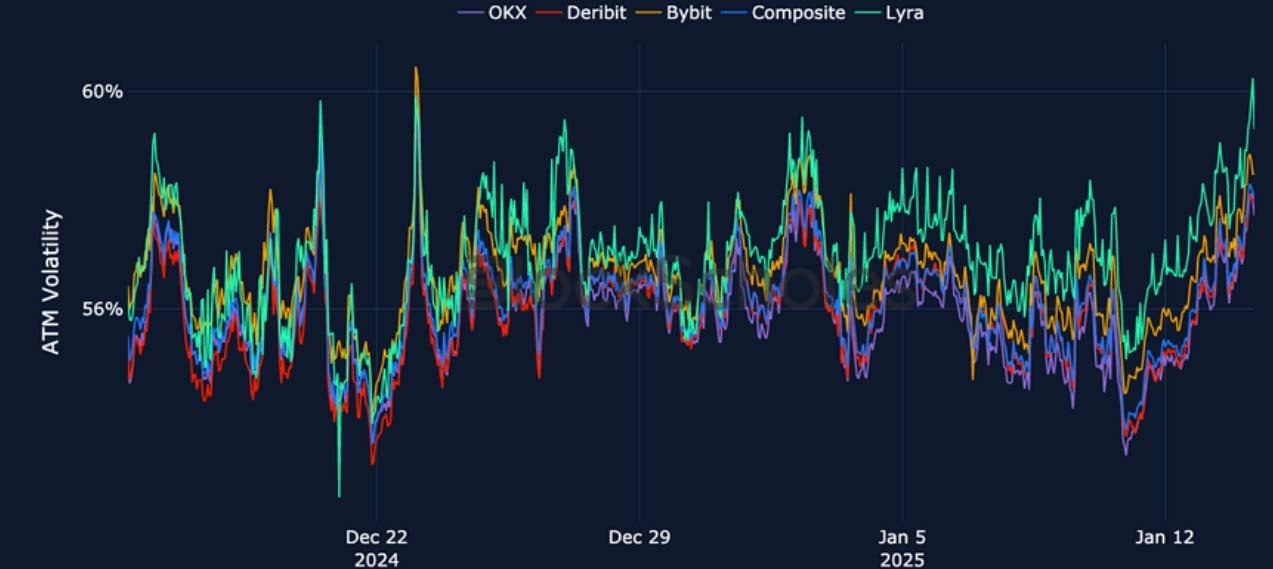

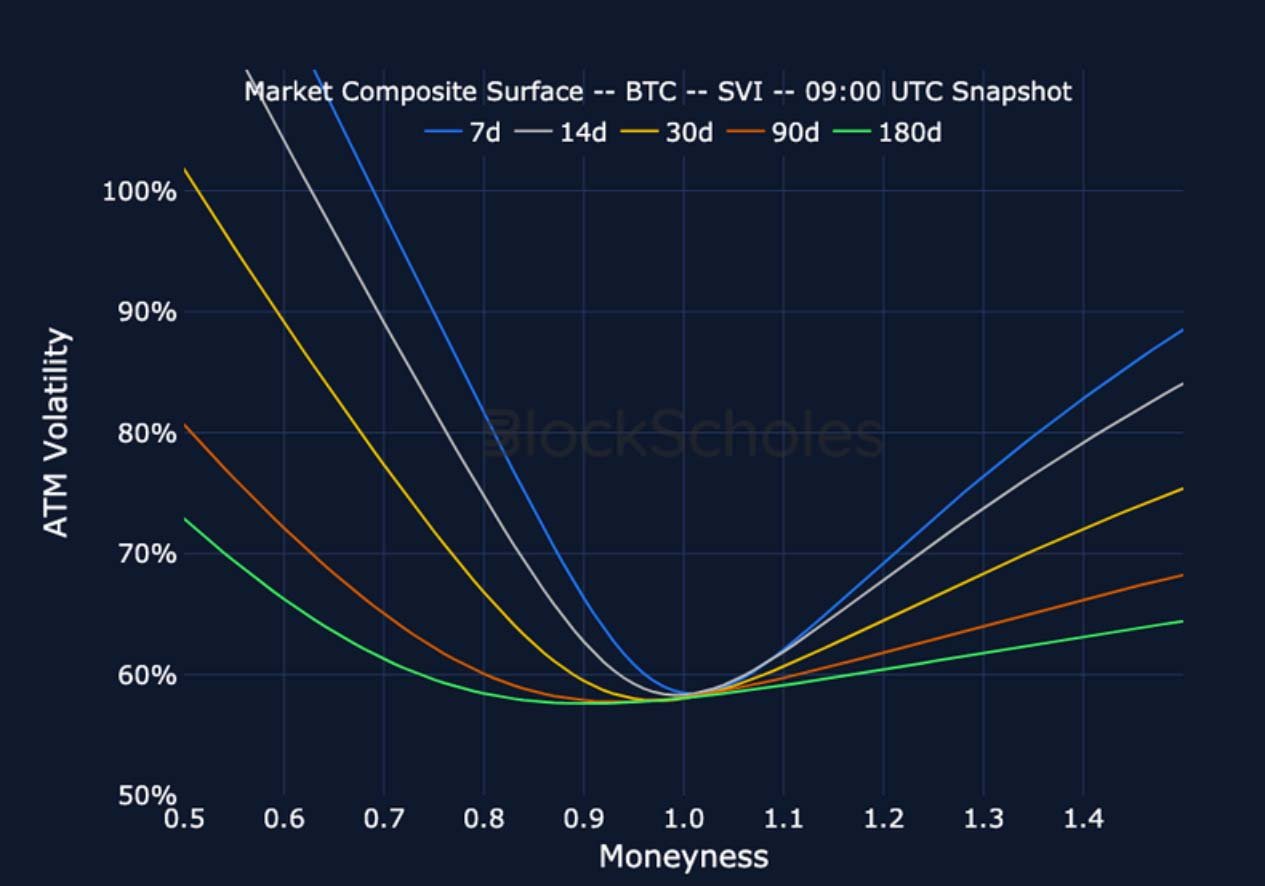

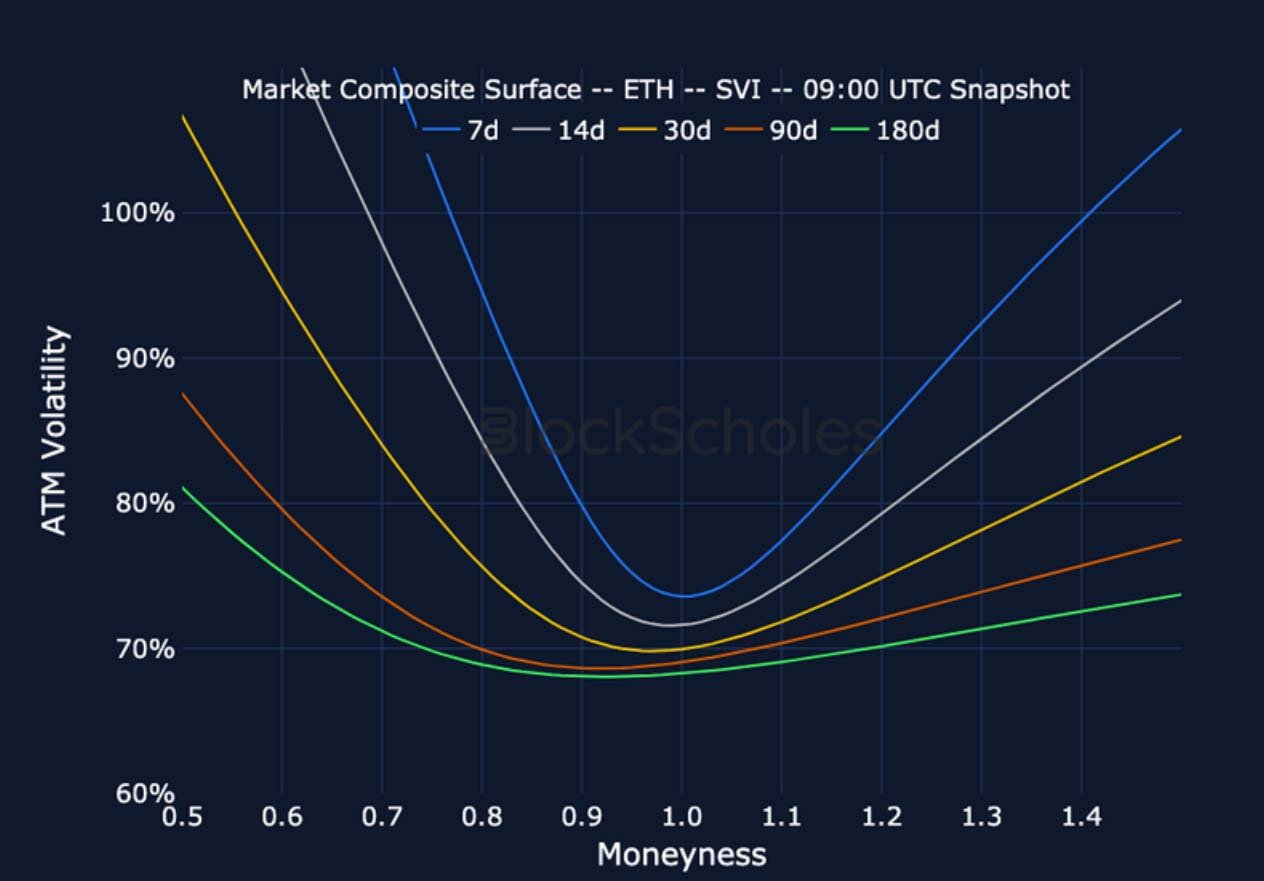

In the face of a second week of potentially scary macro data releases, the BTC spot bounced decisively from $90K levels to trade closer to $97K this morning. Derivatives markets remain supportive of the move: futures yields are positive and trending higher, with short tenors rallying harder to invert the term structure. Perpetual swap funding rates have spiked higher, after never trading below zero throughout last week’s move lower. Short-tenor volatility smiles are the exception, lifting only slightly from their skew towards out-the-money puts to trade neutral. However, they are priced very differently to the back end of the curve, with higher at-the-money implied volatility (inverting the term structure) and a persistently bullish skew towards out-the-money calls over the long term.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

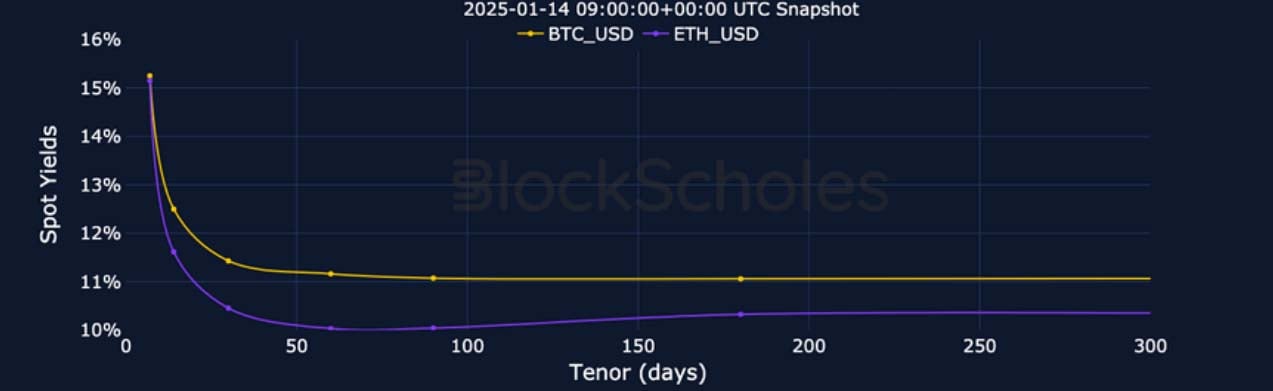

BTC ANNUALISED YIELDS – We see an inversion in BTC’s implied yield term structure once more, after yields compressed at 10% in early January.

ETH ANNUALISED YIELDS – Despite levels broadly trending sideways over the last month, the term structure remains inverted.

Perpetual Swap Funding Rate

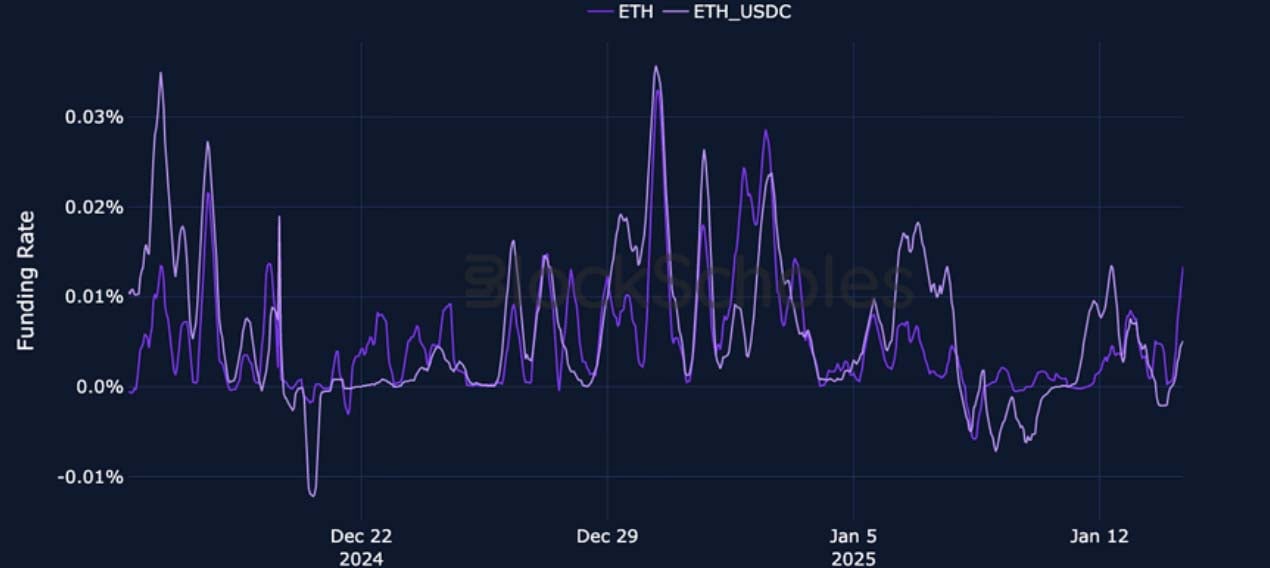

BTC FUNDING RATE – Funding rates did not dip into the negatives on the way down in spot but have exploded back to month highs on the way up.

ETH FUNDING RATE – A less extreme funding rate than BTC reflects a less impressive recovery rally in ETH’s spot price.

BTC Options

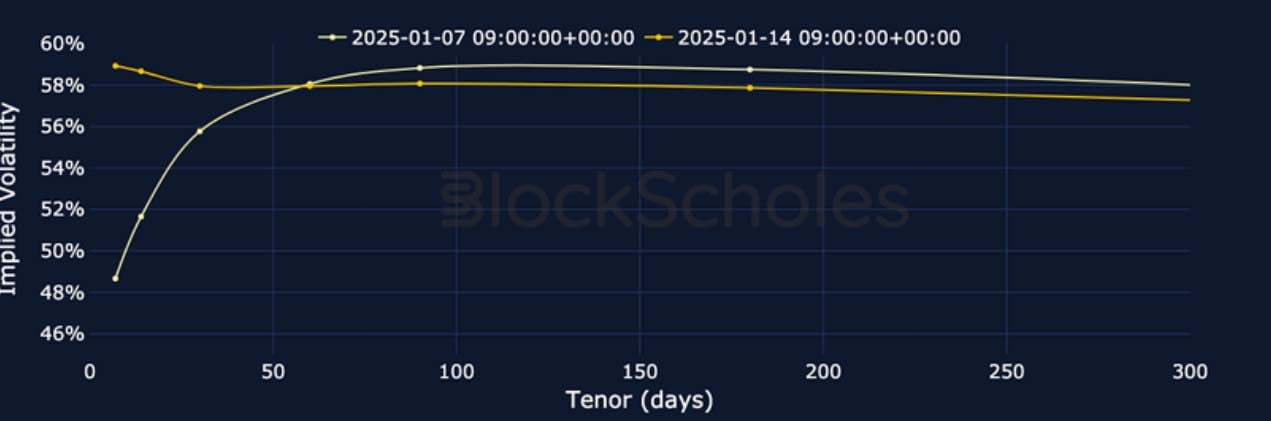

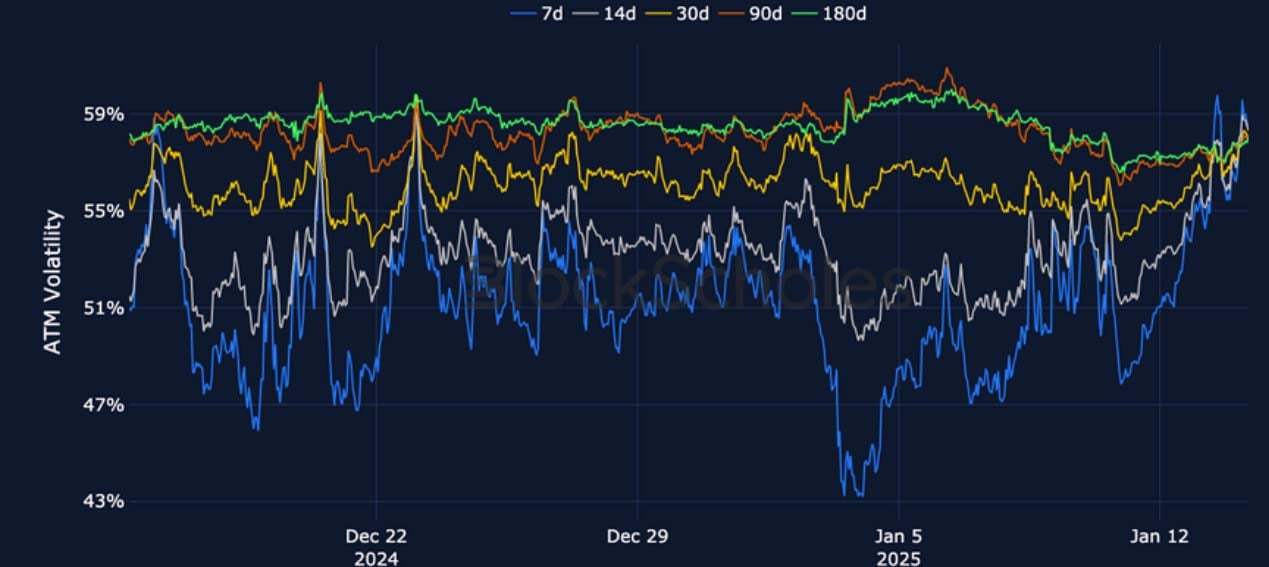

BTC SVI ATM IMPLIED VOLATILITY – Short-dated volatility levels have risen to their highest in the last month, surpassing the levels at a 180-day tenor.

BTC 25-Delta Risk Reversal – While less bearish than yesterday, short-tenor smiles remain slightly skewed toward OTM puts despite the rally in the spot.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – The term structure is inverted once more as the recovery in spot price sees short tenors lead the way.

ETH 25-Delta Risk Reversal – Skew at short tenors has recovered to a neutral- to-bullish tilt after the spot bounce from $3K.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

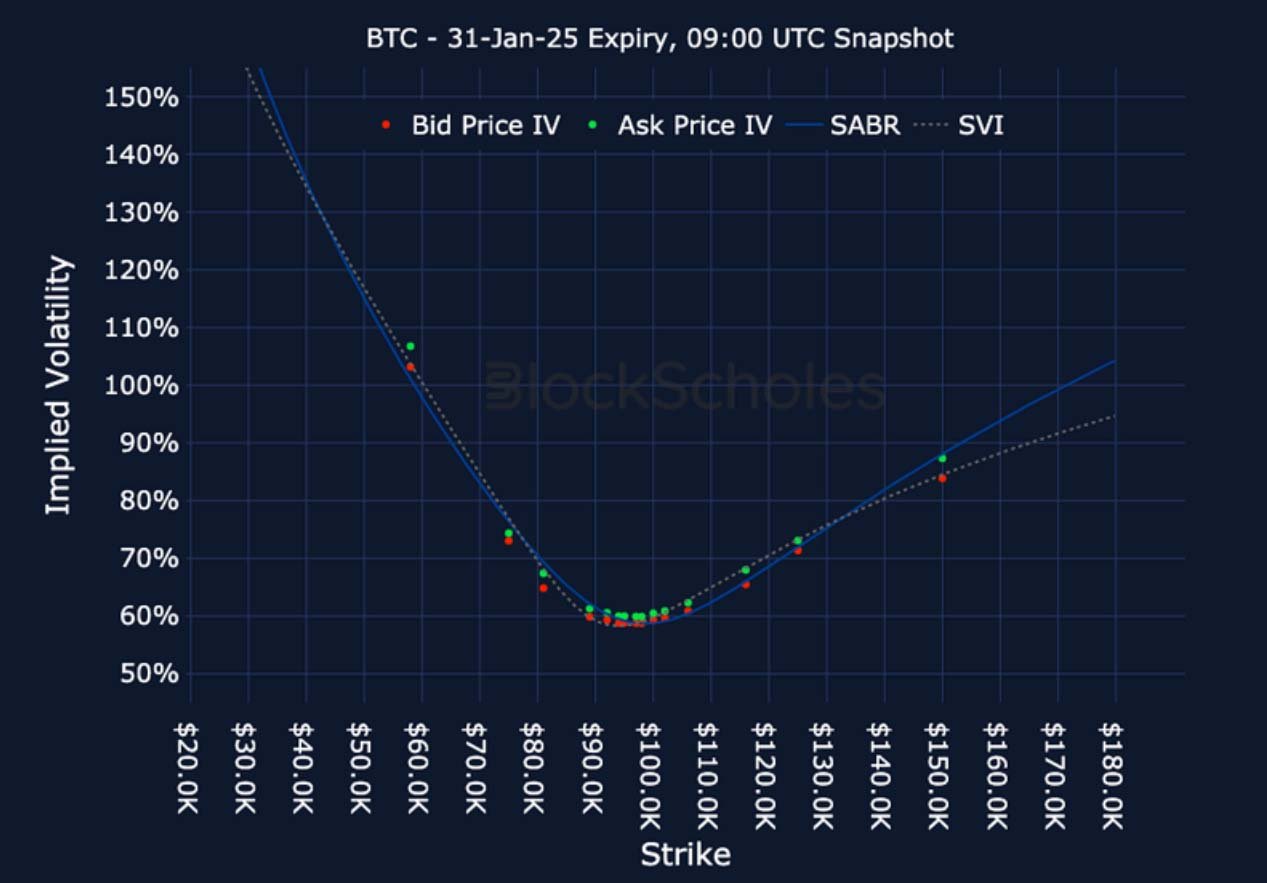

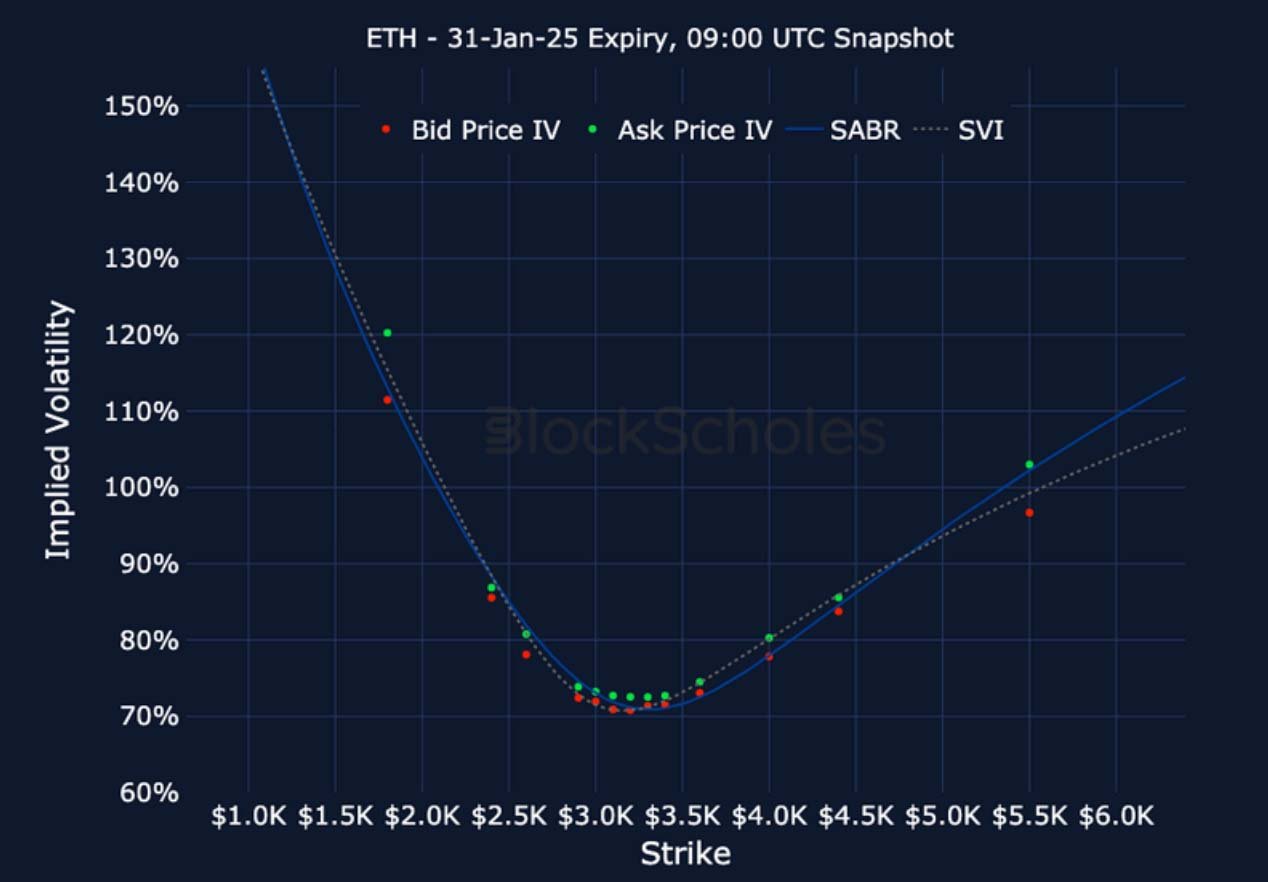

Listed Expiry Volatility Smiles

BTC 31-JAN EXPIRY – 9:00 UTC Snapshot.

ETH 31-JAN EXPIRY – 9:00 UTC Snapshot.

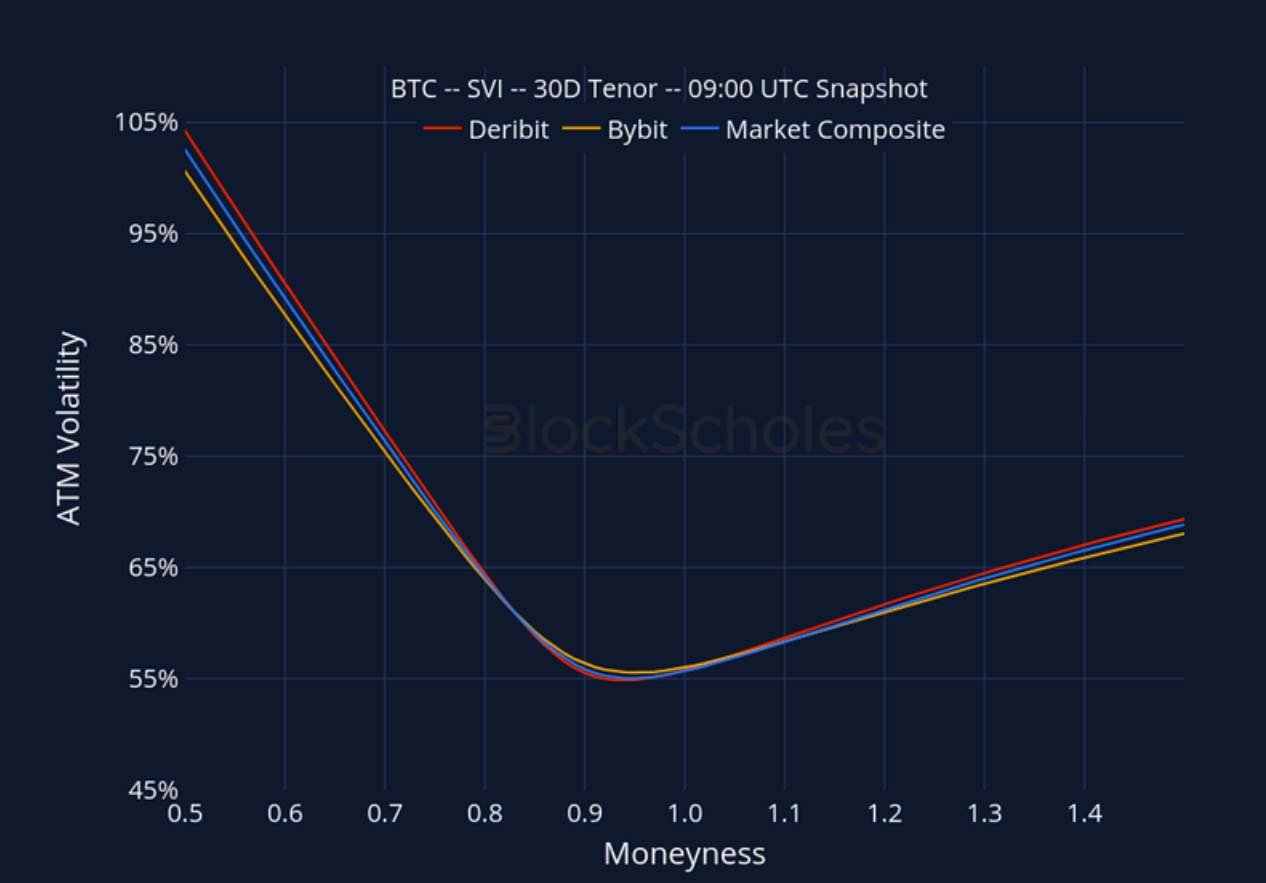

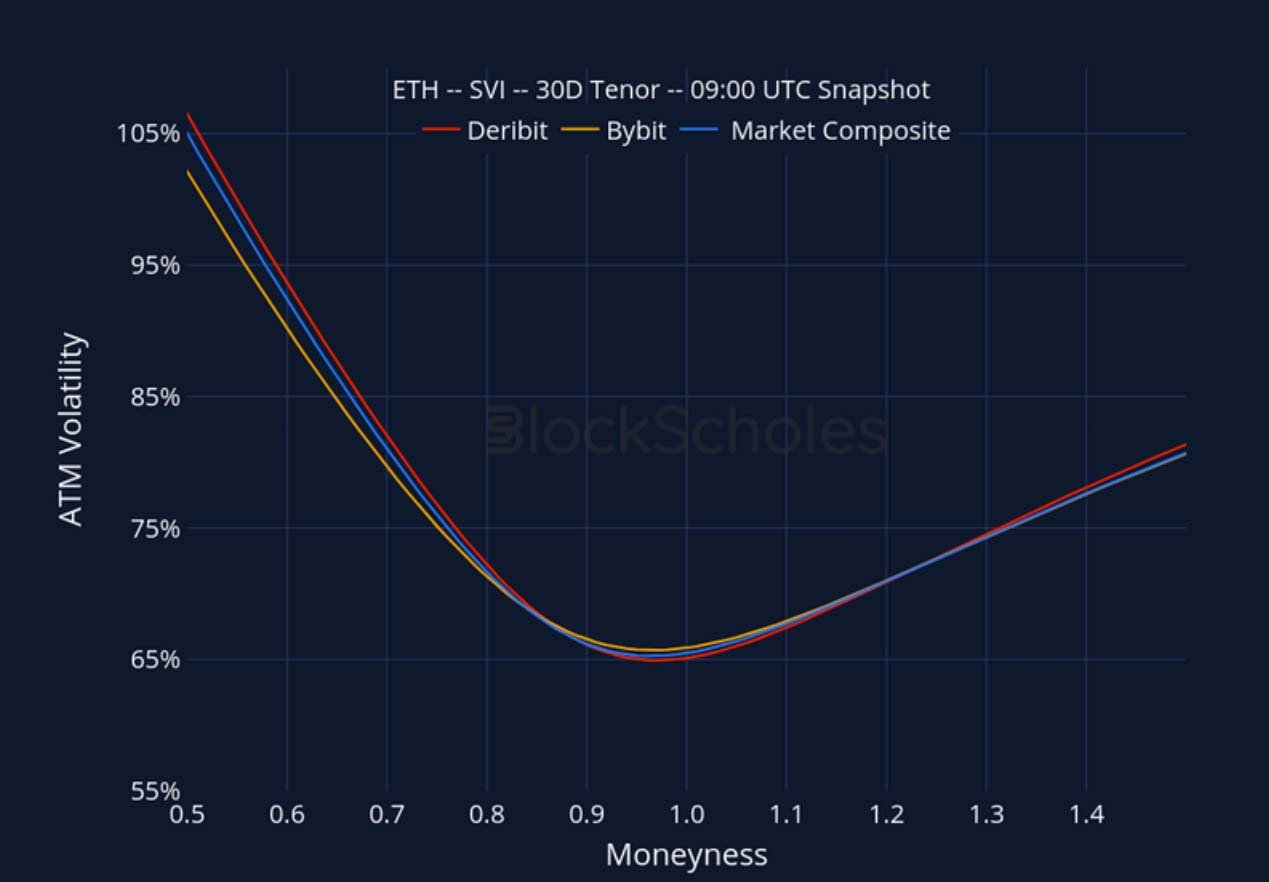

Cross-Exchange Volatility Smiles

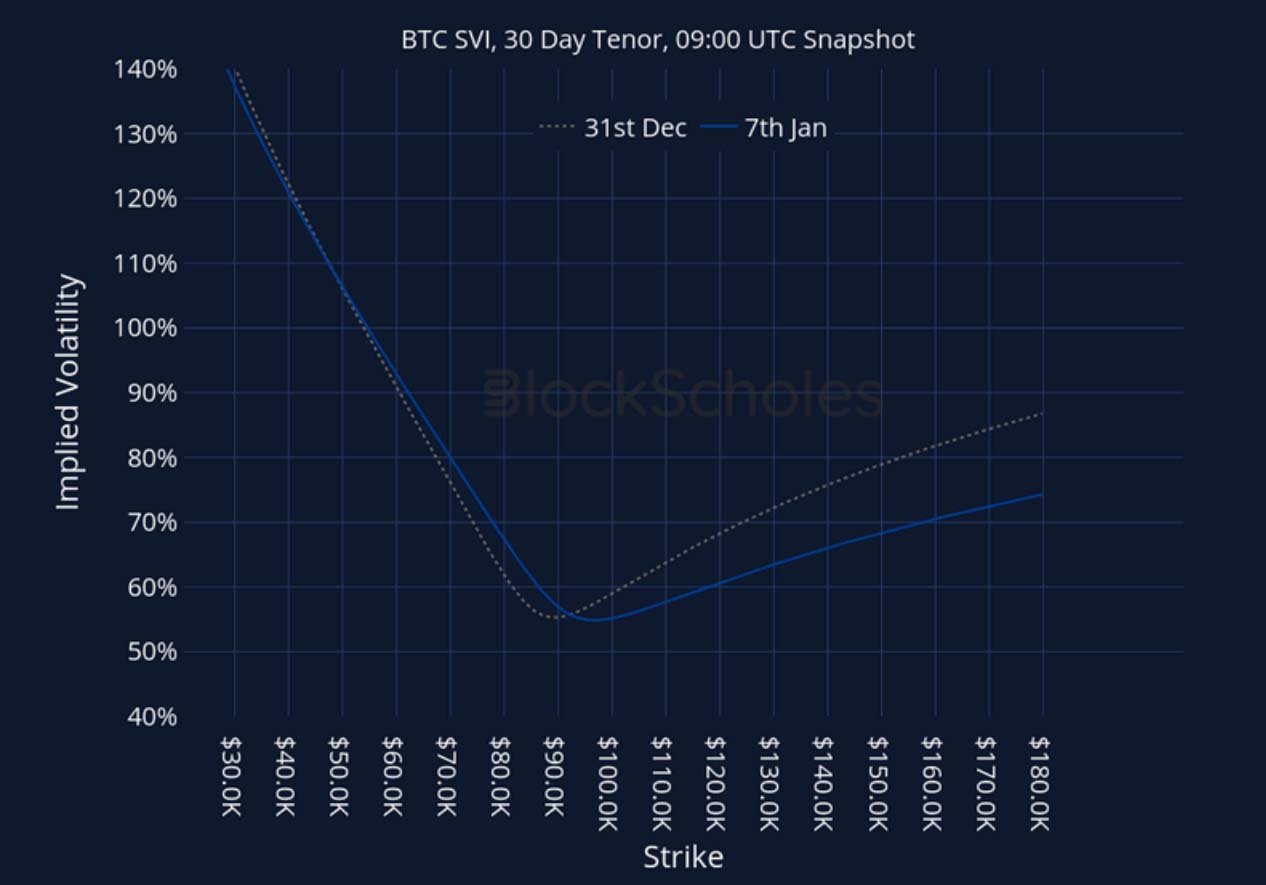

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

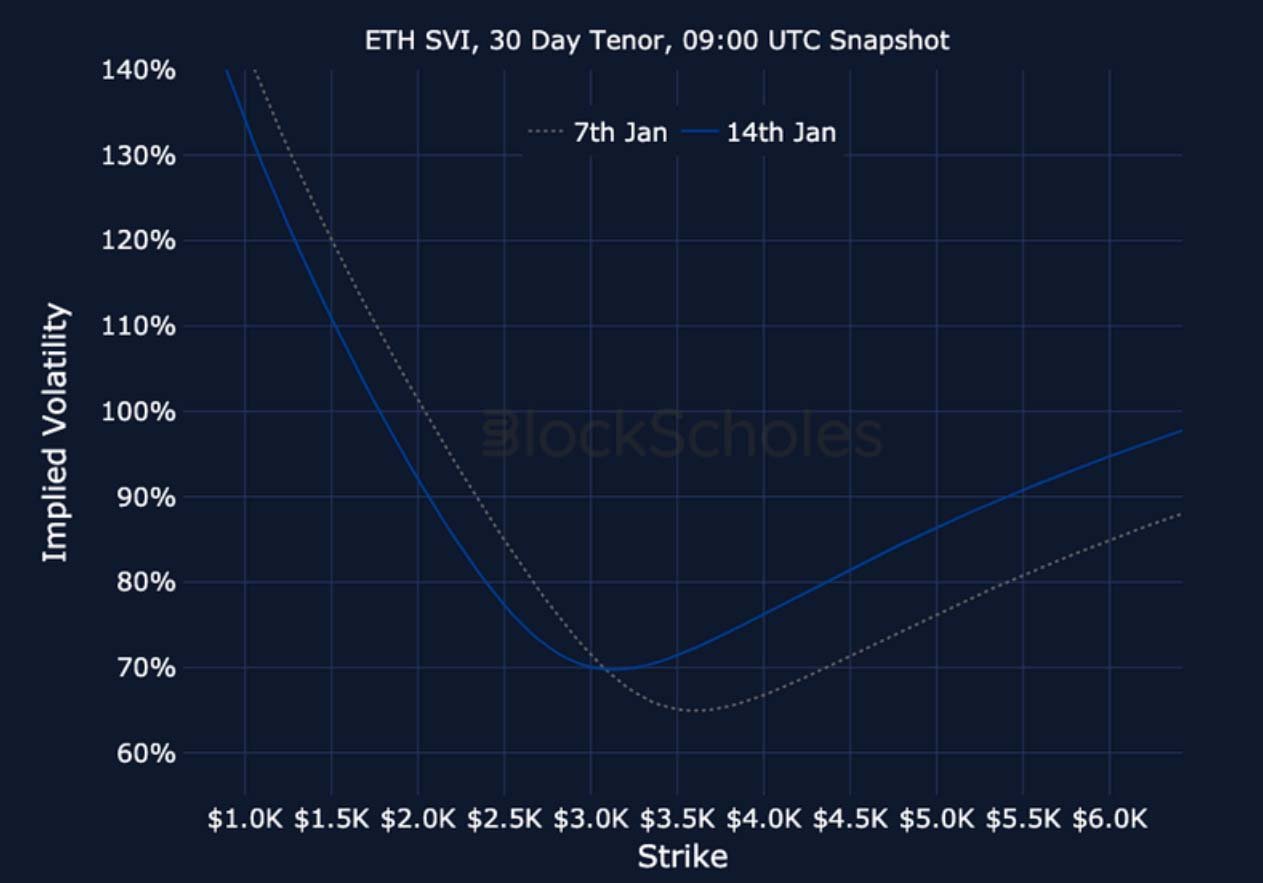

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)