View on market

A bullish pattern of higher highs and lows has formed, but the price faced multiple minor rejections at the flip zone. With a supply zone and options data pointing to $2,900, the price may stay near this level approaching expiry.

Call Ratio Spread

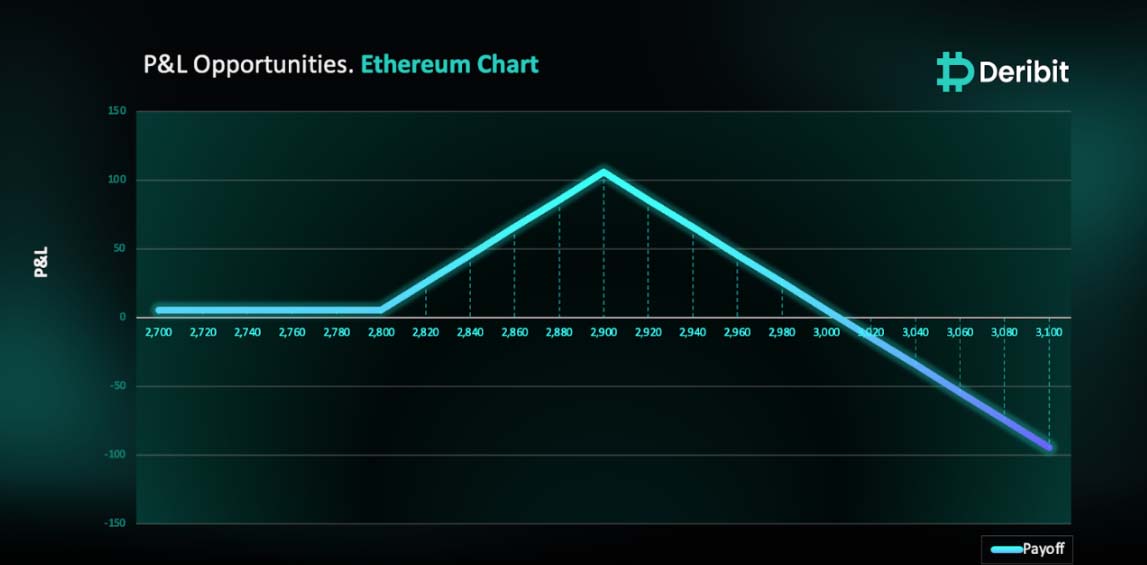

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are eyeing bullish days in ETH.

Trade Structure

(OTM Call) Buy 1x ETH-30AUG24-$2,800-C @ $31.25

(OTM Call) Sell 2x ETH-30AUG24-$2,900-C @ $18.5

Target: Spot level < $2,900

Payouts

Maximum Profit: $105.75/ETH

Credit of Strategy: $5.75/ETH

Why are we taking this trade?

As highlighted in yesterday’s insights, a pattern of higher highs (HH) and higher lows (HL) was formed, indicating a bullish trend. However, we observed rejections when the price hit the flip zone, a behavior seen in the past as well. The price was rejected seven times but did not show any significant retracement or decline – just minor rejections that prevented the price from moving higher. With multiple tests of the flip zone already, the price may attempt to break through it in the near future. Additionally, there’s a supply zone at $2,900, which could provide resistance to further price increases.

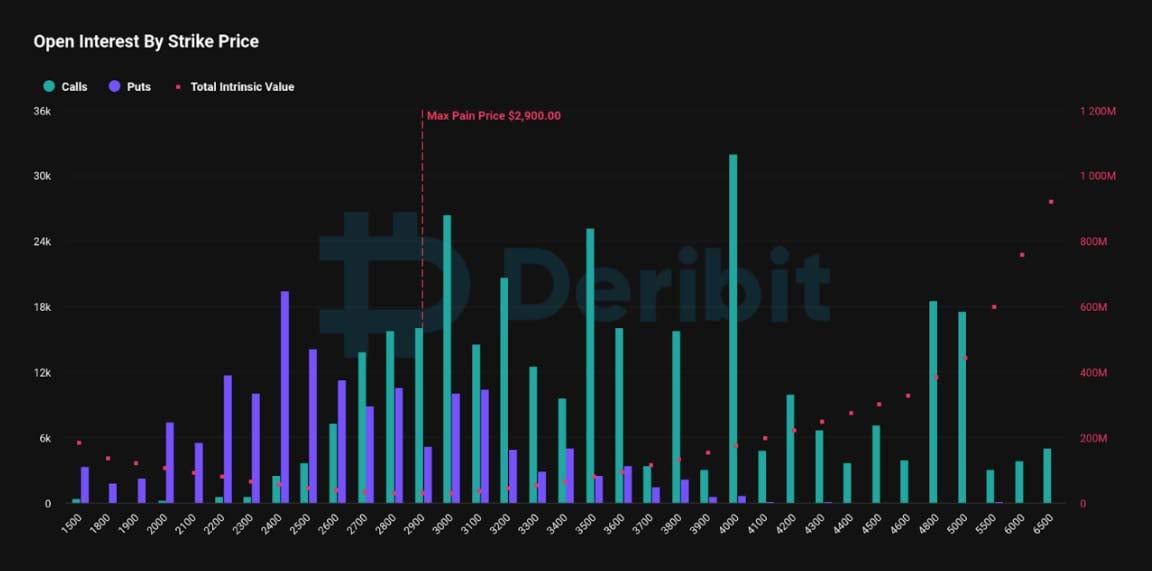

Adding to our analysis, the options data suggests that the maximum pain point for the 30th August expiry for ETH stands at $2,900, indicating that the price may remain close to this pivot during expiry. (Source: Deribit Options Metrics).

Therefore, traders might consider deploying a Call Ratio strategy in ETH for 30th August expiry based on the above rationale.

To implement this strategy, traders can buy a Call option (e.g., $2,800) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $2,900).

If the price of ETH is at $2,900 when the options expire on August 30th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy collects an initial credit of $5.75, significant losses are possible due to the position’s net short Call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)