Bitcoin Steady On Flows, Policy, and Macro Tailwinds

Bitcoin is nearing all-time highs again, supported by renewed investor interest and a favorable macro environment.

In April, spot Bitcoin ETFs attracted nearly $3B in net inflows, with another $1.6B so far in May. CFTC data shows leveraged funds didn’t significantly increase short positions, indicating most flows were directional bets-not arbitrage.

On the policy front, momentum is growing. New Hampshire became the first U.S. state to pass a Strategic Bitcoin Reserve law, while 19 others are exploring similar bills. Arizona is advancing legislation on both crypto custody and strategic reserves.

At the federal level, the Senate blocked the GENIUS Act, a stablecoin regulation bill-but the crypto market shrugged it off. Risk appetite remains firm.

Macroeconomic signals are also supportive. Trump’s tariff revision is seen as pro-growth, lifting equities and the dollar while pushing down gold, the yen, and recession odds. Volatility has cooled, with the VIX now at its 12-month average.

Bottom line: Bitcoin is benefiting from rising institutional demand, political tailwinds, and a macro setup that favours risk assets. The positioning suggests investors are leaning bullish.

BTC passes the Vol baton to ETH

Bitcoin’s realized volatility climbed about 8 points as it broke back above 100k. Ethereum stole the show—realized vol surged to 90% as it jumped 30% in just two days.

BTC front-end implied vols drifted slightly lower, while ETH exploded 20 vols higher due to the sharp move.

BTC carry returned to neutral, but ETH carry turned deeply negative-gamma sellers were hit hard.

BTC’s move breached implied highs just once (at 100k), but ETH had multiple upside breaks. It looks like Bitcoin just handed off the momentum baton to Ethereum—time will tell if it lasts.

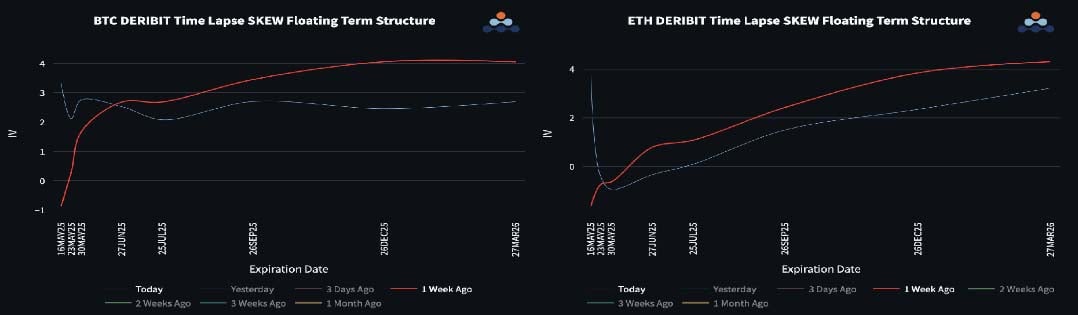

BTC Skew Term Structure Flattened Out Into Call Premium Again

As markets rallied, skew curves flattened, and call premiums returned.

Bitcoin skew sits around 2–3 vols across the curve, suggesting bullish flows targeting upside. Implied vol levels remain relatively cheap.

Ethereum skew shifted lower, with a mild lean toward puts-except at the front end. If ETH holds recent gains and breaks through the 2800 level, we could see a sustained call bid return. For now, the market remains cautious.

From a longer-term view, ETH still has ground to make up versus BTC.

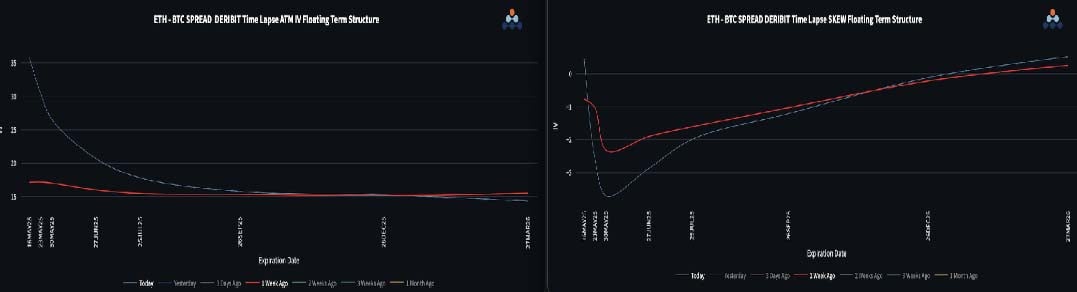

Front End Vo Spreads Explode

ETH/BTC jumped 33% over the past week and is now testing key downtrend resistance at 0.025. Short-term vol spreads surged to 35 vols as ETH outperformed dramatically on realized vol.

Meanwhile, back-end vol spreads held steady around 15 vols and didn’t react much-supporting the view that long-term VEGA is likely a sell here.

Despite the big ETH move, skew has shifted further into put premium across short-dated expiries. That tells us the options market isn’t fully buying this rally-yet.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)