View on market

SEC Chair Gary Gensler stated that the spot Ether ETF launch process is progressing smoothly, with potential approval imminent. Historical patterns suggest that Ethereum might reach $3700 with the news, but traders should be cautious of a possible “sell the news” scenario.

Call Ratio Spread

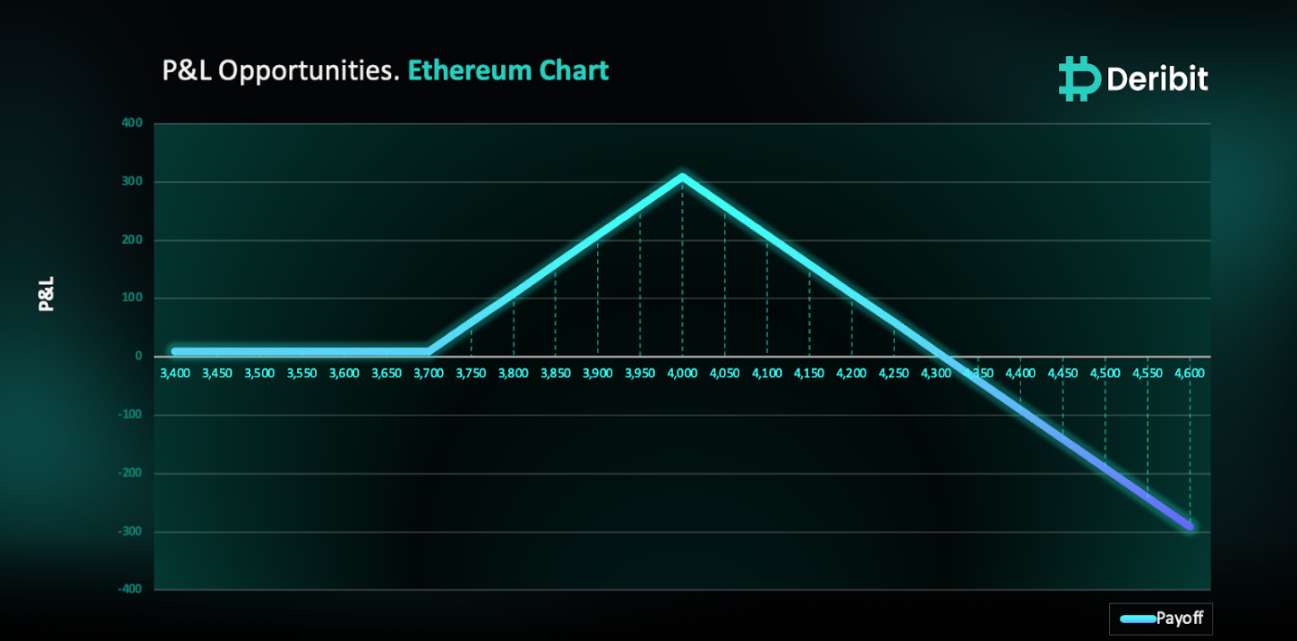

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are anticipating continued resistance at the $4,000 levels in ETH and particularly suited for those expecting limited upward movement on ETH ETF’s approval.

Trade Structure

(OTM Call) Buy 1x ETH-26JUL24-$3,700-C @ $113

(OTM Call) Sell 2x ETH-26JUL24-$4,000-C @ $61

Target: Spot level < $4,000

Payouts

Maximum Profit: $309/ETH

Net Credit of Strategy: $9/ETH

Why are we taking this trade?

The SEC’s Progress on Spot Ether ETFs

SEC Chair Gary Gensler recently stated that the launch process for spot ether ETFs is “going smoothly,” though he did not provide an exact timeframe. That same day, VanEck filed a Form 8-A for its Ethereum ETF, suggesting that the instrument could soon be traded on an exchange. The regulatory agency, SEC approved 19b-4 forms for eight Ethereum ETFs which is a preliminary approval for spot ether ETFs last month and is currently reviewing amended registration statements from issuers. The Firms are now awaiting their registration statements (S-1s) to become effective before trading can begin.

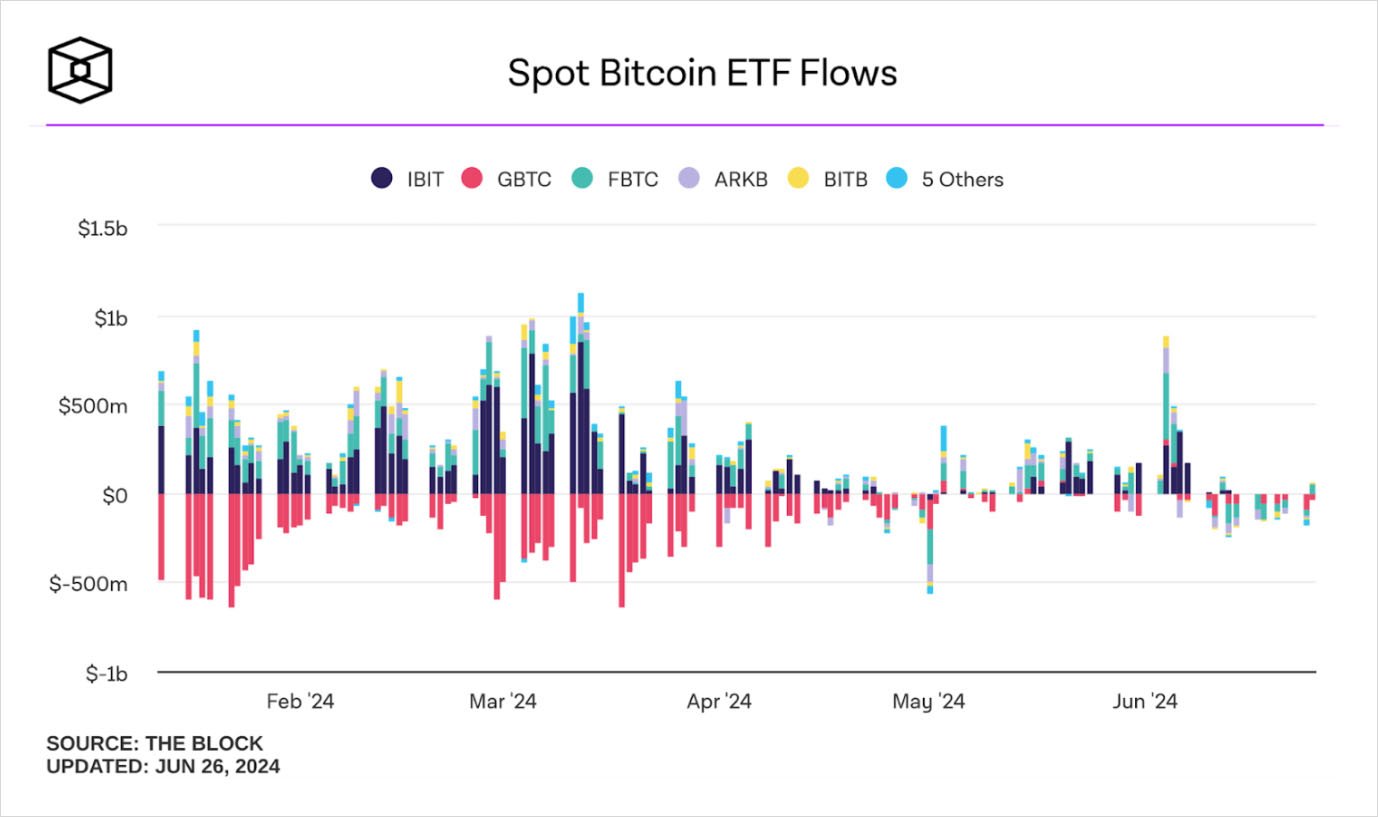

Meanwhile, U.S. spot bitcoin ETFs recorded their second consecutive day of net inflows on Wednesday, extending a positive streak. (Source: Farside Investors)

Asset managers like BlackRock, Fidelity, and Franklin Templeton, who launched spot bitcoin ETFs earlier this year, have also applied to issue spot ether ETFs.

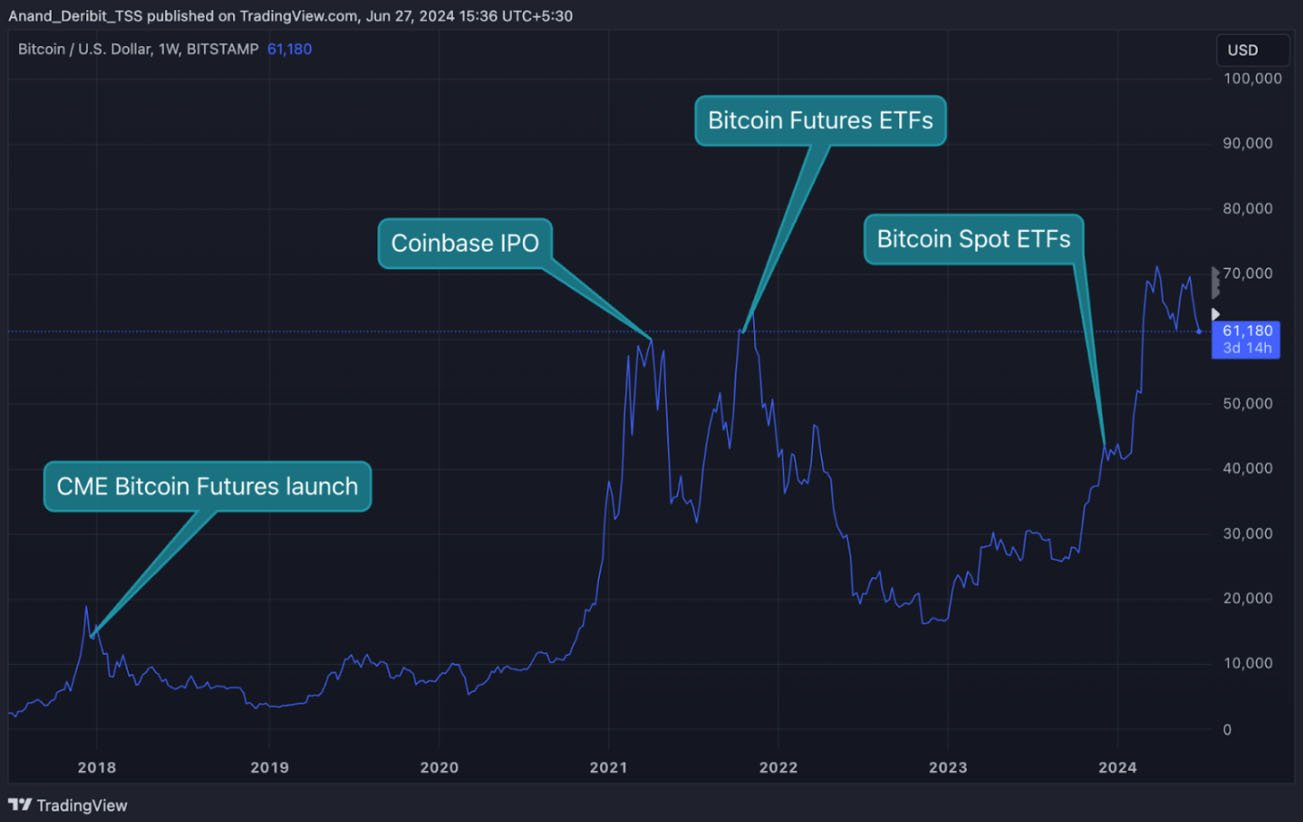

Historical Context and Market Reactions

Historically, the listing of regulated exchange products has been followed by Bitcoin corrections. This pattern was observed with the CME Bitcoin Futures launch in December 2017, the Coinbase IPO in April 2021, the Bitcoin ETFs based on Futures in October 2021, and the Bitcoin ETFs based on Spot in January 2024. Each correction occurred after a significant price run-up driven by anticipation of these launches.

The potential approval of Ethereum ETFs is a welcome development, and approval seems imminent. For instance, VanEck met with the SEC on Monday and filed Form 8-A shortly after, and the same atmosphere was observed precisely seven days before the Bitcoin Spot ETFs were approved.

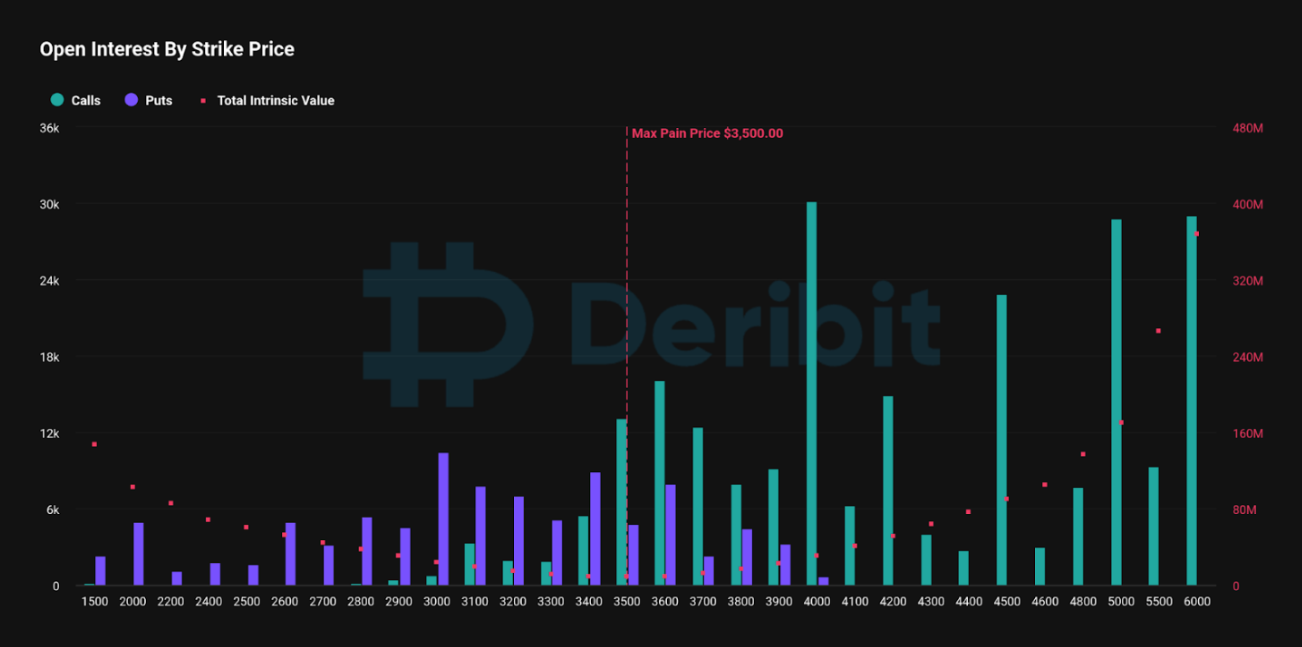

Technical Analysis of Ethereum

On the technical front, as illustrated in the attached chart of Ethereum, the $3,700 level is a crucial pivot. With the news of ETF approval, Ethereum’s price could aim to breach $3,700, and witness $4,000 mark but due to the high resistance at this pivot point, it could result in a “sell the news” scenario. Adding to our odds, upon looking at the Options Data, high OI is sitting at $4,000 strike of ETH options for 26th July. (Source: Deribit)

Therefore, traders can consider deploying a Call Ratio strategy to capitalize on the anticipated price movements.

To implement this strategy, traders can buy a higher strike Call option (e.g., $3,700) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $4,000).

If Ethereum prices are at $4,000 when the options expire on July 26th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy collects an initial credit of $9, significant losses are possible due to the position’s net short Call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)