Institutional Bitcoin Momentum & Regulatory Shifts

Bitcoin is back above $95k as the US and China signal they may finally be ready to come to the negotiating table as part of the trade war. This boosted BTC, following the China’s Ministry of Commerce statement that they have ‘decided to agree to engage with the US.’

Meanwhile, BTC continues to gain traction among institutional players. Digital asset manager Strategy just doubled its fundraising target – a strong signal that conviction in Bitcoin’s long-term value is deepening. At the same time, spot Bitcoin ETFs are quietly accumulating inflows, suggesting continued appetite from traditional allocators.

Markets ended last week cautiously optimistic. U.S. nonfarm payrolls came in at 177k, with unemployment steady at 4.2%. However, uncertainty lingers around the longer-term impact of new tariffs, which could complicate the Fed’s efforts to contain inflation without stifling growth. While equities rallied – with the S&P 500 marking a 10-day win streak before giving back some ground – those gains were tested after Trump hinted at no immediate plans to resume talks with China.

This week, all eyes are on the Fed. Rates are expected to remain on hold, but policymakers face a tightrope walk: keep inflation in check without overreacting to temporary tariff-induced pressures.

The most pivotal development, however, flew under the radar. U.S. regulators – including the Fed and FDIC – rolled back previous guidance that restricted banks from engaging with crypto. This opens the door for mainstream institutions to explore crypto custody, tokenization, and blockchain payments without needing prior approval.

That shift is already making waves. Charles Schwab and Morgan Stanley are preparing to launch crypto trading platforms in the next 12 months. One by one, the legacy financial system is integrating Bitcoin – policy by policy, product by product, and bank by bank.

Vol Drops, Ranges Hold, All Eyes on FOMC

Volatility declined steadily last week as crypto markets traded sideways. Realized vol fell to below 30% for BTC and 45% for ETH – a clear sign of a market in pause mode.

On the options front, front-end implied vols dropped sharply – down 3 points in BTC and nearly 7 in ETH. That adjustment has made short vol strategies more appealing again, with carry climbing back above 10 vols in both majors.

Price action stayed well-contained. Implied ranges were respected throughout the week with only a few brief challenges to the upper or lower bounds. Technically, the market is consolidating.

This quiet might not last long. The FOMC meeting this week could be a catalyst. While rate cuts now look less likely by June, any dovish surprise or hint at easing could fuel a sharp relief rally across risk assets. Stay alert – especially if positioning remains short vol into the event.

Skew Signals Bullish Dip Buyers & Hedging Opportunities

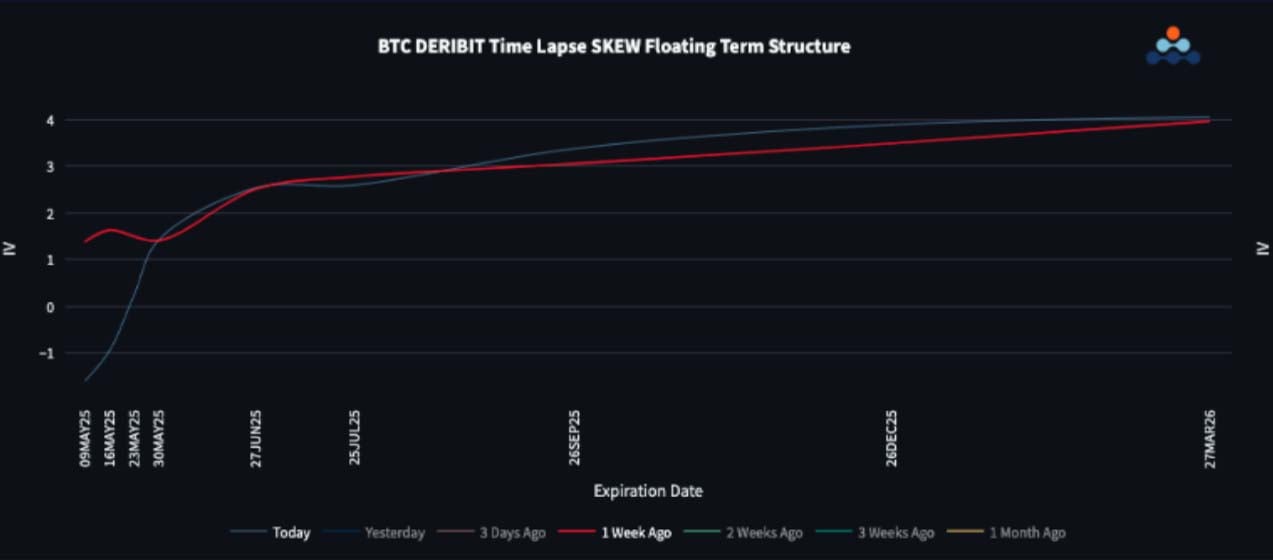

Skew structures steepened again as short-term downside demand crept back in and the recent rally lost momentum.

In BTC, front-end expiries show only modest put premium – mostly in the next two weeks. ETH, however, flipped decisively toward puts through the May expiry, showing a stronger defensive tilt.

Despite that, the broader skew dynamics still point to a bullish backdrop. While traders are hedging the near-term, year-end call skew is catching a quiet bid – the opposite of what’s playing out on the short end. That pattern reinforces the idea of dip buying in a longer-term bull trend.

For those concerned about macro risks like tariffs and trade volatility, this market offers attractive pricing for risk reversals. Vol markets are giving disciplined hedgers an edge – especially for those anticipating more turbulence in Q2.

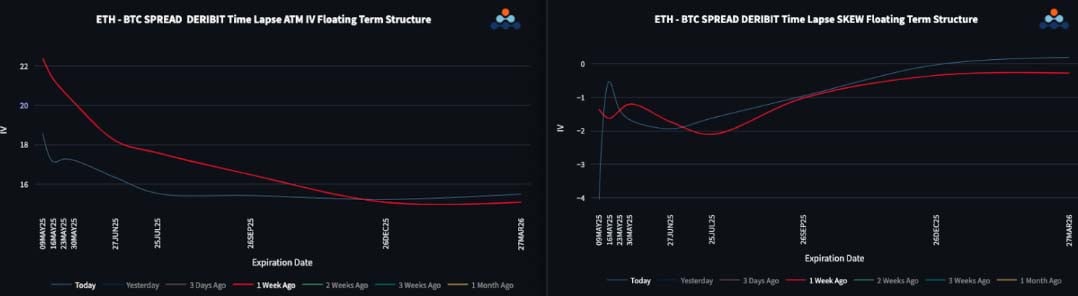

ETH/BTC Still Weak, Vol Spreads Offer Short Opportunities

ETH/BTC attempted a bounce, but the move barely dented the prevailing downtrend. The pair remains technically weak, with ETH continuing to underperform BTC.

On the vol side, the front-end ETH/BTC vol spread compressed back to 18 – just above the realized spread of 15. That premium suggests there's still room for further normalization if ETH stabilizes.

The back-end vol spread remains steady at 15 and now looks increasingly attractive to sell, particularly as the broader market calms down. If ETH avoids fresh downside, this could easily mean- revert toward the 10-vol range.

Meanwhile, ETH front-end put skew remains elevated. That pricing reflects the market’s ongoing preference to hedge ETH downside, driven by its weaker technical profile versus BTC.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)