As part of Deribit’s continuing effort to improve the collateral choices and efficiency for users, including reward generating tokens, Deribit will now be paying rewards to eligible users holding USDC on Deribit

These payments are made possible due to Deribit using Coinbase as a custody solution for USDC, and Coinbase paying rewards to holders of USDC stored with them.

As an example of the rates available, the reward rate as of July 2025 is 4% per year. Be aware though that Coinbase regularly assesses the USDC rewards rate and may make periodic changes.

Eligible users

A user’s eligibility to receive USDC is based on their location. For retail users, this is determined by their country of residence. For corporate users, both the place of incorporation and principal place of business are considered, and both locations must be in an authorised jurisdiction to receive USDC rewards.

For the most up to date details on eligible jurisdictions for USDC rewards, see the Deribit Knowledge Base here.

Users who store their funds with external custody solutions, and do not hold their funds with Deribit, are not eligible to receive USDC rewards on Deribit. However, if a user is using a hybrid solution where part of their funds are held with a custodian and part are held with Deribit, they will be eligible to receive rewards based on the amount of USDC funds held with Deribit.

Reward calculation and payments

Every day at 00:00 UTC, Deribit calculates the minimum equity of USDC that a user has been holding over the previous 24 hours. After the month is over, the rewards from each day are summed together and paid out as a single monthly payment early in the following month.

For example, the minimum equities for each day in January would be used to calculate any rewards due to eligible users, and these would all be paid as a lump sum in early February.

Please note, the first reward payment will be in August 2025, and the minimum equities for each day from the date of the announcement (the 15th of July) to the 31st of July 2025 will be used to calculate any rewards due to eligible users, then these will all be paid as a lump sum in the first 2 weeks of August.

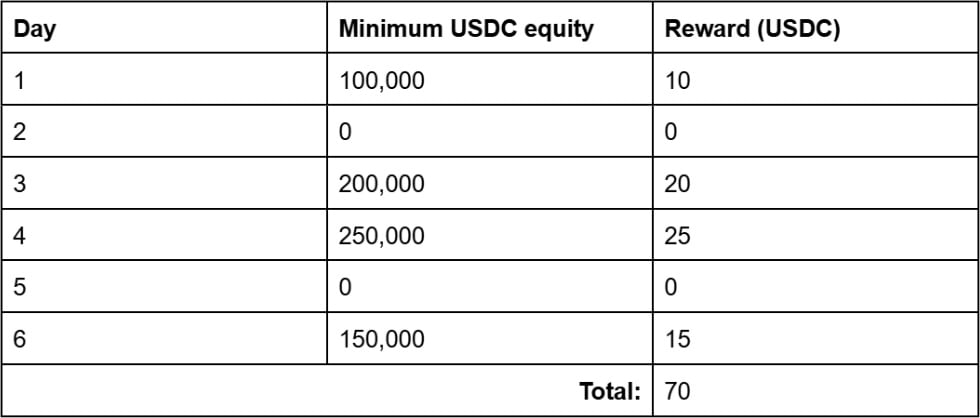

Reward example 1

For the purposes of this example, we will assume a constant APR (Annual Percentage Rate) of 3.65%, and therefore a daily rate of 0.01%. A user is holding the following amount of USDC over a period of a few days in the same month.

In this example, the user would receive a 70 USDC reward payment early on in the following month.

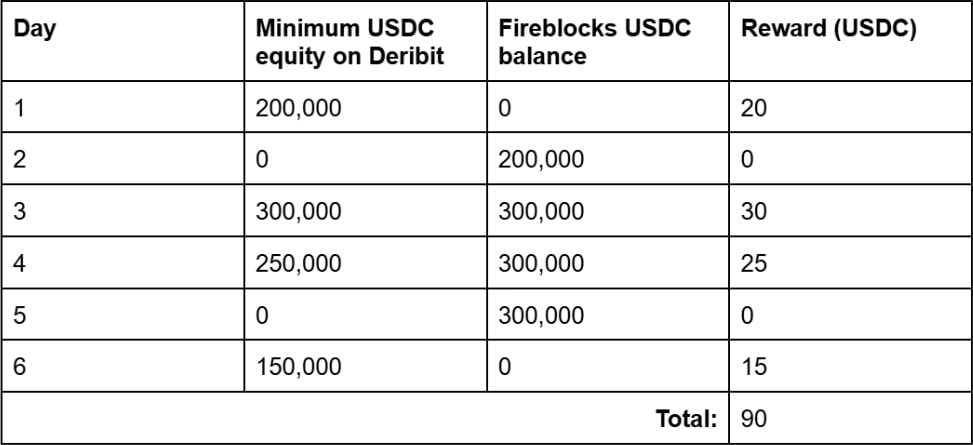

Reward example 2 – Hybrid custody

For the purposes of this example, we will assume a constant APR (Annual Percentage Rate) of 3.65%, and therefore a daily rate of 0.01%. This time the user is holding some USDC on Deribit, and some in Fireblocks custody. They are holding the following amounts of USDC over a period of a few days in the same month.

In this second example, the user would receive a 90 USDC reward payment early on in the following month. Notice that the Fireblocks balances do not contribute to USDC rewards, but the user still earns rewards based on their minimum equity on Deribit each day.

For more details on reward payments, see the Deribit Knowledge Base here.

Cross collateral on Deribit

When cross collateral is enabled in a Deribit account, it allows the trader to use currencies other than the settlement currency of an instrument as collateral to trade that instrument. Any currency that is considered a cross collateral currency can be used, and USDC is already considered a cross collateral currency on Deribit.

Along with the addition of rewards to users storing USDC on Deribit, the haircut applied to USDC in the cross collateral system has been reduced from 2% to 0%. This means the full amount of USDC can be used to satisfy margin requirements in any derivative instrument on Deribit.

For those wanting to maximise capital efficiency, it is well worth looking into Deribit’s cross collateral feature in more detail. As always, the most up to date information can be found in the Deribit Knowledge Base here.

AUTHOR(S)