View on market

Spot Ethereum ETFs will start trading on Tuesday, but ETH prices haven’t surged despite the approval and the put-call ratio suggests potential downside. Historically, new crypto product listings often lead to corrections.

Put Butterfly Strategy

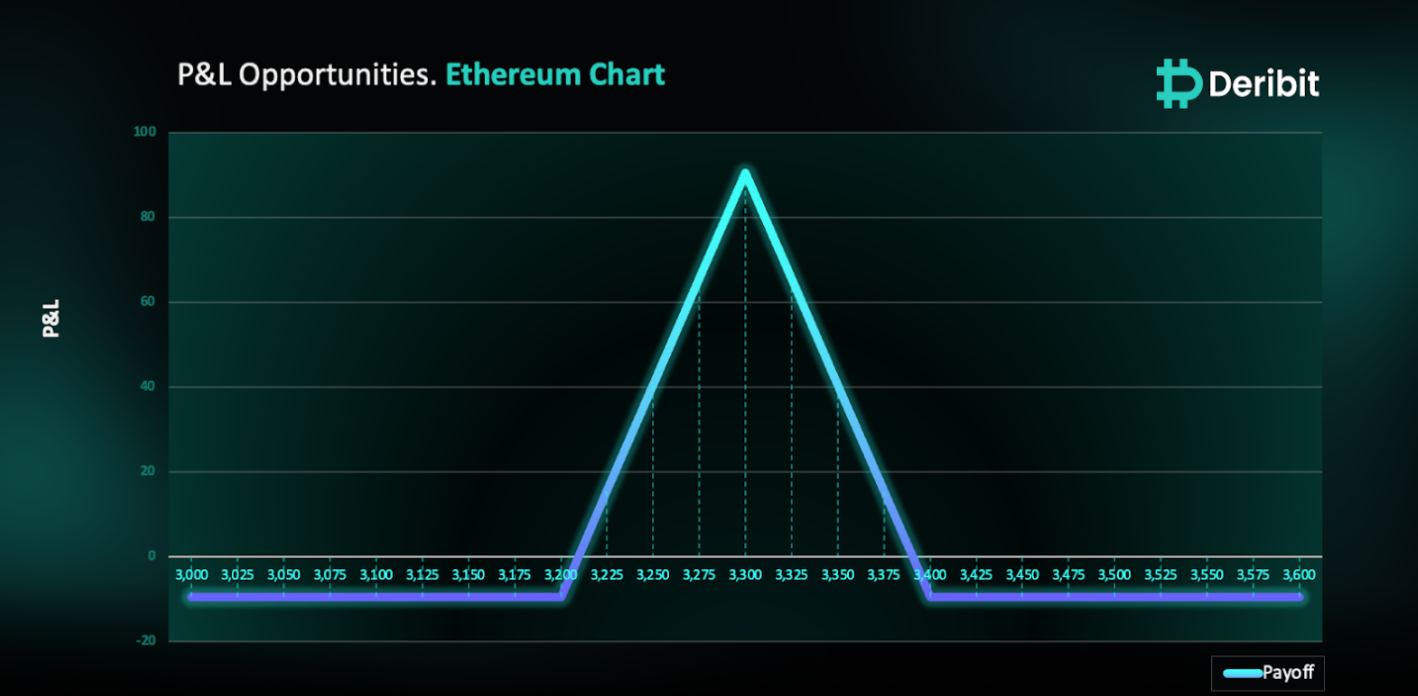

The proposed strategy is a Put Butterfly strategy. A Butterfly Spread with Puts is a three-part strategy that is created by buying one Put at a higher strike price, selling two Puts with a lower strike price and buying one Put with an even lower strike price.

You can consider executing this strategy if you are eyeing downward movement in ETH prices.

Trade Structure

(OTM Put) Buy 1x ETH-09AUG24-$3,400-P @ $144.5

(OTM Put) Sell 2x ETH-09AUG24-$3,300-P @ $105

(OTM Put) Buy 1x ETH-09AUG24-$3,200-P @ $75

Target: Spot level = $3,300

Payouts

Maximum Profit: $90.5/ETH

Debit of Strategy: $9.5/ETH

Why are we taking this trade?

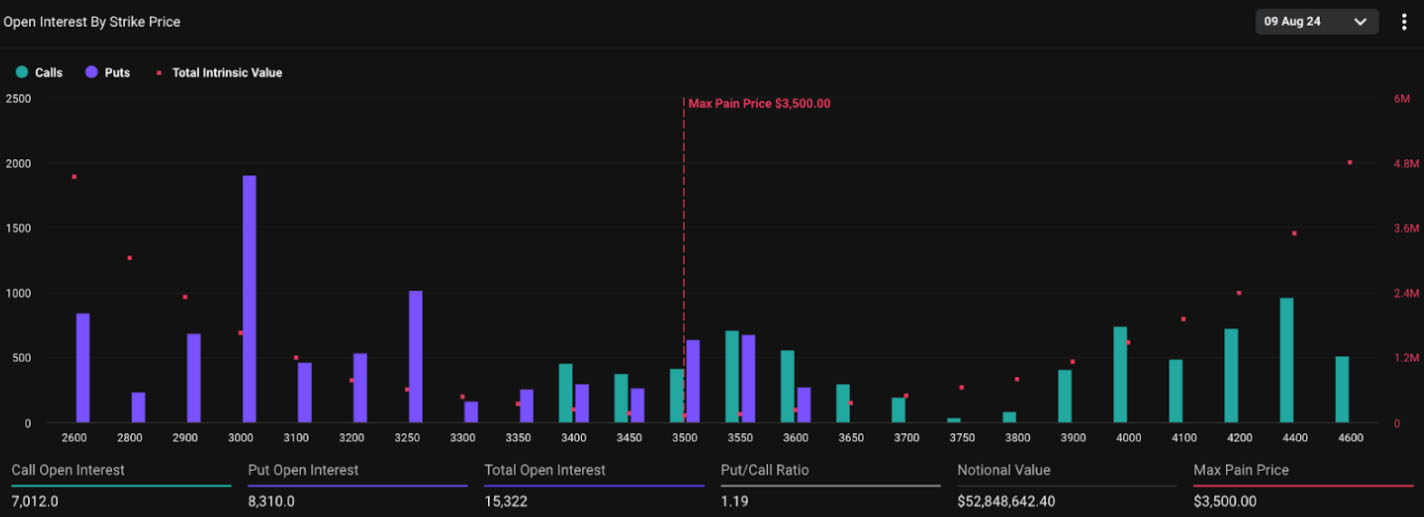

Spot Ethereum ETFs have received final approval to begin trading on Tuesday. According to Deribit data, the put-call ratio for 9th August expiry has spiked to 1.19.

This indicates a higher number of put options relative to call options, suggesting that traders expect potential immediate downside or are seeking to hedge against price declines. Despite the approval news, there was no significant price surge in ETH. The anticipation of ETF approval had been prevailing in the crypto market since May. However, compared to other cryptocurrencies on a weekly basis, ETH has underperformed in terms of market cap, as highlighted in the chart below.

I have written a detailed insight on the performance of crypto products after their listings. Historically, the listing of regulated exchange products has often been followed by corrections. This pattern was observed with the CME Bitcoin Futures launch in December 2017, the Coinbase IPO in April 2021, the Bitcoin ETFs based on futures in October 2021, and the Bitcoin ETFs based on spot in January 2024.

For more information, you can refer to the 27th of June insight here.

Looking at the technical chart of ETH, it appears that selling pressure is already mounting on the underlying asset with no significant price surge despite the approval of spot ETH ETFs to begin trading on Tuesday. I anticipate the price of ETH to fall till $3,300, exactly to the support pivot as highlighted by the yellow line in the attached chart of ETH.

Therefore, traders can consider deploying a Put Butterfly strategy to capitalize on the anticipated price movements.

To execute this approach, traders can purchase a Put option with a higher strike price (e.g., $3,400) while simultaneously selling double the quantity of Puts at a lower strike price (e.g., $3,300) and buying a Put at an even lower strike price (e.g., $3,200).

If the ETH price is at $3,300 when the options expire on August 9th, traders will achieve maximum profit from this strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $9.5.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)