View on market

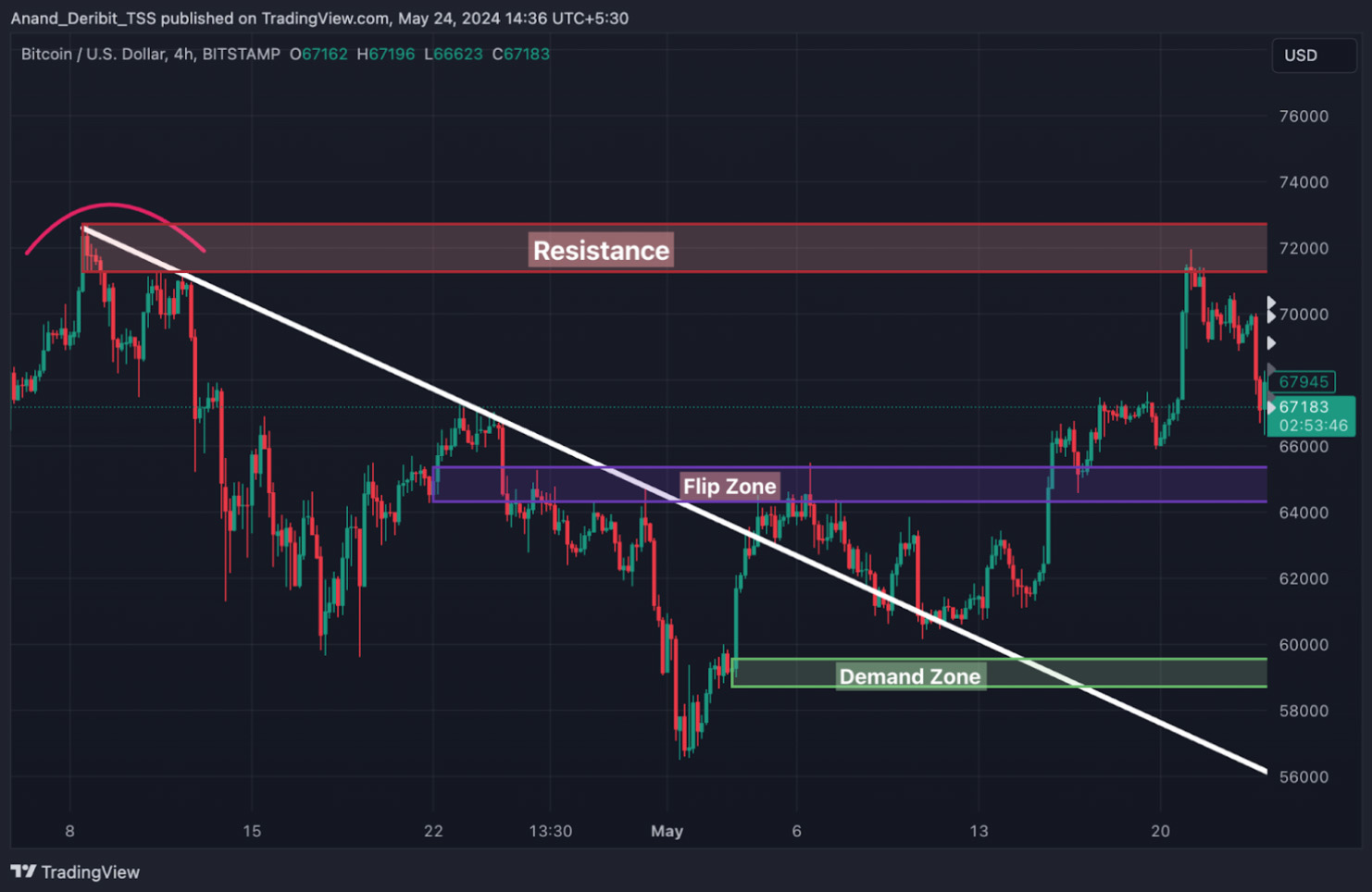

I anticipated the approval of the Spot Ether ETF, which has now been confirmed, creating a bullish sentiment in the crypto space. With Ethereum ETFs approved and Spot Bitcoin ETFs seeing significant inflows, traders might consider a Bull Put Spread strategy to capitalize on the trend.

Bull Put Spread

The proposed strategy is a Bull Put Spread and it consists of one short put with a higher strike price and one long put with a lower strike price. Both puts have the same underlying and the same expiration date.

You may take this trade if you believe BTC will continue the upside momentum.

Trade Structure

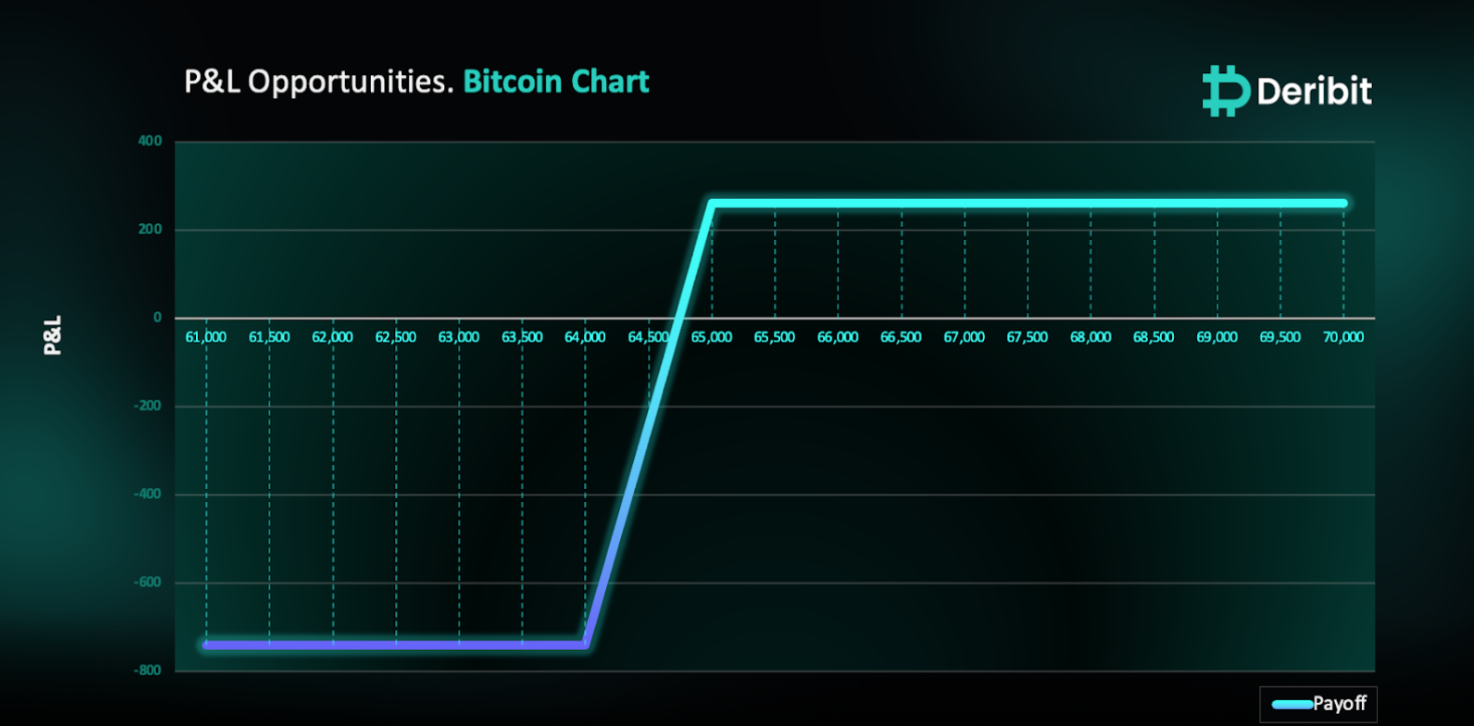

(OTM Put) Sell 1x BTC-31MAY24-$65,000-P @ $751

(OTM Put) Buy 1x BTC-31MAY24-$64,000-P @ $490

Target: Spot level > $65,000

Payouts

Maximum Profit: $261/BTC

Why are we taking this trade?

In my Wednesday and Thursday Insights, I anticipated the approval of the Spot Ether ETF based on five key indicators that suggested this milestone was imminent. With the latest developments confirming the approval of Ethereum ETFs, the crypto space has become decidedly bullish. The industry is celebrating this ‘historic move,’ although it will take some time before these products are available for trading. This bullish sentiment is further evidenced by Spot Bitcoin ETFs recording net inflows for nine consecutive days. On Thursday alone, U.S. spot Bitcoin exchange-traded funds saw net inflows of $107.9 million. (Source: Farside Investors)

Given this optimistic environment, I expect the bullish trend to continue. Traders might consider implementing a bull put spread strategy to capitalize on this anticipated trend.

To implement this strategy, traders can sell a higher strike put option (e.g., $65,000) and simultaneously buy a put of a lower strike price (e.g., $64,000).

If Bitcoin is at or above $65,000 when the options expire on May 31, traders will be at maximum profit from the strategy.

In case of market downturn, the maximum loss is limited to $739, Maximum loss of Bull Put Spread = Difference between strike prices of puts ($65,000 – $64,000) – Net Credit ($261).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)