View on market

In light of the ongoing downtrend in BTC prices and signs of market weakness, here’s a trading approach for Traders eyeing further weakness in BTC, from the mentioned strategy.

Put Butterfly Spread

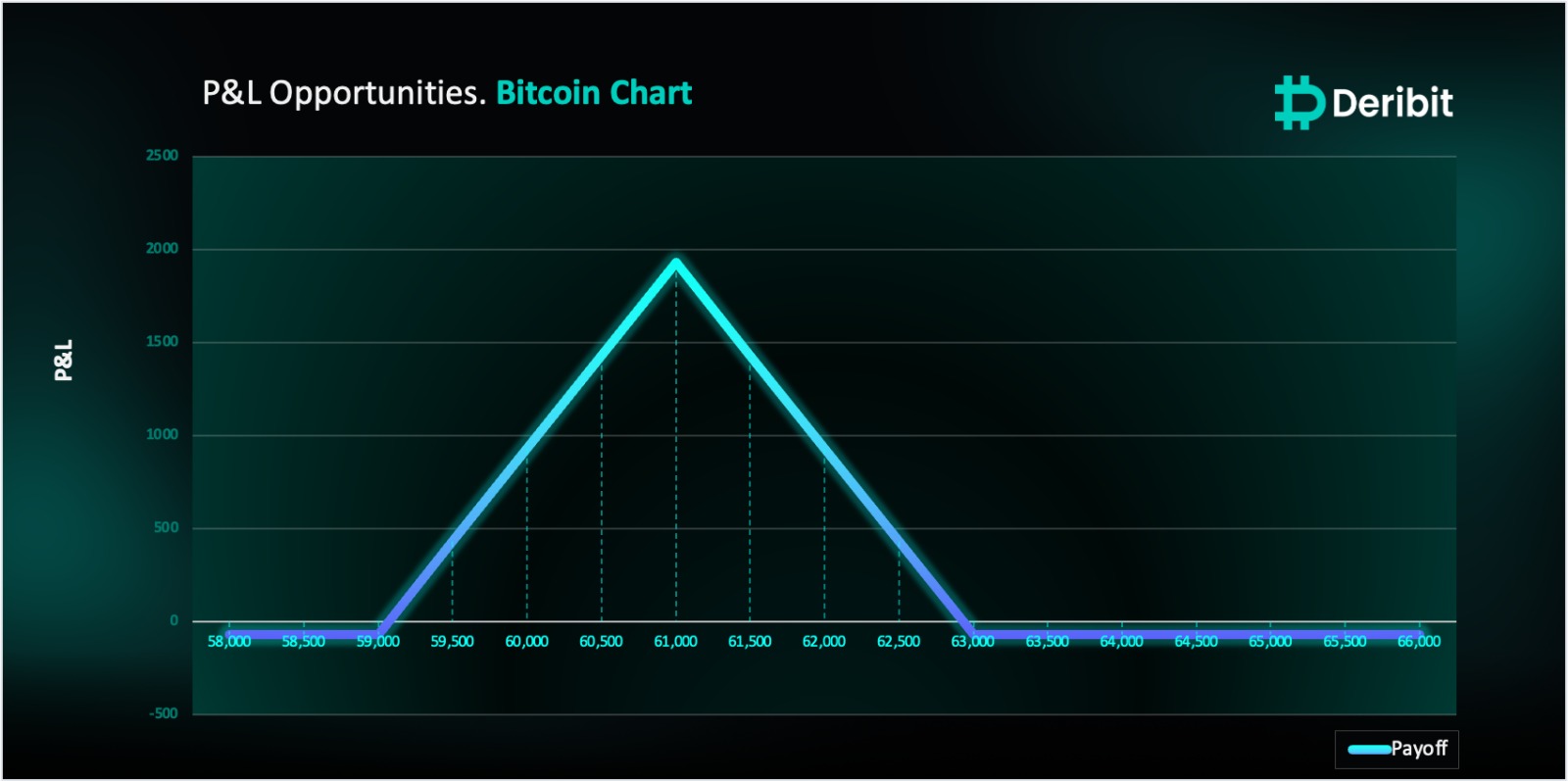

The proposed strategy is a Put Butterfly Strategy. A Long Butterfly Spread with Puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. All puts have the same expiration date, and the strike prices are equidistant.

If you see weakness in BTC and eye for a gradual decline over the short term, it might be worth considering execution of the below strategy.

Trade Structure

(OTM Put) Buy 1x BTC-7APR24-$63,000-P @ $210

(OTM Put) Sell 2x BTC-7APR24-$61,000-P @ $100

(OTM Put) Buy 1x BTC-7APR24-$59,000-P @ $60

Target: Spot level > $61,000

Payouts

Maximum Profit: $1,930/BTC

Debit of Strategy: $70/BTC

Why are we taking this trade?

As mentioned in yesterday’s Insights, BTC exhibited notable retracements to levels around $69,315, slightly missing our target price of $70,000, which was the sold strike in the suggested strategy. There were indications of weakness in BTC around the resistance area, as indicated in the attached charts. Moreover, the weakness in BTC ETF inflows failed to inspire confidence among traders, which also fuelled the weakness in the market.

Echoing our previous insights, the next significant demand zone lies within the range of $61,800 to $60,000. This zone holds considerable significance for the market, having previously served as a pivotal level that propelled Bitcoin to a high of $73,800. This demand zone could potentially act as a temporary halt to the BTC sell-off, presenting an opportunity for traders to capitalize on gains using the suggested strategy. Hence, traders can utilize a put butterfly spread strategy in BTC for short-term bearish views.

To execute this approach, traders can purchase a put option with a higher strike price (e.g., $63,000) while simultaneously selling double the quantity of puts at a lower strike price (e.g., $61,000) and buying a put at an even lower strike price (e.g., $59,000).

If the Bitcoin price is at $61,000 when the options expire on April 7th, traders will achieve maximum profit from this strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $70.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)