View on market

July’s CPI data shows inflation slowing to 2.9%, while the crypto market remains bullish, fueled by the approval of Bitcoin and Ethereum spot ETFs. Morgan Stanley’s $187 million stake in BlackRock’s spot Bitcoin ETF underscores growing institutional interest.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying price rises.

You may consider taking this trade if you expect the BTC price to rise as the technical setup is bullish and institutional adoption is increasing.

Trade Structure

(OTM Call) Buy 1x BTC-08NOV24-$70,000-C @ $3,340

(OTM Call) Sell 1x BTC-08NOV24-$72,000-C @ $2,931

Target: Spot level > $72,000

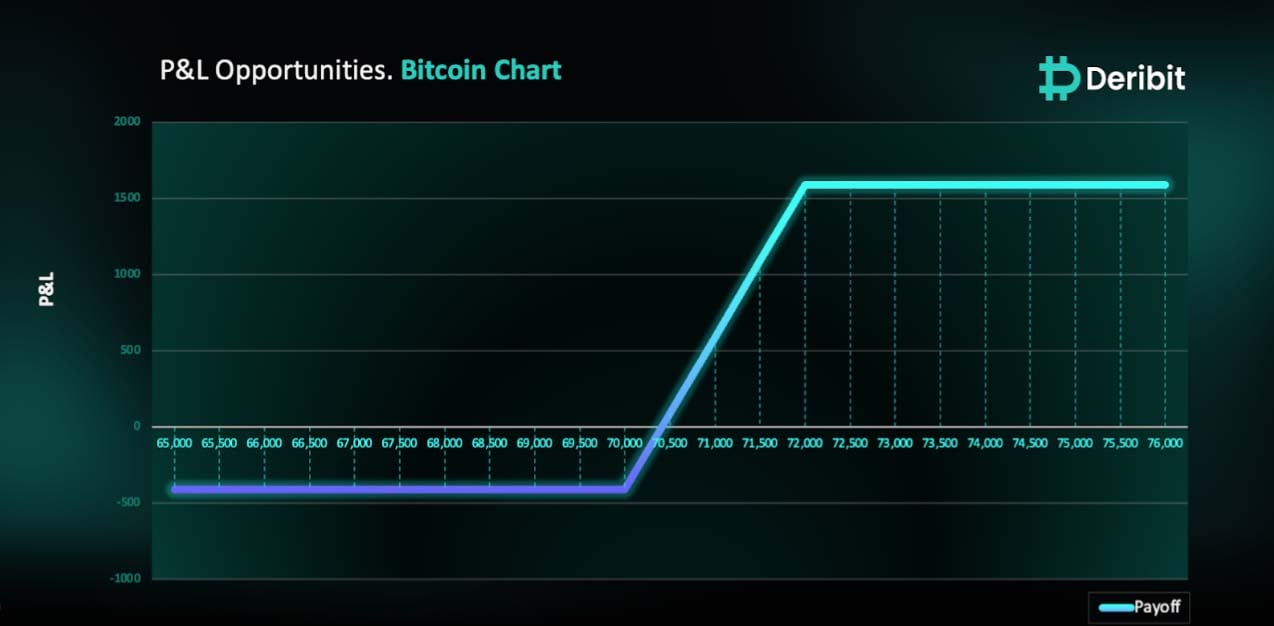

Payouts

Maximum Profit: $1,591/BTC

Debit of Strategy: $409/BTC

Why are we taking this trade?

July’s Consumer Price Index (CPI) data reveals a significant slowdown in inflation, dropping to 2.9% – the lowest rate in over three years and below expectations. The overall sentiment in the crypto market remains optimistic, especially following the approval of Bitcoin and Ethereum spot ETFs. These developments are expected to increase institutional interest and investment in BTC and ETH, potentially driving prices higher.

Notably, Morgan Stanley has disclosed a $187 million position in BlackRock’s spot Bitcoin ETF. The 13F filings, which are quarterly reports submitted to the U.S. Securities and Exchange Commission (SEC) by institutional investment managers, highlighted this significant stake. Morgan Stanley, a leading multinational investment bank and financial services firm, reported this substantial position in its latest 13F filing.

Analyzing the 4-hour price chart of Bitcoin (BTC), we noticed a strong rebound after the decline on August 5th. Despite some retracements, the price has respected the marked demand zone in the attached chart. With the breach of two supply zones, the trend appears to be upward, indicating a bullish market atmosphere.

We can therefore expect the price to continue trading higher with the increased institutional flows, reinstating a bullish market environment.

US elections are to be held on 5th Nov 2024, therefore the 8th Nov expiry is the election expiry, and we can expect increased speculations around it, with more participation from traders, in expectation of crypto friendly government and policies.

Hence, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $70,000) and simultaneously sell a Call option at a higher strike price (e.g., $72,000).

If the price of BTC is at or above $72,000, when the options expire on November 8th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $409.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)