In March 2024 Deribit launched USDC settled options on three altcoins, SOL, XRP, and MATIC. These options being settled in USDC sets them apart from the already well established options on BTC and ETH.

In this lesson, we’re going to show how to place some trades on the new options, and point out any important differences to be aware of.

Settlement currencies

The first of these differences is the settlement currency. All of the options on Deribit are cash settled, meaning it is only the intrinsic value of the option at expiry that is paid to the holder of the option. However, the currency that this cash payment is made in, also known as the settlement currency, differs depending on which product is being used. The bitcoin and ethereum options use the base currency as the settlement currency, meaning the BTC options are settled in BTC, and the ETH options are settled in ETH. Whereas the new altcoin options for SOL, XRP, and MATIC, all use USDC as the settlement currency.

This means that for the SOL, XRP, and MATIC options, the price of each option is quoted as an amount of USDC, and any profit/loss payments are also made in USDC.

Contract multipliers

There is another important difference worth mentioning. The contract multiplier for the existing BTC and ETH options has always been 1. This means that a position size of 1 in a BTC or ETH option represents a notional size of 1 BTC or ETH. This means no extra maths is required to calculate your notional size.

The added altcoins (SOL, XRP, MATIC) all have much lower prices than BTC and ETH, so to avoid the trade sizes being too small, they have been given the following contract multipliers:

- SOL: 10

- XRP: 1,000

- MATIC: 1,000

What this means is that if we purchase a SOL call option for example, each contract represents the right to buy 10 SOL at the strike price, rather than 1 SOL. Similarly if we purchase a MATIC put option, each contract represents the right to sell 1,000 MATIC.

Traders of options in traditional markets will likely already be familiar with contract multipliers, as stock options for example typically have a multiplier of 100.

Placing trades on Deribit

Let’s take a look at how both the settlement currency, and the contract multiplier affect how we trade these options on the Deribit platform.

We’re starting off on the SOL option chain. If you’re on any other page on the Deribit platform and want to navigate to an option chain, just go to the top menu, then Options, and then select whichever currency and date you want to view.

I’ve added the account summary component to my layout at the top, so we can see the balances of each currency. In this account we’ve got some BTC, some SOL, and some USDC.

While the account does have some SOL in it, this is currently only tradeable in the SOL spot markets. The ability to use it for collateral for something like a covered call will be added when cross collateral is added to the platform, so keep an eye out for that in future updates.

What we will be using as margin for all of our trades today is the USDC balance, which is sitting at a little over 2,100. As we are on the option chain for SOL options, which has a settlement currency of USDC, the USDC balance is also displayed in the top right of the screen.

When we buy an option on either SOL, XRP, or MATIC, we will be paying an amount of USDC. Similarly, when we sell an option on any of these currencies, we will be receiving an amount of USDC. All of the option prices for these currencies are also quoted as an amount of USDC.

If we look at the Bid and Ask columns, these values are an amount of USDC. For example, this $125 strike SOL call option has a current best bid of $6.60, and a best ask of $7. It’s very important to note that this is the price per SOL, so to get the total amount that would be paid/received we need to multiply this amount by the contract multiplier. For SOL the contract multiplier is 10.

Selling a SOL put

Let’s place a trade to see this in action. We’re going to sell the 100 strike SOL put option, in the 10th of May expiry. Once we click on this option in the chain to open the order book, we can see this list of bids and asks. We can also see an important field in the contract details, called ‘Contract Size’. Here we can see that each contract represents 10 SOL, meaning the notional size measured in SOL will always be 10 times the number entered in the Contracts input field.

For example, if we place an order to sell 1 contract with a limit price of 2.1 USDC, we would collect 21 USDC in total if it is filled. Both the price per SOL and the total price are shown on the order confirmation screen.

If instead we sell 1 contract with a limit price of 1.9 USDC, we will collect 19 USDC in total. The limit price of the order is simply multiplied by the contract multiplier, which we can see in the Contract Size field on the order form.

Let’s sell into the best bid of 1.9 USDC to sell this option. Again, both the price per SOL and the total price are shown on the order confirmation screen.

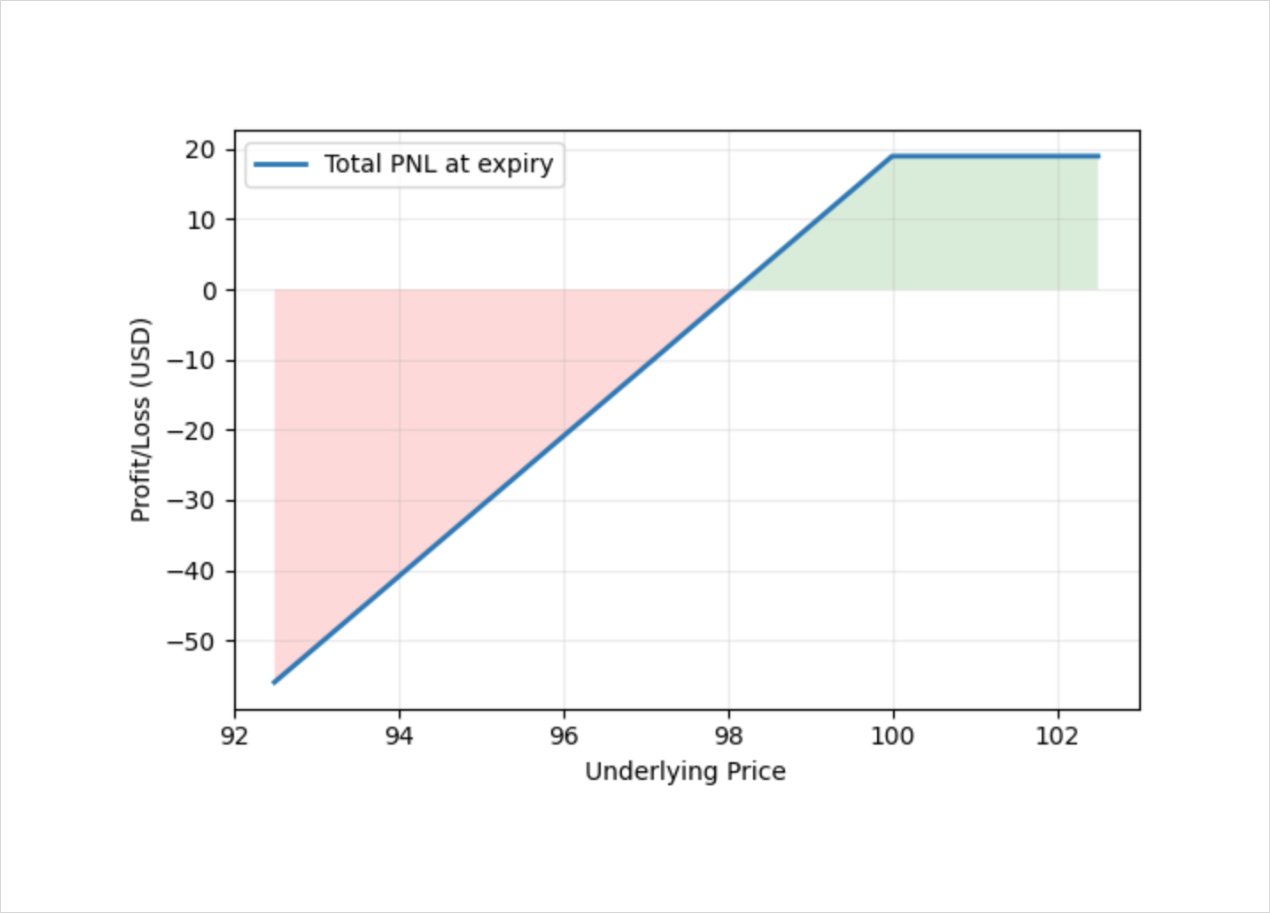

We are now short one contract of the 100 strike put, which at expiry, has the payoff shown on this chart.

If the price of SOL at expiry is 100 or greater, we will retain the $19 that was collected as our profit. If the price is below 100 at expiry though, then we will have to pay something out to the buyer of the option.

For example, if the delivery price of SOL is 94 at expiry, then we will need to pay 6 USDC per SOL, which is 60 USDC in total, due to the contract multiplier of 10. If we subtract from this the initial 19 USDC that we collected for the option, we get the loss shown on the chart of 41 USDC.

We could also calculate the amount per SOL, then multiply by the contract multiplier at the end. For example:

(1.9 – 6) * 10 = -41

Either way is fine, so feel free to use whichever you find the most intuitive.

We now have a short put on SOL on the 10th of May expiry. Let’s add a position on one of the other USDC settled currencies, XRP.

Bear put spread on XRP

To navigate to the XRP options, we just go to the top menu for options, then click on one of the expiry dates under XRP. We’ll use the same expiry date of the 10th of May.

Let’s execute a bear put spread on XRP, which involves buying a put, and then selling another put that is further OTM.

For the long leg, let’s use the 0.47 put. The current best ask is 0.013 USDC, which is the price per XRP. The contract multiplier for XRP options on Deribit is 1,000. So the total amount we pay will be 1,000 times this number, which is 13 USDC. We can see the Contract Multiplier in the contract details on the order form, and we can see both the price per XRP, and total price, on the order confirmation screen.

For the long leg, Now we have bought the 0.47 strike put option, we need to sell a further OTM put to turn this into a bear put spread. Doing this will cap our potential gains, but also reduce the cost of the position.

Let’s sell the 0.45 strike put. The best bid is currently 0.007 USDC which means we will collect 7 USDC in total for selling this option.

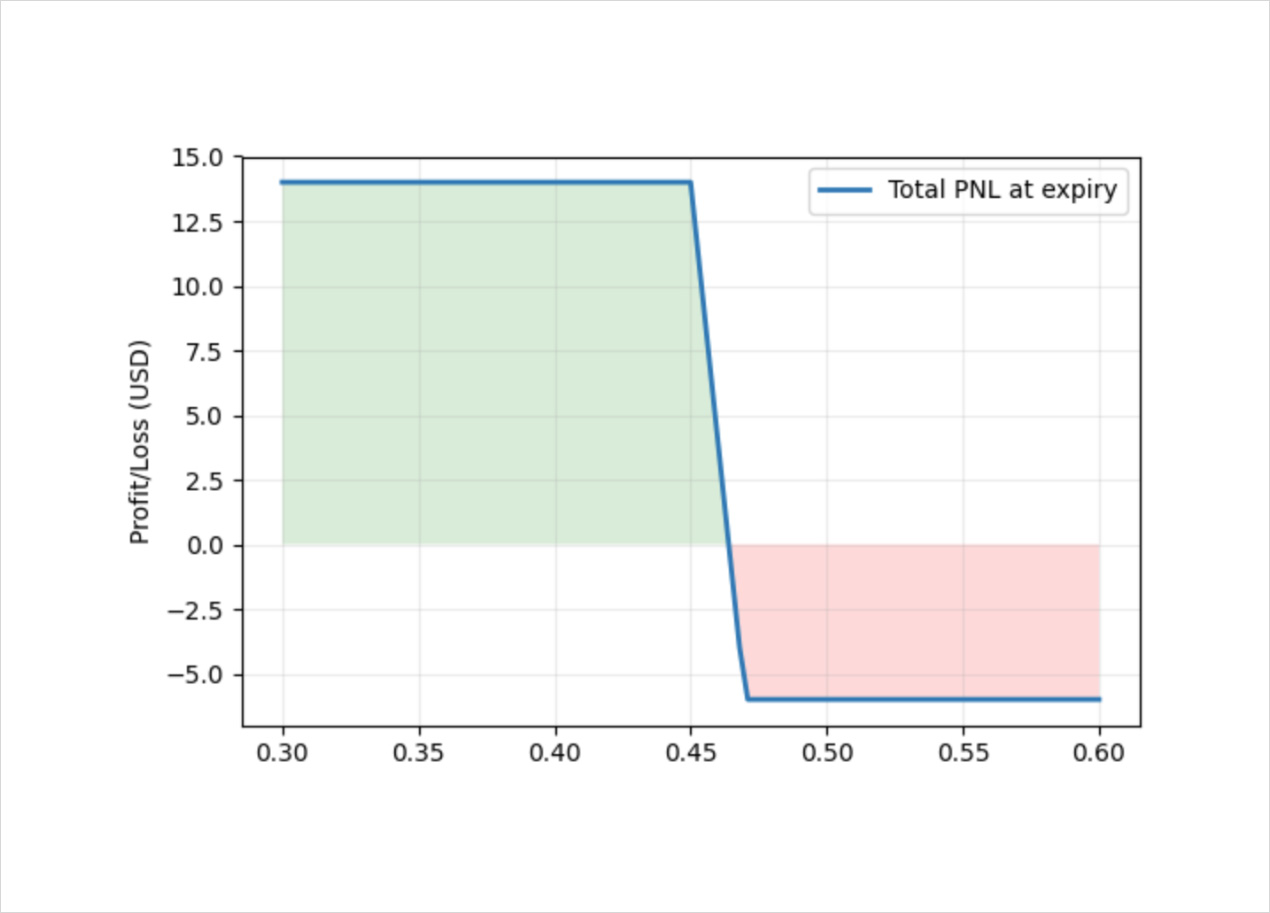

This bear put spread will therefore have the following payoff at expiry.

If the price of XRP is above 47 cents at expiry, we will lose the net premium paid of 6 USDC. If the price of XRP is below 45 cents at expiry, we will make the maximum profit of 14 USDC.

So, we now have a bear put spread on XRP, and a short put on SOL. Both of these use the USDC in the account as margin. As we can see at the top of the page though, our margin requirements are very low for these positions, because even when combined, they are relatively small sizes for this account size.

The maximum loss on the XRP bear put spread is the net 6 USDC we paid for the spread, and the short SOL put only needs 1,000 USDC to be fully cash secured, which is less than half of our balance.

Base amount

We can see our position size in contracts in the Amount column. This shows the number of contracts, with short positions having a negative value, so -1 means we are short 1 contract.

As these options also have contract multipliers though, it would be useful to also add the new Base Amount column to the positions table. This can be found in the column settings on the right, where we check the box for Base Amount.

Now we can also see the notional size of our position in the base currency, meaning SOL and XRP in this case. This allows us to see at a glance that our 1 SOL contract represents 10 SOL, and that each of our XRP contracts represents 1,000 XRP.

Progress check

Let’s take a look at how the positions look after we have let some time pass and prices have moved. 4 days later, we can see that the price of XRP has increased to around 0.53, up from around 0.49 when we opened the positions. The price of SOL has also increased from 122 to 148.

As we are short a SOL put, this overall increase in prices has resulted in our SOL position being in a nice profit of just under $18 already.

The bear put spread on XRP is at a loss of just over $5. With the short 45 cent put being in profit, and the long 47 cent put having a loss.

The net effect of all current positions is an unrealised profit of over $12.

After expiry

After all of the options have expired, we can see the delivery price for each day by going to the Indexes page. The desired currency can then be selected from the dropdown menus.

With SOL selected, we can see that on the 10th of May, when our options expired, the delivery price for SOL was 154.751. This means our short 100 strike put was OTM, and therefore we realised the full profit of 19 USDC on that one.

Looking at the XRP index, we can see the delivery price was 0.5175. This was above our long strike of 0.47, so our bear put spread expired worthless, and we realised the loss of 6 USDC.

We can confirm this by going to the transaction log, where we can see that all 3 of the options expired worthless, and so nothing was paid or received at expiry.

For those with a good eye for detail, you might also have noticed a small position was moved into this account on the 9th of May. This position was worth $5 and was immediately closed, which is why the total USDC in the account is $5 higher than would be expected based on the 2 trades that were shown in this video.

Summary

In this video we have covered:

- Settlement currencies, which for these new options is USDC.

- Contract multipliers, and how this affects the size and profit of our positions.

- Some live trades on the platform, noting where we can see the size in contracts and notional, and the price per coin vs the total price.

Hopefully this video will serve as a useful example of how to place trades in the new USDC settled options on Deribit, and has highlighted any important differences to be aware of for those that are already used to trading the well established BTC and ETH options.

If you have any further questions though then feel free to ask the Deribit support staff, who are always available to help, or tag either Deribit or myself on X (twitter).

AUTHOR(S)