If you are new at trading, especially crypto trading, leverage and margin are important terms to understand. Leveraged trading is a high-risk strategy, and is quite different from spot trading. Therefore, in this tutorial, you can learn about these terms in detail and the difference between them.

What is leverage?

Leverage allows you to control a position larger than the value of the assets in your account. Leverage is the ratio between a trader’s position size and the equity used as collateral for the position.

For example, if you want to go long (buy) 10 bitcoins and only have 2 bitcoins in your account to act as margin, leverage is what allows you to open this position. In this case, you would be using 5:1 leverage (10 / 2), also sometimes referred to as 5x leverage.

More generally:

Leverage = Position size / Margin

What is margin?

Margin is the funds in your account used as collateral for your positions. Therefore,in the previous example, your margin was your account balance of 2 bitcoins.

You can easily rearrange the leverage formula above to solve for margin instead:

Margin = Position Size / Leverage

And of course to solve for position size:

Position Size = Leverage * Margin

You will also come across the terms initial margin and maintenance margin on Deribit.

Initial margin is the minimum amount of margin required to open the position.

Maintenance margin is the minimum amount of margin required to keep the position open.

If your total account equity falls below your maintenance margin requirements (also displayed as the MM bar in the top right getting to over 100%) your positions be liquidated until your maintenance margin requirements are below the account equity again, or until the whole position is liquidated.

What is liquidation?

You might be thinking that leverage trading sounds great as you can open larger positions and therefore make larger profits, however, it is important to remember, that your losses are magnified as well. Due to this, leverage trading also includes the possibility of your position being liquidated.

Liquidation – your position is closed by the risk engine, as your remaining margin is no longer enough to support the losses of your position.

The possibility of being liquidated is one of the biggest differences between trading leveraged derivatives and trading on an unleveraged spot exchange.

We will go into more detail on the liquidation process in the liquidation lesson. For now, it is enough to understand that liquidation means your account has run out of funds to support your position and so your positions have been closed.

Isolated vs standard margin

Update June 2024: This article previously referred to standard margin accounts as using ‘cross margin’, but references to ‘cross’ have been removed to avoid confusion with similarly named upcoming updates to the platform. Specifically, cross collateral.

By default, all accounts on Deribit use a standard margin system. What this means is your entire balance for that account is used as margin for positions in that account. And each position shares that same margin with each other. Note that this margin sharing does not apply to long option positions unless portfolio margin is enabled. Also note that the sharing of the same pool of margin in the standard margin system does not imply any offsetting of margin requirements. For offsetting margin requirements, (e.g. a long call vs a short call) portfolio margin would again be required.

For example, if you have one long future and one short future, profits on one position can offset losses on the other automatically without the need to close or add margin to either of the positions separately. However, if both positions are in the same direction, this will cause leverage to increase.

With isolated margin you would set aside a specific amount of margin that is only to be used for a single position. This position and the margin used for it are isolated from the rest of the account and any other positions. On Deribit this can be achieved manually by using subaccounts. If you wish to assign some margin to a single position without it being affected by anything else in the account, you simply transfer this margin to a subaccount and open the position there.

Subaccounts are completely isolated from the main account, as well as from other subaccounts. This means a liquidation in one subaccount will not affect equity in any of the other accounts.

How do I change my leverage with standard margin?

This is a common question from users new to Deribit’s standard margin system. As the leverage is handled automatically with standard margin, the answer is by controlling the other two variables in the equation, position size and margin (account balance).

Let’s look at some examples:

Calculating leverage

A trader wants to open a 10 BTC position in an account with a 0.5 BTC balance, and wants to know what the effective leverage will be.

Leverage = Position size / Margin = 10 / 0.5 = 20

The position will be at 20x leverage.

Calculating position size

A trader wants to use 0.25 BTC as margin for a position and wants the position to be at 5x leverage. The trader wants to know what position size should be used.

Position size = Margin * Leverage = 0.25 * 5 = 1.25 BTC

The trader should open a position of 1.25 BTC.

Calculating margin

A trader wants to open a position of 5 BTC at 10x leverage and wants to know how much margin to move to the subaccount for the position.

Margin = Position size / Leverage = 5 / 10 = 0.5 BTC

The trader can transfer 0.5 BTC to the subaccount and open the position, which will not affect any other positions on other accounts.

How does leverage relate to profit and fees?

Leverage has zero effect on either your profits and losses or fees. Both fees and profits and losses are calculated using position size.

Example:

If you open a $10,000 long position on BTC/USD, it does not matter if you do so with $200 worth of bitcoins in your account (50x leverage), or with $5,000 worth of bitcoins in your account (2x leverage). The fees and profits and losses will be precisely the same in each case because it is the $10,000 position size that is used to calculate both.

However, this certainly does not mean that you should pay no attention to it because leverage has a very large effect on your liquidation price.

The effect of leverage on liquidation/bankruptcy price

When trading with leverage, It is important to keep in mind the price at which your position would be liquidated.

For example, placing a stop-loss order on a long position 10% below the current price will be useless, if the liquidation reference price is 4% below the current price.

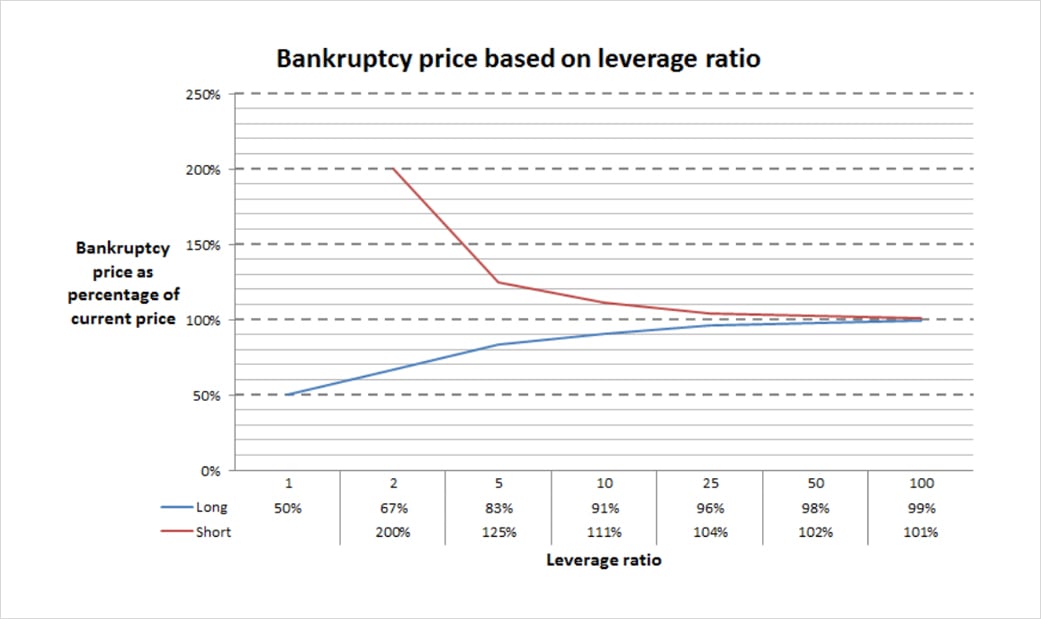

The following chart displays at what point your account balance would hit zero based on how much leverage you were using for both longs (in blue) and shorts (in red). This chart assumes trading BTC/USD futures using Bitcoin as collateral.

As you can see, the higher the leverage (moving from the left to the right of the chart), the closer the liquidation price is to the current price. This is true for both longs and shorts, though at different rates.

In the chart above there is no entry for the bankruptcy price of a short position when using 1x leverage. This is because there is no bankruptcy price when you are short with 1x leverage or less. You are using Bitcoin as collateral, and as the bitcoin price rises against your short position, so does the value of your remaining collateral. Therefore, your account maintains its USD value. We will cover this in more detail in the “Hedging USD value” lesson.

Note: The bankruptcy price is slightly different than the liquidation price. The bankruptcy price is where your account would be completely out of funds, i.e. an account balance of zero. The liquidation price is the price at which your remaining funds are not high enough to support your open positions, i.e. a low account balance but not zero tet. For simplicity, we have used bankruptcy price in the chart.

Summary

Leverage is what allows you to open a larger position than the funds in your account. And the funds you have in your account to use as collateral for your positions is called margin.

When trading leveraged products you need to be aware of liquidation and how your leverage affects the price at which this will happen. However, leverage does not affect your profits and losses. Your profits and losses are determined by the position size. Leverage only allows an account to achieve a position size greater than its equity.

AUTHOR(S)