View on market

I anticipate that BTC may experience more Bearish days as DTCC’s 100% haircut can aid-in more weakness to the diminished flows of ETFs, Lower Highs formations on BTC chart. Considering a put butterfly strategy in BTC for bearish positioning could be a suitable approach to consider.

Put Butterfly Spread

The proposed strategy is a Put Butterfly Strategy. A Long Butterfly Spread with Puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. All puts have the same expiration date, and the strike prices are equidistant.

If you see further weakness in BTC prices,, it might be worth considering execution of the below strategy.

Trade Structure

(OTM Put) Buy 1x BTC-3MAY24-$56,000-P @ $146

(OTM Put) Sell 2x BTC-3MAY24-$54,000-P @ $90

(OTM Put) Buy 1x BTC-3MAY24-$52,000-P @ $64

Target: Spot level > $54,000

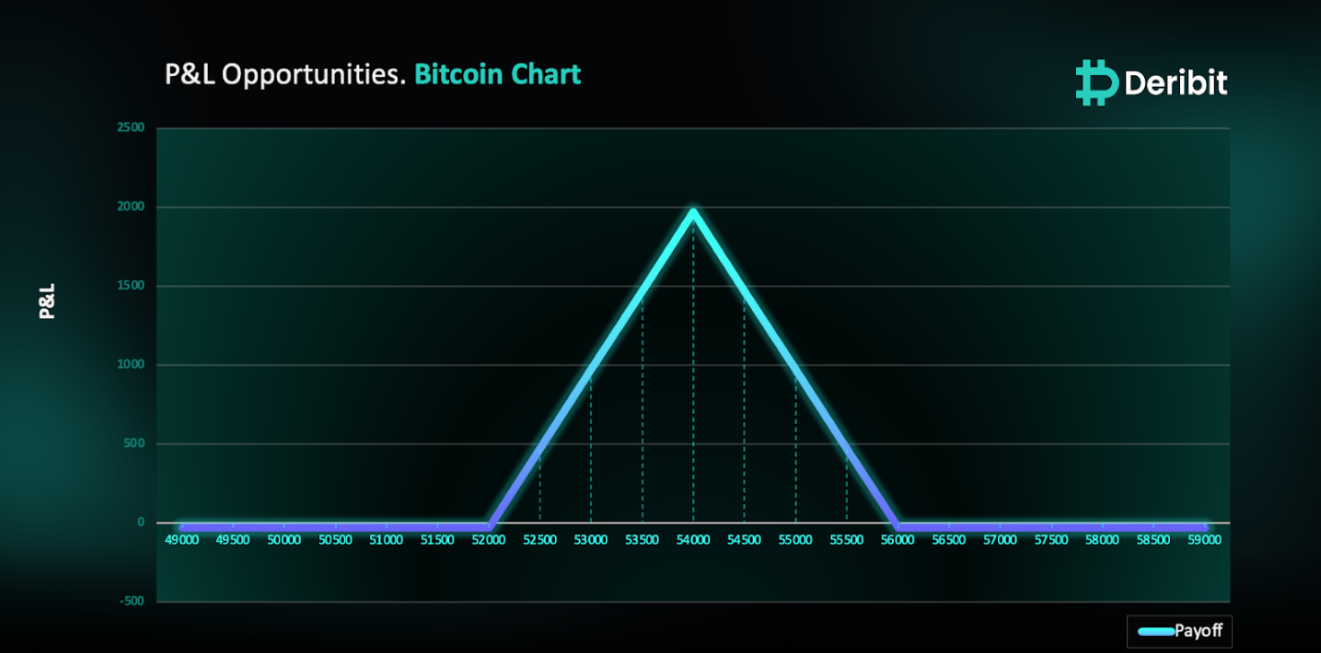

Payouts

Maximum Profit: $1,970/BTC

Debit of Strategy: $30/BTC

Why are we taking this trade?

Based on our latest insights, BTC is demonstrating ongoing indications of weakness, which is also confirmed by Bitcoin’s price action by the formation of lower highs, as highlighted in the attached BTC 4-hour price chart. The macroeconomic environment has emerged as a significant obstacle, with Bitcoin ETF inflows dwindling, signaling a waning interest from investors, particularly as BTC prices decline. This reluctance to buy into the market downturn suggests investor hesitation to buy the Dips. The Deposit Trust Company (DTCC) has further sparked concerns to the BTC ETF Inflows by implementing a 100% haircut effective April 30th, which means that no collateral value will be assigned to an ETF containing Bitcoin or any other cryptocurrency as an underlying asset. This development could potentially exacerbate market weakness. Therefore, traders may consider employing a put butterfly strategy in BTC to align with bearish sentiments.

To execute this approach, traders can purchase a put option with a higher strike price (e.g., $56,000) while simultaneously selling double the quantity of puts at a lower strike price (e.g., $54,000) and buying a put at an even lower strike price (e.g., $52,000).

If Bitcoin is at $54,000 when the options expire on May 3rd, traders will be at maximum profit from the strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $30.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)