View on market

Bitcoin faces resistance due to conflicting U.S. job data, falling below $66,000 with continuous ETF outflows. Key resistance levels at $67,000 and $70,000 suggest traders may benefit from a Call Ratio strategy.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two (or more; in below case it is 3 legs) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if you are anticipating continued resistance at the $67,000 and $70,000 levels in BTC and particularly suited for those expecting limited upward movement in Bitcoin’s price.

Trade Structure

(OTM Call) Buy 1x BTC-28JUN24-$67,000-C @ $1305

(OTM Call) Sell 3x BTC-28JUN24-$70,000-C @ $540

Target: Spot level < $70,000

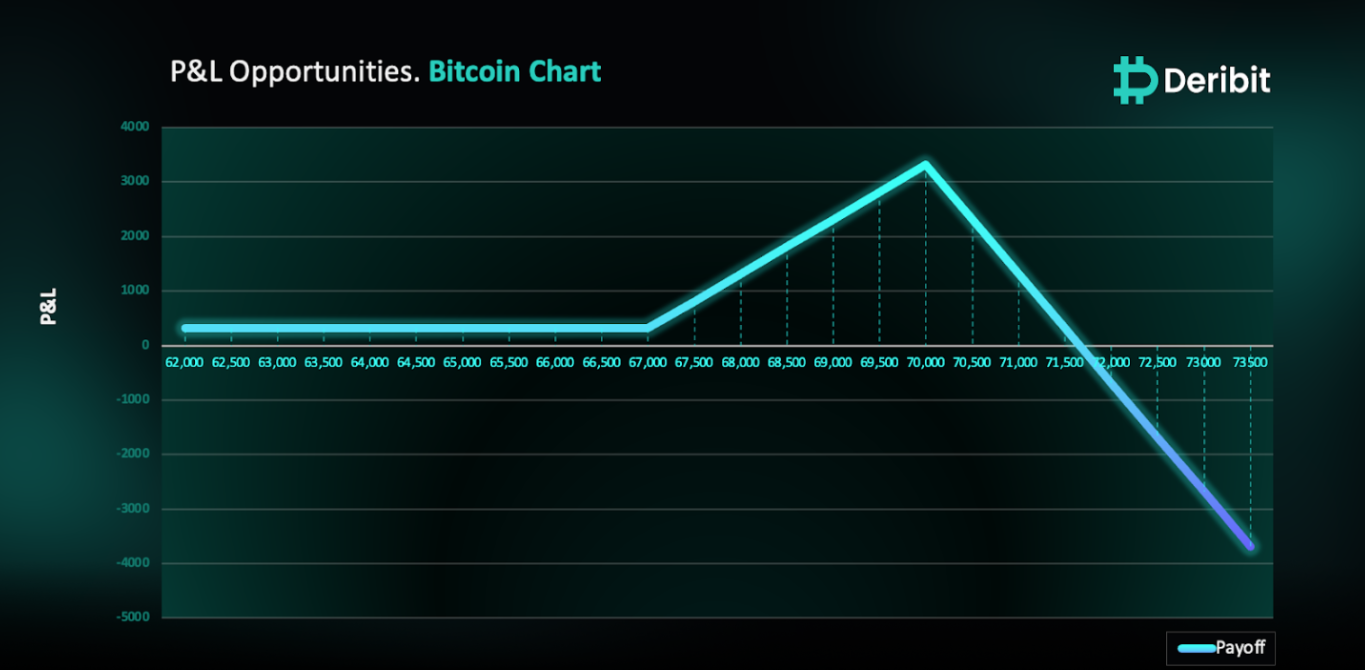

Payouts

Maximum Profit: $3,315/BTC

Net Credit of Strategy: $315/BTC

Why are we taking this trade?

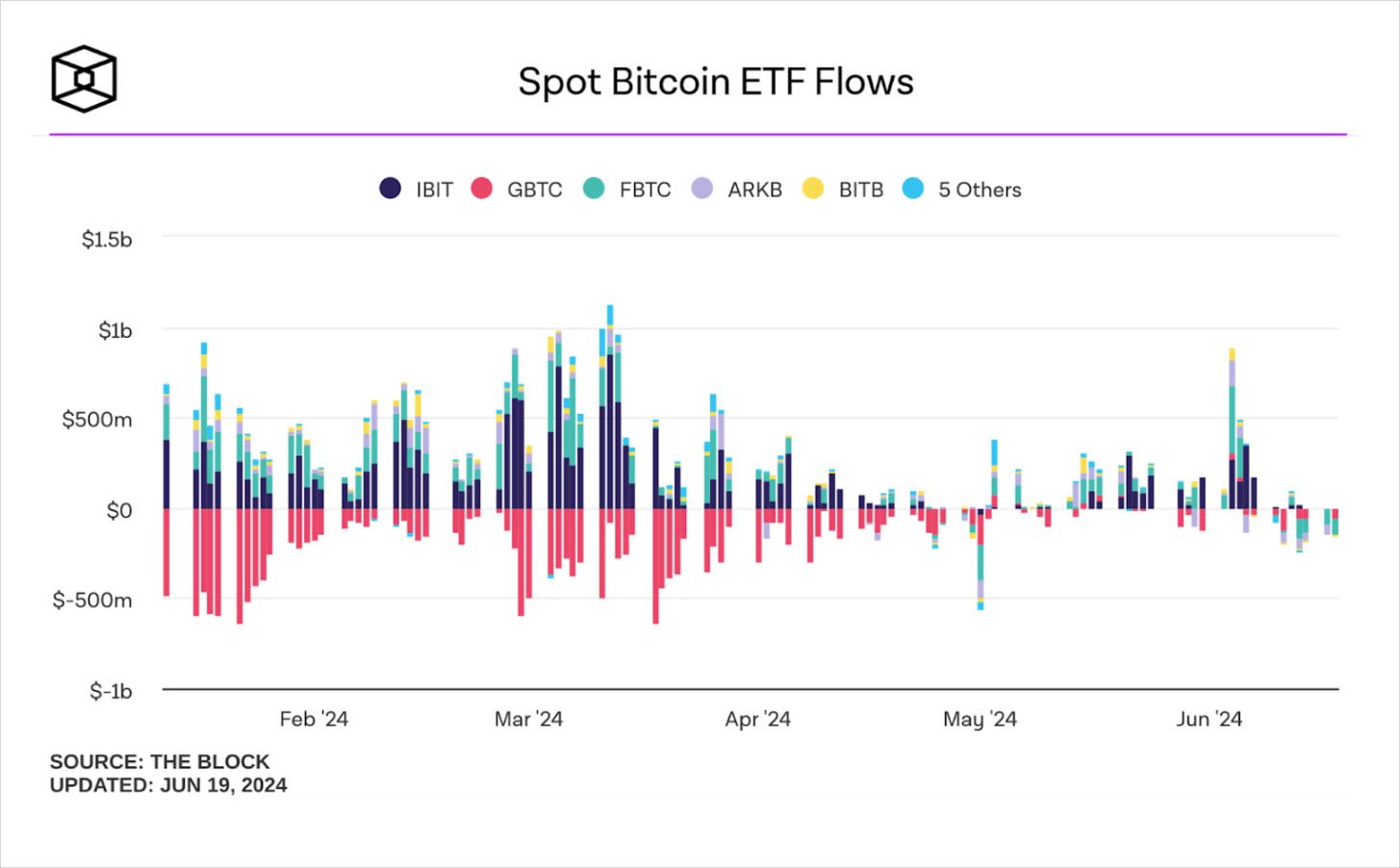

As mentioned in yesterday’s insights, Bitcoin is facing resistance at higher levels due to economic uncertainty generated from conflicting U.S. job data. Bitcoin has fallen below the critical support level of $66,000, and we haven’t seen any significant retracements. On Tuesday, U.S. spot Bitcoin ETFs recorded $152.4 million in net outflows, marking the fourth consecutive day of daily net outflows. (Source: Farside Investors)

As illustrated in the attached 4-hour price chart of BTC, crucial supports have been breached, and new supply zones are formed. The $67,000 level is a major hurdle for the price, and the maximum pain for the June 28th BTC Options expiry stands at $67,000. This confluence with technical patterns suggests that the price will face substantial resistance in moving up. Another strong resistance has formed at the $70,000 price level. Therefore, traders can consider deploying a Call Ratio strategy to capitalize on the anticipated price movements.

To implement this strategy, traders can buy a higher strike Call option (e.g., $67,000) and simultaneously sell Calls in triple quantity (3x) of a higher strike price (e.g., $70,000).

If Bitcoin is at $70,000 when the options expire on June 28th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy collects an initial credit of $315, significant losses are possible due to the position’s net short call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)