In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Bitcoin grasping gold’s tailwind vs macro risk.

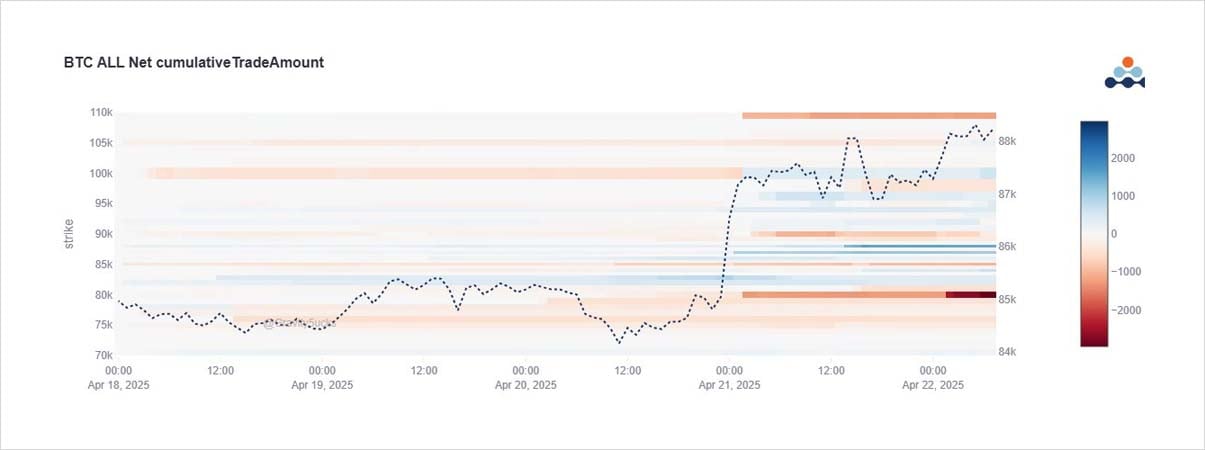

Strong upside momentum via Spot +ETF inflows has not persuasively encouraged fresh material Call buying, but aggressive opening Put selling across 76-80k Strikes does appear to be setting a comfortable base, taking in premium+IV.

2) Bitcoin following Gold? Fresh Call buying is muted.

May 100ks bought but funded by selling Jun 110ks.

Other Blue lines short-term low premium Calls hoping for an upside shock (or covering slide risk). But Apr76+78k, May+June 80k Puts sold in chunks, forming a confident base.

3) Skew has been retracing back to flat, with the Apr+May+Jun 76-80k sales hitting the Puts, and a little demand in upside Calls coming back, there is now a fractional +ve Call skew across all months.

4) Dvol has round-tripped Liberation Day, after surging early in the month, consolidating then plunging at the end of last week into sellers of Apr Gamma, May+Jun Vega.

VIX is still elevated at 35%. Now that BTC showing strength contra-macro, the Jun 80k Puts +Dvol absorbed well.

View X thread.

AUTHOR(S)