Major Liquidation & V-Shaped Reversal

The crypto market just saw an unprecedented wave of liquidations—nearly $10 billion—eclipsing previous records. ETH took a bigger hit than BTC, revealing a shift away from the support it once enjoyed. Ongoing trade tensions and tariffs further amplify market anxiety, yet these bearish moves may be short-lived. If you’re seeking long-term growth, the fundamental outlook remains promising. For now, tread carefully and stay alert to rapid market changes as we remain in a headline-driven environment under Trump’s early innings taking the presidential office.

Realized Vol Explosion

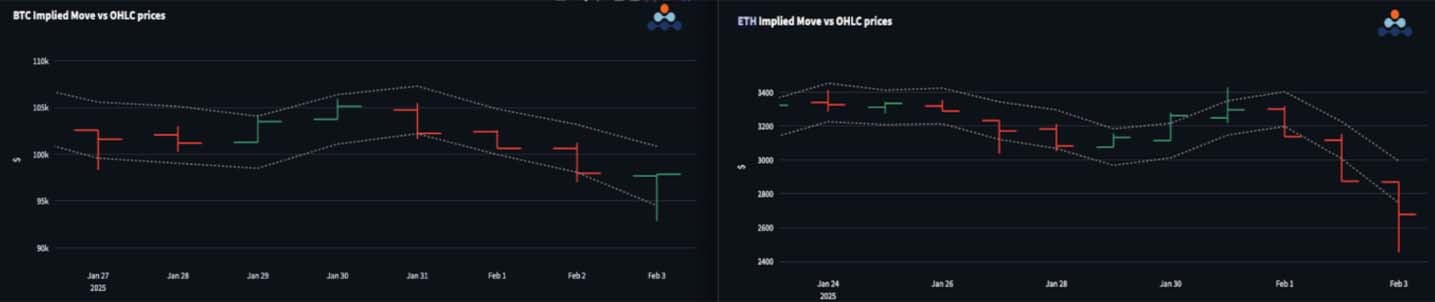

BTC’s realized volatility has ticked up from the mid-40s to the mid-50s, while ETH soared from 50% to 120% in a far less orderly move. Although front-end implied vols spiked over the weekend, they’re already settling down. BTC carry remains slightly positive, whereas ETH swung sharply negative after a swift 20% drop. Both assets tested their implied downside ranges, but ETH’s breakdown was especially severe.

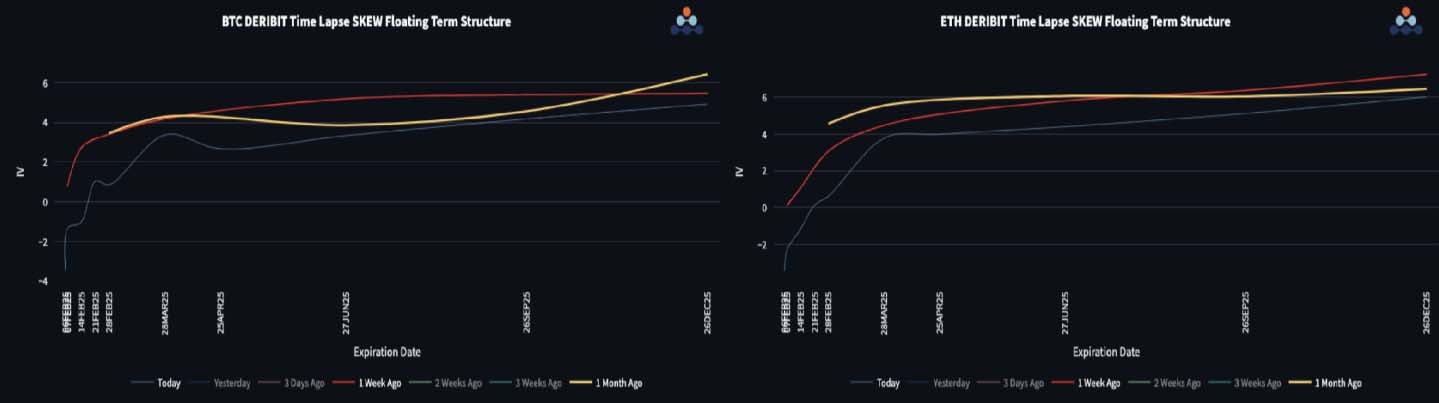

Skew Hints At Short–Lived Correction

Front-end skew term structures shot into deeper contango as put options gained momentum following the latest tariff news. BTC put skew briefly reached a 5-vol premium, and ETH jumped to 10 before reverting closer to 2. Meanwhile, back-end skew held steady, hovering around a 5–6 vol premium for calls. The options market suggests these moves may be short-lived, offering a window to act before the landscape shifts bullishly again.

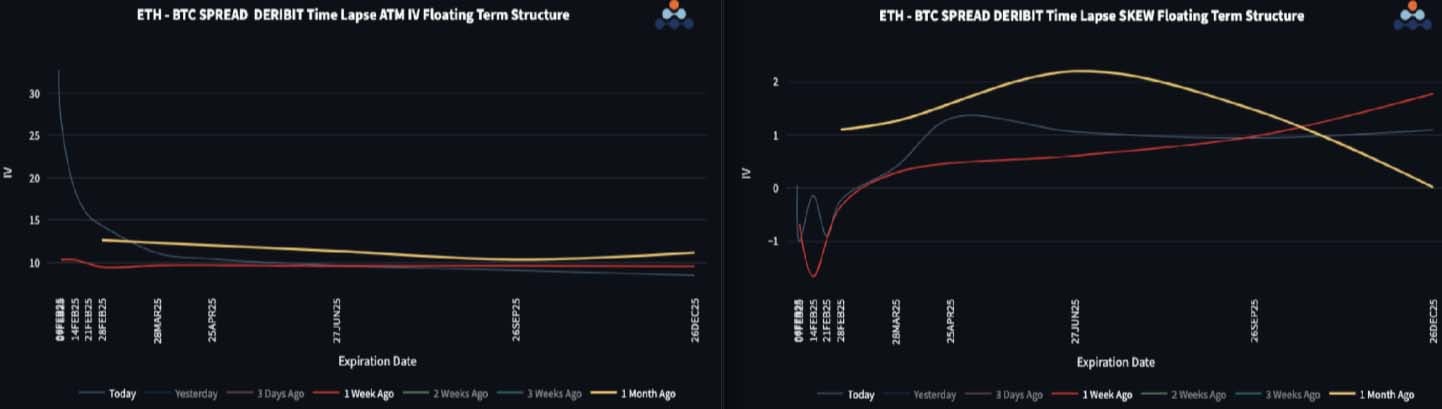

ETH/BTC Plummets Into New Lows

ETH/BTC spot broke key support near 0.03 amidst overnight liquidations, sending ETH volatility roughly 20 vols higher than BTC in the front end. The market views this as a one-off event, with the gap expected to narrow from late March onward. Skew spread remains flat out to June, then rises slightly—favouring ETH calls by about 1 vol. This setup hints that recent turbulence may be temporary and that selective opportunities could emerge soon.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)