View on market

I’ve been optimistic about ETH, and the recent approval of spot ETH ETFs has created a bullish market environment, with Ether’s market share and price performance rising significantly, making a Bull Call Spread strategy in ETH a viable trading approach.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying stock and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying stock rises in price.

You may consider taking this trade if your perspective on ETH is bullish.

Trade Structure

(OTM Call) Buy 1x ETH-7JUN24-$4,100-C @ $53

(OTM Call) Sell 1x ETH-7JUN24-$4,300-C @ $25

Target: Spot level > $4300

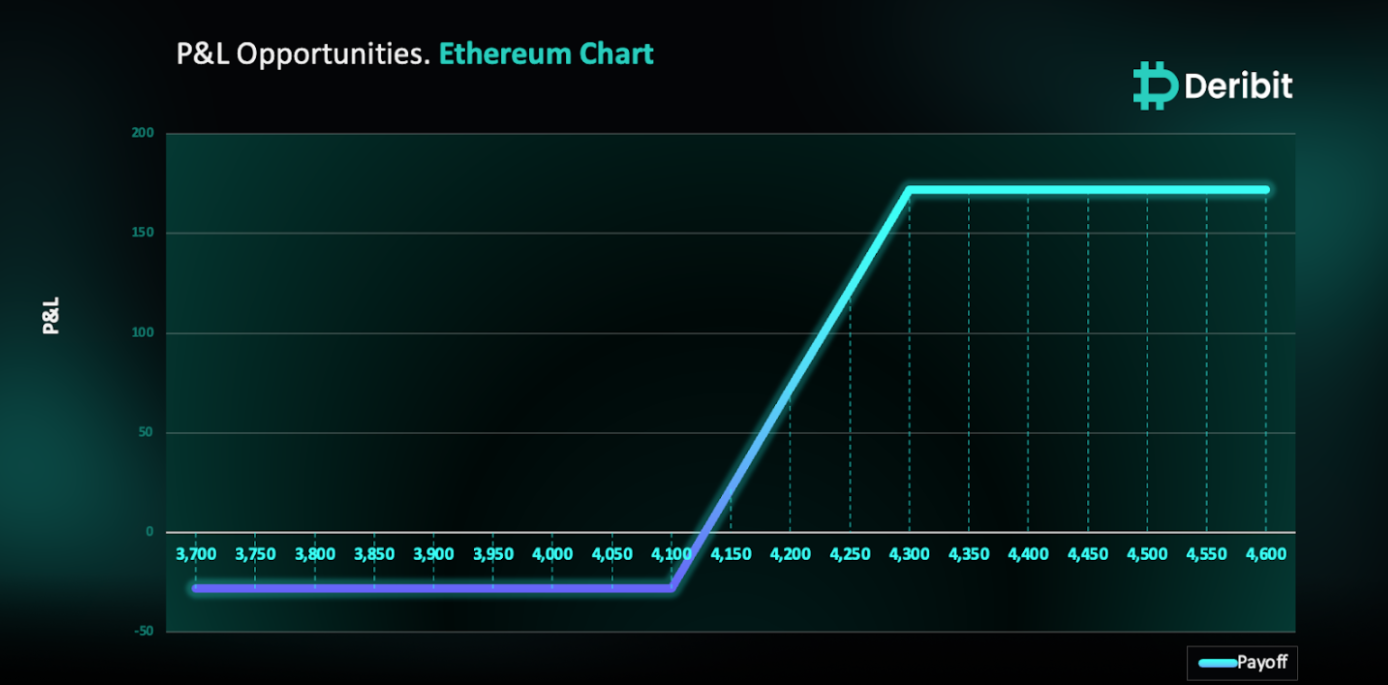

Payouts

Maximum Profit: $172/ETH

Net Debit of Strategy: $28/ETH

Why are we taking this trade?

In my recent analysis, I’ve been optimistic about Ethereum (ETH). With the approval of spot ETH ETFs, the market sentiment has turned bullish across the board, and it is quite visible in the OI Data as well. Ether’s spot trading market share has been increasing following the ETF approval. The BTC/ETH ratio, which measures Bitcoin’s performance relative to Ether, has dropped to 17.5, indicating ETH is outperforming BTC. Additionally, significant transfer of BTC was observed from a Mt. Gox cold wallet.

Many believe it’s Ethereum’s time to shine, especially with growing political support for cryptocurrencies in the U.S. and the strong demand expected for the Ether spot exchange-traded fund (ETF) once it begins trading, which will likely attract fresh capital into the crypto market. Analyzing Ether’s price chart reveals that it is holding steady near the $4,000 mark, with no significant retracements even at these higher price levels.

Traders looking to capitalize on this bullish outlook for ETH, might consider deploying a Call Spread strategy.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $4,100) and simultaneously sell a Call option at a higher strike price (e.g., $4,300).

If ETH reaches $4,300 when the options expire on June 7th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $28.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)