In part 1 we covered straddles and strangles, both of which had either undefined risk when selling or undefined reward when buying. We’ll now take a look at vertical spreads (call and put spreads), then bring these together to create iron butterflies and iron condors in part 3. Parts 2 and 3 together will show how you can use option combinations to define your risk and/or reward.

If you haven’t already feel free to download a copy of the position builder spreadsheet here.

(Go to File > Make a copy)

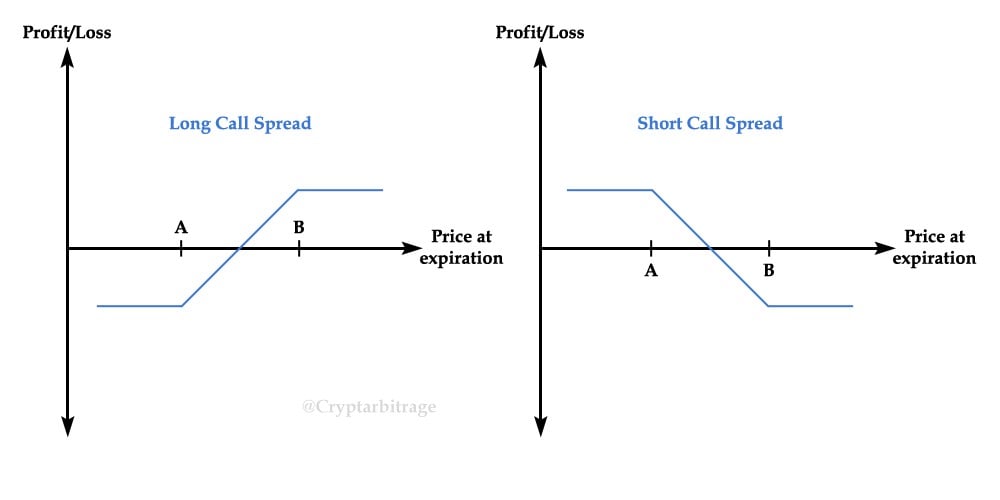

Call Spreads

Both call and put spreads are an easy way to take a directional trade with very well defined risk and reward. A call spread consists of 2 calls, one short and one long, each at a different strike price.

Opening a Long Call Spread (aka Bull Call Spread)

- You are buying a call at strike price A, and selling a call at strike price B.

- Your risk is limited to the net debit paid to establish the position.

- Your position will stop making money once the price gets up to strike B, so your profit is also limited.

- As the total amount paid will be less than if you had only purchased the call at strike A, your breakeven point is a little closer and you need a smaller move to be in profit.

- You want the price to be at or above strike B at expiry.

Opening a Short Call Spread (aka Bear Call Spread)

- You are selling a call at strike price A, and buying a call at strike price B.

- Your risk is limited to the difference between the two strikes minus the net credit you received for the position.

- Your maximum profit is the net credit received for the position.

- You won’t receive as much as if you had only sold the call at strike A, but you have limited your risk substantially.

- Ideally you want both options to expire worthless i.e. the price to be below strike A at expiry.

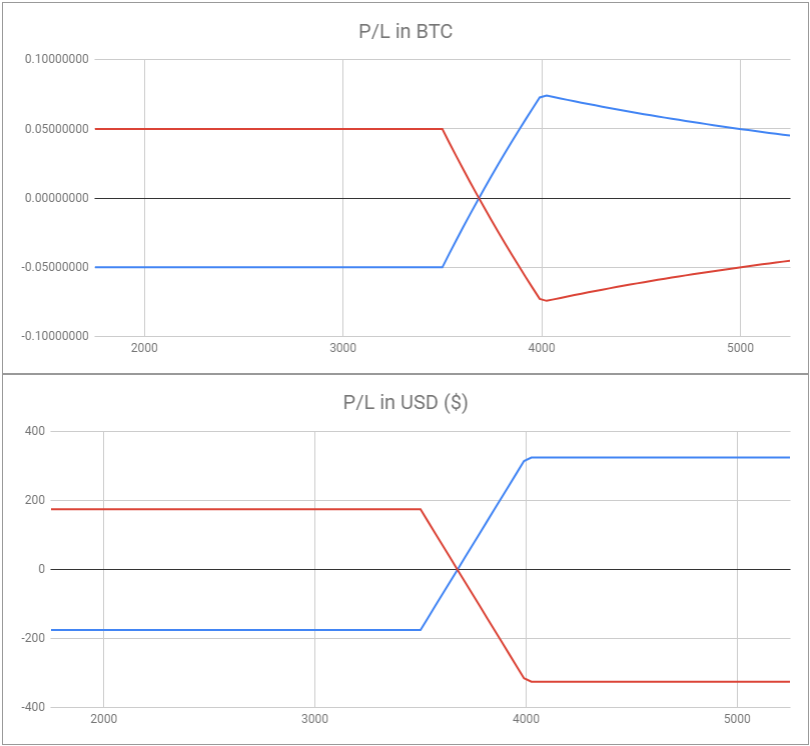

Bitcoin Call Spread Example

Using the spreadsheet provided I have constructed here an example of both a long call spread and a short call spread.

The long call spread contains the following options:

+1 call with a strike price of 3500 and a price of 0.1BTC

-1 call with a strike price of 4000 and a price of 0.05BTC

The short call spread contains the following options:

-1 call with a strike price of 3500 and a price of 0.1BTC

+1 call with a strike price of 4000 and a price of 0.05BTC

The long call spread here is in blue, and the short call spread is in red.

As you can see both the risk and reward are very well defined for either longing or sorting a call spread. This is particularly true when measured in USD, but we’ll cover the asymmetry of the bitcoin profit/loss properly in a future article.

This example will be left in the downloadable version of the sheet under the name ‘Call Spread’.

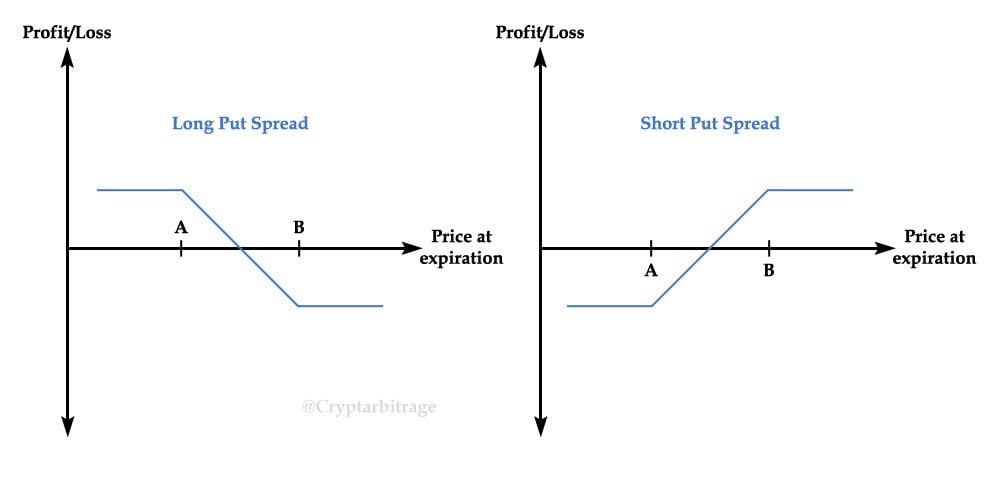

Put Spreads

A put spread consists of 2 puts, one short and one long, each at a different strike price.

You will notice here a similarity with call spreads. In particular that a short call spread looks identical to a long put spread, and a long call spread looks identical to a short put spread. And indeed in USD P/L terms they are basically the same thing just using different options, however they do differ when measuring the profit/loss in BTC. As mentioned though we’ll cover this difference including how to adjust for it properly in future.

Opening a Long Put Spread (aka Bear Put Spread)

- You are buying a put at strike price B, and selling a put at strike price A.

- Your risk is limited to the net debit paid to establish the position.

- Your position will stop making money once the price gets down to strike A, so your profit is also limited.

- As the total amount paid will be less than if you had only purchased the put at strike B, your breakeven point is a little closer and you need a smaller move to be in profit.

- You want the price to be at or below strike A at expiry.

Opening a Short Put Spread (aka Bull Put Spread)

- You are selling a put at strike price B, and buying a put at strike price A.

- Your risk is limited to the difference between the two strikes minus the net credit you received for the position.

- Your maximum profit is the net credit received for the position.

- You won’t receive as much as if you had only sold the put at strike B, but you have limited your risk substantially.

- Ideally you want both options to expire worthless i.e. the price to be above strike B at expiry.

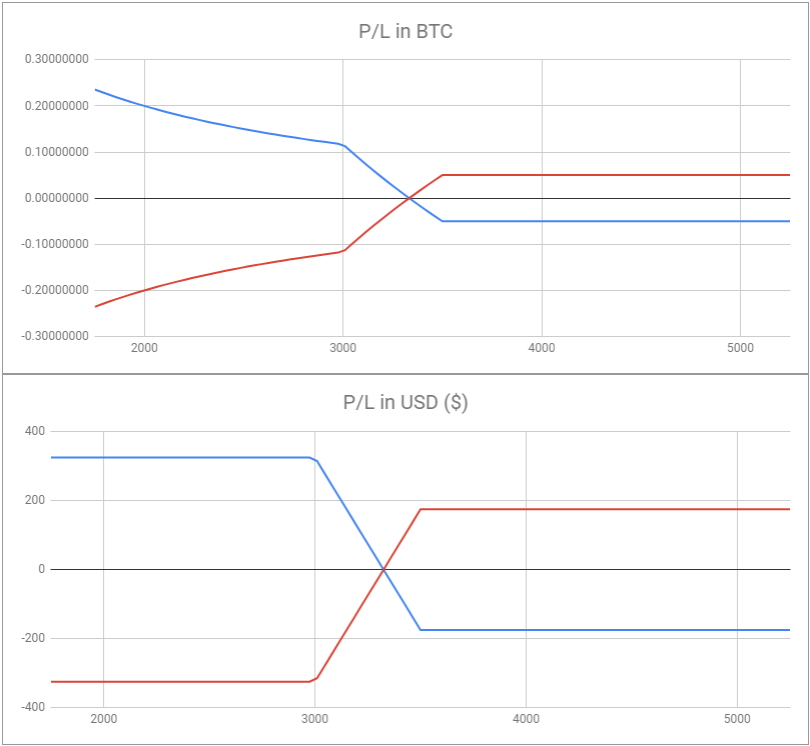

Bitcoin Put Spread Example

Using the spreadsheet provided I have constructed here an example of both a long put spread and a short put spread.

The long put spread contains the following options:

+1 put with a strike price of 3500 and a price of 0.1BTC

-1 put with a strike price of 3000 and a price of 0.05BTC

The short put spread contains the following options:

-1 put with a strike price of 3500 and a price of 0.1BTC

+1 put with a strike price of 3000 and a price of 0.05BTC

The long put spread here is in blue, and the short put spread is in red.

As you can see both the risk and reward are very well defined for either longing or shorting a put spread. This is particularly true when measured in USD, but this time you’ll notice the Bitcoin P/L for buyer and seller diverging instead of converging like it did with the calls. Again we’ll cover the reason for this in future.

This example will be left in the downloadable version of the sheet under the name ‘Put Spread’.

On to part 3 next where we pull the positions we’ve looked at so far together to construct iron butterflies and iron condors.

See part 3 here.

AUTHOR(S)