In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

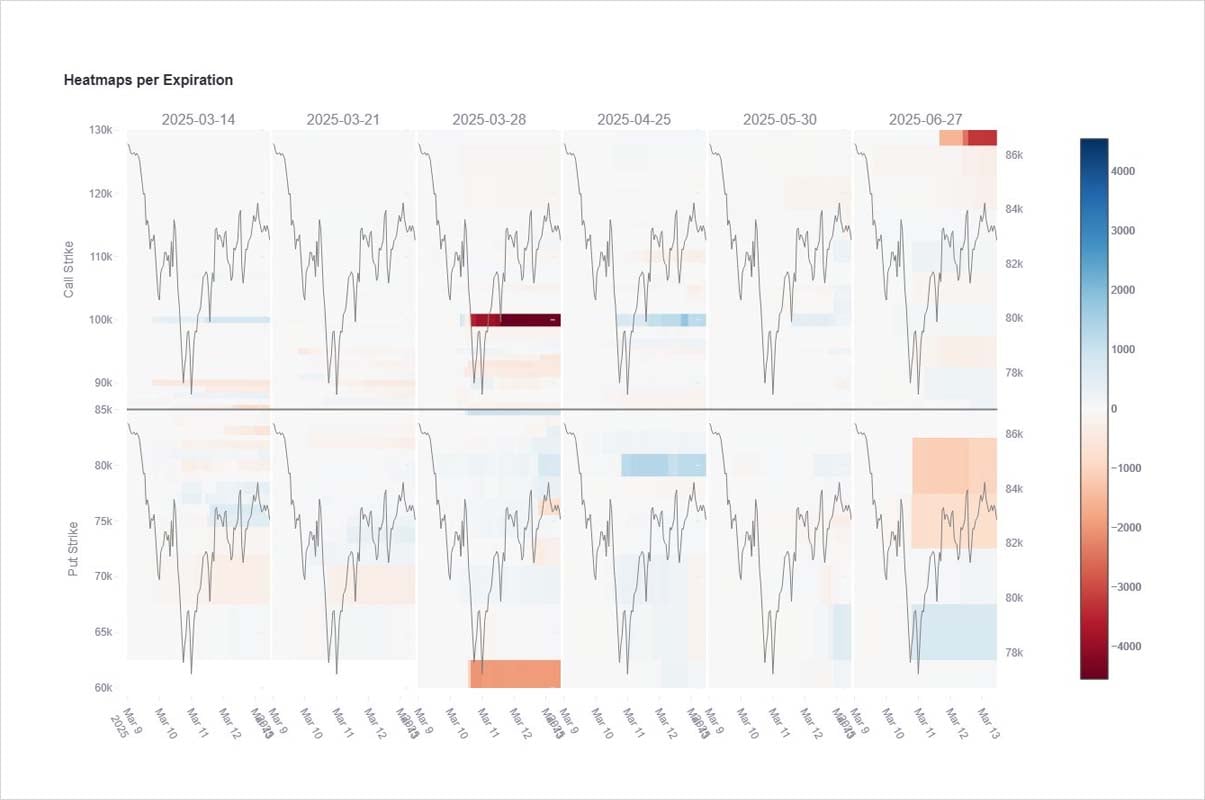

Last report’s Put buyers+Call sellers outperformed on the dip to 76.5k, +parallel pump in vol.

The bounce back was not as well supported via Option flows, as further 90k+ Calls sold.

Large rotation from Mar100k+Jun130k longs into Apr+May 100k Calls.

Apr-May synthetic Var swap.

2) New @Amberdataio beta view function:

An entity rolled their long-held Mar 100k+Jun130k Calls into April+May 100k Calls. Essentially Mar100k+Jun130k Calls over-ambitious in timing; moved to a more realistic Apr+May100k upside Strike.

Jun 80+75k longs moved to Apr80+Jun65k Puts.

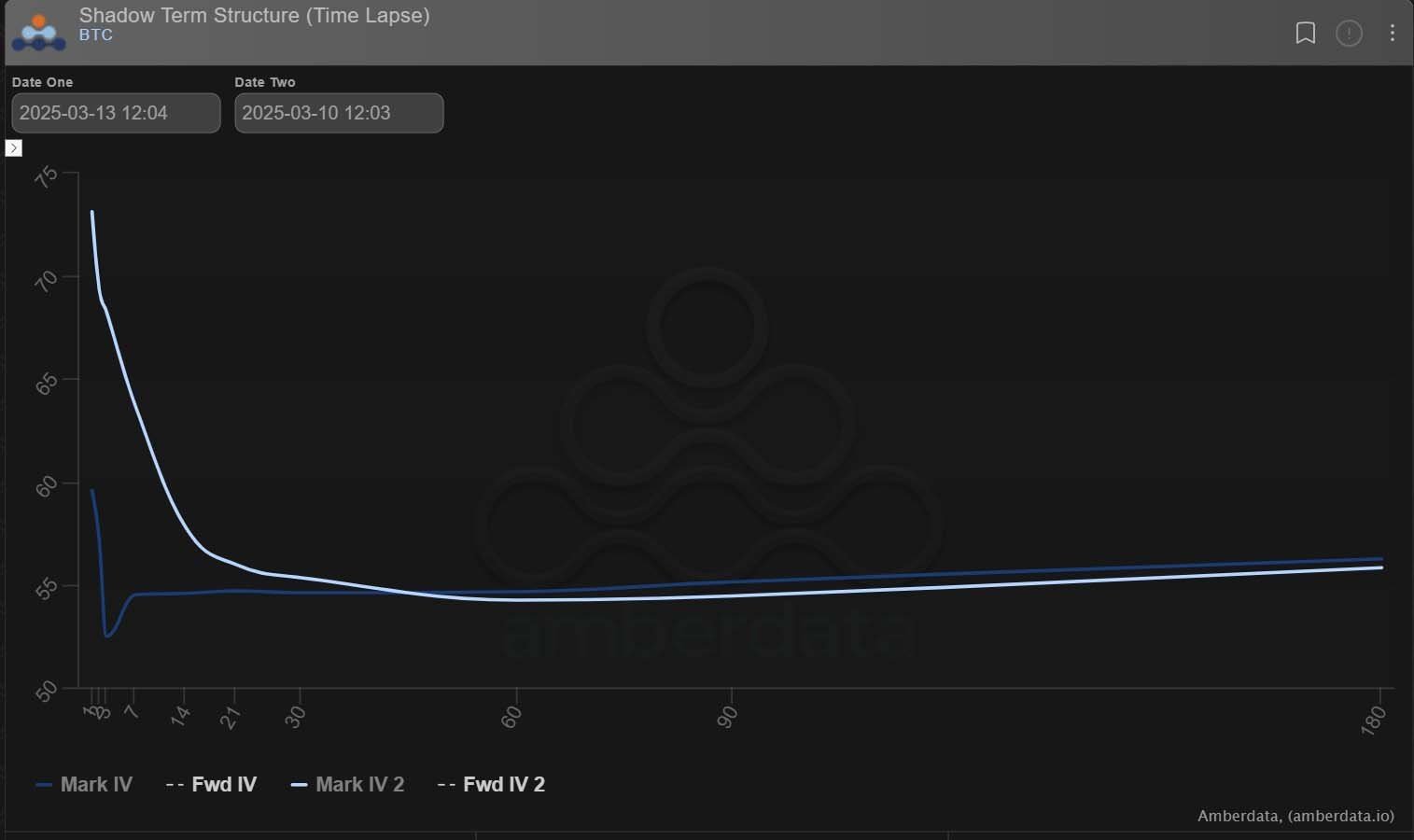

3) For the first time in a while, the term-structure flattened, indicating less desire / more supply of Gamma after some wild fluctuations.

One rare bundled trade, adding to this flow, simulated a Var swap where a strip of OTM May Puts+Calls was bought, OTM April Puts+Calls sold.

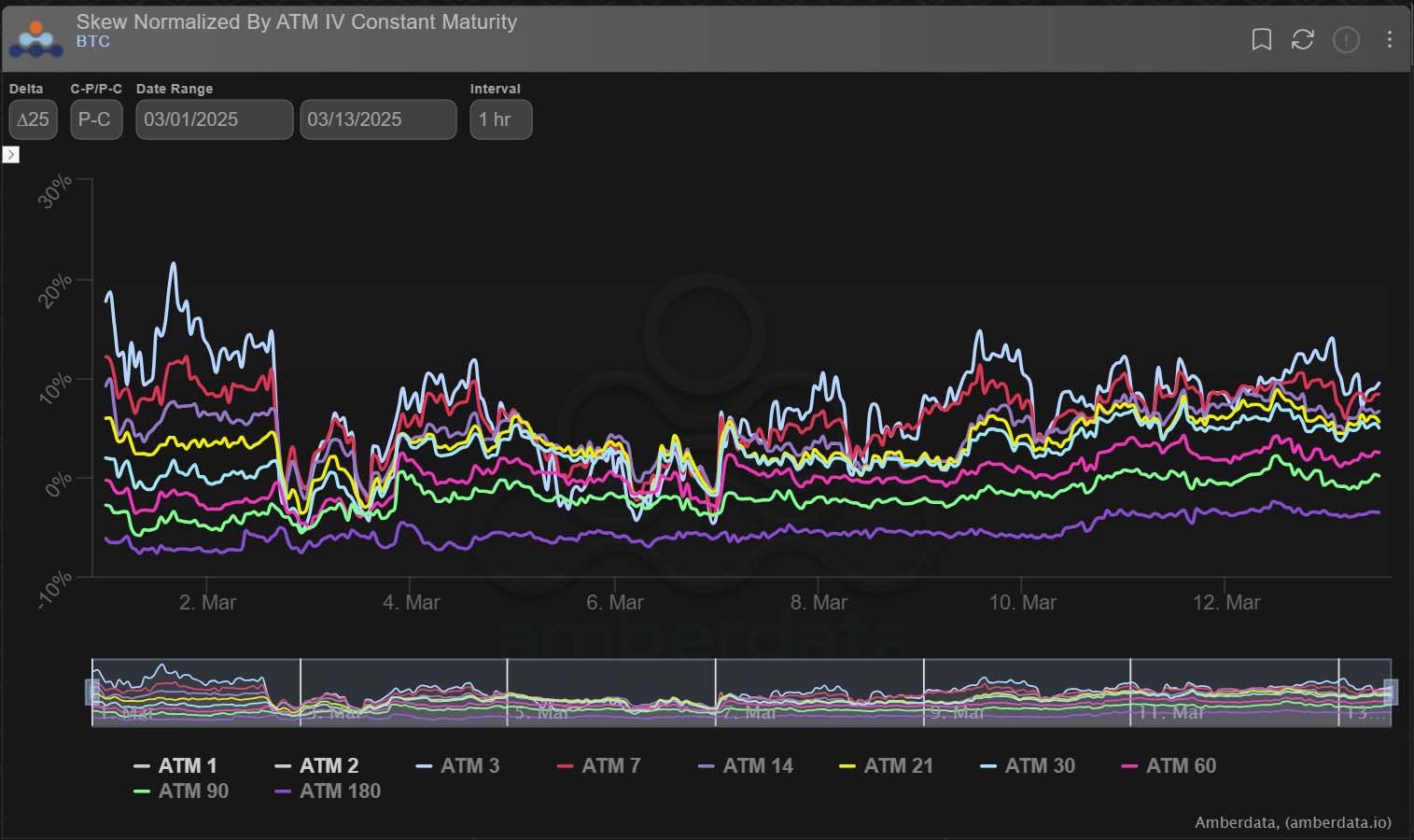

4) While IV has calmed, Put Skew remains elevated, with desks still cautious of the downside.

One player that tried to take advantage of this elevated Skew was a buyer of Mar28 80-76k 1×1.5, buying the 80k Strike x600, to sell the higher vol 76k strike x900. Puts barely nudged.

View X thread.

AUTHOR(S)