Cross collateral is now available on Deribit for all users who wish to use it. Cross collateral allows traders to use currencies other than the settlement currency as margin for open positions or orders on derivatives products. For example, the bitcoin options on Deribit are cash settled in BTC and a trader would typically use BTC as collateral. However, with cross collateral, the trader can choose to instead use, for example, USDC or ETH as collateral.

This allows for much better capital efficiency for traders who want to trade products on more than one currency, and gives them access to all markets with much more freedom over which currencies they want to actually hold in their account.

In this lesson, we’ll cover the main features of the new cross collateral system, and recap each of the available account types that now exist on Deribit.

Firstly, it will be useful to define some different roles that currencies can take on Deribit. Some currencies will fall into more than one category, so it’s important to know which currencies can be used for what.

Settlement currencies

Each tradeable derivative instrument on Deribit has a settlement currency. The settlement currency is what is used to receive/pay any profit/loss from trading the instrument, and so the margin requirements for the instrument are also calculated in this settlement currency.

Without cross collateral, it is only possible to use the settlement currency as collateral to trade each product. For example, a trader would need to use BTC as collateral to trade products that settle in BTC, ETH as collateral to trade products that settle in ETH, and USDC to trade products that settle in USDC.

Therefore, without cross collateral enabled, there is an obvious inefficiency for traders that want to trade products with different settlement currencies. If a trader wanted to trade BTC options and ETH options at the same time, they would previously have had to hold both BTC and ETH in their account.

Cross collateral currencies

The new cross collateral system solves the above problem by allowing traders to use currencies other than the settlement currency as margin for a product. The currencies that can be used as collateral to trade products with a different settlement currency are called collateral currencies.

The current list of collateral currencies is:

- BTC

- ETH

- PAXG

- SOL

- stETH

- USDC

- USDT

- USYC

Each of these collateral currencies can now be used as collateral to trade any of the derivative products on Deribit. This makes life much easier for traders who like to keep their ‘main’ currency as USDC for example, but also want to trade the BTC or ETH settled options.

Offset currencies

The collateral currencies mentioned above are all large, well established cryptocurrencies. Due to this they are deemed suitable to be used to satisfy margin requirements for products settled in different currencies.

There are also ‘offset currencies’, which can not be used in such a broad manner, but still have some use for a smaller subset of products on Deribit.

The current list of offset currencies is:

- BNB

- XRP

Each of these offset currencies can be used to offset upside risk only in products for the respective currency. For example, an XRP balance can be used to offset upside risk in XRP products. If a trader is short some XRP calls for instance, they will start making losses if the price of XRP increases. If they are also holding some XRP though, then this XRP will increase in value as the price increases, so the margin system will use this XRP balance to offset some of the risk.

The main use for the offset currencies is to better facilitate positions such as covered calls, and short futures positions.

Portfolio margin vs standard margin

Traders can either choose whether to enable cross margin, or for their currencies to remain segregated. In addition to that choice, traders can choose whether they want to use standard margin, or portfolio margin.

In a standard margin account, the margin requirements for each position are calculated separately, and then summed together to give the total margin requirements. In an account with portfolio margin enabled, the portfolio of positions in the account are looked at together, and the portfolio is stress tested against various scenarios. The worst performing of the tested scenarios is used to calculate the total margin requirements.

Regardless of the margin account type, sub accounts are treated separately. So even in a portfolio margin account with cross collateral enabled, each sub account is treated entirely separately for margin purposes.

As cross margin is optional, an account can either use cross collateral, or segregated currencies. Combined with the choice between portfolio margin and standard margin, this leaves us with four distinct margin account types:

- Segregated Portfolio Margin (S: PM)

- Cross Portfolio Margin (X: PM)

- Segregated Standard Margin (S: SM)

- Cross Standard Margin (X: SM)

Segregated Portfolio Margin

Each of the settlement currencies is treated separately. Within each settlement currency though, all of the positions that use that settlement currency are looked at together, with the margin requirements being calculated based on the worst performing of the stress test scenarios.

For more information on segregated portfolio margin, please check the guide here.

Cross Portfolio Margin

First a total USD margin requirement for all positions in all settlement currencies is calculated. The total margin requirements in a particular settlement currency are then calculated by converting this USD total into the relevant settlement currency.

For example, if positions are held in BTC settled instruments, and ETH settled instruments, first a total USD margin requirement will be calculated which includes both the BTC and ETH positions. Then the margin requirements in BTC will be calculated by converting the total USD margin requirements into BTC. Similarly, the margin requirements in ETH will be calculated by converting the total USD margin requirements into ETH.

The results of these new calculations are shown in the Account Summary.

The total USD calculations are shown in the bottom row.

At the initial launch, derivative positions in one underlying currency will not offset the margin requirements for derivative positions in another currency. However, this feature is planned for a future release. Once this cross asset position offset is enabled, it would, for example, allow a long BTC call to at least partially offset the risk of a short ETH call. This will further increase the capital efficiency for traders trading multiple assets at once.

For more information on cross portfolio margin, please check the cross PM guide here.

And the segregated PM guide here.

Segregated Standard Margin

Each of the settlement currencies is treated completely separately. Within each settlement currency, the margin requirements for each position are calculated separately, and then summed together to give the total margin requirements for that settlement currency.

Segregated SM is the same as the old version of SM.

Cross Standard Margin

Within each settlement currency, margin requirements are initially calculated using standard margin calculations for instruments that settle in that currency. The total margin requirements measured in a particular settlement currency are then calculated by adding the margin requirements for positions in instruments of that settlement currency, to the requirements for all other positions converted into that settlement currency.

For example, if positions are held in BTC settled instruments, and ETH settled instruments, the margin requirements in BTC will be calculated by converting the margin requirements for the ETH settled instruments into a BTC value, and then adding this to the margin requirements for the BTC settled instruments.

Similarly, the margin requirements in ETH will be calculated by converting the margin requirements for the BTC settled instruments into an ETH value, and then adding this to the margin requirements for the ETH settled instruments.

The margin requirements measured in either BTC or ETH will have the same dollar value.

Haircuts

By using cross collateral, traders are able to use multiple currencies to support their positions. For the purposes of calculating the initial margin (IM) in each settlement currency, some currencies may have a haircut applied. The rate of the haircut will depend on the currency being used as collateral. It is possible for the haircut rate for a currency to be zero.

The purpose of the haircuts is to make the cross collateral system safer by holding a little extra margin for some cross collateral currencies. This is achieved by reserving a certain percentage (the relevant haircut percentage) of some currencies as initial margin.

For example, if a currency has a 2% haircut in the cross collateral system, 98% of the equity in that currency can still be used as margin for derivatives positions, and 2% will be reserved for the haircut.

Let’s look at an example of how this looks on the platform with a few different currencies.

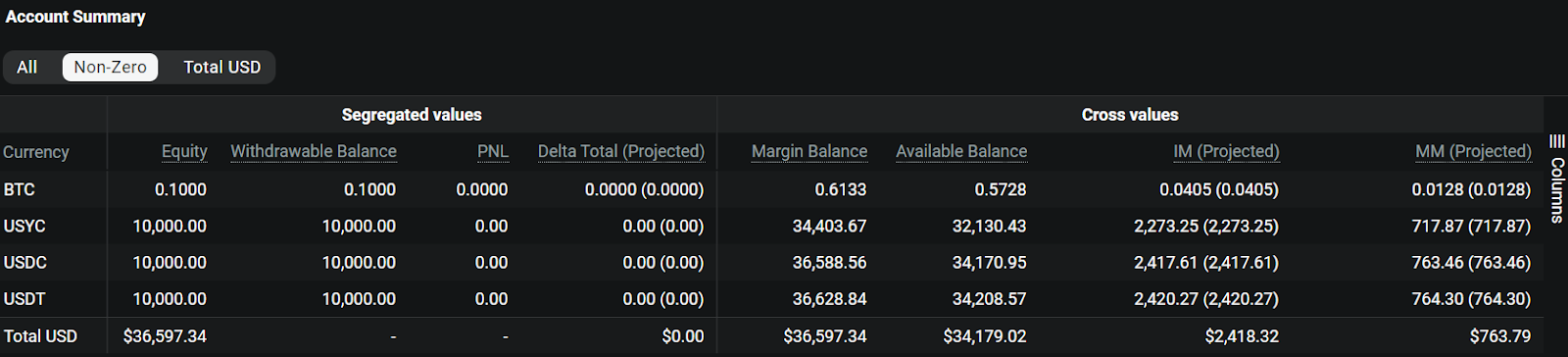

The following picture shows the account summary for a sub account where four different currencies have been deposited, and cross collateral portfolio margin (X:PM) has been enabled.

As can be seen in the Equity column, the following amounts have been deposited into the account:

- BTC: 0.1

- USDC: 10,000

- USDT: 10,000

- USYC:10,000

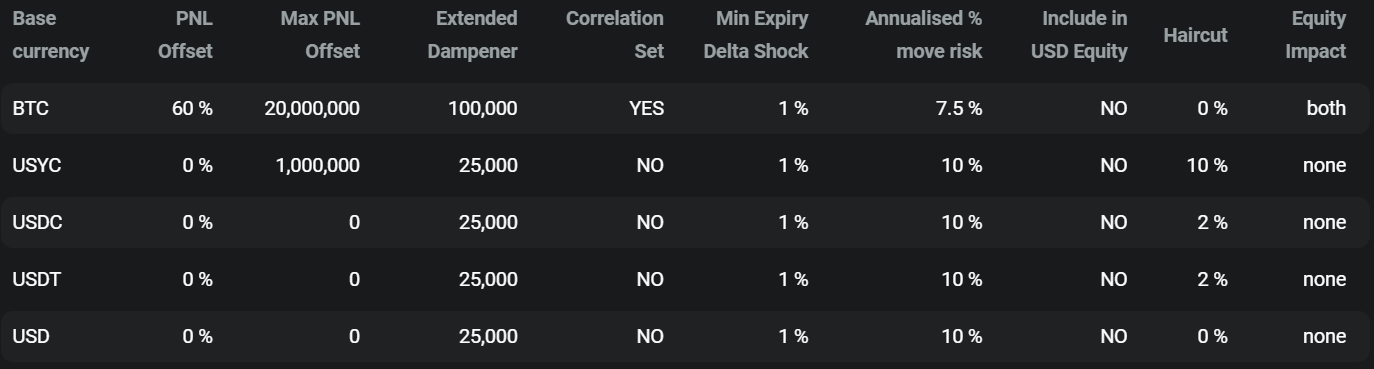

On the Portfolio Margin page, the haircut percentages for each currency can be seen in one of the tables at the bottom of the page.

Note that the percentages shown in the above screenshot are just an example. To see the up to date haircut values, see the user interface, or the knowledge base here.

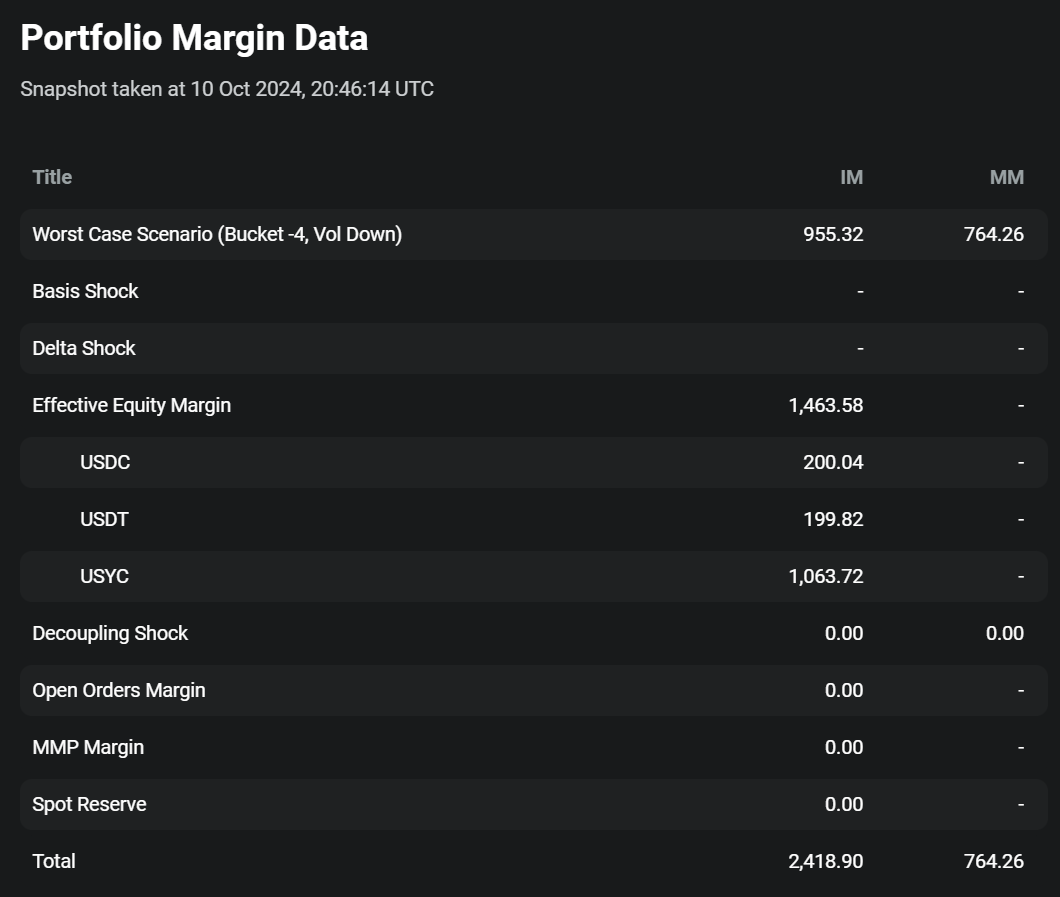

At the top of the same page, the portfolio margin data can be seen, which shows some of the calculated figures for the margin requirements.

There are no derivatives positions open in the account. What we are interested in is the Effective Equity Margin section, as this will show us the effect of the different haircuts. The amounts shown here are being reserved for initial margin. Notice that there is no entry for BTC because there is no haircut for BTC. USDC shows an amount of $200, which is 2% of the roughly $10,000 value of the 10,000 USDC in the account. The same is true for USDT.

USYC is showing a value of $1063.72. The price of USYC at the time was $1.06372, so this represents 10% of the $10,637.20 value of the USYC in the account.

Note that the haircut percentages described here are just an example of how haircuts work. To see the up to date haircut values, check either the user interface or the knowledge base here.

Account rebalancing

When cross collateral is enabled, it is possible for the equity of a particular settlement currency to go negative, while the account as a whole remains solvent. There are two limits to how large a negative equity in a particular currency can go. There is an absolute limit, and a relative limit. The absolute limit is a fixed value (default is $1 million) chosen by the Deribit risk department, and the relative limit is a percentage (default is 100%) of your cross equity. Once either limit is breached, Deribit will rebalance the account by using one of the currencies in the account with a positive equity to purchase some of the currency with a negative equity.

The negative equity limit for accounts that use external custody is zero.

Account rebalancing is a separate process from liquidation. Even a healthy account with sufficient maintenance margin may require account rebalancing if the equity of a particular settlement currency is sufficiently negative. Account rebalancing will only rebalance the currencies held in the account. Positions in derivatives instruments (e.g. options, futures, perpetuals) will not be liquidated during this process.

There are no additional fees associated with rebalancing, and the spot markets used for exchanging between currencies also have zero fees.

Collateral fees

While the equity of a currency in an account remains negative, a collateral fee will be charged to that account. This fee is charged daily in the same currency as the negative balance (default is 0.05% per day).

To avoid paying collateral fees, a trader may replenish the currency with the negative equity themselves instead. Indeed the main role of the collateral fees is to encourage traders to stay on top of any required rebalancing themselves. Traders can do this by either depositing more of the currency that has a negative equity or by swapping between currencies via the spot markets.

The collateral fee rates can be seen on the fees page here.

Switching margin model

You can change whether you are using standard margin or portfolio margin, and whether you are using cross collateral, by going to the margin page in your account and clicking on Change Margin.

Cross PM spot holdings

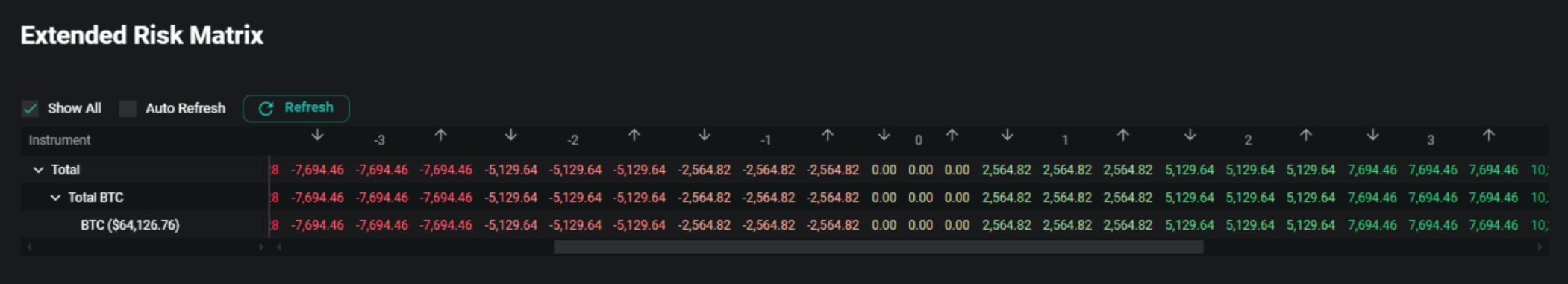

If you choose to utilise the new cross portfolio margin, you may notice that even when you have no positions at all, your margin numbers are not zero. For example this account has no positions, and yet does have non-zero values for IM and MM.

This does not mean that simply holding a balance on a cross PM account could result in the account being liquidated. And it does not affect your ability to withdraw the funds when there is no position. It is simply a result of all balances being converted to dollars. The spot holdings are also an entry in the risk matrix.

As always, liquidations will only happen if derivative positions are held, and maintenance margin requirements subsequently go over 100%.

Margin balance for cross collateral accounts

For portfolio margin accounts with cross collateral, the margin balance is calculated as follows:

Margin Balance in BTC settlement currency = BTC Equity + BTC equivalent value of the other Equity in other Cross Collateral Currencies (E.g. ETH, USDC, USDT)

For standard margin accounts with cross collateral, the margin balance is calculated as follows:

Margin Balance in BTC settlement currency = BTC Equity + BTC equivalent value of the other Equity in other Cross Collateral Currencies (E.g. ETH, USDC, USDT) – BTC equivalent value of the options in the account

This calculation is made for each settlement currency, so it is possible to see the margin balance expressed in any of the settlement currencies. BTC has been used as the settlement currency for these formulas, but the same process is followed for each of the other settlement currencies as well.

If a trader prefers, they can look at the Total USD values for Margin Balance and Maintenance Margin. This information is displayed in the Account Summary component for example.

Summary

The new cross collateral margin system allows for far greater capital efficiency for most traders. Given the changes from the old system though, portfolio margin users in particular should make sure to read through the available guides, as there are new parameters and calculations.

If you would like to try out any Deribit features, including the new cross collateral system, without putting any funds at risk, you can try it out for free here.

AUTHOR(S)