View on market

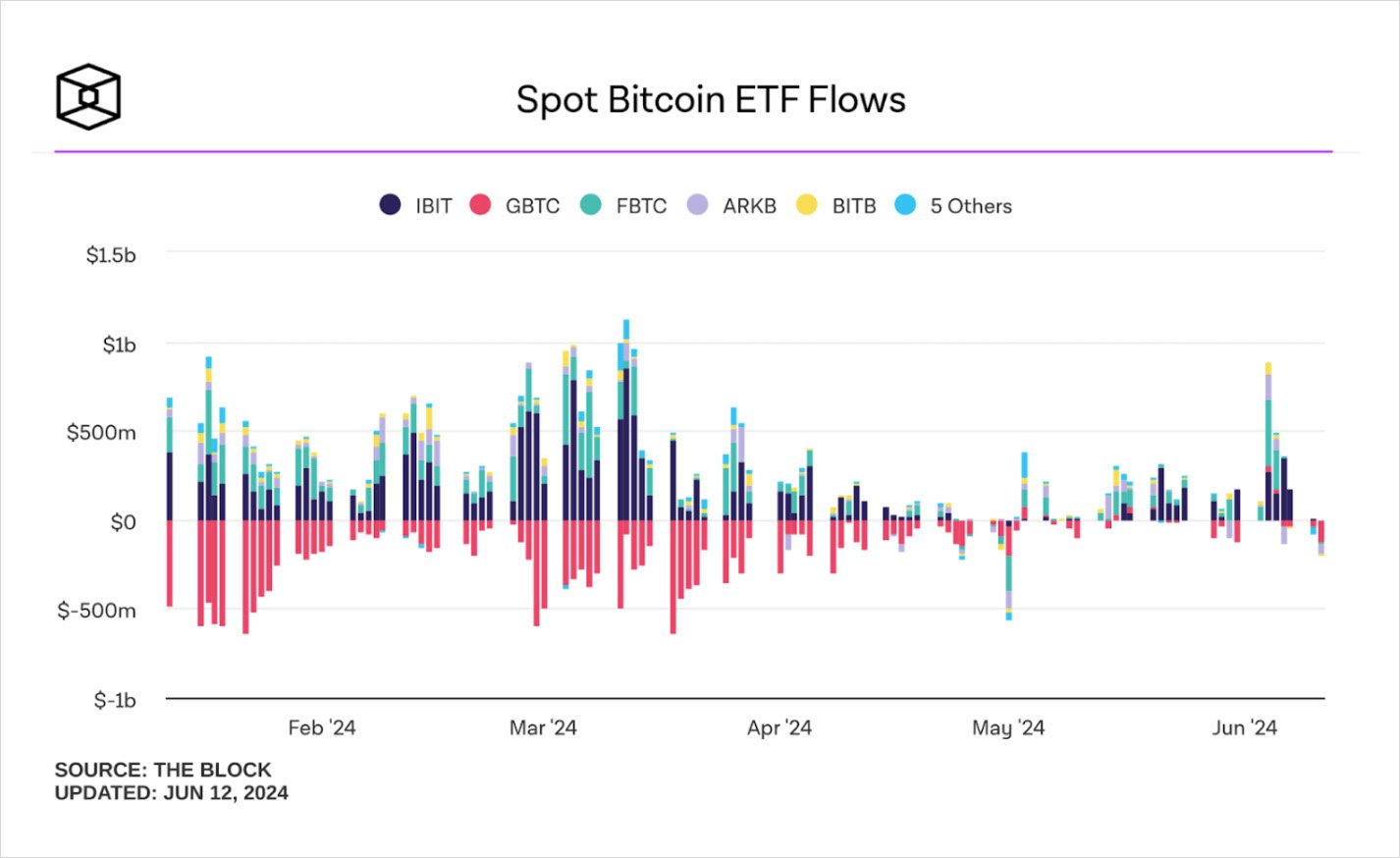

US spot bitcoin ETFs experienced net outflows on June 10th and 11th, ending a 19-day inflow streak due to economic uncertainty from conflicting U.S. job data. The Federal Open Market Committee maintained interest rates at 5.25%-5.50%, while Bitcoin’s price is facing resistance in moving higher, signaling a downward momentum.

Put Butterfly Spread

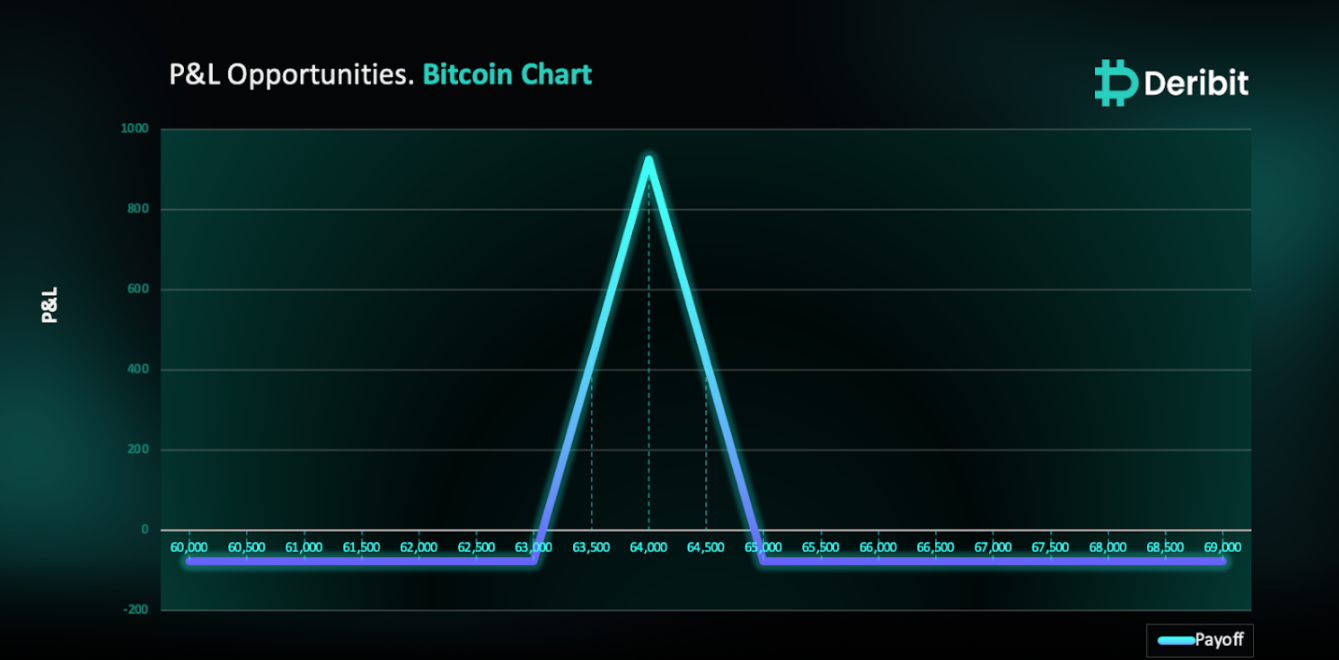

The proposed strategy is a Put Butterfly Spread strategy. A Butterfly Spread with Puts is a three-part strategy that is created by buying one Put at a higher strike price, selling two Puts with a lower strike price and buying one Put with an even lower strike price.

You can consider executing this strategy if you are eyeing downward movement in BTC prices.

Trade Structure

(OTM Put) Buy 1x BTC-21JUN24-$65,000-P @ $672

(OTM Put) Sell 2x BTC-21JUN24-$64,000-P @ $457

(OTM Put) Buy 1x BTC-21JUN24-$63,000-P @ $318

Target: Spot level > $64,000

Payouts

Maximum Profit: $924/BTC

Debit of Strategy: $76/BTC

Why are we taking this trade?

The recent trend in US spot bitcoin ETFs saw a reversal on June 10th and 11th, ending a 19-day streak of net inflows (Source: Farside Investors).This shift came as Bitcoin’s price fell last Friday, following conflicting U.S. non-farm payroll and unemployment data, which created uncertainty and prompted investors to move away from riskier assets.

At the same time, U.S. ETF issuers are still waiting for feedback from the Securities and Exchange Commission (SEC) on their S-1 registration statements submitted at the end of last month. Approval of these S-1 forms by the SEC is crucial for issuers to officially launch their spot ETH funds.

The FOMC decided to maintain the current interest rate of 5.25% to 5.50%. Powell reiterated that the FOMC is waiting for more encouraging inflation data to come in before it starts to cut rates.

On the technical front, Bitcoin’s price has recently moved closer to the proximal line of the demand zone at $66,500. After a brief upward movement, the price has returned to this demand zone, indicating that buy orders were insufficient to break the resistance at $72,000. This suggests price can move towards the next support level at $64,000, which is also a flip zone and holds significant importance. Given this scenario, traders might consider deploying a Put Butterfly Spread strategy to capitalize on the anticipated price movement.

To execute this approach, traders can purchase a Put option with a higher strike price (e.g., $65,000) while simultaneously selling double the quantity of Puts at a lower strike price (e.g., $64,000) and buying a Put at an even lower strike price (e.g., $63,000).

If the Bitcoin price is at $64,000 when the options expire on June 21st, traders will achieve maximum profit from this strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $76.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)