View on market

Spot Bitcoin ETFs in the U.S. experienced significant outflows, indicating investor reluctance amid technical downtrend and broader economic uncertainties. The recent declines and downtrend suggest strong resistance, with further downside risk for Bitcoin.

Bear Call Spread

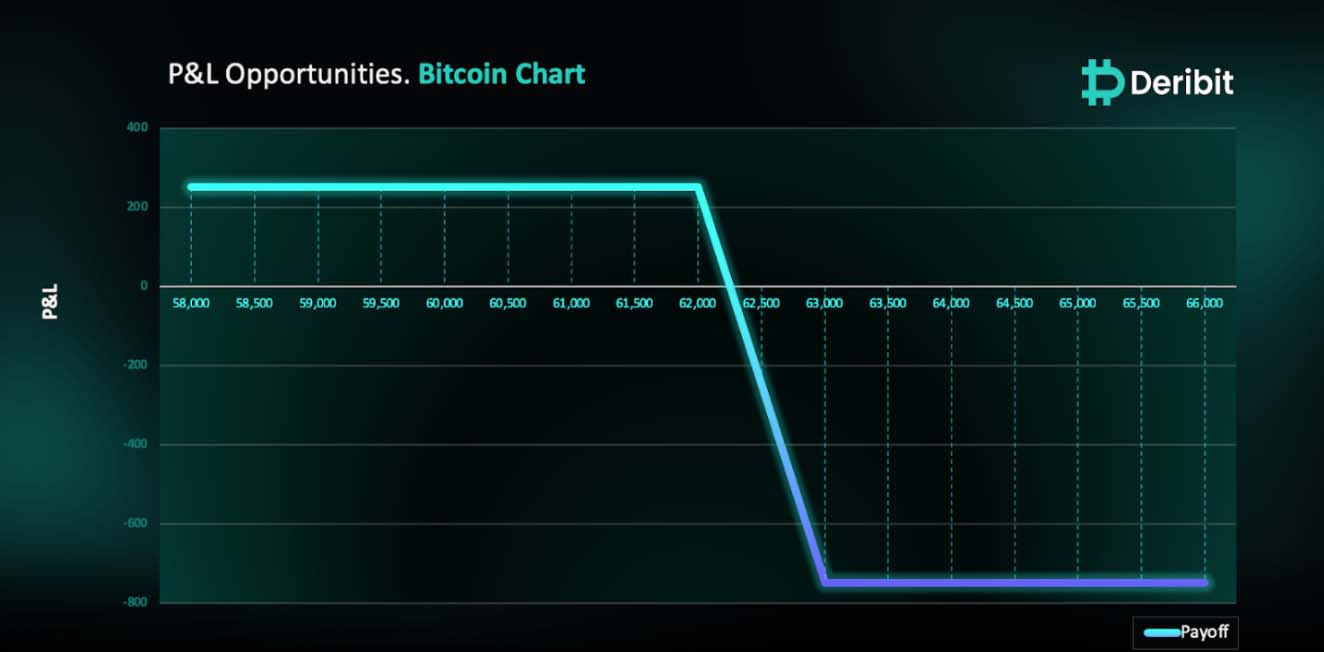

The proposed strategy is a Bear Call Spread. A Bear Call Spread is achieved by simultaneously selling a call option and buying a call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you believe that BTC can face hurdles in moving higher.

Trade Structure

(OTM Call) Sell 1x BTC-30AUG24-$62,000-C @ $1,549

(OTM Call) Buy 1x BTC-30AUG24-$63,000-C @ $1,297

Target: Spot level < $62,000

Payouts

Maximum Profit: $252/BTC

Why are we taking this trade?

On Tuesday, spot Bitcoin ETFs in the U.S. saw a significant $148.6 million in net outflows. Investors in Bitcoin Spot ETFs are currently not taking advantage of the dip in prices. The recent declines are getting deeper than before, with prices hitting ~$56,500 in May, around $53,500 in July and ~$49,500 in August.

According to recent insights, the technical chart shows considerable damage and is in a downtrend, with Bitcoin breaking below the lower trend line of its current channel, as illustrated in the attached chart. While Bitcoin is making efforts to recover, it faces strong resistance from the well-defined downtrend, which will likely pose a challenge following the recent support break.

As the world focuses on the unwinding of the Japanese carry trade, it’s essential to understand that the U.S. tech sell-off is mainly driven by disappointing earnings growth. Therefore, even if the hype around the Japanese carry trade news fades, the downside risk for the Nasdaq remains, and Bitcoin could face further declines. Economic uncertainty, inflation, and potential interest rate cuts are likely to persist for some more time.

On the technical side, as highlighted in the attached daily BTC chart, we see a “drop-base-drop” structure on the higher time frame. The sell-off intensified following this base, which plays a significant role and may act as a crucial resistance to prices moving upward.

Hence, Traders can capitalize on this outlook on BTC using a Bear Call Spread strategy. To execute this strategy, traders can sell a call option of a higher strike price, eg. $62,000 while simultaneously purchasing a call option at an even higher strike price, like $63,000.

In case of market upturn, the maximum loss is limited to $748. Maximum loss of Bear Call Spread = Difference between strike prices of calls ($63,000 – $62,000) – Net credit ($252).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)