In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

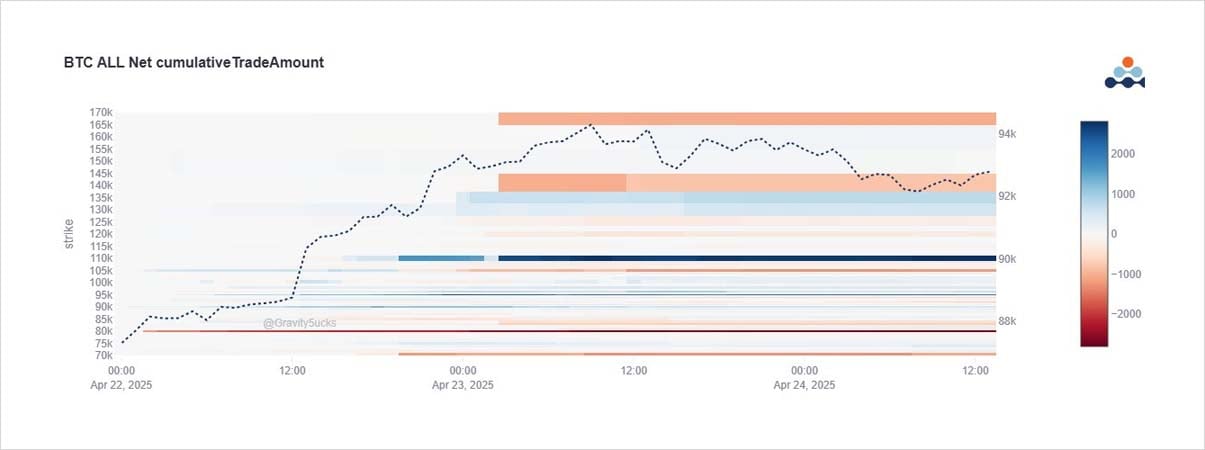

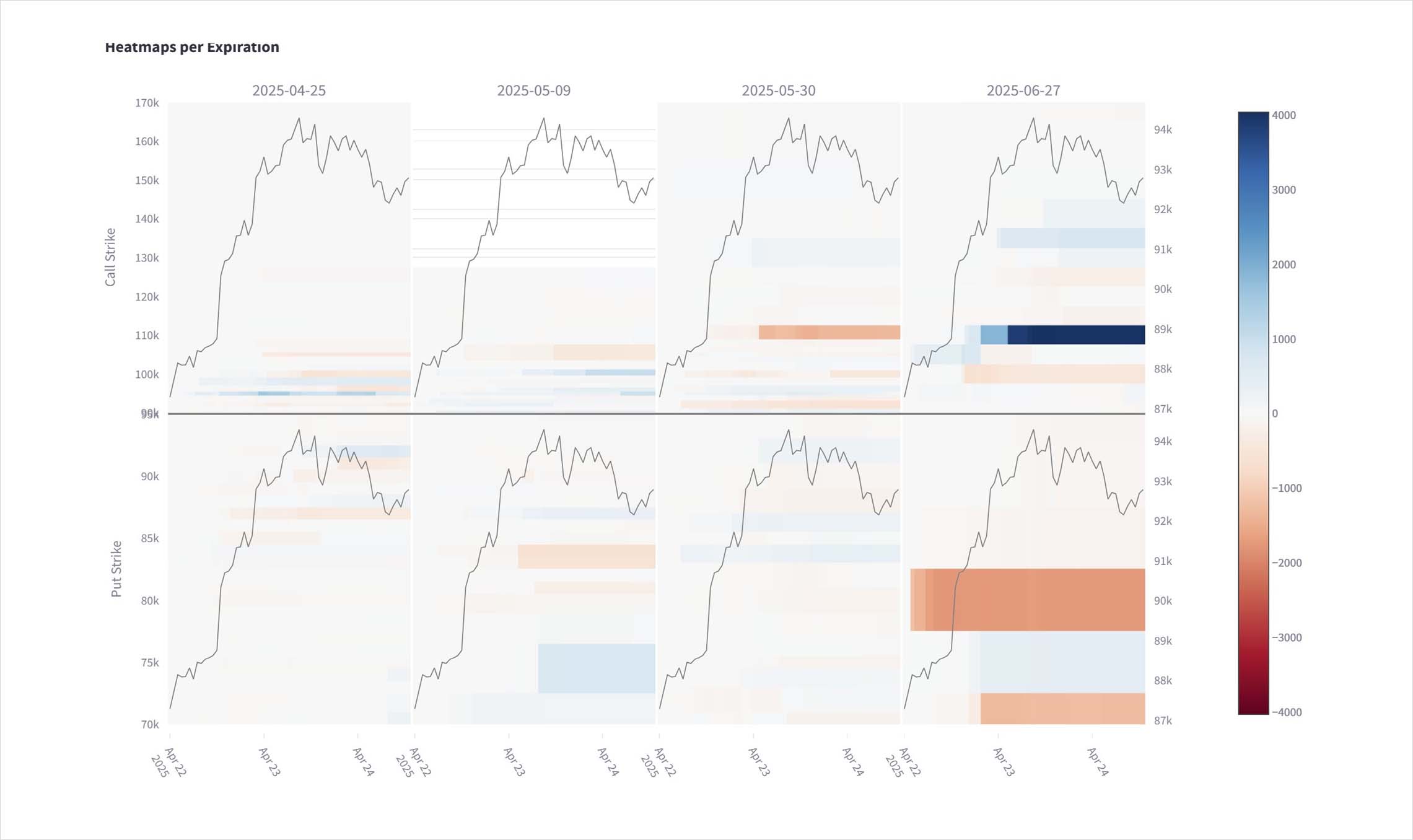

After last report’s bullish heavy Put selling, the breach above 89k immediately stimulated BTC Call buying in Apr-Jun expiries, 90-95k in Apr, May 90-100k, Jun 110k focussed rolled up, outright, and within Call spreads.

Trump walk-backs calmed markets, possible Gold rotation.

2) FOMO buying of Apr 95k Calls, and May 90-100k Strikes as BTC accelerated>90k. But Jun110k Calls buy stands out prominent.

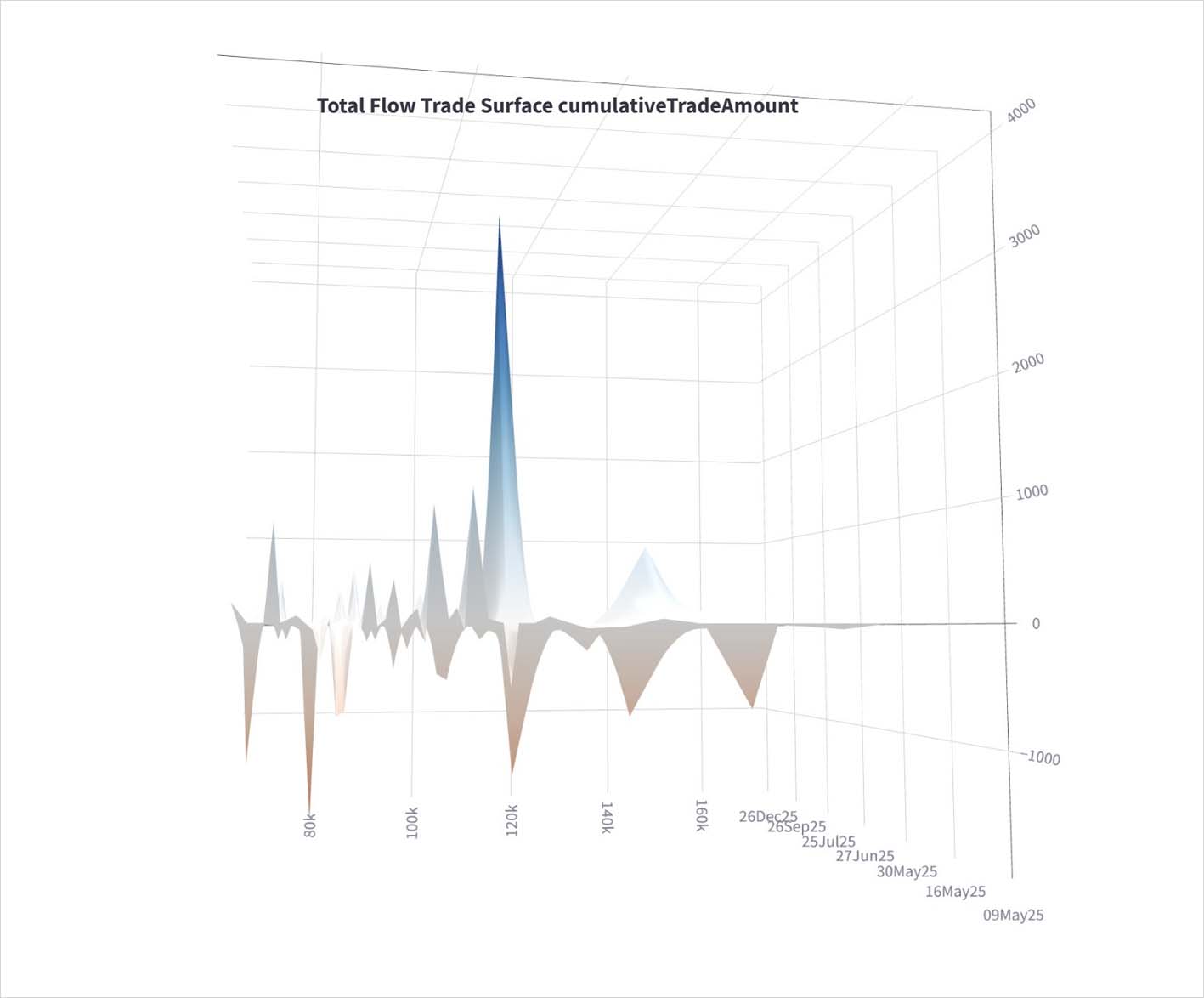

Not all was fresh money, OI only increased 20% of the volume, half was a messy rollup from the 100+105k Calls, half part of Jun-Sep140/Dec170 Call spreads.

3) Somewhat hidden was a sale of 1k May 110k Calls, and similar size buying of blue-sky June 135k Calls.

Jun 70k Puts appear to be rolled up to the 75k Put by the same Jun 100-105-110k rotation entity.

80k Puts further dumped across maturities.

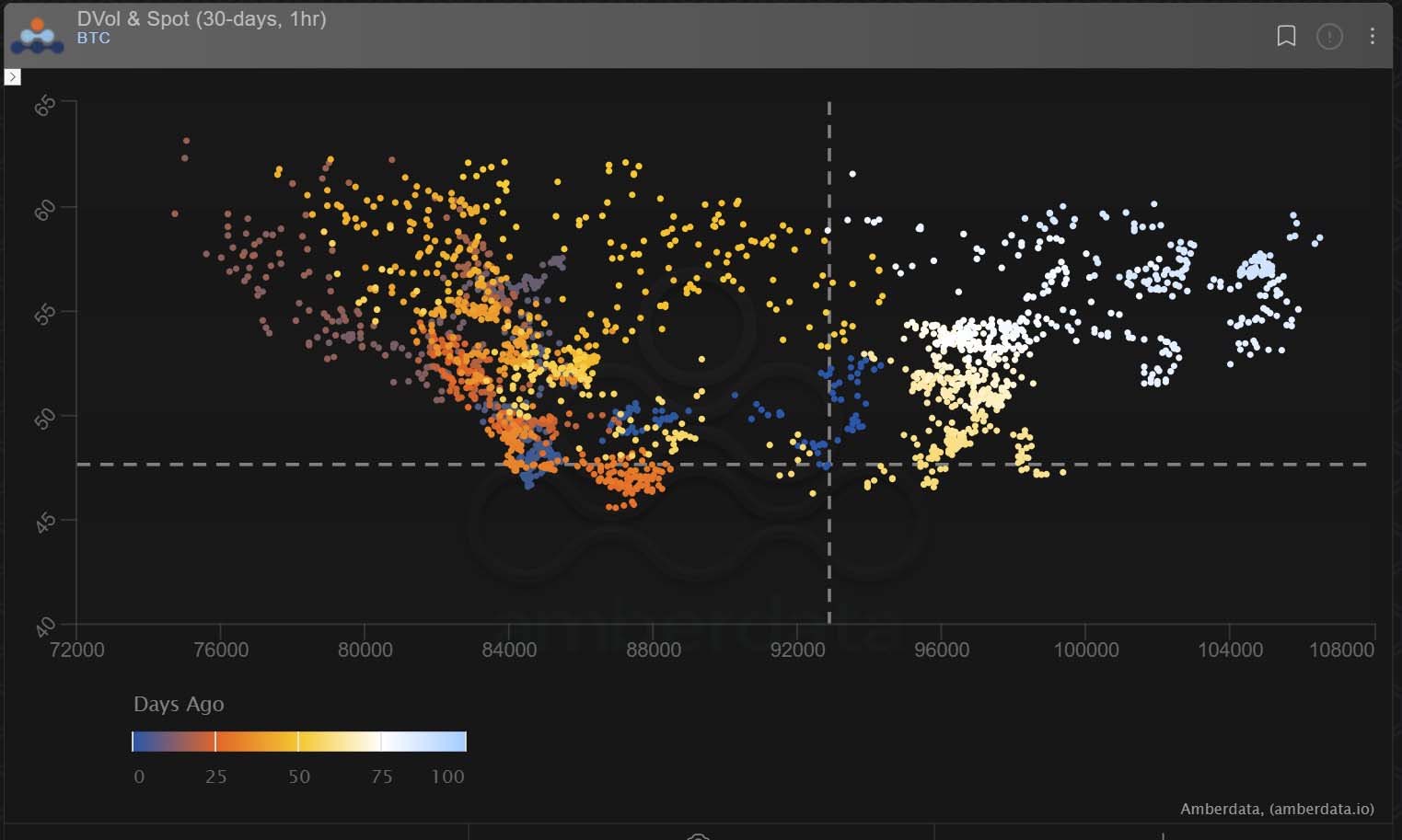

4) Due to Apr Calls being TPd on the rally >93k, and Vega being sold via Sep140+Dec170k Calls, plus net Jun Vega from 80k Puts, and 100+105k sales to rotate to the 110k Call, the implied vols did not spike on the spot surge.

5) Vol vs Spot suggests 90-95k is currently a comfort zone after so much rhetoric-led volatility.

6) In fact DVol has completely collapsed, causing some headaches for those long optionality with Spot having retraced from 94.5k highs, and for those longing Gamma in what has been a choppy range.

Delight for those finally able to reap rewards from shorting vol after turbulence.

View X thread.

AUTHOR(S)