View on market

Speculations suggest the SEC might settle a major case, and Trump may announce Bitcoin as a strategic reserve asset during his July 27 speech, potentially causing a significant crypto market shift. Meanwhile, strong inflows into Bitcoin ETFs and upcoming events, including the Ethereum ETF launch and potential Ripple Labs settlement, indicate bullish market sentiment.

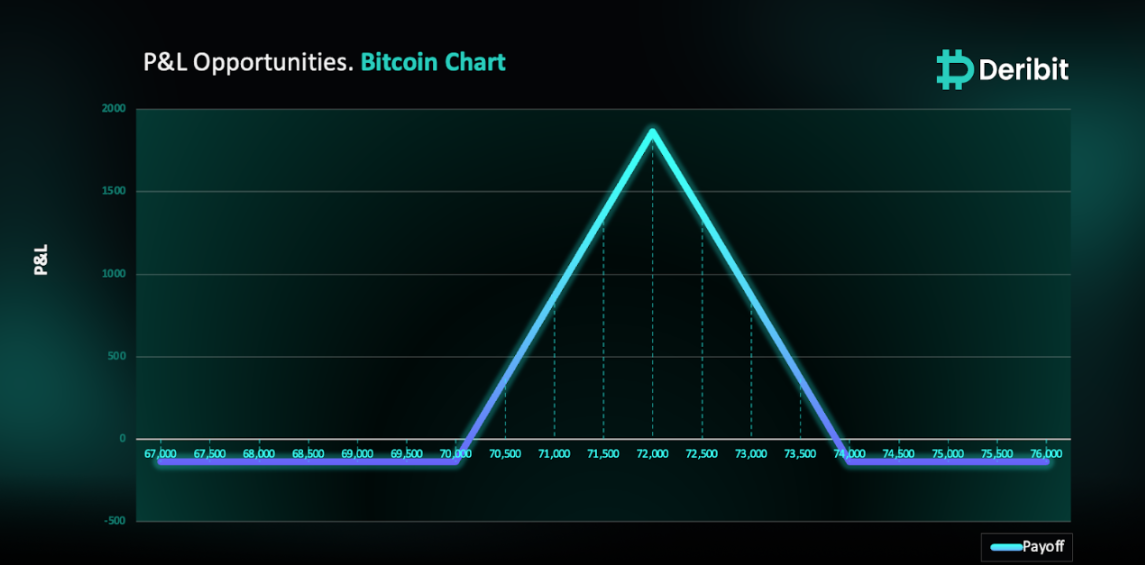

Call Butterfly Spread

The proposed strategy is a Call Butterfly Spread strategy. A Butterfly Spread with Calls is a three-part strategy that is created by buying one Call at a lower strike price, selling two Calls with a higher strike price and buying one Call with an even higher strike price.

You can consider executing this strategy if you are anticipating a bullish environment to continue for BTC.

Trade Structure

(OTM Call) Buy 1x BTC-09AUG24-$70,000-C @ $2,943

(OTM Call) Sell 2x BTC-09AUG24-$72,000-C @ $2,304

(OTM Call) Buy 1x BTC-09AUG24-$74,000-C @ $1,799

Target: Spot level = $72,000

Payouts

Maximum Profit: $1,866/BTC

Debit of Strategy: $134/BTC

Why are we taking this trade?

Potential Major Shifts in Crypto: Key Updates

Speculation is circulating that the SEC may soon settle a significant case, coinciding with former President Trump’s highly anticipated speech in Nashville on July 27. This event is expected to attract considerable attention. Vivek Ramaswamy and Senator Cynthia Lummis are pushing for Bitcoin to be integrated into the U.S. financial system as a strategic reserve. They believe that Bitcoin’s decentralized nature and its growing global acceptance could bolster economic resilience and stability. Speculation is rife that Trump might announce Bitcoin as a strategic reserve asset, potentially causing a significant increase in Bitcoin’s price. If such an announcement is made, it would likely mean the U.S. Treasury is on board, leading to major implications for the cryptocurrency industry. There are also rumors that Trump’s favorite candidates for Treasury Secretary include BlackRock’s Larry Fink and JP Morgan’s Jamie Dimon. Along with a possible shift in SEC leadership, these changes could dramatically alter the crypto landscape.

Another significant development is the potential settlement of the Ripple Labs (XRP) vs. SEC case, which is expected to be announced this week. This could have substantial impacts on the cryptocurrency market.

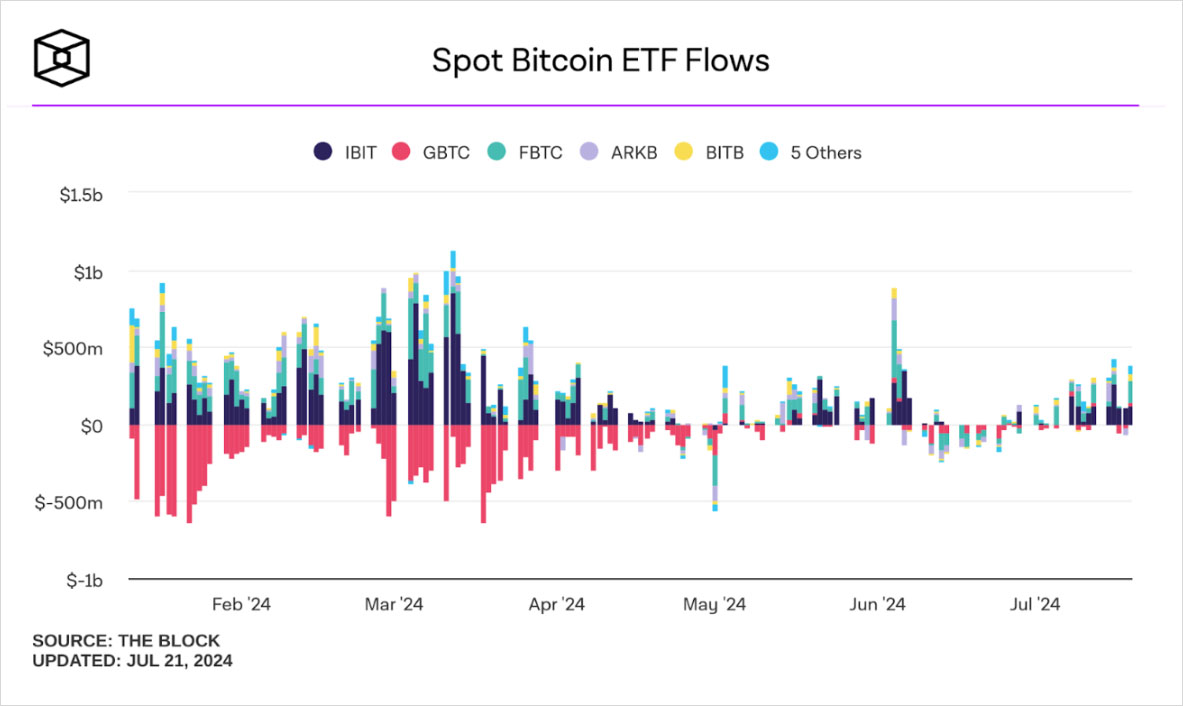

Ethereum ETF Launch and Bitcoin ETF Inflows

The Ethereum ETF is set to launch on Tuesday, July 23, as highlighted in my previous insights. Strong inflows into spot Bitcoin ETFs over the past two weeks suggest that market sentiment has turned positive, with traders aggressively buying (Source: Farside Investors).

Technical Analysis

From a technical analysis perspective, the attached 4-hour Bitcoin price chart shows a significant breakout. The highlighted supply zone at $67,200 has been breached following the formation of a flag and pole pattern (highlighted in yellow), indicating an upward trend.

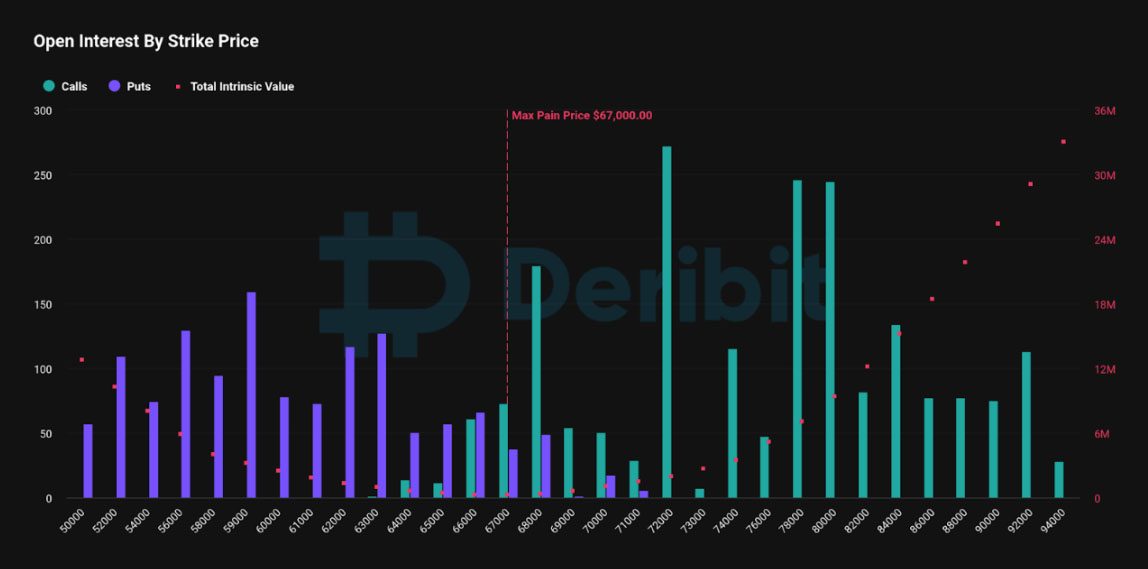

Additionally, options data from Deribit indicates high open interest at the $72,000 strike for Bitcoin options expiring on August 9th, further emphasizing the market’s bullish sentiment (Source: Deribit).

For traders, looking to capitalize on this analysis in BTC, implementing a Call Butterfly Spread strategy could be advantageous.

To execute this approach, traders can purchase a Call option (e.g., $70,000) while simultaneously selling double the quantity of Calls at a higher strike price (e.g., $72,000) and buying a Call at an even higher strike price (e.g., $74,000).

If the BTC price is at $72,000 when the options expire on August 9th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $134.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)