View on market

As anticipated in my latest analysis, BTC has reached a crucial support zone around $62,000 after a bearish market, with potential bounces and high implied volatility in the $60,000 strike for the 28 June options expiry, traders might consider a Bull Put Spread strategy to capitalize on the anticipated price action.

Bull Put Spread

The proposed strategy is a Bull Put Spread and it consists of one short Put with a higher strike price and one long Put with a lower strike price. Both Puts have the same underlying and the same expiration date.

You may take this trade if you believe BTC can take a pause at current levels.

Trade Structure

(OTM Put) Sell 1x BTC-28JUN24-$60,000-P @ $870

(OTM Put) Buy 1x BTC-28JUN24-$58,000-P @ $377

Target: Spot level > $60,000

Payouts

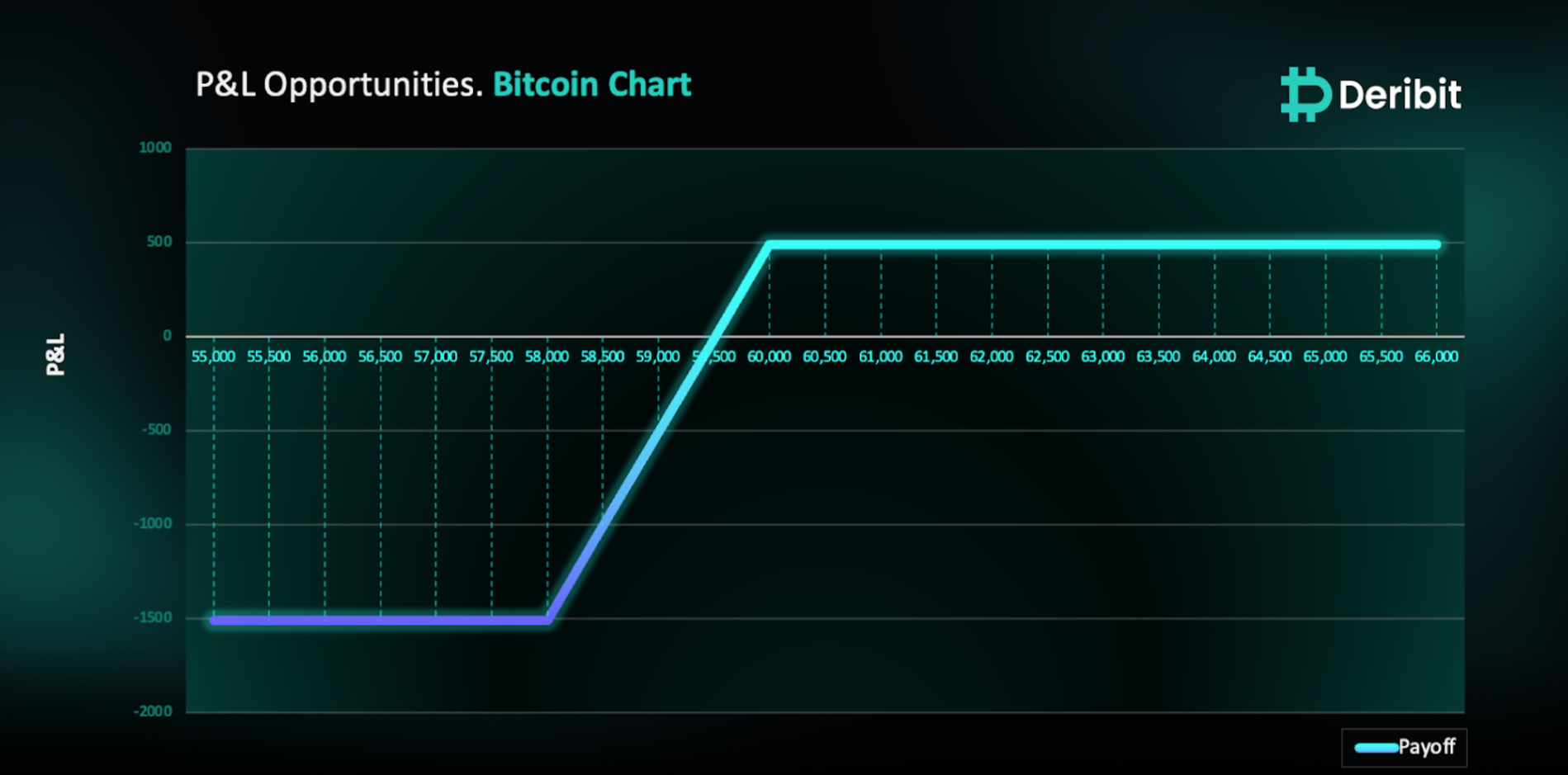

Maximum Profit: $493/BTC

Why are we taking this trade?

In my latest analysis, I discussed the bearish market structure and recommended the Put Butterfly strategy. Traders who followed the trade setup, must have seen positive results. After the recent decline, BTC has reached lower time frame support areas, leading to some expected bounces. I foresee potentially choppy days ahead if there isn’t a sharp move from these support areas. Notably, there’s high implied volatility observed in the $60,000 strike for the 28 June BTC options expiry. (Source – BTC Options Chain)

As shown in the attached 4-hour BTC price chart, BTC has established demand zones/support at $60,000. This support level formed after breaking through a key resistance level, making it a crucial area to watch. Traders might consider implementing a Bull Put Spread strategy to take advantage of this anticipated trend.

To implement this strategy, traders can sell a higher strike Put option (e.g., $60,000) and simultaneously buy a Put of a lower strike price (e.g., $58,000).

If Bitcoin is at or above $60,000 when the options expire on June 28th, traders will be at maximum profit from the strategy.

In case of market downturn, the maximum loss is limited to $1,507, Maximum loss of Bull Put Spread = Difference between strike prices of puts ($60,000 – $58,000) – Net Credit ($493).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)