View on market

BTC’s weak structure broke the $62,000 support amid significant ETF outflows, signaling potential further downside towards the $56,000 level.

Bear Put Spread

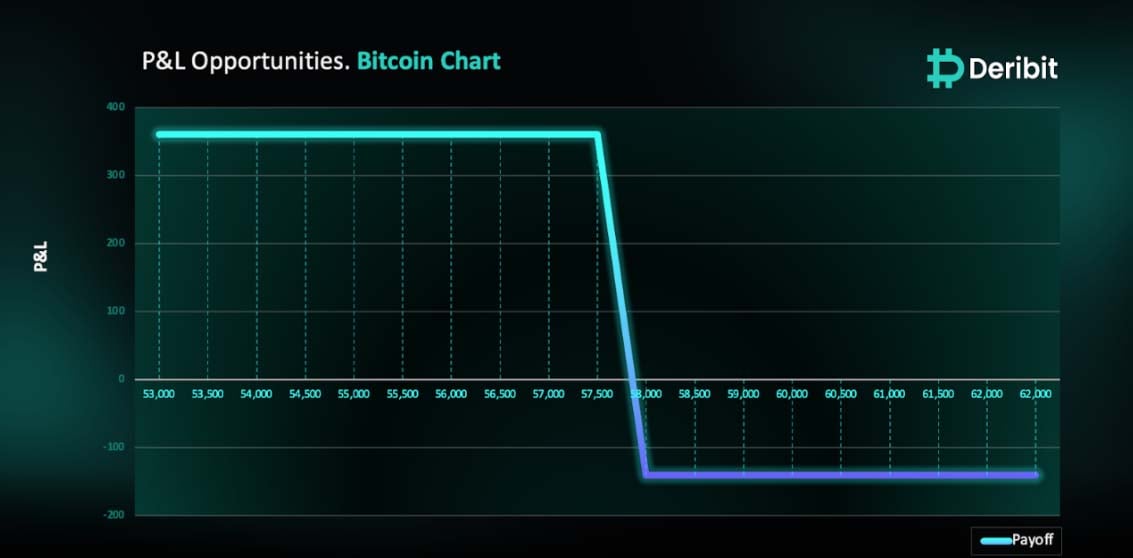

The proposed strategy is a Bear Put Spread. A Bear Put Spread is achieved by simultaneously buying a Put option and selling a Put option at a lower strike price but with the same expiration date.

You might consider initiating this trade if you feel BTC can fall further as the support area of $62,000 has been taken out in Tuesday’s sell off.

Trade Structure

(OTM Put) Buy 1x BTC-29AUG24-$58,000-P @ $450

(OTM Put) Sell 1x BTC-29AUG24-$57,500-P @ $310

Target: Spot level < $57,500

Payouts

Maximum Profit: $360/BTC

Debit of Strategy: $140/BTC

Why are we taking this trade?

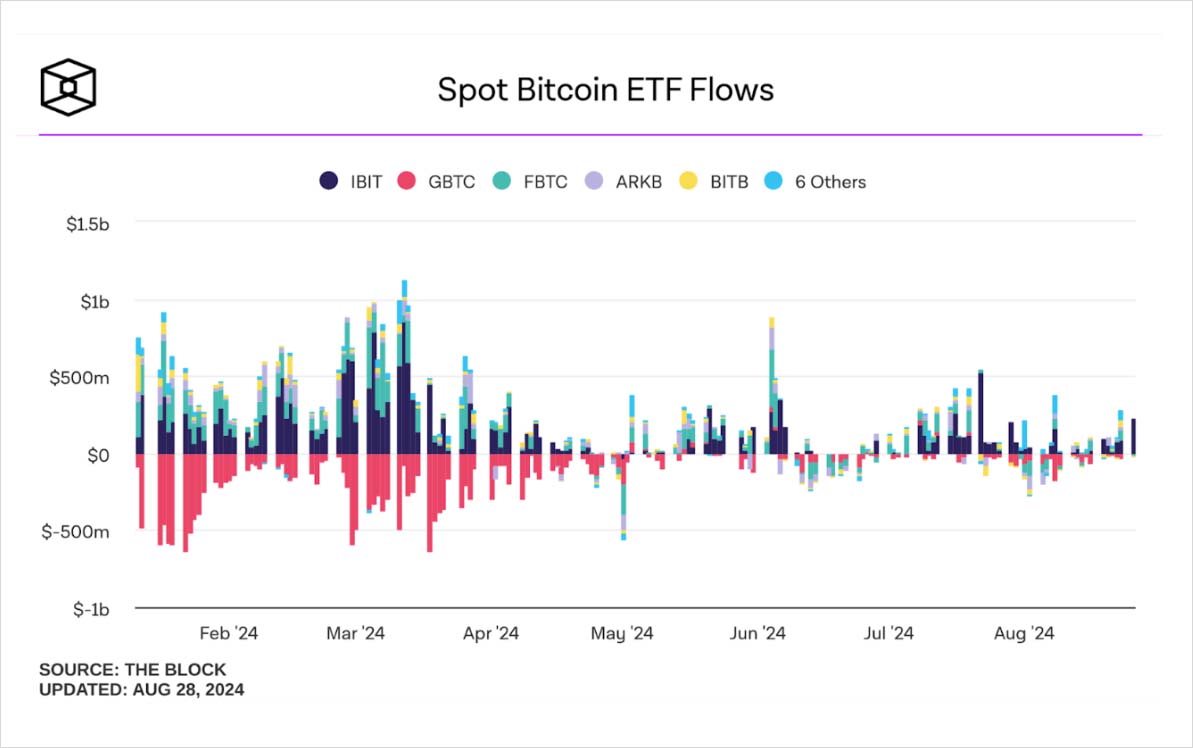

In my recent analysis, I anticipated a potential downside movement as the supply zone at $65,000 showed signs of a pullback. Although there was support around the 62,000 level, the market sell-off on Tuesday broke through this support, driving prices even lower. The next significant demand zone or support lies around the $56,000 level, where we might see some bounces. Additionally, BTC spot ETFs saw significant outflows, with 127.1 million recorded on Tuesday. (Source: Farside).

Given the weak market structure, especially after trading below the $62,000 support, I anticipate further downside for BTC.

Hence, traders might consider deploying a Bear Put Spread strategy to capitalize on the anticipated price movement.

To execute this strategy, traders can buy a Put option of a lower strike price, eg. $58,000 while simultaneously selling a Put option of an even lower strike price, like $57,500.

If BTC prices are at or below $57,500, when the options expire on August 29th, traders will achieve maximum profit from this strategy.

In case of market upturn, the maximum loss is limited to the initial debit of $140.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)