View on market

Following the ETH ETF approval, the price dropped 39% to a demand zone at ~$2,150, and now, after hitting a resistance flip zone, it may attempt to rise, though a supply zone at $3,200 could pose a challenge.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are eyeing bullish days in ETH.

Trade Structure

(OTM Call) Buy 1x ETH-30AUG24-$3,000-C @ $62.5

(OTM Call) Sell 2x ETH-30AUG24-$3,200-C @ $31

Target: Spot level < $3,200

Payouts

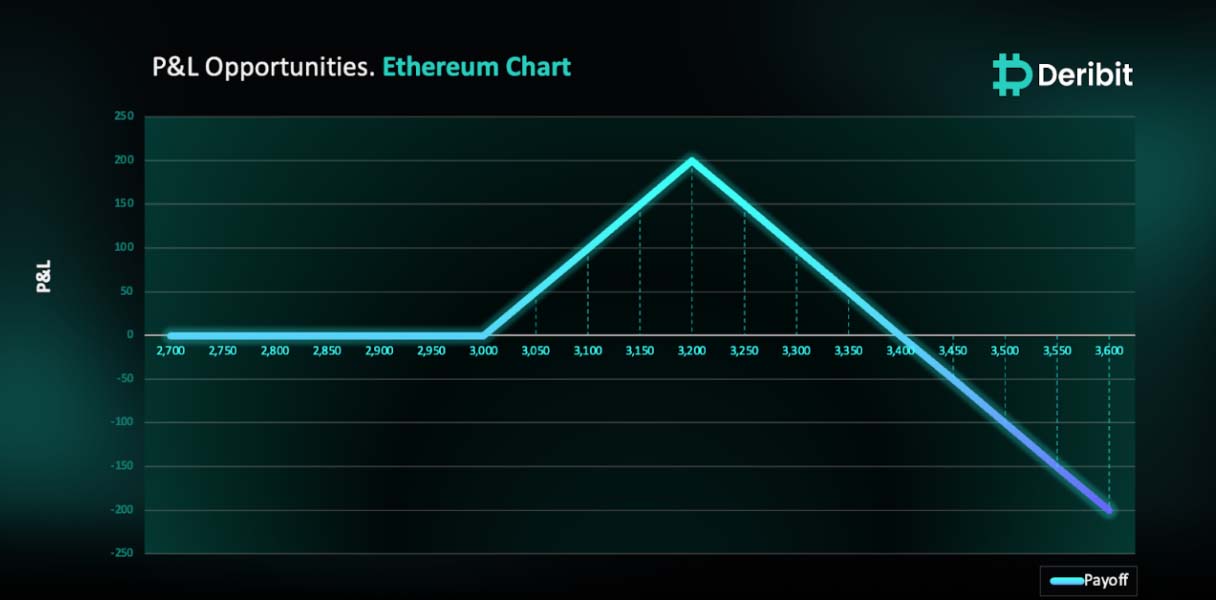

Maximum Profit: $199.5/ETH

Net Debit of Strategy: $0.5/ETH

Why are we taking this trade?

As highlighted in the July 23rd insight, the performance of crypto products following their listings often shows a distinct pattern. Historically, the introduction of regulated exchange products has frequently been followed by market corrections. We observed this trend with the launch of CME Bitcoin Futures in December 2017, the Coinbase IPO in April 2021, the Bitcoin futures-based ETFs in October 2021, and the spot Bitcoin ETFs in January 2024.

A similar behavior occurred after the approval of the ETH ETF, where the price dropped to a low of approximately $2,150 – a correction of around 39% from the listing date.

However, the price reached a higher time frame demand zone at ~$2,150, as indicated in the attached chart. After this decline, some retracements and price bounces were observed. Currently, ETH is trading sideways after hitting the flip zone, which previously acted as a support area but has since turned into a resistance zone following its break.

After nearly a week, ETH hasn’t shown significant retracements from this flip zone/level, suggesting that there may be a chance for the price to attempt a higher move and breach this flip zone. However, there is a supply zone around $3,200, as marked on the higher time frame chart, which could pose a challenge for ETH in its upward movement.

When comparing ETH to BTC on a weekly basis, Ethereum has outperformed in terms of market cap, as illustrated in the chart below.

Therefore, traders might consider deploying a Call Ratio strategy in ETH for 30th August expiry based on the above rationale.

To implement this strategy, traders can buy a Call option (e.g., $3,000) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $3,200).

If the price of ETH is at $3,200 when the options expire on August 30th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy is at a debit of $0.5, significant losses are possible due to the position’s net short Call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)