If you are trading on a spot exchange and wish to end your exposure to the BTC price and maintain the dollar value of your account, you will simply sell BTC for USD.

On Deribit no USD are deposited or traded, and all balances are in cryptocurrencies. However, you can still achieve the same result by using the available derivative. You might have heard of this as “Shorting 1x”, “Hedging USD value” or “Going into Synthetic USD”.

The perpetual swaps, futures, and options can all be used to achieve this same result, so let’s take a look at exactly how this is done and what are the reasons for choosing each.

Shorting the Perpetual Swap 1x

This might be considered to be the simplest option, as the perpetual swap is designed to closely track the price of the underlying asset.

Example:

You have 1 BTC balance in your Deribit account, and the current price of BTC is $10,000. If you enter a short position of $10,000 (1x your account balance), your account will maintain its USD value of $10,000 no matter which way the price moves.

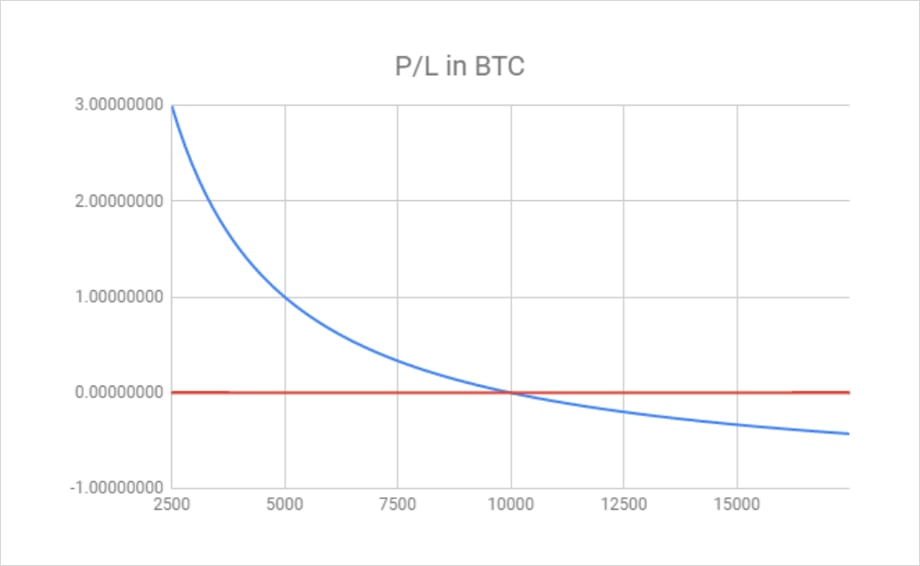

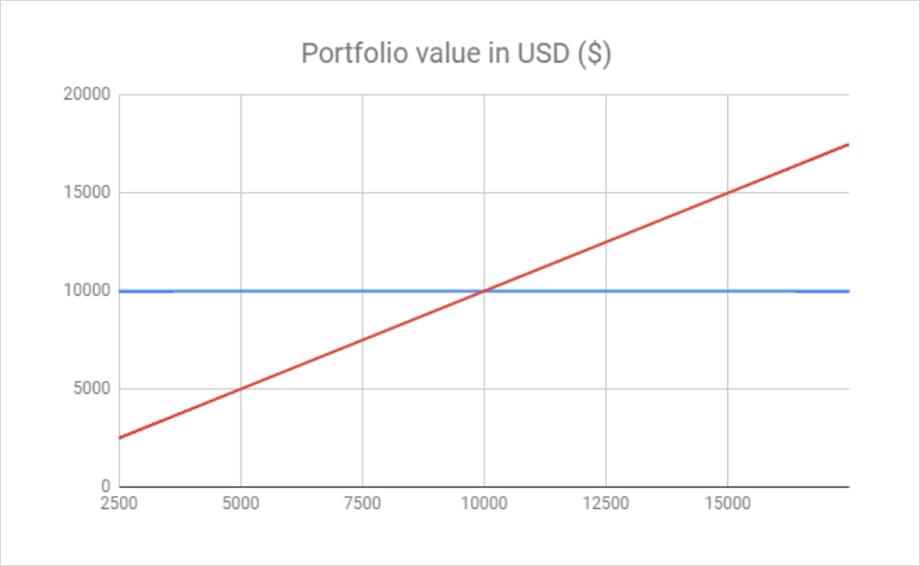

The following two charts show the profit and loss curve for the short hedge position described above (in BTC) and the total value of your account in USD. In blue you can see the short position, and in red what would happen if you simply held the 1 BTC you started with.

Without the short position (in red) you will not gain or lose any BTC, however, your account value measured in USD will change based on BTC price.

With the short position (in blue) the amount of bitcoin you have will fluctuate based on BTC price, however, the USD value of your account will remain constant at $10,000 no matter what the BTC price is. The short position completely hedges the USD value.

Shorting of perpetual also has its drawbacks. As these contracts are perpetual (i.e. they do not have an expiry date), they have a funding mechanism. The funding mechanism keeps the contract price in line with the index via small payments paid from one side of the trade to the other, whenever the price deviates too far from the index. While this mechanism is very useful for pricing, it adds an unknown variable to your short position. You could receive funding and make a little extra, or you could have to pay funding, thus slightly decreasing your USD value.

As you are not using high leverage, the impact should be quite small, particularly over short time frames. However, it is worth keeping this in mind, if you are planning to hold this hedge position for extended periods.

Shorting futures 1x

If you wish to avoid the funding issue, you may consider using futures instead. As with the perpetual swap, you simply open a short position equal to the value of your account balance.

Unlike the perpetual contracts, futures do not have funding to worry about. However, futures are more likely to be trading at a price further away from the index price.

If they are trading above the index price, you can capture extra premium, as you will be shorting from a price higher than the index.

If they are trading at a discount though, this means you are shorting from a lower price than the index, which will cost you the difference, if held to expiry.

Synthetic short using options

The option route is a little less obvious, particularly to those who mainly trade futures, however, it is possible to set up a position that imitates a futures short using only options. For you to do this, you have to sell an at the money call option, and buy at the money put option.

As with the futures and perpetuals, the position size has to be equal to your account balance.

Occasionally, when prices are skewed, (specifically when calls are more expensive than puts) this position can be established for a net credit, which will net a little profit as well as provide the desired hedge.

In most situations, though this will not be the most cost or time effective choice. Options often have wider spreads than futures, therefore filling both legs at a favorable price may be difficult and time-consuming in comparison to the other choice. Additionally, if you wanted to open and close the position several times this would be an even bigger issue.

Why does this type of hedge work?

This is not always intuitive for traders, who are not used to using an asset as collateral for margin trading the dollar price of that same asset. For example, trading the BTC/USD pair and using BTC as collateral instead of USD.

If you are using BTC as collateral, you are already long that amount of BTC simply by holding it. The 1x short essentially just offsets your 1x long position, leaving your position BTC price neutral.

As the BTC price increases, so does the value of your remaining collateral in USD terms, such that it perfectly offsets the losses on your short.

Incidentally, this is why you have no liquidation price if you are short for 1x or less of your account balance.

If the BTC price decreases, the BTC you were already holding goes down in USD value, however, you gain from your short position at a rate that perfectly offsets this fall in balance value.

In a perfect hedge, the dollar value of your account remains the same while the Bitcoin value fluctuates. You can see the current USD value of your account by hovering over the equity in the header.

Summary

The perpetual, futures and options can all be used to hedge against the downside price risk of a volatile asset, without having to sell the asset via a spot exchange. This way a trader can take advantage of the lower fees, higher liquidity and funding payments of a derivatives exchange.

AUTHOR(S)