When trading leveraged products, even on low leverage, it is wise to know about how liquidations are handled on the platform you are trading on. And of course it’s always a good idea to know where your current positions or any open orders you have would be liquidated.

Liquidations happen when there are no longer enough funds (margin) in your account to support your open positions. Your positions are then taken out of your control and closed (liquidated) by the platform. Another name for this is a margin call. The possibility of being liquidated is one of the biggest differences between trading leveraged derivatives and trading unleveraged on a spot exchange.

At what point this happens depends on several factors such as the margin requirements for the instrument you are trading, how large your position size is and of course how much margin you have.

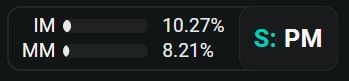

On Deribit when your maintenance margin requirements get above your margin balance your positions will be liquidated. Note: for Portfolio Margin users, Margin Balance = Equity. You can see how much of both your maintenance margin and initial margin you are currently using in the top right of the website UI like this:

When the IM (initial margin) bar gets to 100% you will no longer be able to place new orders that would increase your position size.

When the MM (maintenance margin) bar gets to 100% this is when the liquidation process will begin. The system will take over your account and you will not be able to do any trading (including closing your positions yourself) until the process is complete.

Note: The equity in your account is calculated based not on the last traded price of each instrument, but on the mark price of each instrument.

As you can see in the above picture, that account has IM of 10.27% and MM of 8.21%, both well below the limits and so they can feel free to place more trades and are nowhere close to being liquidated.

Incremental liquidation

Unlike some other platforms Deribit uses an incremental liquidation system. Meaning the liquidation engine will first try to liquidate only a part of the position to try to get the maintenance margin below 100% again. If the partial liquidation is successful in reducing maintenance margin to below the account equity again, the liquidation process will stop and any of the position not yet liquidated will remain open.

Of course, even with these increments it’s still possible the price continues to move against the position and it is eventually fully liquidated, but the incremental steps at least give a chance that some of the position will be saved. This can also have the side effect of slightly smaller wicks caused by liquidations compared to some other platforms, due to only part of the position hitting the orderbook at any one time.

Liquidation fees

Liquidation orders (any orders placed by the system to liquidate a position) are charged an extra fee. These extra fees are paid into an insurance fund that pays for any deficits of accounts that become bankrupt after liquidation. We’ll cover the insurance fund in more detail in a separate lesson.

These extra liquidation fees mean it is usually more cost effective to try and exit positions with proper stop losses, rather than using the liquidation as a stop loss by itself.

Details of the fees can be seen on the fees page here.

Estimated liquidation prices

For standard margin accounts, there is an estimated liquidation price displayed both on the order confirmation screen before a trade is placed and in the ‘Positions’ tab on the futures page once the position is open.

This is an estimate of when the account would enter the liquidation process, assuming of course that there are no changes to the position. These values will change if the position is increased/decreased, any other positions on the account are altered, or if margin is withdrawn from/deposited to the account.

As well as not showing in portfolio margin accounts, it is also possible for no liquidation price to be shown in a standard margin account if the account has enough funds to cover the maximum loss for the position. For example, an account with 1 BTC, and an inverse futures short with a position size of less than 1 BTC.

In summary, liquidation occurs when the remaining funds left in your account are no longer enough to support the margin requirements of your open positions. The process involves the liquidation engine taking over full control of your account while it incrementally closes your positions in order to bring the maintenance margin requirement lower than the account equity. Once this process is completed, if there are any funds and/or positions left, these remain in the account.

AUTHOR(S)