Deribit has launched options on two more altcoins: Avalanche (AVAX), and Tron (TRX). Both of these new altcoin option markets will use USDC as the settlement currency. There is also an existing USDC settled perpetual market for both coins. Users in eligible jurisdictions holding USDC in their Deribit accounts will also benefit from monthly USDC rewards.

The new options, as well as the perpetuals, are of course useful for speculators, however they are also useful for hedgers and yield seeking individuals or companies. Let’s take a look at how these instruments work, as well as some use cases.

Most traders, at least most crypto traders, will already be familiar with perpetual contracts. In short, a perpetual is a type of futures contract that does not expire, and instead has a funding mechanism to keep the price of the perpetual in line with the spot price. For more on perpetual funding, see here.

A growing but smaller number of traders will be familiar with options, so below we will go through the two basic types of options (calls and puts) and how each might be used.

Call options

The buyer of a call option holds the right to buy the underlying asset (for example AVAX, or TRX), at a fixed price before the option expires. If the underlying price is above the strike price of the call option at expiry, the option will have some value. To keep things simple in this article, we will only consider the value of the option at expiry.

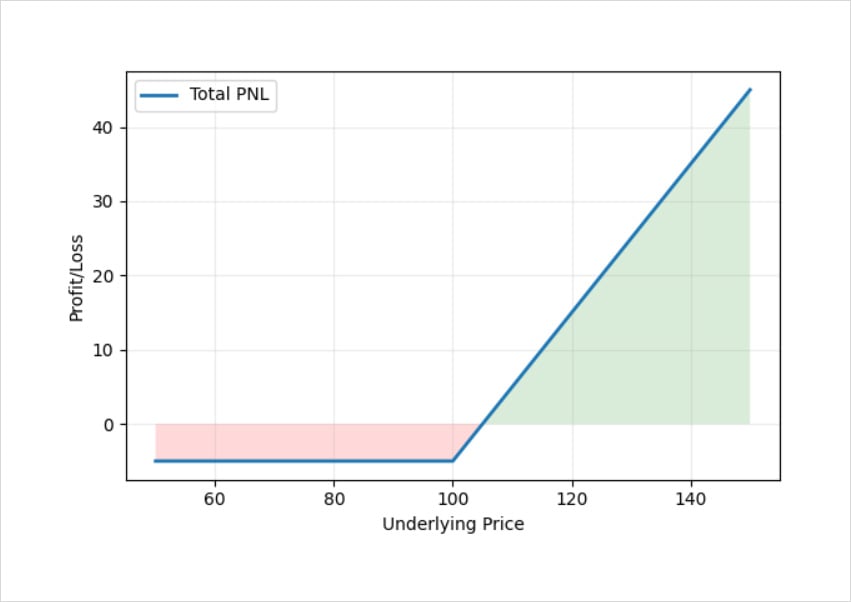

This is what the basic payoff of a call option looks like if we hold it until it expires. The profit/loss is in dollars here. In this example, it’s a call option that costs $5 and has a strike price of $100.

If the price of the underlying asset is below the strike price at expiry, the maximum loss is limited to the premium paid of $5. If the price is above the strike price at expiry, the profit is similar to being long the underlying asset, except minus the $5 premium paid.

Put options

The buyer of a put option holds the right to sell the underlying asset (for example AVAX, or TRX), at a fixed price before the option expires. If the underlying price is below the strike price of the put option at expiry, the option will have some value at expiry.

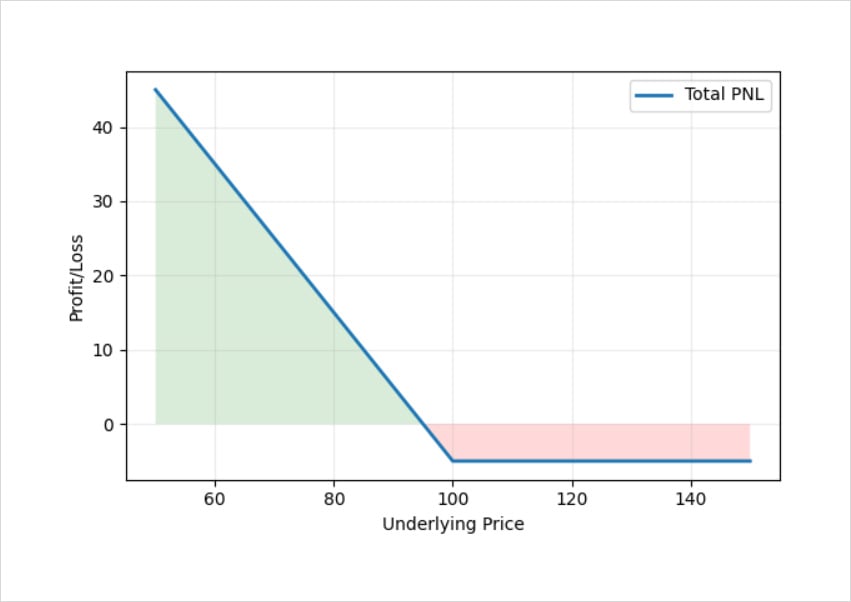

This is what the basic payoff of a put option looks like if we hold it until it expires. The profit/loss is in dollars here. In this example, it’s a put option that costs $5 and has a strike price of $100.

If the price of the underlying asset is above the strike price at expiry, the maximum loss is limited to the premium paid of $5. If the price is below the strike price at expiry, the profit is similar to being short the underlying asset, except minus the $5 premium paid.

In the case of both calls and puts, the buyer of the option has a choice whether to use the option they have purchased, but they are not obliged to. This of course is a valuable right to hold, so option buyers have to pay for this by paying a premium up front. Option buyers have a fixed risk (the premium paid), but a potentially unlimited profit.

Let’s take a look at a couple of ways people holding a particular coin could benefit by using options.

Hedging spot by buying puts

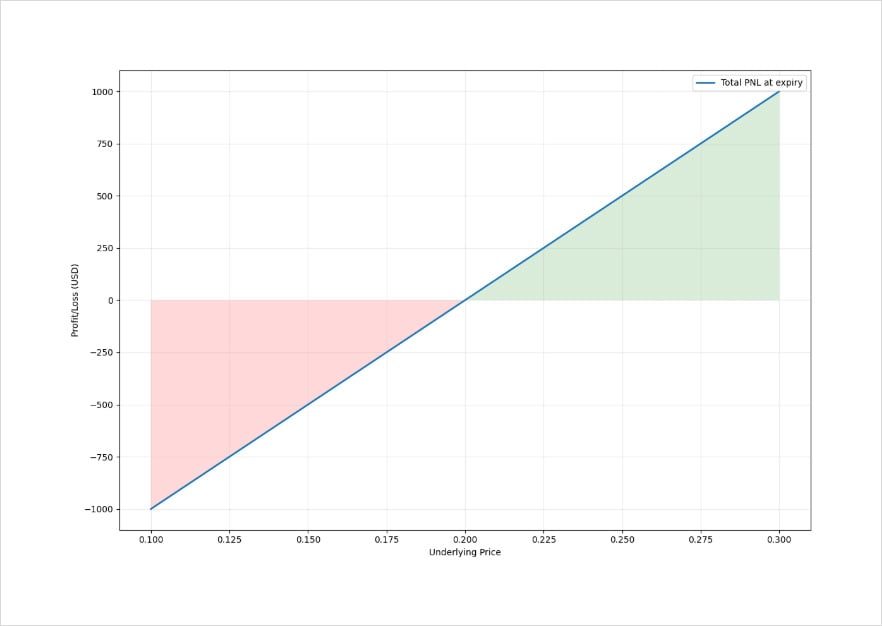

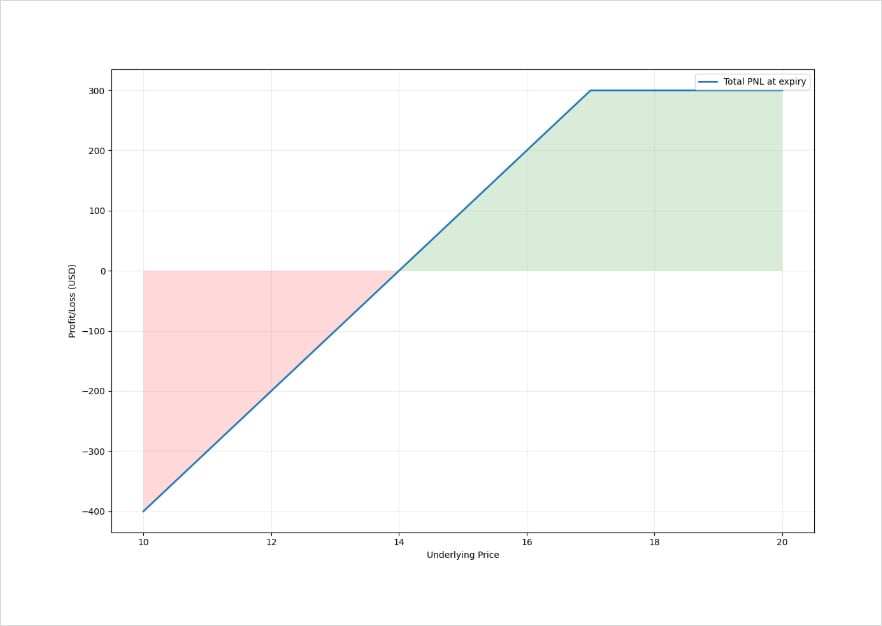

Firstly, imagine we already own some TRX, let’s say it’s 10,000 TRX that we purchased at a price of $0.20 each. This is what our profit/loss looks like when we are just holding the 10,000 TRX.

Imagine we are bullish on TRX long term but are concerned there may be a decrease in the price in the short term. We don’t want to sell our spot holdings because we still want to participate in any price increases, but we want some sort of protection in case prices do move down. Buying put options fits this need well.

If we purchase TRX put options with a strike price of $0.18 for $0.01 each, we transform our profit/loss into this.

Buying puts means that if the price of TRX decreases below the strike price of the puts, we still have the right to sell the TRX at the strike price of the option ($0.18 in this case). Or in the case of cash settled options(All options on Deribit are cash settled), we will simply receive the difference between the strike price and the underlying price at expiry. This property caps our losses when the underlying price of TRX drops below the $0.18 strike price, while still allowing us to benefit from further increases in the price of TRX

Eagle eyed readers will have noticed that this payoff looks remarkably similar to that of buying a call option. Indeed buying a call option with no position in the underlying, is equivalent to holding the underlying and buying a put option. For more on synthetic positions, which refers to creating equivalent positions with different instruments, see this article in the Deribit option course.

Which strikes and expirations to choose are up to the individual. The choice will depend on their views on the market, risk tolerance, current option prices, and how much protection they wish to purchase.

Generating yield by selling calls

Another way someone may choose to use options to their advantage is to generate a form of yield by selling call options against their spot holdings. Deribit is a marketplace where any trader is free to buy or sell options, so even smaller traders are not limited to long only strategies.

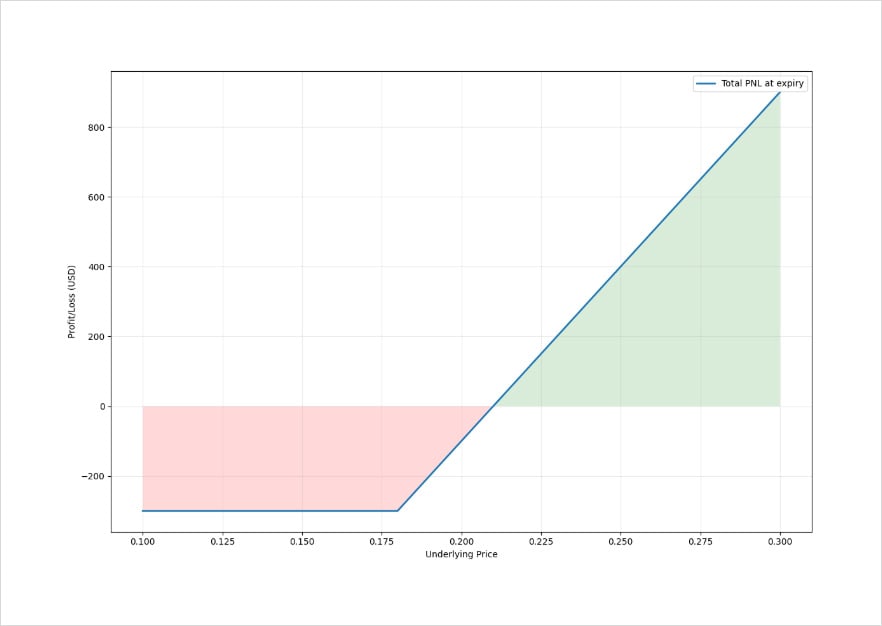

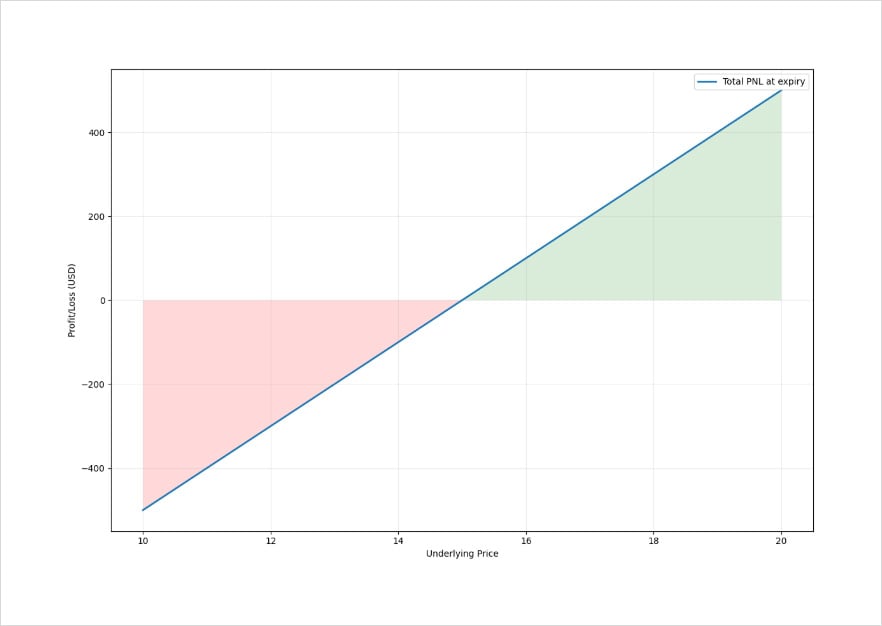

Imagine that we already hold 100 AVAX with a cost basis of $15 each. This is what our profit/loss looks like when we are just holding the 100 AVAX.

Rather than simply hold the AVAX, imagine that we would like to generate some form of yield on our holdings. If we sell AVAX call options against our holdings of 100 AVAX, with a strike price of $17 for $1 each, we will collect a credit of $100, and transform our profit/loss into this.

The $100 credit is ours to keep, and this is our yield. We still have risk to the downside, but our cost basis has effectively moved down from $15 to $14. The catch is that if the price of AVAX is over $17 at expiry, we do not benefit from any of the additional gains beyond this level.

When selling calls for yield, it is always a trade off between leaving room to benefit from more upside, and collecting more premium for the calls. We also need to bear in mind that the ‘yield’ here is not risk free. We are being compensated for the risk of missing out on further upside.

This strategy of selling a call while holding the underlying, is often referred to as a covered call. The Deribit option course contains more information on covered calls here.

It is worth noting here that Deribit will not yet be supporting deposits of TRX or AVAX tokens, so unlike with the existing SOL and XRP options, it will not yet be possible to use the TRX or AVAX tokens as an offset currency. For more information on offset currencies, see the knowledge base here.

Option contract specs

One of the most important contract details to be aware of is the contract size. That is, how many units of the underlying each option contract represents. For AVAX, the contract size is 100, meaning each AVAX option contract represents a notional size of 100 AVAX. For TRX, the contract size is 10,000, meaning each TRX option contract represents a notional size of 10,000 TRX.

For the full contract specifications, see the knowledge base here.

Options education

We’ve covered a couple of ways holders of a particular token could use options to their advantage in this article, but really we’ve barely scratched the surface of what positions can be built with options. If you are new to options, a great place to learn more about options is the free Deribit option course, which is also available on the Deribit YouTube.

AUTHOR(S)