In this lesson we will be focusing specifically on cryptocurrency call options. We’ll be looking at how they work, their payout structures, how to calculate their profit/loss and how to calculate their breakeven point.

Let’s have a brief recap of the 5 basic parameters that make up an option:

- Underlying asset – The underlying asset, the price of which is being speculated on, for example Bitcoin

- Option type – Call or put

- Expiry date – The date the option will expire and be exercised

- Strike price – The price at which the option buyer has the right to trade at on the expiry date

- Option price (aka option premium) – The price the buyer pays to the seller for the right to trade the asset at the strike price on the expiry date

A call option is the right to buy the underlying asset at the strike price on the expiry date.

All the options on Deribit are European style which means they are only exercised at expiry. However, this does not stop traders being able to buy and sell the option before expiry.

They are also cash settled which means when they are exercised, it is only the profits that are paid. For example if a Bitcoin call option with a strike price of $9,000 expires with the Bitcoin price at $10,000, then $1,000 would be paid from the seller to the buyer. On Deribit this $1,000 is paid in Bitcoin so this would be 0.1 BTC ($1000/$10,000).

Profit/loss for a Bitcoin call option

For a call option, if the price expires below the strike price, then the option expires out of the money and therefore worthless. The buyer’s only loss is the premium paid, and of course the buyer’s loss is the seller’s profit.

However, if the price expires above the strike price, this option is in the money and has some value. The seller is then required to pay to the buyer the difference between the expiry price and the strike price. As all balances on Deribit are cryptocurrency, the difference in dollars will of course be converted to BTC.

The buyer’s profit/loss in BTC is calculated as:

= ((BTC Price – Strike Price) / BTC Price) – Option Price

The seller’s profit/loss of course is the opposite, and can be calculated as:

= Option Price – ((BTC Price – Strike Price) / BTC Price)

Example

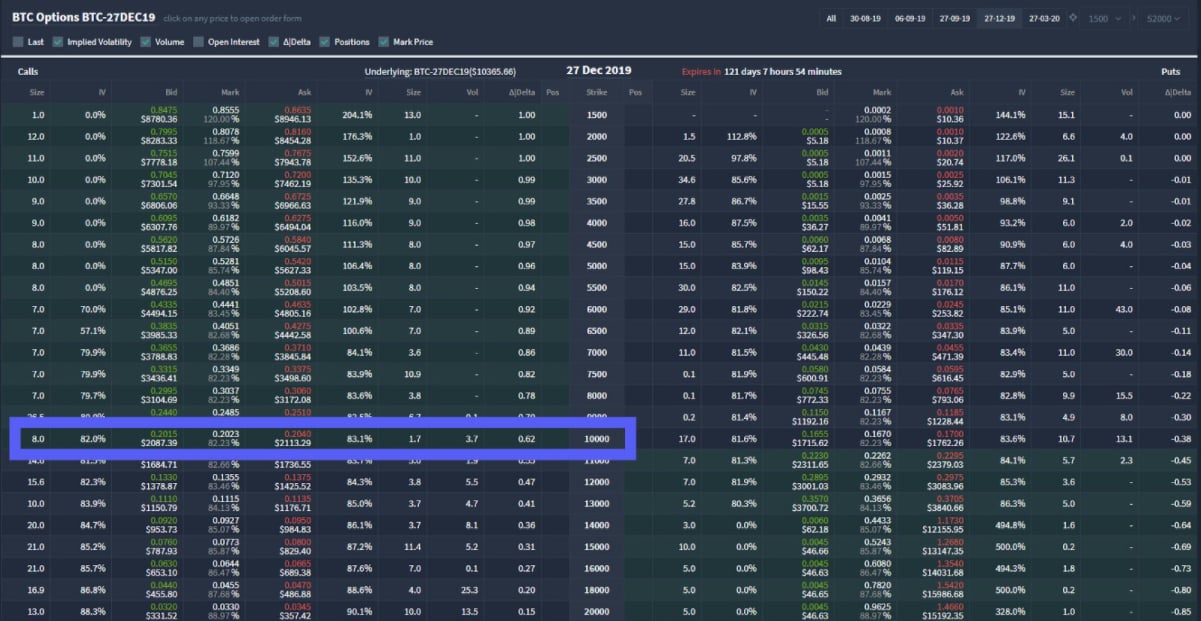

Taking a look at the Bitcoin option chain for the December 2019 expiry, we can see here the $10,000 call option.

Let’s work through using this option as an example to calculate and visualise the profit/loss and breakeven point. We will assume a quantity of 1 and use the current ask price of 0.204 BTC as displayed here.

So the buyer has paid 0.204 BTC to the seller for this option and held the option to expiry.

Scenario 1

At 0800 UTC on 27DEC19 the option expires and the settlement price is $8,000.

The settlement price of $8,000 is below the strike price of $10,000 so the option has expired out of the money and therefore worthless.

The buyer paid 0.204 BTC for this option and received nothing in return, so they have made a loss of 0.204 BTC.

The seller collected 0.204 BTC for the option and has not had to pay anything out, so they have made a profit of 0.204 BTC

Scenario 2

At 0800 UTC on 27DEC19 the option expires and the settlement price is $16,000.

The settlement price of $16,000 is above the strike price of $10,000 so the option has a value of $6,000 (16,000 – 10,000). This must be paid by the seller to the buyer.

The buyer’s total profit/loss can be calculated as follows:

= ((BTC Price – Strike Price) / BTC Price) – Option Price

= ((16000 – 10000) / 16000) – 0.204

= 0.375 – 0.204

= 0.171 BTC

The seller’s loss will of course just be the negative of this, but can be calculated as follows:

= Option Price – ((BTC Price – Strike Price) / BTC Price)

= 0.204 – ((16000 – 10000) / 16000)

= 0.204 – 0.375

= -0.171 BTC

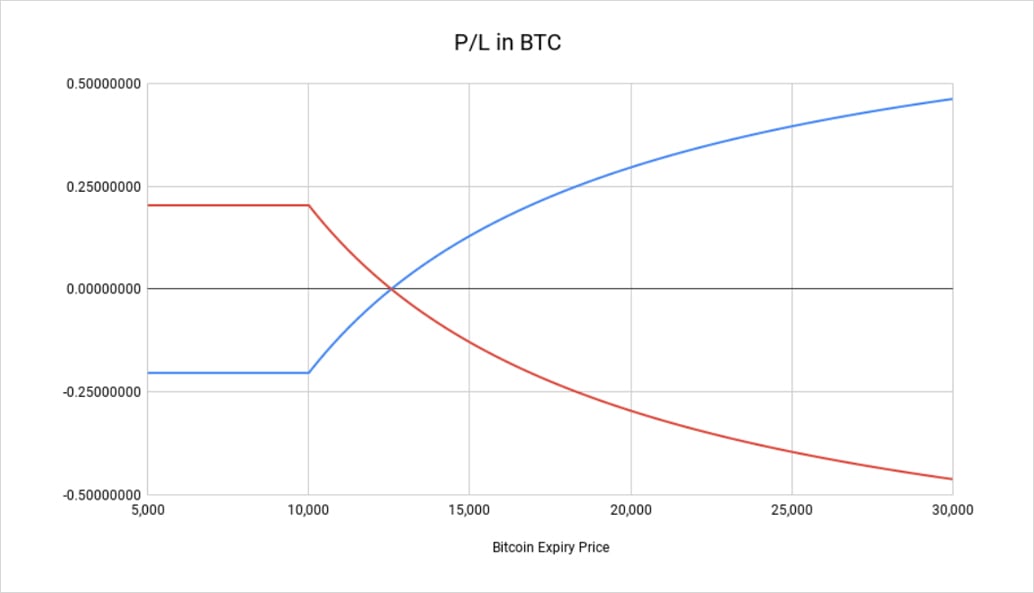

More generally we can plot the profit/loss of an option for both buyer and seller on a chart like so:

This chart shows the $10,000 call option we selected and used in the examples, with the expiry price along the x-axis, and the profit/loss in BTC on the y-axis. The buyer’s profit/loss is displayed in blue and the seller’s profit/loss is displayed in red.

As you would expect the inflection point is the strike price at $10,000. Below this point the profit/loss is fixed to the premium paid of 0.204 BTC. This is one of the most appealing features of being long a call option. No matter how low the price falls, the buyer can never lose more than they paid for the option. They still have long exposure similar to being long a futures contract for example, but with a fixed risk. It’s not all good news for the buyer though.

Breakeven point of cryptocurrency call options

Notice where the profit/loss lines cross the x-axis. This is the breakeven point. Notice how even though the call option has a strike price of $10,000, the breakeven point is considerably higher than this. This means the price needs to move quite far in the right direction before the position is profitable at expiry. The higher the price paid for the option, the further away from the strike price the breakeven price will be.

The call option is at breakeven when:

((BTC Price – Strike Price) / BTC Price) – Option Price = 0

So rearranging this formula to solve for BTC Price gives us:

Call Breakeven BTC Price = Strike Price / (1 – Option Price)

Breakeven Example 1

Taking the previous example where the option price was 0.204 BTC and the strike price was $10,000, we can calculate the breakeven price precisely as follows:

Breakeven Price

= 10000 / (1 – 0.204)

= 10000 / 0.796

= $12,562.81 (rounded to the nearest penny)

Breakeven Example 2

Taken from the same screenshot as the first example, let’s calculate the breakeven price of the $20,000 call assuming a price of 0.0345 BTC.

Breakeven Price

= 20000 / (1 – 0.0345)

= 20000 / 0.9655

= $20,714.66 (rounded to the nearest penny)

Maximum profit/loss

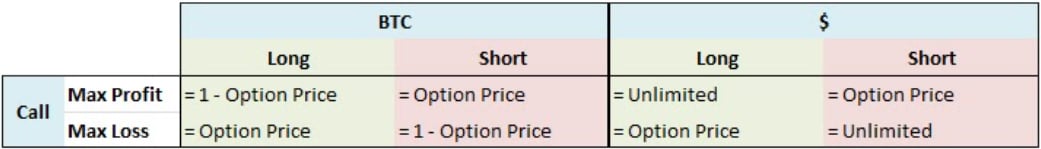

The buyer’s maximum loss is always limited to the option price paid. This also means the seller’s maximum profit is also limited to the option price collected.

Maximum profit for the call buyer when measured in USD is unlimited, but when measured in BTC is capped at 1 – Option Price. As the underlying Bitcoin price continues to rise, the amount of BTC required to pay each dollar owed decreases.

Here you can see a comparison of the maximum profit/loss for the call option buyer (long) and call option seller (short), measured in both BTC and USD.

Pros and cons of call options

A trader may wish to buy a call option instead of long a futures contract if they believe the price is going to move higher, but they wish to have a fixed risk. It is possible of course to use a stop loss when long a futures contract to limit your risk, however a call option has one very big advantage in comparison.

The call option can not be stopped out or liquidated. If the price spikes down even temporarily the trader who is long the futures contract may be stopped out, unable to benefit from subsequent price increases. The trader who is long the call option though will still be in the trade, and so still able to benefit it the price then rallies.

Stop losses also have the added risk of slippage, where due to the violent nature of the price movement and thin orderbooks the stop loss order executes at a worse price then desired, leading to a larger than expected loss. Long options positions do not have this problem as the maximum loss is limited to the premium paid and can never go higher.

Of course there is also a downside to buying call options. Firstly, a premium must be paid. As shown earlier this means the breakeven price is higher than the strike price, sometimes considerably so. How far away this is depends on the amount paid for the option.

Secondly, the option has a time limit. The expiry date of the option means the clock is ticking as soon as the option is purchased. If the underlying price fails to move sufficiently by the expiry date, the trade is over and will finish as a loser. So the call option buyer must not only be correct about the direction, but also the timing.

This brings us nicely onto why a trader would choose to sell a call option. The call option seller benefits not only when the underlying price falls, but also when it fails to rise fast enough before the expiry date. If price expires below the strike price, the seller gets to keep the entire premium collected. Even if the price rises though, they can still make some profit as long as it doesn’t rise past the breakeven point.

The downside for the seller being that they do not get the benefit of having a fixed risk. If the underlying price keeps rising well past the strike price, their losses will also continue to rise.

Summary

- A call option gives the buyer a way to have long exposure to the price of an asset with a fixed risk.

- The cost for this fixed risk position is the premium the buyer pays to the seller.

- The buyer must also be correct about the timing of the rise in price.

- The breakeven price for a call option will always be above the strike price. How far above depends on the price paid for the option.

AUTHOR(S)