In collaboration with Fireblocks, Deribit is the first exchange to fully integrate the new Off Exchange solution to its infrastructure.

Fireblocks, a leading technology provider for self-custody enables trading firms and asset managers to trade on Deribit from an on-chain MPC wallet, eliminating counterparty risks.

The new solution, leveraging MPC technology enables traders to allocate and mirror assets directly to Deribit from a mutually controlled wallet, protecting their principal from perceived security risks such as cyber hacks, bankruptcy and fraud, while providing Deribit with complete on-chain transparency that client accounts are fully collateralized.

Deribit is strongly committed to innovate and work with leading providers to resolve and mitigate these risks, offering a suite of solutions that caters to the needs of its client.

Counterparty risk can take various forms that is the greatest current market challenge. Bankruptcy, commingled accounts and misappropriation of client funds are a great concern and stem from the unique structure of the crypto trading market where the trading venue also plays the role of a custodian. The high counterparty risk considerations have restricted trading firms to deploy large capital to exchanges and prevented traditional firms to enter the crypto market entirely.

To reduce these risks, operational processes that monitor exposure, sweep excess margins can be a time-consuming and labor intensive exercise, while the exposures are only managed but risks are not fully mitigated. This trading model also adversely impacts exchanges, as institutions reduce their capital to maintain acceptable levels of risk.

Fireblocks`s Off Exchange delivers a blockchain-native solution that enables traders to eliminate all forms of counterparty risks by programmatically locking funds in secure MPC wallets, with the ability to move capital between venues, allowing firms to quickly capitalize on trading opportunities.

The solution also provides Deribit with transparency to monitor and validate collateral on-chain and enforce risk management without taking custody of client assets.

This results in increased liquidity and higher capital efficiency for both clients and the exchange.

With Deribit`s and Fireblocks`s commitment to building solutions that eliminate counterparty risk in the ecosystem, this collaboration represents a significant step forward in building the next generation of digital financial markets.

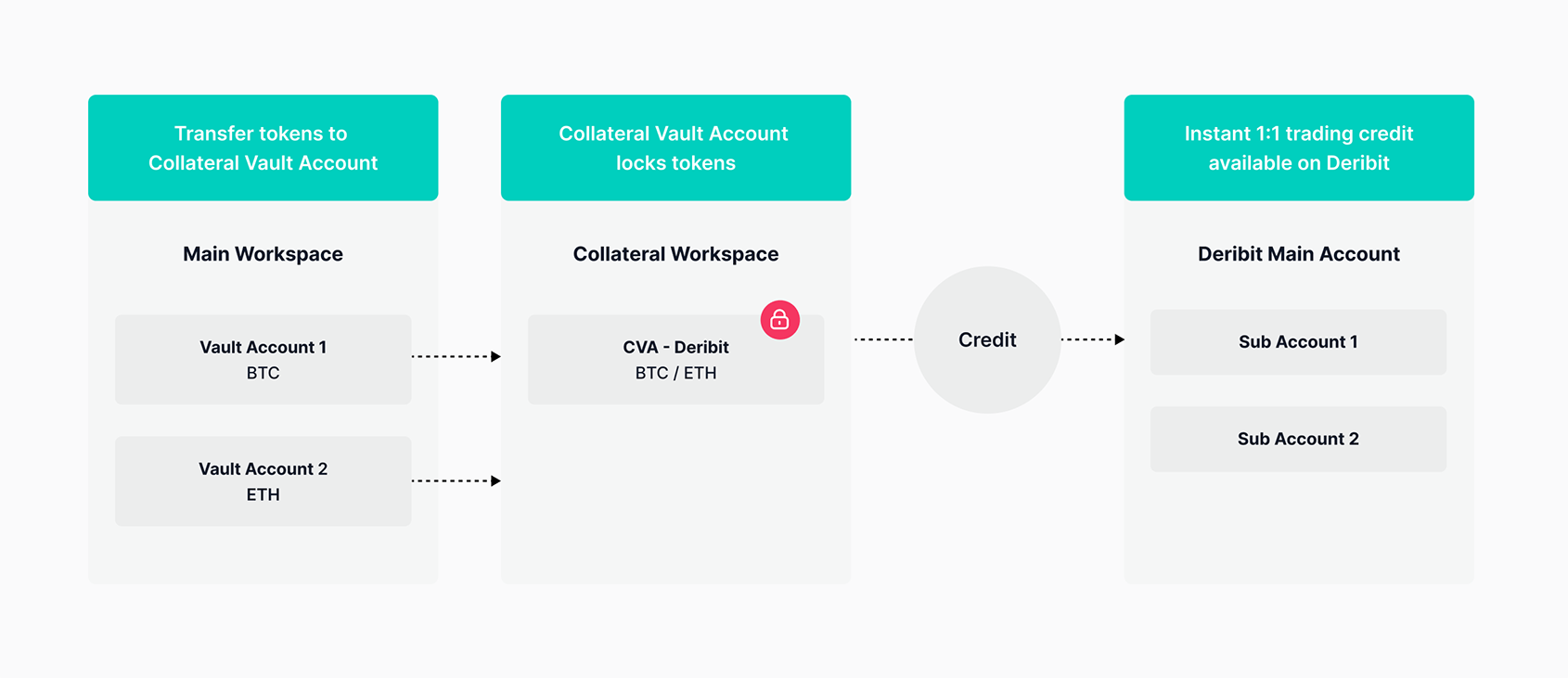

How it works

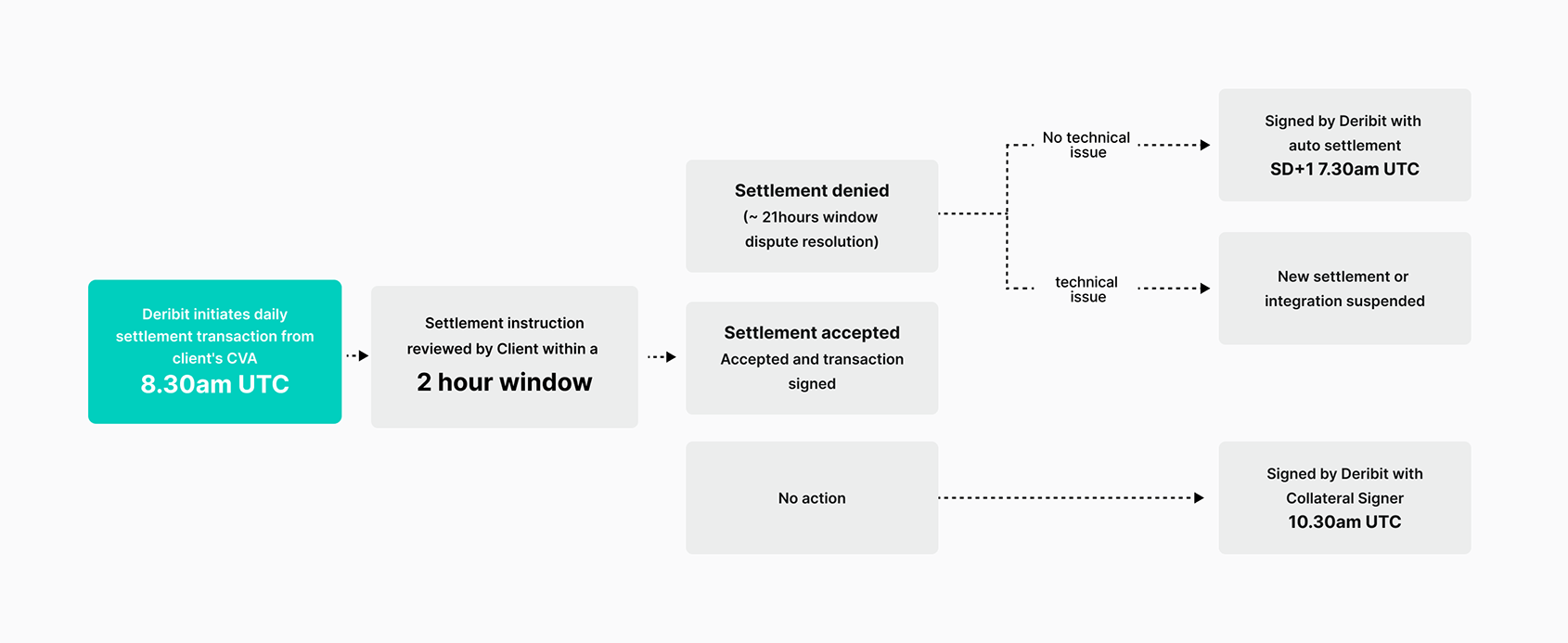

Settlement flows

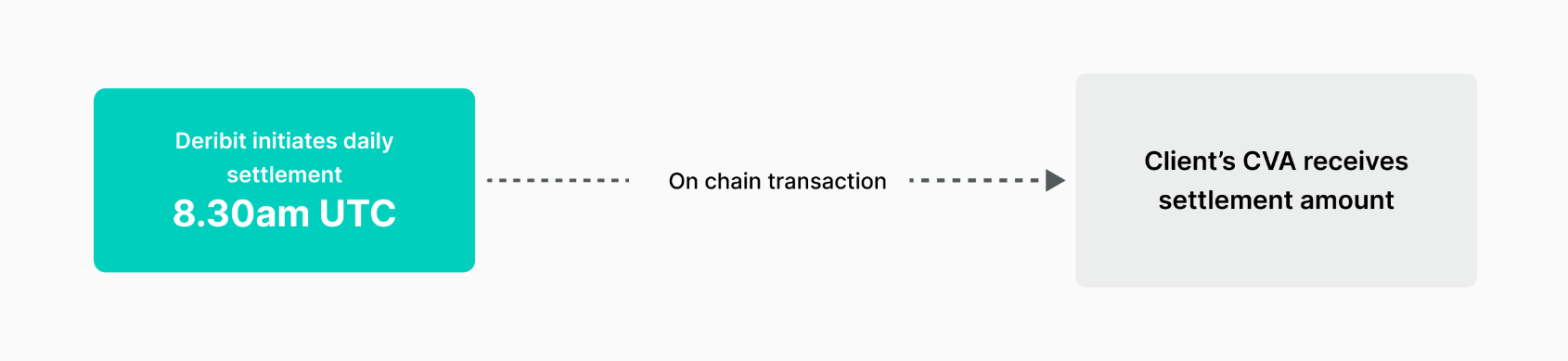

The following diagrams show the settlement flows for daily settlement scenarios.

- Settlement from the CVA to Deribit will appear as a withdrawal transaction to be reviewed and signed.

- Settlement from Deribit to the CVA will appear as a deposit transaction in the transaction history and increases the balance in the CVA.

For the auto-sign and forced settlements:

- Collateral signer is an API user that is run on a Deribit machine in the Collateral Workspace.

- The collateral signer is limited to signing daily settlement transactions.

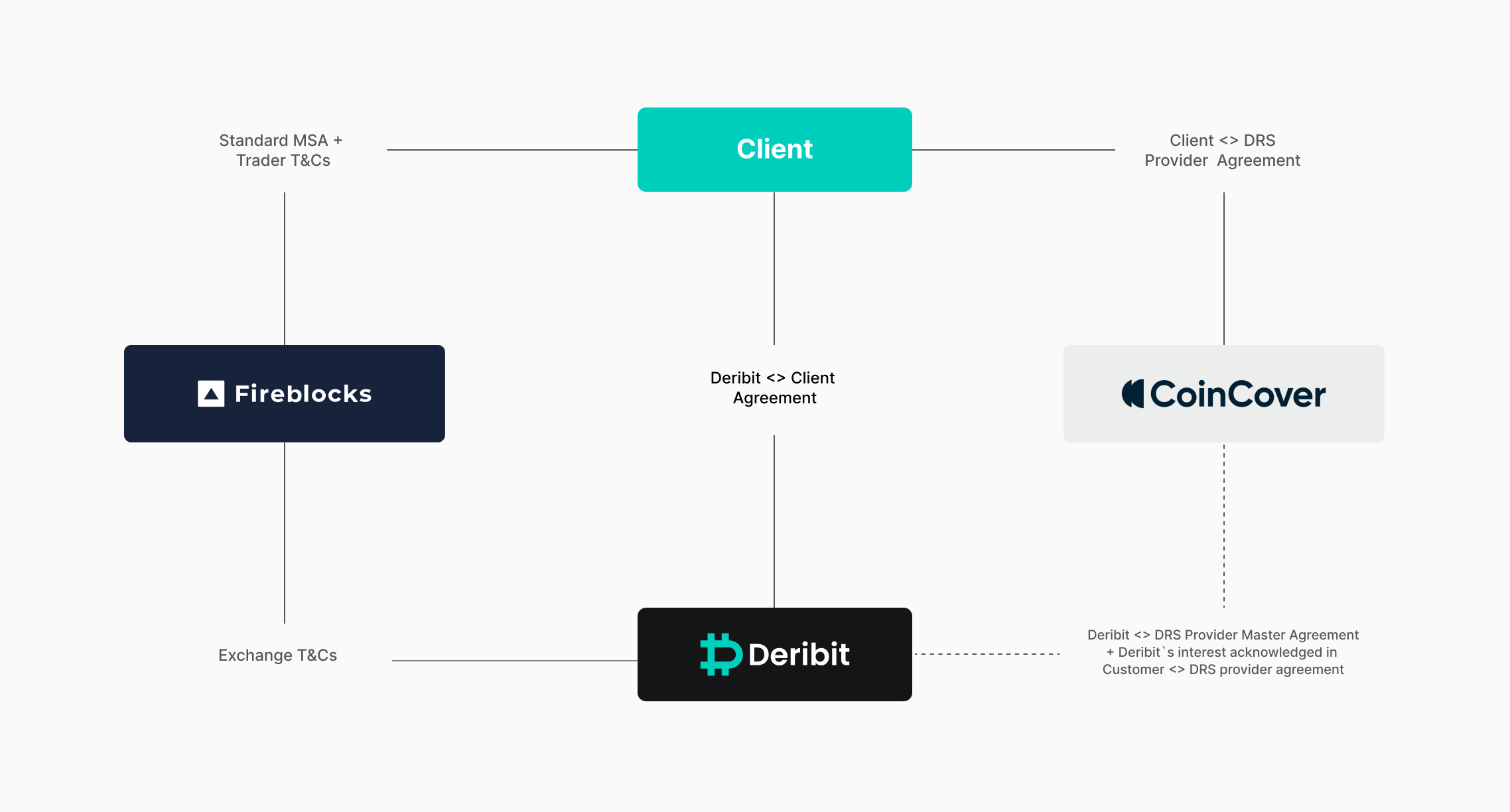

Legal structure

During the onboarding process there are various applicable documents to be executed as shown below. These agreements ensure both Client and Deribit are protected in scenarios such as bankruptcy of a party, unavailability of Fireblocks etc.

Set up

To use the Fireblocks Off Exchange settlement on Deribit, you must be a client of both services as well as of Coincover, the trusted party for disaster recovery service. If you are already registered at both platforms, and completed an order form with Coincover, please reach out to your dedicated representative or email [email protected] to kickstart the onboarding process which includes completing the supplementary terms and a few operational steps such as setting up the collateral signer. As a last step, Deribit and Fireblocks will activate your account under the Off Exchange model and settlement begins the next day.

Summary of requirements:

- Verified Deribit account.

- Completed supplementary terms: please note this is a supplementary agreement specific to the Fireblocks Off Exchange model, standard Deribit Terms and Conditions still apply.

- Fireblocks subscription and accepted terms for the Off Exchange model.

- Completed Order Form for Coincover`s Disaster Recovery Service (via Fireblocks).

Operational set up steps:

- Add Deribit as an Exchange connection to your main Fireblocks workspace using an API key generated on your Deribit account with “custody:read_write” and “account:read” scopes.

- Complete the steps of enabling the feature on your Fireblocks workspace.

- Add an API user as Collateral signer to your Fireblocks workspace, using the .csr file Deribit provides you with. Once added, provide Deribit with the pairing token (via email or Slack), this is used by Deribit for completing the set up of the Collateral Signer.

- Add a small amount of collateral for each currency.

- During the set up process Deribit receives confirmation from Fireblocks and Coincover of the activation of the feature and the safe storage of the backup material.

- After above steps Deribit activates the feature on your Deribit account and settlement begins the following day.

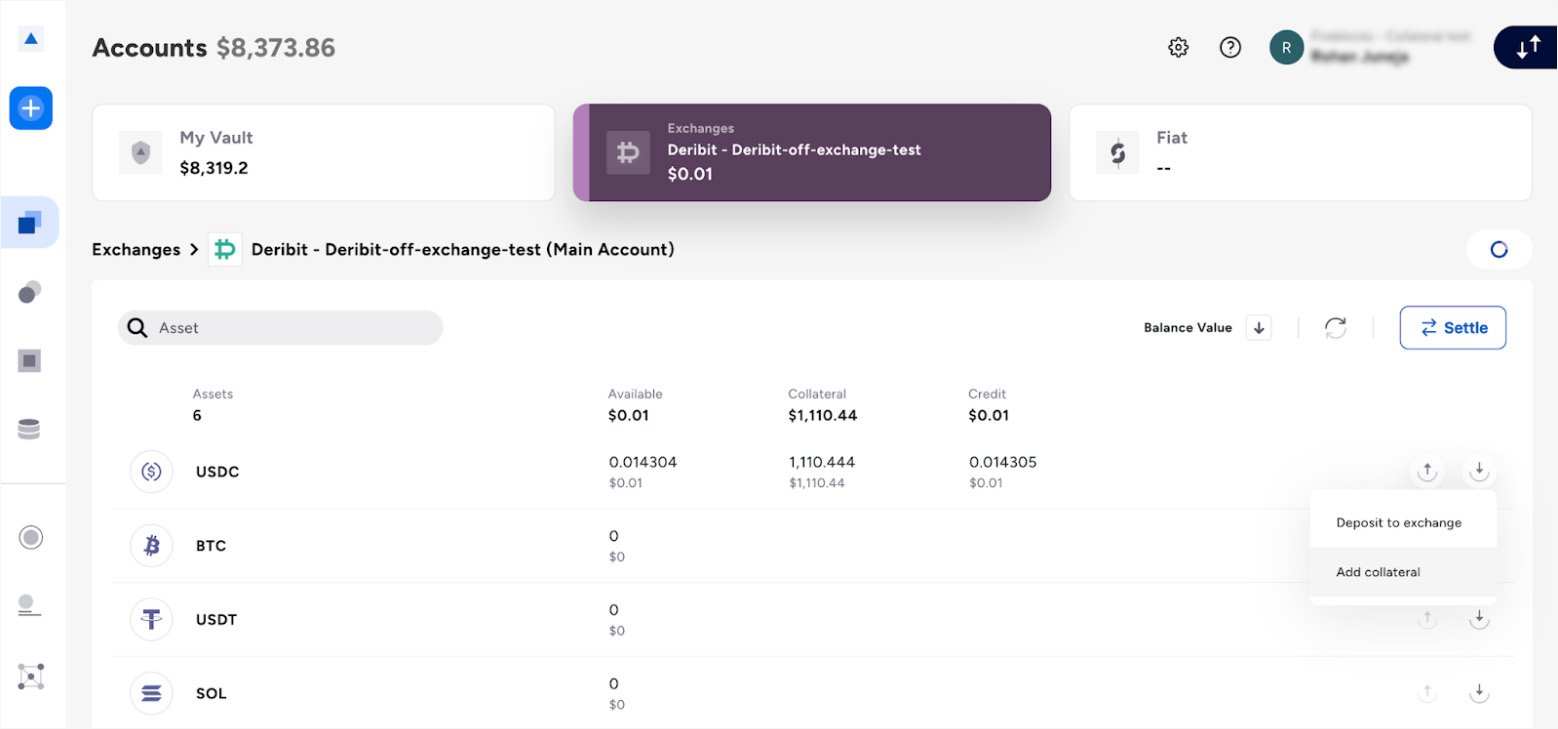

Once the set up is complete, you will see your connected Collateral Vault Account in your Fireblocks Workspace.

Frequently Asked Questions (FAQ)

AUTHOR(S)