Deribit has launched a new and dramatically improved way to request and execute block trades directly on the Deribit platform, the new Deribit Block RFQ interface.

RFQ stands for “request for quote”, and a block trade is a trade arranged privately between two parties that is executed directly between the two accounts, without hitting the public order books. As you may have guessed from the name then, the new Block RFQ interface allows traders to request quotes for block trades, and then to execute against those quotes if they so choose.

Note: While the feature is open to all traders, block trades do have higher minimum sizes, so this feature is targeted at clients who execute trades for larger sizes.

Deribit Block RFQs are now available via:

- The website UI

- The mobile app

- The API

The basic process of a block trade will go something like this:

- The requestor (“taker”) requests a quote for a structure. This could be for a single instrument or a combination of multiple instruments. Options, perpetuals, futures, and spot markets are all available.

- After the RFQ is created, makers can respond with either single or double-sided quotes for any amount above the minimum block amount.

- The best quote for the bid and the best quote for the ask are then displayed to the taker, who can trade by crossing against either the bid or the ask (depending on the desired direction). The taker can only trade for the amount requested.

If the taker has not chosen to trade after 5 minutes, the RFQ expires.

Multi-maker model

When using block trades, the primary concern of the taker is of course getting the best price possible for their desired trade, as quickly as possible, and in most cases they won’t be too concerned about which maker (or combination of makers) is providing the liquidity. Makers want to be the ones receiving the taker flow, so they want their price to be competitive. However, because they can’t see the other maker’s prices for block trades, they may be concerned about adverse selection if they offer a price that is ‘too good’, and the resulting trade would move the market past their quoted price immediately. The multi-maker model aims to solve this problem.

Deribit Block RFQ allows quotes for smaller quantities from multiple makers to be aggregated into a single response for the full amount requested by the taker. Though each maker must still offer at least the minimum block size amount. When a maker responds to an RFQ, they can choose whether they want their quote to be included in the multi-maker model, or whether they want to keep their quote separate as an All-Or-None (AON) quote.

As the name suggests, an AON quote will either be executed for the full amount or not at all. The amount of an AON quote must be equal to the amount requested in the RFQ. An AON quote therefore essentially competes against the multi-maker model.

Benefits of the multi-maker model

For makers, the multi-maker model can be attractive for those wanting to quote a smaller quantity than the quantity requested by the taker. When doing so, they are also protected against adverse selection by the pricing logic of multi-maker quotes (more on this shortly). This allows them to offer their best possible price without fear of receiving the worst fill in the trade.

For takers, the multi-maker model offers the chance to get a price improvement from a combination of multiple makers, rather than only having the AON quotes to choose from.

Pricing logic

The following logic is used for block RFQ trade pricing and priority:

- A multi-maker quote will execute at the last matched price for the entire block trade.

- No matter the quote type (multi-maker/AON), the best priced order will be given priority.

- For quotes of the same type that have the same price, the order that was placed first will be given priority.

- If a multi-maker quote and an AON quote have the same price, the AON quote will be given priority. So a multi-maker quote only has priority when it offers the best price.

Multi-maker example

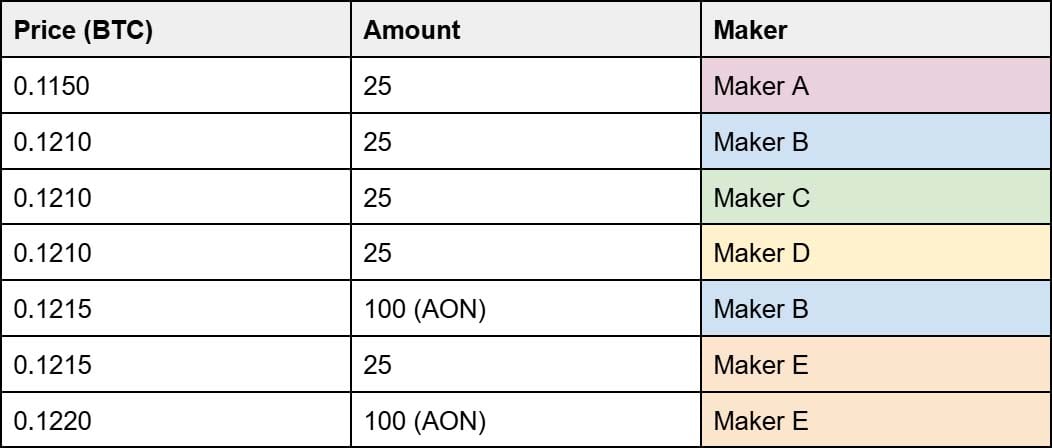

A taker requests a quote for a BTC block trade structure (sends a block RFQ), with a quantity of 100. The following quotes are returned from several different makers.

In this case, there are sufficient smaller quotes to create a multi-maker quote for the requested amount of 100. The last price reached before achieving the requested amount of 100 is 0.1210. This means the multi-maker quote has a price of 0.1210, which is better than any of the AON quotes, so the multi-maker quote is what is shown to the taker. Only the best available quote at the current point in time is shown to the taker.

If the taker executes the trade, the entire block trade will execute at a price of 0.1210 BTC. The taker has received a better price than they would have done without the multi-maker system, but they are not the only party that has benefited.

Maker B also received a small benefit from the multi-maker model. They were not willing to offer the full amount at 0.1210, but they were willing to offer a smaller amount at that price. As a result, they have received at least some of the flow, which they would not have done with their AON quote at a slightly higher price.

Maker A probably received the largest benefit in this example, as they are filled at 0.1210 as well. They were not willing to offer the full amount, but because they knew they were protected from adverse selection in the multi-maker model, they were happy to quote a very good price. In this case it turned out to be a price that was likely ‘too good’, however had a sufficient amount from other makers also been offered at this price, the taker would have got an even better price.

Benefits of multi-maker

In the above example, while the taker hasn’t been able to trade at Maker A’s price of 0.1150, this was never available for the full amount anyway, and they have still benefited from a price improvement via the multi-maker model.

If only one market maker is willing to offer 25 contracts at the better price (Maker A in this case), they are not punished for doing so, because the quote shown to the taker, and the price that the whole block trade will be executed at if the taker chooses to execute, will be the last price reached. This gives them more freedom to quote tightly, without worrying as much about whether they are the only one quoting that tight.

However, if some combination of the market makers is able to offer the full amount for a better price, the taker enjoys an improved price compared to just the AON quotes from single market makers.

And of course for those market makers who are not interested in partial fills, and prefer to quote the for the full amount themselves, they can simply choose to use AON quotes instead.

As a result, quotes should be as good or better for the taker than they would otherwise be. Either one of the AON quotes from a single market maker will be the best, similar to other block trade platforms, or a combination of quotes for smaller quantities via the multi-maker model will add up to the full amount and offer a price improvement.

Counterparty visibility

While submitting a block RFQ, takers can choose whether to disclose their identity to the makers or not. If the taker does disclose their identity, then they will also get to see the identity of the maker with the quote received and any resulting trades. Note that the taker only ever sees the best quote (one bid and one ask) at any given time, so they will only see the identity of the best bid and ask.

Taker rating system

As the takers can choose to be anonymous, to protect makers from undesirable behaviour such as price fishing, there is a rating system for takers. The basic premise is that takers are given a score that indicates how often they actually trade when submitting RFQs.

Each taker has an OTV (order to volume) ratio, which is calculated as follows:

OTV = RFQ amount / Traded volume

For the purposes of calculating the RFQ amount and traded volume, all values are converted to a USD notional amount, so takers will have a single OTV across all currencies.

For example, if a taker requests a quote for an amount of 100,000 three times, and only executes one of those trades, their OTV would be calculated as:

OTV = 300,000 / 100,000 = 3

An excessively high OTV gives the makers an indication that the taker may not be serious about executing a trade, and they can act accordingly. Deribit also reserves the right to restrict access to the feature for anyone judged to be abusing it.

To offer an additional degree of privacy to takers who choose to remain anonymous, rather than the precise value, the OTVs displayed to makers are grouped into buckets.

Quote visibility

A few seconds after the RFQ is submitted, the taker is shown the most competitive quote on the bid and ask, and these then update in real-time. Non-AON quotes (multi-maker quotes) are all aggregated into a single quote for the requested amount and the price of the last quote that would be matched. The taker only sees one bid and one ask at any given moment, whichever is the most competitive at that moment, and this could be either an AON quote, or a multi-maker quote. A quote will only be shown to the taker if the full amount is available at that price, so takers can be sure that when they choose to execute, the full amount will be executed at the price shown.

Deribit Block RFQ operates a blind auction model, so makers can see their own quotes, but not the quotes of other makers.

Hedge legs

As well as the main structure being traded, some traders may wish to add a hedge leg. A typical reason for a hedge leg would be to hedge some or all of the delta from an option structure, or to hedge a spot market purchase.

One hedge leg is allowed per Block RFQ structure, and it can either be a perpetual or a dated future:

- Hedge legs can be added to both option and spot structures.

- Hedging a spot pair with a future creates an implied cash and carry trade.

- For option structures, any future with the same native currency can be added as a hedge leg.

- Spot structures can be hedged with any future that shares a base currency with at least one of the base currencies in the legs. Any of the base currencies are permitted as there are no dated futures for some currencies.

Pooling liquidity of other block trade platforms

The Deribit Block RFQ system has been designed with other block trade platforms in mind. While they are not obligated to do so, any third party block trade platform is welcome to connect their systems to the new Deribit Block RFQ system as well. This will have the effect of centralising liquidity from other block RFQ interface providers. So in theory a taker could initiate a block RFQ from platform A, and receive a quote from a maker on Deribit itself, or from a maker on platform B.

So instead of a taker on a third party platform being limited to the makers on that platform, they can gain access to makers on Deribit and also other third party platforms. Similarly, makers can receive RFQs from more takers. And the third party platforms still receive the relevant rebates for any orders sent from their platforms.

Summary

The Deribit Block RFQ system adds a fantastic new way for larger trades to be executed on the Deribit platform. The multi-maker system allows makers to pool their liquidity into a single quote. It also offers makers some protection from bad fills, allowing them to quote tighter, with any resulting price improvement being passed on to the taker. For makers who prefer to avoid partial fills and quote the full amount themselves, they are still free to do so.

If you already use block trades, or think you might be interested in doing so, take a look at the new interface here.

There is more information available on the Deribit Knowledgebase here, and API documentation here. And of course if you still have any questions at all, feel free to reach out to Deribit support at [email protected].

AUTHOR(S)