On the 19th of August 2025, USDC settled options for BTC and ETH will be added to the Deribit platform. This launch brings traders smaller minimum trade sizes, and more collateral choices.

You may also see USDC settled products referred to as “linear” products on Deribit. This distinguishes them from “inverse” products, which use the underlying (e.g. BTC) as the settlement currency.

These new USDC settled options for BTC and ETH are an addition, not a replacement, so there will now be both inverse and linear options available on Deribit for both BTC and ETH.

How USDC settled options work

USDC settled options work very similarly to options in more traditional markets, except instead of payments being made in USD, they are made in USDC (a stablecoin token that is designed to be worth 1 USD).

For example, if a trader buys one BTC_USDC call option with a strike price of 90,000, and at expiry the price of bitcoin is 100,000, the trader will receive a payout of 10,000 USDC.

Similarly, if a trader buys one BTC_USDC put option with a strike price of 80,000, and at expiry the price of bitcoin is 75,000, the trader will receive a payout of 5,000 USDC.

Benefits

This addition gives traders greater freedom to use their collateral of choice, as traders who prefer to stay in stable coins most of the time can now trade the USDC settled BTC and ETH options, and avoid any concerns about negative BTC and ETH equities and rebalancing.

Having coin settled and USDC settled versions trading alongside each other will also present hedging and arbitrage opportunities for traders who trade both markets. When using cross portfolio margin (X:PM), traders will benefit from risk offsets in the portfolio margin risk matrix, lowering margin requirements. For example, if a trader is using X:PM and is long a BTC_USDC 100,000 strike call option, and short an inverse BTC 100,000 strike call option, or vice versa, the risk of these positions will mostly offset each other.

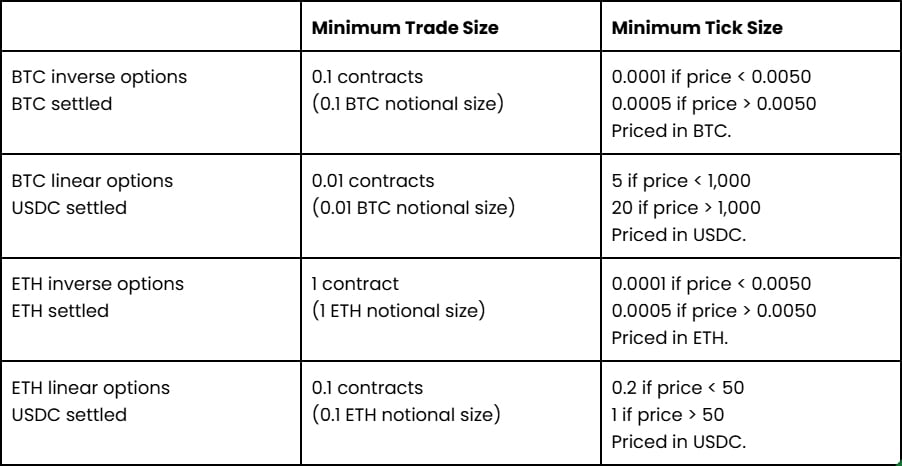

The minimum trade size for the new USDC BTC and ETH settled options is lower than the existing inverse BTC and ETH options. The tick sizes are also smaller. The following table summarises the trade and tick size differences.

In the public order books, the minimum trade size and tick sizes for the new USDC settled BTC and ETH options are lower than their inverse equivalents. However, for block trades, the size limits are the same for both types.

Inverse (coin settled) vs linear (USDC settled)

The linear options will likely be easier to understand for traders who already have some experience trading options in more traditional markets. They work in essentially the same way, except the settlement currency is a dollar stablecoin (USDC) rather than the US dollar itself.

The linear options are particularly well suited for traders who prefer to stay in stablecoins the majority of the time. They also allow easier execution of positions such as cash secured puts. Traders keeping their funds in USDC will also benefit from the USDC rewards, which are paid monthly to traders holding USDC in their Deribit accounts. Currently these rewards are roughly 4% per year. For more information on USDC rewards, see here.

The inverse options are better suited for traders who prefer to keep their funds in the coin itself (e.g. BTC). Long term holders, miners, and those holding coin treasuries, are likely to find the inverse options attractive, because these options allow them to use the funds they are already holding as collateral for their trades. Covered calls are especially easy with the inverse options.

Traders are not forced to choose one or the other though, and with Deribit’s cross collateral system it’s even possible to trade both types of options with the same pool of collateral. For more on cross collateral, see here.

Deribit BTC-USDC, ETH-USDC index details

In preparation for the launch of the USDC settled BTC and ETH options, as of the 15th of July 2025, the BTC-USDC and ETH-USDC indexes have been pegged to the BTC-USD and ETH-USD indexes respectively.

This means that, for example, the Deribit BTC-USDC index is no longer calculated as an average of bitcoin prices across various BTC_USDC spot markets. Instead, the value of the BTC-USDC index is simply pegged to the value of the BTC-USD index (which is calculated as an average of bitcoin prices across various BTC_USD spot markets). This has the effect of removing the USDC-USD exchange rate from the Deribit BTC-USDC index.

This means the USDC settled BTC and ETH options settle on the same delivery prices as the existing BTC settled and ETH settled options. And this in turn allows for more efficient hedging and margining between the BTC/ETH settled and USDC-settled products.

What if USDC loses its peg to the US dollar?

As with any USDC settled derivatives there is an exposure to the depeg risk of USDC itself. In other words, if the USDC token loses its value, traders holding USDC and/or positions in USDC settled derivatives will be affected. For these new USDC settled BTC and ETH options, as well as the BTC_USDC and ETH_USDC perpetuals, this risk is altered by the indexes also being pegged to the respective USD indexes.

To summarise, for the purposes of delivery and settlement of derivatives that use either the BTC-USDC index or ETH-USDC index, parity between USD and USDC is assumed. So any payouts will be paid as if 1 USDC = 1 USD. For the valuation of collateral in X:SM and X:PM accounts though, the USDC/USD exchange rate is still used to calculate equities and margin balances in USD terms.

For more details on this, including examples, see the knowledge base here.

Summary

Deribit continues to refine and add to the range of instruments and collateral available to traders, and the new USDC settled options for BTC and ETH will benefit traders in the following ways:

- Increased collateral freedom

- Risk offsets with inverse instruments

- Hedging and arbitrage opportunities

- Lower minimum trade sizes

- Lower tick sizes

For those traders who first want to test out how these new products work, and how they interact with the existing products and margin system, the BTC_USDC and ETH_USDC options are also available on the testnet.

Please note that while USDC is technically available on several different blockchains, Deribit currently only supports the ERC-20 version on the Ethereum blockchain. The available networks are always displayed on the deposit and withdrawal pages, and only those networks should be used.

Disclaimer

DRB Panama Inc is unregulated and services retail and non-retail clients. Virtual Assets are subject to extreme market volatility, involve a high degree of risk, and can lose value, in part or in full.

AUTHOR(S)