Butterflies and Condors

So far each of the positions we’ve looked at has still only had 2 legs in it. Now we’ll look at some non directional positions that have 4 different legs in one single position. First iron butterflies and then iron condors.

Before we do that it’s worth quickly mentioning that there is some disagreement about which side to label long and which to label short for iron butterflies and iron condors. The definition we will use in this article is that if the position is established for a net credit (i.e. you receive a premium for opening the whole position) then we’ll consider that selling to open the position and therefore label it the short side. Conversely if the position is established for a net debit (i.e. you pay a premium for opening the whole position) then we’ll consider that buying to open the position and therefore label it the long side.

No matter which way round you label it there is no effect on the P/L, but it’s worth being aware of when conversing with someone about iron condors and iron butterflies to make sure that you both understand which side you are talking about.

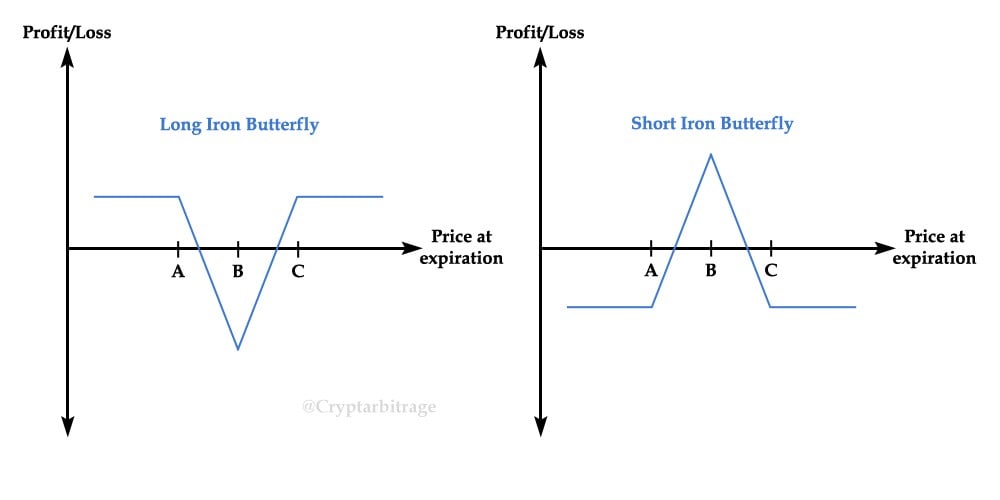

Iron Butterfly

One way to think of iron butterflies and iron condors is they are risk defined versions of straddles and strangles respectively.

You can also think of an iron butterfly as a combination of a call spread and a put spread, with the lowest strike in the call spread and the highest strike of the put spread both at strike B.

Opening a Long Iron Butterfly

- The current price will typically be at or near strike B.

- You are selling a put at strike A, buying a call and a put at strike B, and selling a call at strike C

- Your risk is limited to the net debit paid to establish the position.

- Your position will stop making gains once the price gets down to strike A or up to strike C, so your profit is also limited.

- This position is similar to a long straddle, but you have limited your maximum profit in exchange for an overall cheaper position due to collecting some premium by selling the put at strike A and the call at strike C.

- You are longing volatility. You want implied volatility to increase once the position is opened as it will increase the value of your position.

- Ideally you want the price to expire either below A or above C.

Opening a Short Iron Butterfly

- The current price will typically be at or near strike B.

- You are buying a put at strike A, selling a call and a put at strike B, and buying a call at strike C

- Again your risk and maximum profit are defined.

- This position is similar to a short straddle, but you have limited your risk by purchasing the OTM options at strike A and C.

- You are shorting volatility. You want implied volatility to decrease once the position is opened as this will decrease the value of the options you have sold. A sideways ranging market would be ideal for you.

- Ideally you want the price to expire at strike B

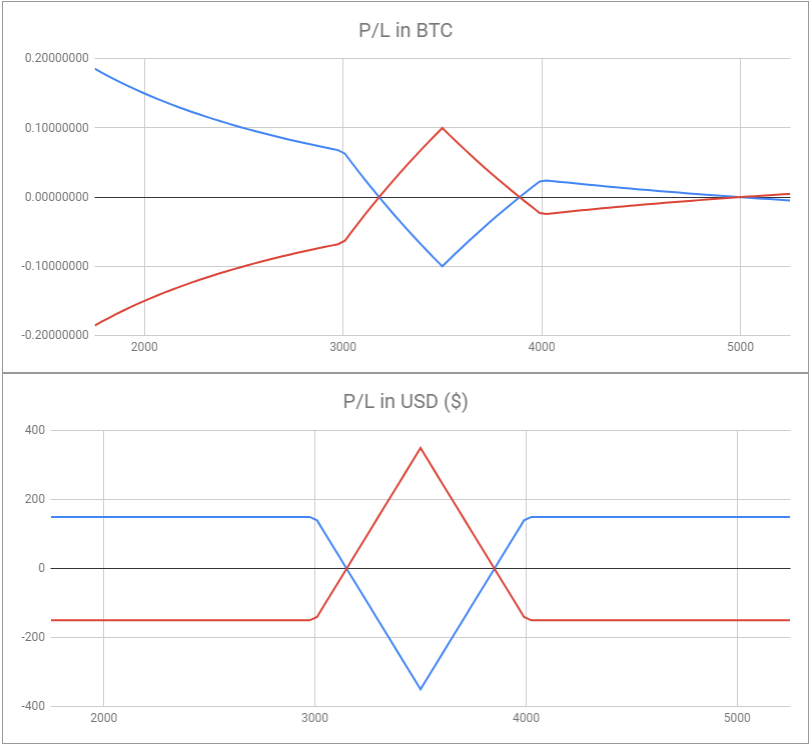

Bitcoin Iron Butterfly Example

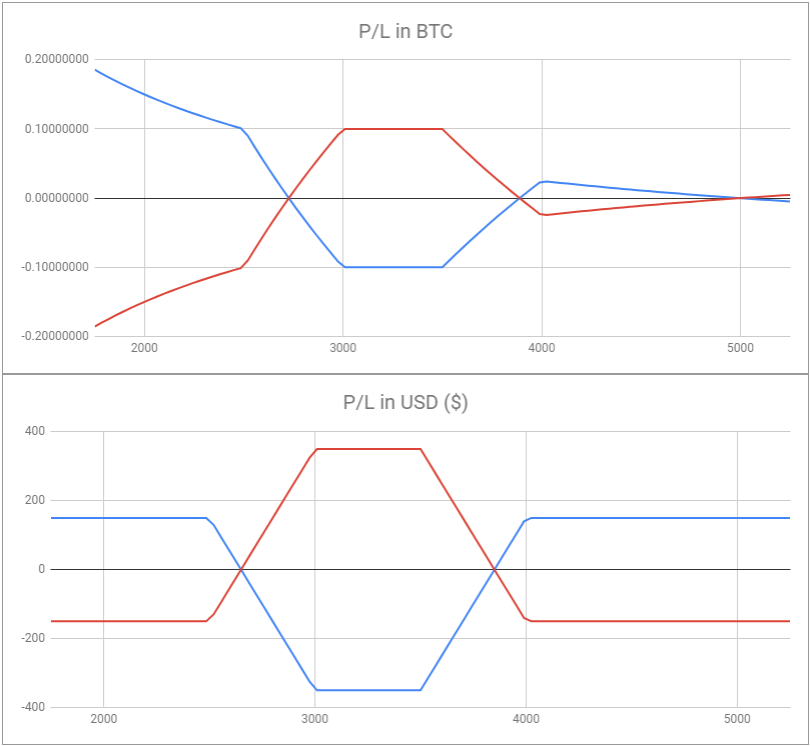

Using the spreadsheet I have constructed both a long and short iron butterfly.

The long iron butterfly consists of the following legs:

-1 put with a strike price of 3000 and price of 0.05BTC

+1 put with a strike price of 3500 and price of 0.1BTC

+1 call with a strike price of 3500 and price of 0.1BTC

-1 call with a strike price of 4000 and a price of 0.05BTC

The short iron butterfly consists of the following legs:

+1 put with a strike price of 3000 and price of 0.05BTC

-1 put with a strike price of 3500 and price of 0.1BTC

-1 call with a strike price of 3500 and price of 0.1BTC

+1 call with a strike price of 4000 and a price of 0.05BTC

The middle two options in bold are the same as the straddle from part 1, and the other two options are called the wings. These are the legs that turn it into an iron butterfly, defining the risk for sellers and profit for buyers.

This example will be left in the downloadable version of the sheet under the name ‘Iron Butterfly’.

Compared to the long straddle the long iron butterfly is considerably cheaper for the buyer meaning the max loss is lower and a much smaller move is needed to get to breakeven, the obvious trade off being that the profit in both directions is now capped.

Compared to the short straddle the short iron butterfly has the benefit of having defined the risk in both directions for the seller (in USD at least). The trade off being of course the premium collected is lower.

Here I’ve plotted the short butterfly as above (in red) and the corresponding short straddle (in blue) for visual comparison.

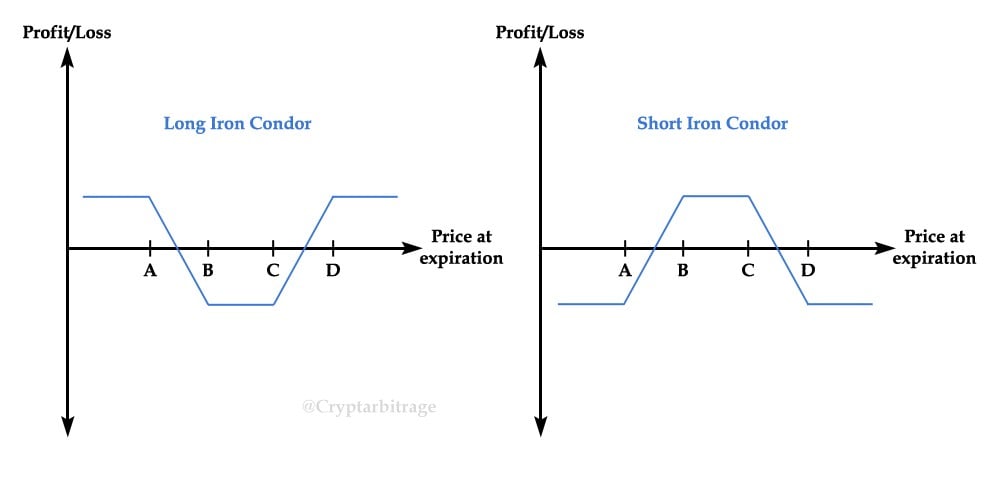

Iron Condor

An iron condor is very similar to an iron butterfly in that it is a combination of a call spread and a put spread, but this time they do not overlap creating a wider range. You can also think of it as a strangle with wings that define the risk (or reward for buyers).

Opening a Long Iron Condor

- The current price will typically be between strikes B and C.

- You are selling a put at strike A, buying a put at strike B, buying a call at strike C, and selling a call at strike D

- Your risk is limited to the net debit paid to establish the position.

- Your position will stop making gains once the price gets down to strike A or up to strike D, so your profit is also limited.

- This position is similar to a long strangle, but you have limited your maximum profit in exchange for an overall cheaper position due to collecting some premium by selling the put at strike A and the call at strike D.

- You are longing volatility. You want implied volatility to increase once the position is opened as it will increase the value of your position.

- You want the price to expire either below A or above D.

Opening a Short Iron Condor

- The current price will typically be between strikes B and C.

- You are buying a put at strike A, selling a put at strike B, selling a call at strike C, and buying a call at strike D

- Again your risk and maximum profit are defined.

- This position is similar to a short strangle, but you have limited your risk by purchasing the options at strikes A and D.

- You are shorting volatility. You want implied volatility to decrease once the position is opened as this will decrease the value of the position you have sold. A sideways ranging market would be ideal for you.

- Ideally you want the price to expire between strikes B and C.

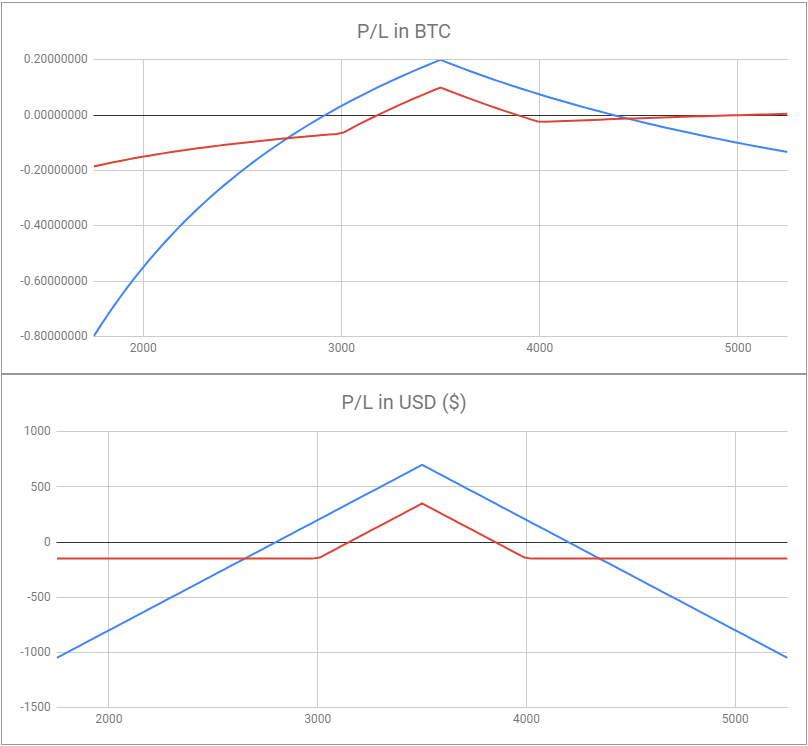

Bitcoin Iron Condor Example

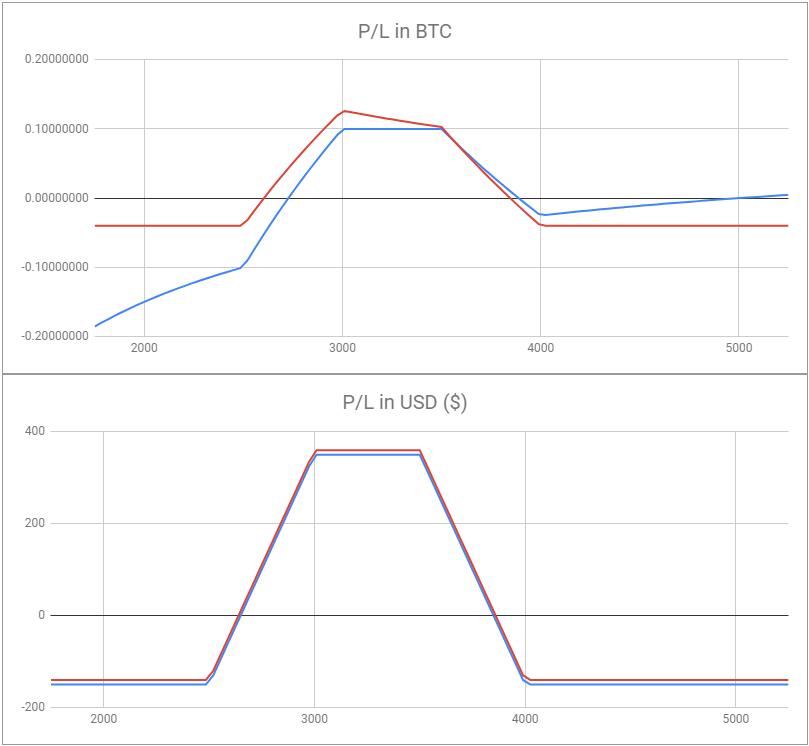

Using the spreadsheet I have constructed both a long and short iron condor.

The long iron condor consists of the following legs:

-1 put with a strike price of 2500 and a price of 0.05BTC

+1 put with a strike price of 3000 and a price of 0.1BTC

+1 call with a strike price of 3500 and a price of 0.1BTC

-1 call with a strike price of 4000 and a price of 0.05BTC

The short iron condor consists of the following legs:

+1 put with a strike price of 2500 and a price of 0.05BTC

-1 put with a strike price of 3000 and a price of 0.1BTC

-1 call with a strike price of 3500 and a price of 0.1BTC

+1 call with a strike price of 4000 and a price of 0.05BTC

The middle two options in bold are a strangle, and the other two options are called the wings. These are the legs that turn it into an iron condor, defining the risk for sellers and profit for buyers.

This example will be left in the downloadable version of the sheet under the name ‘Iron Condor’.

Compared to the long strangle the long iron condor is considerably cheaper for the buyer meaning the max loss is lower and a much smaller move is needed to get to breakeven, the obvious trade off being that the profit in both directions is now capped.

Compared to the short strangle the short iron condor has the benefit of having defined the risk in both directions for the seller (in USD at least). The trade off being of course the premium collected is lower.

Constructing Butterflies and Condors Using Different Options

In the put spread section earlier we touched on how the USD P/L of a short call spread looks identical to a long put spread, and a long call spread looks identical to a short put spread. As a corollary to this it is possible to construct both butterflies and condors using solely calls, or solely puts.

I won’t go through all the permutations or it will result in unnecessary repetition, but as one example I have constructed here in the spreadsheet an example of a regular short iron condor (in blue) and a condor using only puts (in red).

As you can see in USD terms this has no effect on the P/L (the slight difference only there due to the prices I’ve chosen so you can see both lines), however it does change the shape of the BTC chart. This kind of example can sometimes be very useful when making sure your position’s payoff aligns with what you want in terms of BTC.

Next Up: Option Pricing and Implied Volatility

There are still a few other multi leg positions that skew the P/L in different directions and have their own pros and cons, essentially moving potential profit from one area of the chart to another. We’ll come back to those eventually but it’s about time we starting diving into options pricing and implied volatility, which we will do in the next article.

Before we move onto the price you manage to get for each leg of a position, everything on these profit and loss charts that we’ve been looking at so far is a trade off. If you make one part of the chart more profitable then you must sacrifice profit somewhere else, if you are willing to have higher risk in one direction, you can make a larger profit in the other etc.

I would strongly advise having a play around in the sheet by adding different combinations of options and even adding in futures longs and shorts to see what effect these have. It’s a great way to learn and will help you be able to visualise things without the need to keep referencing back to articles or websites for each position while you’re trading. This will allow you to choose the right position for your outlook on the market more easily.

AUTHOR(S)