View on market

Bitcoin is expected to continue bullish momentum, driven by strong ETF flows and significant Institutional investments. Technical analysis indicates strong support at $65,500, suggesting further price advances; a Call Butterfly Strategy could be a viable trading approach.

Call Butterfly Spread

The proposed strategy is a Call Butterfly Strategy. A Butterfly Spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price.

You can consider executing this strategy if you are eyeing upward movement in BTC prices.

Trade Structure

(OTM Call) Buy 1x BTC-24MAY24-$70,000-C @ $460

(OTM Call) Sell 2x BTC-24MAY24-$72,000-C @ $235

(OTM Call) Buy 1x BTC-24MAY24-$74,000-C @ $105

Target: Spot level < $72,000

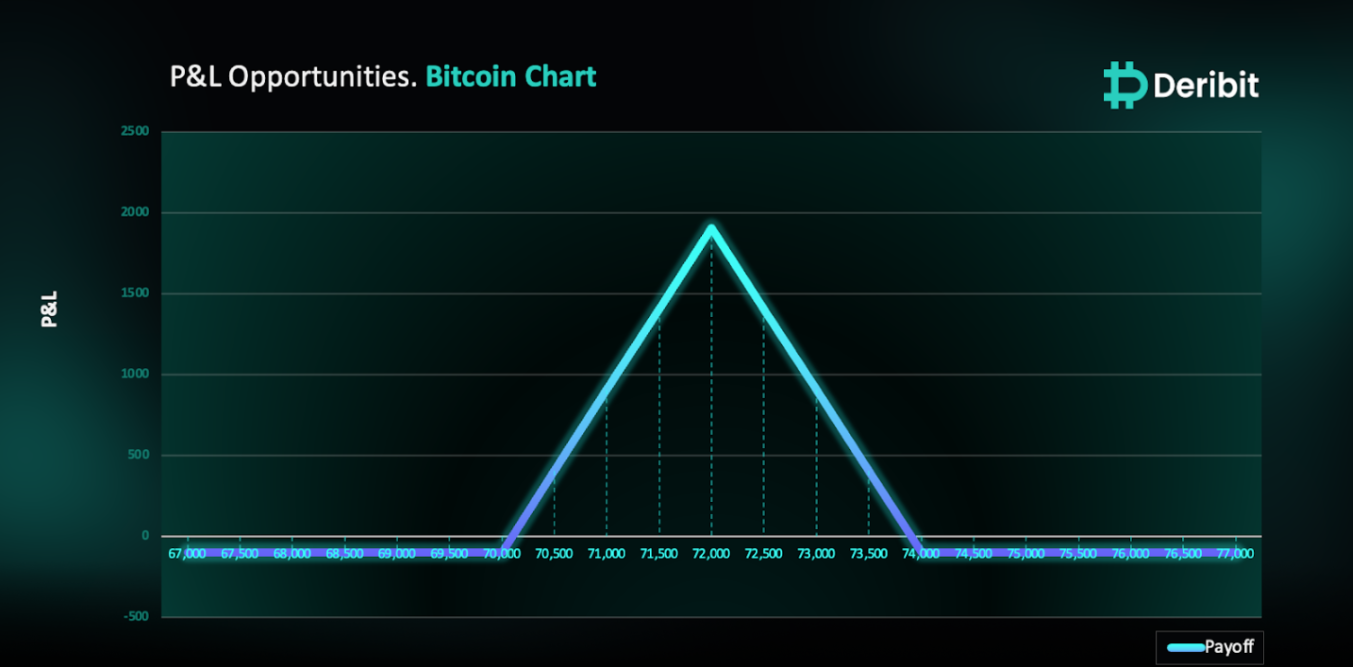

Payouts

Maximum Profit: $1905/BTC

Debit of Strategy: $95/BTC

Why are we taking this trade?

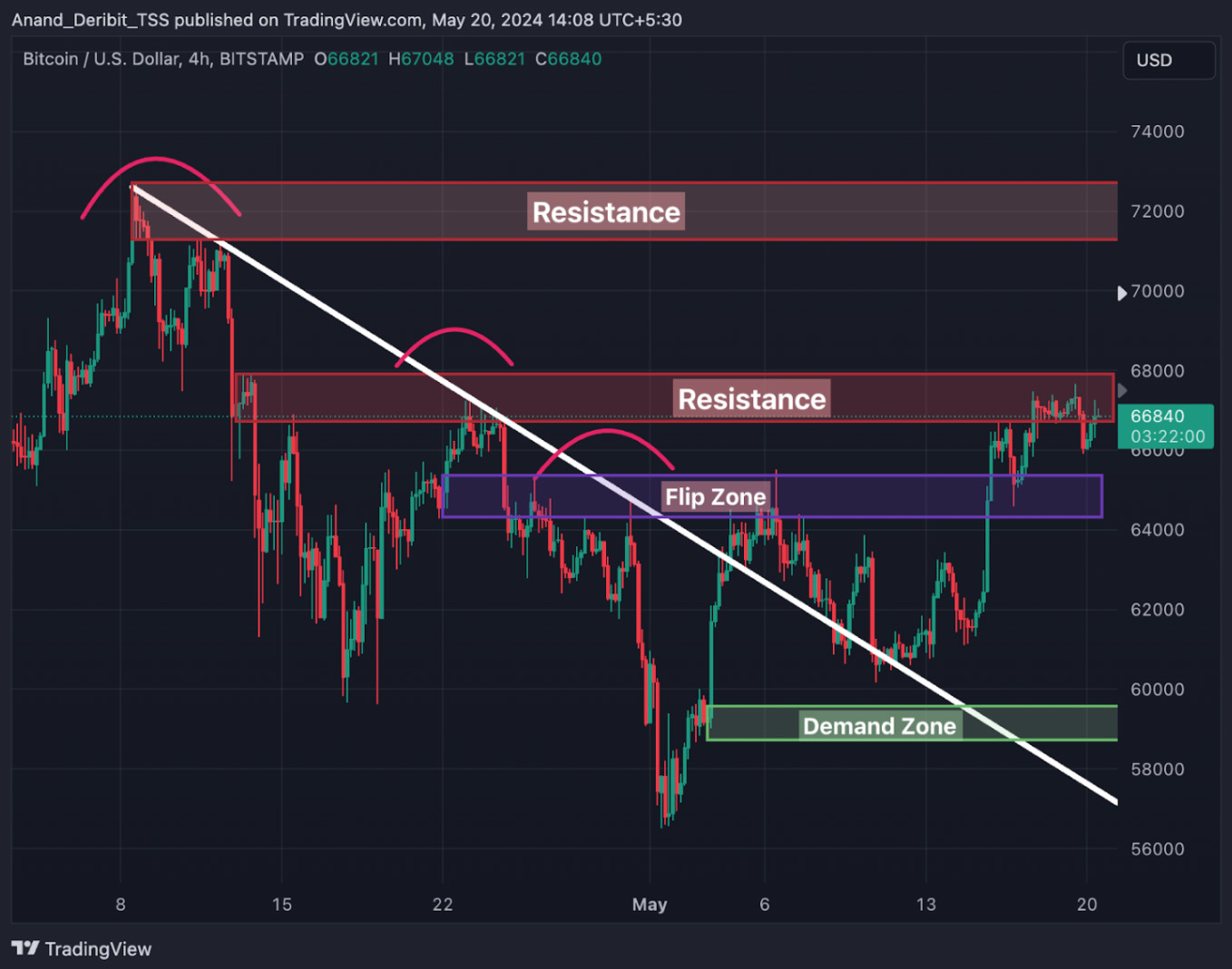

I expect Bitcoin to maintain an upward trend, supported by the resurgence of Bitcoin ETF flows. Over the past week, all days saw positive net flows into US Bitcoin ETFs (Source: Farside Investors), leading to a strong rebound in Bitcoin’s price to $67,500. Major financial players disclosed their stakes in the spot bitcoin funds, which turned out to be greater than some expected during the Wall Street’s first quarter 13F reporting session. As mentioned in previous insights, the flip zone at $65,500 has been surpassed, and this breakout has established it as a major support level. The attached 4-hour price chart shows Bitcoin finding solid support at these levels.

Additionally, my technical analysis indicates the continuation of this rally. Higher Lows have appeared on the BTC price chart, and despite trading in the resistance zone at $67,000 for some time, we haven’t seen significant rejections. This suggests that the sell orders in this zone have been absorbed or were insufficient to counter the bullish momentum.

Considering these technical indicators, it’s reasonable to anticipate Bitcoin advancing further from current levels. Traders looking to capitalize on this outlook might consider deploying a Call Butterfly strategy.

To execute this approach, traders can purchase a call option with a higher strike price (e.g., $70,000) while simultaneously selling double the quantity of calls at a higher strike price (e.g., $72,000) and buying a call at an even higher strike price (e.g., $74,000).

If the Bitcoin price is at $72,000 when the options expire on May 24th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $95.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)